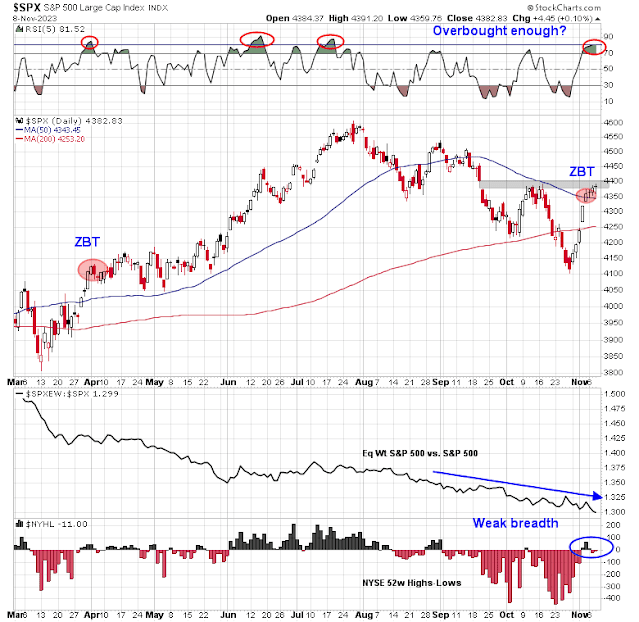

Mid-week market update: I have written extensively about the Zweig Breadth Thrust and its bullish implications in the past few days. In case you haven’t seen the numerous historical return studies floating around on the internet, here is one from Ryan Detrick of Carson Group.

In almost instance, the market cools off for a few days after the ZBT buy signal. Is it time for a temporary ZBT price reset?

The historical evidence

Here is a survey of the out-of-sample ZBT buy signals since 1986. The first one was in 2004, which is marked by the vertical line. The bullish news is the S&P 500 only saw a one-day consolidation after the buy signal. The bad news is the market rallied but weakened to test and eventually undercut the buy signal level within 2-3 months.

The 2009 ZBT signal saw a two-day pullback and a sideways consolidation for about two weeks.

The market traded sideways for four days after the 2011 signal and went on to re-test and undercut the buy signal level within two months.

The market action after the 2013 buy signal can be best described as a runaway freight train, though it did consolidate sideways with a slight upward bias in the first week after the buy signal.

The 2015 buy signal failed badly. The market traded sideways for a week but weakened within three months and fell well below the buy signal level. That said, the S&P 500 was positive both 6 and 12 months after the buy signal.

The market rose after the 2019 buy signal and never looked back. This was another runaway freight train experience.

The ZBT buy signal of March 31, 2023 saw the market consolidate sideways for almost two months. While it did see high prices, the S&P 500 eventually corrected back to buy signal levels until it flashed the most recent buy signal.

Regardless of stocks reacted after the ZBT signal, the historical evidence shows that any pullback during the immediate consolidation period has been minor at worse.

The challenges ahead

Investors and traders face different time horizons and different challenges. For investors, the ZBT is an extremely bullish signal with strong historical returns and success rates. Don’t miss this buying opportunity and remember the words of technical analyst Walter Deemer.

While I am intermediate-term bullish, here are the tactical challenges ahead for bulls and bears. The daily S&P 500 chart shows that the S&P 500 is struggling to overcome gap resistance at the 2380-2400 level. The 5-day RSI only reached the 80 level but this indicator has been higher this year. Arguably, a breadth thrust should carry the RSI reading higher. On the other hand, breadth (bottom two panels) have been poor. Leadership is narrow and breadth hasn’t broadened out, which argues for a short-term price reset.

In conclusion, a rare bullish ZBT signal has been triggered. Goldman Sachs Prime Brokerage data shows that trend-following CTAs are in a crowded short in equities and their positioning is even more extreme than the readings seen at the COVID Crash bottom. A decisive upside breakout through the 4400 level could spark a short-covering melt-up stampede.

On the other hand, the U.S. House of Representatives is expected next week to consider how to address the expiring Continuing Resolution (CR) that will determine whether the government will undergo a shutdown. My political crystal ball is broken and I have no idea how any CR would resolve itself, only that events in Israel and Ukraine is expected to put tremendous pressure on lawmakers. This could be a source of uncertainty and volatility in the coming week.

My inner investor is bullishly positioned, and my inner trader is choosing to look through any possible downdraft and he is staying long the market. The usual caveats apply to my trading positions.

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosure: Long SPXL

Nice!

I’m going to hitch my horse against the crowded shorts.

Of course they could be short the S&P and long something else, but it looks extreme. I’ll look for a pullback or if it breaks out try some options.

Given the persistent poor breadth readings, should it be perhaps just called the Zweig Upward Thrust?!

I address this issue Sunday. Stay tuned.