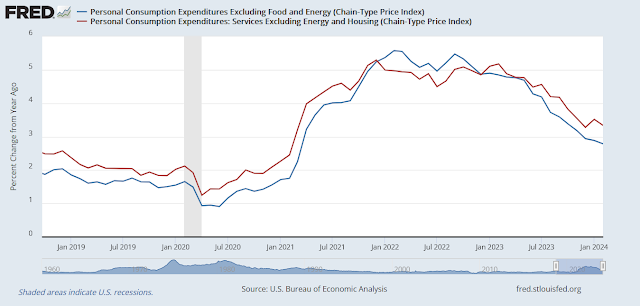

The closely watched April PCE moderated as expected. Headline PCE came in 0.3%, in line with expectations, while core PCE was 0.2% (blue bars), which was softer than expectations. Supercore PCE, or services ex-energy and housing, also decelerated (red bars). This latest print represents useful progress, but won’t significantly move the needle on Fed policy.

The worrisome development is the global trend of transitory disinflation. The Citi Inflation Surprise Index, which measures whether incoming inflation data is beating or missing expectations, is bottoming in most countries and rising again. If this continues, any expectations of ongoing rate cuts are likely to be pulled back.

Now that 2024 is nearly half over, it’s time to peer into 2025 to see the upside and downside factors that are expected to affect inflation and the Fed’s interest rate trajectory. The three main factors to consider are changes in immigration policy and how they affect employment; the evolution in productivity; and the possible political effects of the election on inflation.

Immigration and labour supply

Immigration has become an increasingly touchy subject in the 2024 election. What’s surprising is the degree of agreement about not only restricting illegal immigration, but also the willingness to shrink the pool of unauthorized workers.

So what happens if there is a border bill that either restricts unauthorized immigration or implements a mass deportation of illegal workers? I looked at the data to test the hypothesis that unauthorized immigration is expanding the labour supply more than normal.

Here’s another way of analyzing wage growth in greater detail. The accompanying chart shows the average hourly earnings of production and non-supervisory workers (black line), of retail trade workers (red line) and of leisure and hospitality workers (blue line), all normalized to 100 in January 2019, which is about a year before the onset of the pandemic.

Now imagine that in the 2025 post-election world the White House and Congress come to an agreement on an immigration bill. Regardless of whether the bill just restricts the supply of illegal immigrants or takes active steps to deport them, it will worsen labour supply at the low-wage end of the market, tighten the jobs market and create upward pressures on inflation.

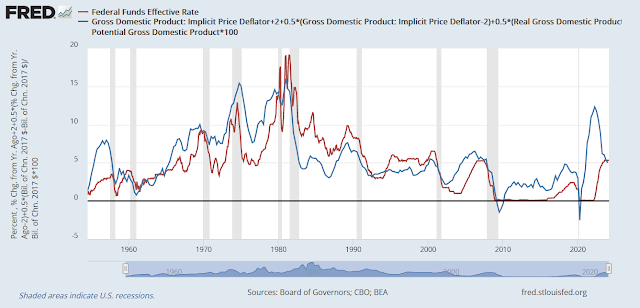

The market is currently discounting one rate cut in 2024, which is expected to occur at the September FOMC meeting. All else being equal, any immigration bill to restrict labour supply in an already tight jobs market may resolve itself in no rate cuts and possibly rate hikes in 2025.

The productivity wildcard

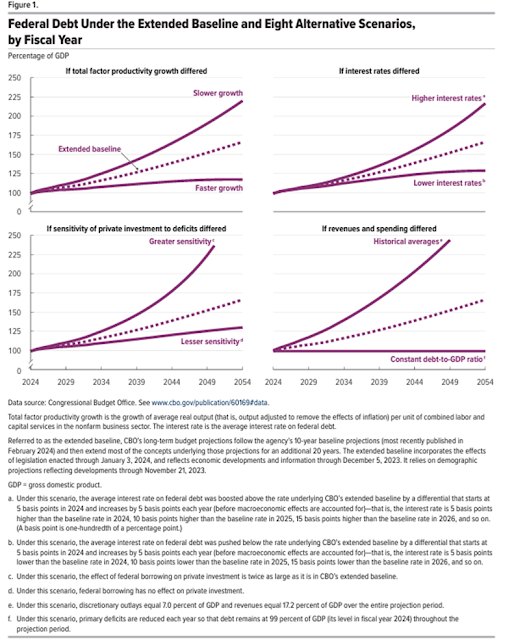

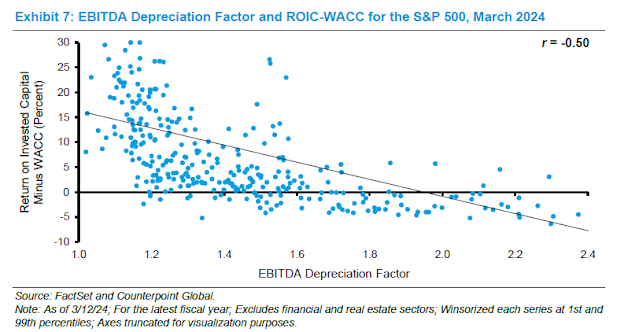

Productivity is the cure for inflation. Better productivity is an offset to higher growth and wages. Analysis from the non-partisan Congressional Budget Office (top left chart) dramatically shows how productivity matters and how it affects not only inflation, but also the degree of fiscal room the government will have in the future.

The question of how productivity evolves has been a puzzle for Fed policy makers as productivity gains have been noisy. Powell discussed this policy dilemma at the May post-FOMC press conference: “We saw a year of very high productivity growth in 2023, and we saw a year of, I think, negative productivity growth in 2022. So I think it’s hard to draw from the data.”

There are several schools of thought on productivity. The conventional view is that changes in productivity are noisy and Fed policy makers can’t reliably depend on productivity gains to moderate inflationary pressures.

Election effects

While it’s always difficult to predict electoral outcomes and it could be argued that polls aren’t very meaningful until the campaign begins in earnest in September, current market expectations of aggregated betting odds has Trump leading Biden despite his felony convictions last week.

With that in mind, Bloomberg reported that Deutsche Bank economists project that Trump’s proposed tariffs are expected to raise headline PCE by 1.2% and core PCE by 1.4%. This will force the Fed’s hand to pivot to raising rates.