Instead of worrying about whether it can rally through resistance, here is another index that staged a cup and handle breakout, but to all-time-highs. It’s the NYSE FANG Plus Index, which represents megacap growth stocks, which has been the market leadership. The catch is its relative strength is faltering and its retreated to test a key relative resistance turned support level. Further relative weakness could signal a loss of megacap growth leadership.

Growth or Value?

It appears that value is starting to take over the baton of market leadership. The accompanying chart shows the relative performance of value and growth across different market cap bands and internationally. In all cases, value stocks are beating their growth counterparts. Even more astonishing is that small-cap value is turning up against large-cap growth (bottom panel).

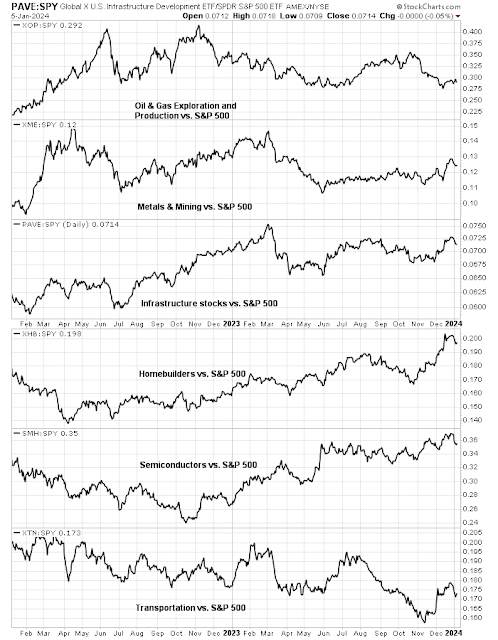

The predominant value sectors are financials, industrials, energy, materials and selected consumer discretionary stocks, except for heavyweights Amazon and Tesla. In other words, value has a significant cyclical exposure. The accompanying chart shows the relative performance of selected key cyclical industries. With the exception of oil & gas extraction, most are exhibiting positive relative strength against the market.

In summary, the bottom-up internals of the stock market are discounting a cyclical revival. This view is confirmed by a longer-term analysis of the relative performance of growth and value. Historically, investors have flocked to growth stocks when economic growth is scarce. We can see the dramatic outperformance of growth in 2020 during the COVID Crash and in 2023 when the consensus called for a recession which never arrived.

It appears that growth stocks are faltering, and cyclicals and value are starting to lead the market.

Transitory disinflation?

In other words, a bottom-up analysis of the stock market shows that it is discounting a “no landing” scenario, in which economic growth revives, instead of the consensus top-down “soft landing”, where economic growth slows and inflation decelerates sufficiently for the Fed to cut rates. An economy that achieves “no landing” may not slow sufficiently for inflation to drop to the Fed’s 2% target, which implies a scenario of higher-for-longer interest rates. Such a development would be a jolt to interest rate expectations, which are discounting a series of quarter-point rate cuts that begin in March.

That said, a more detailed analysis of the jobs data from the JOLTS and December Employment Report shows that data is still inflation friendly, despite the stronger than expected headline prints. Temporary jobs, which lead nonfarm payroll, fell -33,000 in December.

While headline average hourly earnings came in ahead of expectations, average hourly earnings of production and nonsupervisory personnel, which mainly excludes the effects of management bonuses, continues to decelerate. As well, the quits rate from the JOLTS report is also falling, which is another sign of a cooling jobs market.

In conclusion, I have highlighted the risk of transitory disinflation before (see A Bull Market With Election Year Characteristics). A divergence has appeared between the top-down and bottom-up expectations of growth. The top-down consensus is a soft landing, while the bottom-up consensus is no landing, which could put upward pressure on inflation and interest rates. Investors need to closely monitor these developments as the market could be rattled by a transitory disinflation narrative and a higher-for-longer monetary policy response.

DO YOU BELIEVE IN DOW THEORY?

For old of us to old to remember DOW Theory was a very popular means of judging the start, continuation and ending of a market rally. Without getting into details it basely looked for confirmation of both the Dow Jones Industrial and the Dow Jones Transportation at turning points. Well the last rally we had since November to the recent highs was NOT confirmed. A little more alarming is what you see in the individuals stocks in the Transportation index. Fed Ex, UPS, Airlines (UAL, DAL, ALK and AMR). Add to the mix GM and Ford. Now we have likes of Walmart and Walgreens saying the consumer is pulling back.

Hard Landing anyone?

One thing we have to keep in mind is that times are different , not that this time is different, but that we are in a world of fiat currencies. Back in 1929 when there was the crash, money was backed by gold. FDR did his trick with repricing gold in 1933, but that was it.

The money then was our money, the US was the greatest creditor. They did not want to trash our money.

Now we have fiat, there is no restraint, besides we are the world’s greatest debtor, so why not trash the dollar if we can get away with it? Also called kicking the can down the road BTW.

One thing the covid crisis convinced me of is about the effect of fiscal deficits. Does it matter if the deficit is because we are sending out covid checks or social security checks, or whatever? Do you think that the gov’t in an election year will show restraint? I don’t

It’s a bit like someone who had some tough times before getting a credit card, but now charges it on the card. Does that go on forever? Not for you and I but who knows how long it can go on for for the world?

Well, if the whole world does it, expect more currencies, and I can only see inflation here to stay (in a long time frame) .

Can you imagine if we had to cover our deficits with hard money, and if we had none left could no longer spend? Now that is scary.

Inflation means to buy hard assets, and short term treasuries because if rates keep rising (not in a straight line) for the next 20 years, you don’t want to get hammered like SVB because no matter how loud you holler Jay Pow has you on ignore. For those of us lucky enough to have locked in 30 year mortgages at sub 3%, ah the joy of having money in a Roth IRA that pays over 3% and who knows may go much higher.

What will happen in Canada where there is no such thing as 30 year fixed is food for thought.

If it starts to be realized that inflation is here to stay and maybe going higher….like in 202? how things might look….will 30 year fixed rates be available?

Those lenders who lent at 3% or less, as costs go up, as rates are much higher…how long can they hold out?

My advice to anyone buying a house, get a 30 year mortgage, you can always refi at 30 years if rates go down. In California it is a problem insuring your house because of fire risks. State Farm honors existing contracts but is apparently not underwriting new ones.

Does anyone want to have a variable rate mortgage when rates are going up?

Look at a long term chart $SPX:$GOLD…it peaked around 1999 at 5.55 or so, went to 2.6 in 2022 and now is around 2.29. The caveat of course is “what if people no longer want gold?”

So we may not get a hard landing in equities, but life may not be getting easier. The stock market is not Main Street.

A more modern view of Dow Theory here: https://twitter.com/SethCL/status/1743254316201173200