Mid-week market update: I am sure everyone has seen the breadth divergences. Even as the S&P 500 rises to all-time highs, different versions of the Advance-Decline Line are struggling. Breadth deterioration is evident the further down you go in market capitalization.

The breadth divergence can also be observed in falling correlations between stocks within the S&P 500. That’s because the AI and Magnificent Seven stocks have completely become disconnected with the rest of the index. Such conditions are usually temporary and don’t last for a long time.

The bifurcation in market internals has sparked a Hindenburg Omen signal (see this

article from David Keller). While the name of the signal sounds ominous and it has a history of false positive signals (grey bars), the market usually needs a cluster of signals before breaking downwards (pink bars).

Stretched positioning

Positioning analysis is also flashing warnings of vulnerability. Nomura found that asset manager positioning in equity futures is at the 100 percentile.

Estimates of the positioning of CTAs, who are mainly trend followers, are also very stretched.

Call option skew, which measures call option pricing, is at a 20-year high, while put option skew is at 20-year low. Investors are piling into call options while avoiding put options.

An expensive market

In addition, the S&P 500 is stretched on forward P/E valuation. The index is trading at a forward P/E of 20.0, which is above its 5- and 10-year averages.

Normally during this part of the market cycle, P/E expansion is offset by strong earnings growth. The latest update form Q4 earnings season shows that both EPS and sales beat rates are subpar, though forward 12-month EPS estimates are still rising.

In other words, sentiment is at a crowded long; valuations are expensive; and the market is ripe for an unexpected setback.

Possible bearish triggers

I have no idea what could spark a market pullback, but here are some possible triggers. A simple one might be technical deterioration. The Magnificent Seven, which had been the source of a lot of the bullish momentum, has seen its own breadth narrow recently. The Nvidia earnings report due in two weeks could be pivotal to this rally.

Historically, the market has corrected whenever the NASDAQ High Low – Logic Index rises to 1.70 or more.

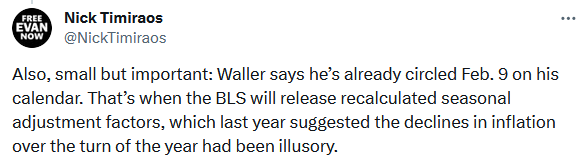

Nick Timiraos of the WSJ highlighted the BLS adjustments to the CPI on Friday as a possible inflection point in how the Fed perceives inflation.

Business Insider reported that even uber-bull Tom Lee at Fundstrat is expecting a near-term correction, though he remains long-term bullish on stocks.

I agree. While I am long-term bullish, the market is vulnerable to a short-term setback. Investment-oriented accounts may want to marginally reduce some risk. Traders should be vigilant about the possibility of a correction, size their long positions accordingly, and implement risk control in order to limit risk.

Even though my inner trader is highly cautious, he isn’t going short this market until he sees a definitive bearish break with sufficient downside potential.

The NYA Adline in 1998 peaked in April and kept dropping all the way through 2000. Irrational markets can stay irrational.

Talking about signs of a top, is Blackrock’s plan to project Bitcoin logos on buildings a sign? If BTC implodes to the point that miners stop mining it, then what? What would the impact of over 1 trillion $ of perceived wealth have? Like any currency BTC requires confidence. I’m not saying this will happen, but after all the ETFs and front running, who is left to buy?

Now just about everyone is waiting for a correction. Does that mean that most people know they will be disappointed so that their algos continue to chase? Let’s see how high ARM can go in next trading session.