In addition to this obvious bullish price reversal on the weekly chart, here are five other risk reversal factors that you may have missed.

A credit reversal

Not very long ago, the market consensus was a U.S. recession is just around the corner. Historically recessions are equity bull market killers.

One characteristic of a recession is a credit crunch. The Fed’s quarterly Senior Loan Officer Opinion Survey (SLOOS) showed some surprising results. Banks tightening credit standards for corporate loans (blue line, inverted scale) reversed a tightening trend and eased. This indicator has been highly correlated with real GDP growth (red line).

Recession, what recession?

A term premium reversal

Also not very long ago, the market was highly concerned about a rising term premium, or the price demanded by investors to hold long-dated bond maturities. Numerous Fed speakers acknowledged that a rising term premium was tightening financial conditions, which lessened the necessity for the Fed to raise rates. The latest Quarterly Refunding Announcement revealed a lower level than expected supply of Treasury bonds and sparked a bond market rally. The term premium fell as a consequence of lower yields.

Does that mean the Fed will have to raise rates to compensate for a falling term premium? Not necessarily. Improvements in productivity gives the Fed more wiggle room as better productivity is conducive to non-inflationary growth.

In fact, BoA pointed out that productivity improvements have enabled real revenue per worker to near all-time highs.

An earnings expectations reversal

From a fundamental perspective, market expectations of an earnings recession and recovery are almost upon us. FactSet reports that consensus EPS estimates for the S&P 500 calls for quarterly EPS to trough in Q4 and recover starting in Q1. As markets are forward-looking and usually look ahead 6–12 months, any weakness has already been discounted.

Indeed, the Q3 GDP growth came in at a sizzling 4.9%, the Atlanta Fed’s Q4 GDPNow has slowed to 2.1%.

Nevertheless, S&P 500 consensus forward 12-month EPS are continuing to rise, indicating bullish fundamental momentum.

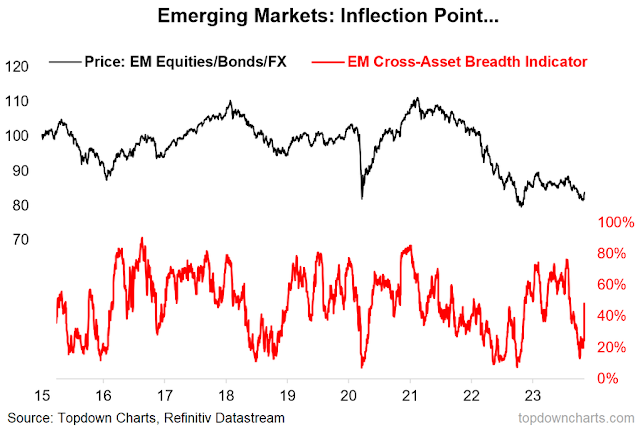

An emerging market risk reversal

I have highlighted how the S&P 500 has been inversely correlated to the USD in the past. The USD Index, which is heavily influenced by the weakness in the euro and the Japanese yen for idiosyncratic reasons, is testing a key support level. However, the more sensitive emerging market currencies (bottom panel) have already rallied above a key resistance level, which has bullish implications for risk appetite.

Callum Thomas of Topdown Charts also pointed out that EM breadth is surging, which is an early sign of improving global risk appetite.

A geopolitical risk appetite reversal

Finally, remember the surprise Hamas attack on Israel and the market fears of what may happen when Israel responded? Since then, while Hezbollah and Iran have used tough rhetoric, they pulled back from participating in the war and the risk of conflict enlargement has receded. As a consequence, the geopolitical risk premium has narrowed. Israeli stocks have begun to recover and oil prices have receded.

This is emphatically not a call to buy the Israeli market, only an illustration of how the geopolitical risk premium has narrowed.

In conclusion, we’re old enough to remember how the market was panicked about a U.S. recession and a rising term premium in the Treasury market. Since then, a series of positive technical, macro and fundamental reversals has occurred to alleviate those concerns. These reversals of an extremely bearish psychology are bullish for risk assets.

6 thoughts on “Five bullish reversals you may have missed”

Comments are closed.

Cam

Thanks for this timely article. So, what are the investment implications of this data?

Overweight EM, European markets, overweight cheaper value stocks/Mid and small caps and limit tech exposure? Such a portfolio skew/mix would be tilted away from S&P 500 (large caps) and more towards an equal weighted portfolio?

It depends on whether you want to be a momentum or value investor. Momentum investors should focus on FANG+ or Magnificent 7. Value investors can find bargains in US mid/small caps, EAFE (mostly Europe and Japan), and EM.

Thanks. Appreciate.

The market has been going up for over a decade, so the Stochs have been high much more than low. This could make the oversold weekly recycling to neutral a bullish indicator, but overbought recycling to neutral didn’t signal much because prices kept going higher. What happens when we get into a true bear market that goes on for years? Do we see the opposite?

Looking at long term weekly charts this does appear to happen. There are some really bad times where stochs stay in the lower half for a couple of years and times when recovering from a bear they stay in the upper half, but it only seems to make sense in the rear view mirror.

$$HYIOAS is still low which is reassuring.

We are in a true bear market as we discus this. It is simply a rolling bear market as pointed out by Liz Ann Saunders.

In a rolling bear market, certain parts of the market correct. 2022 was the mega correction of the tech sector, which has now reversed. With the catching up of the tech sector, NQ has caught up with equal weighted S&P 500 in the last two years of the bear market.

Now, it is the mid and small caps that are in a major, historical bear market. With it, are some more interest rate sensitive segments of the market like utilities, staples etc.

Liz Ann Saunders is right. We are unlikely to see a classic bear market like history would dictate. Tech/big 7 may continue to be expensive. Tech will be bought with small 5-10% corrections, keeping the S&P 500 afloat. In the big 7, Tesla has rolled over, but Adobe and Microsoft are making new highs. Proximity bias dictates Apple will continue to be bought regardless (unless Buffet starts to offload).

Having said that, would disciplined buying dictate buying what is cheap (e.g. small and mid cap/Big Pharma, EMs and overseas markets)? Isn’t this how true, contrarian investing supposed to work, or does it not? Sell what everyone is buy, but buy what no one wants to buy?

Have we not seen many such movies before (buying the super expensive stuff and ignoring the cheap stuff?

Here is another example of buying the super expensive stuff: Buying zero bound bonds in the last few years. Bonds are now much cheaper but we still buy expensive big 7, don’t we?

I don’t know.

The money has to come from somewhere and when things really get bad and correlations go to 1, everything goes down including safe haven gold.

Right now 20 year yields are still in a rising channel, if that breaks to the downside I will get more nervous than I am already.

Is the concept of a rolling bear market a new spin on this time is different?

So maybe some stuff is being “juggled” but at some point everything comes down, we just aren’t there yet and nobody really knows when that will happen, but for me, if $$HYIOAS goes above 6 and starts making higher highs and higher lows, get really nervous. It happened in 2000, 2007 and 2015. 2020 it happened literally overnight, but covid was different in that we did not know how many millions or billions would die. This was not a financial threat from malinvestment, so it was different, but $$HYIOAS just spiked vertically giving no time to react.