Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

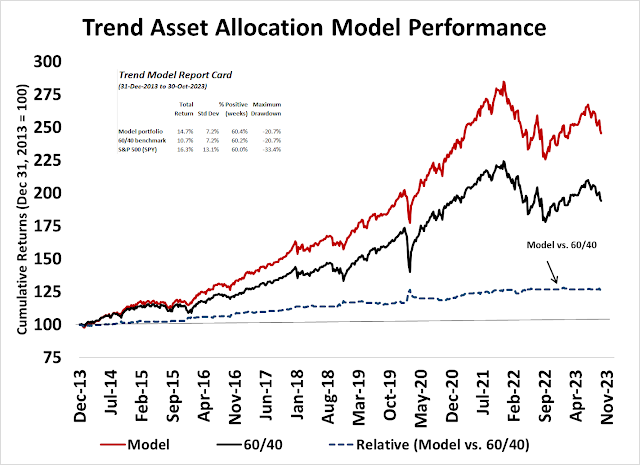

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)

- Trading model: Bullish (Last changed from “neutral” on 20-Nov-2023)

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Publication note: There will be no mid-week market update next week. Regular service will resume the weekend of December 30. Happy Holidays.

A temporary blip

It appears that the best explanation for Wednesday’s sudden market downdraft was same-day option related activity (0DTE) that forced market makers to hedge by selling equities. From a longer-term context, analysis from

Bespoke indicates that similar hiccups in strong bull trends haven’t done damage.

With that in mind, here are the issues to consider as we look ahead into 2024 on differing time horizons.

Short-term outlook

Starting with the short-term outlook, the year-end rally appears to be intact. First, let’s address the issue of Wednesday’s sudden market downdraft on no news, which was accomplished on a TRIN reading of above 3. Such episodes are indicative of price-insensitive selling, this time by option market-makers to hedge an influx of 0DTE put buying in an illiquid market. The past history of TRIN spikes in the last two years have usually resolved with quick price recoveries.

In the short run, I have been focused on equity hedge fund performance and the necessity of HF managers to preserve and enhance returns ahead of their December 31 incentive fee calculation dates. Equity HF returns, as proxied by the market-neutral ETF BTAL, has shown itself to have the following factor bets:

- Negative beta;

- Long quality and profitability;

- Long large caps and short small caps; and

- Long Magnificent Seven and short everything else.

As the accompanying chart shows, BTAL has been losing ground since early November and the FOMC meeting set off a sudden downdraft in returns. This will necessitate a beta chase during a historically illiquid period for funds that haven’t closed their books in order to preserve performance bonuses.

Small cap stocks are staging upside breakouts from multi-month bases during a seasonally positive period for these stocks. Further progress will confirm the bullish prognosis for these stocks, which could spark a FOMO stampede.

In addition, I have highlighted the closely linked relationship between Bitcoin prices and the relative performance of ARK Innovation ETF (ARKK). Bitcoin is also a real-time proxy for financial system liquidity and it’s still rising, indicating strong market animal spirit activity.

Even though I am a cryptocurrency skeptic, Bitcoin may have more room to rally.

Jurrien Timmer at Fidelity has a fair-value estimate for Bitcoin, consisting of a _/- 2.5% real yield, and Bitcoin prices are just moving into that range.

In short, the underpinnings of the Santa Claus rally appears to be intact.

The challenges of 2024

Looking ahead into 2024, investors and traders are hearing calls to take profits in response to the strong equity rally from the October low.

Bloomberg reported that Morgan Stanley’s Portfolio Solutions Group, along with others, is turning cautious on the market:

“We’ve been overweight in equities all year,” said Jim Caron at Morgan Stanley’s Portfolio Solutions Group. “We are starting to think about reducing that and moving towards neutral. We haven’t done it yet but that’s probably our next step. And why that is, everything we thought about in late October, November has actually already come through.”

Marketwatch reported that uber bull Ed Yardeni has also turned temporarily cautious:

Proceed cautiously, warns our call of the day from Yardeni Research’s chief investment strategist, Ed Yardeni, who earlier this month predicted the S&P 500 could reach 6,000 in two years.

“Is everybody (too) happy?” Yardeni asks in an update to clients on Thursday. “Most pundits concluded that the market was overbought and due for a correction. We agree, which is why we haven’t raised our longstanding year-end target of 4,600.”

The strategist said one possible trigger for the selloff was a sign that the Israel-Gaza war is turning more regional, after the U.S. announced a security operation in the Red Sea involving the U.K., Canada, France, Spain and other nations, to protect ships from a wave of Houthi attacks.

Despite these calls to take profits, keep in mind that the BoA Global Manager Survey don’t show the fingerprints of a major market top. While the risk levels of global institutions are normalizing, readings are not a crowded long and equity weights can rise much further before they reach a crowded long condition, which would be contrarian bearish.

Soft landing ahead

What I wonder about is bonds. Why has the Fed been shifting to shorter term paper? What aren’t they telling us? Federal deficits will continue to go up, this is inflationary. Maybe the shift is because nobody really wants the long term stuff because they anticipate higher inflation ahead. So what will bond rates be 5 years from now? Initially rising rates hinder the market but eventually the effect of inflation is to raise equities. It’s why Zimbabwe had the best performing market for a while as it’s currency plunged. I don’t expect that for the US$, but if the dollar drops a lot over the next few years, with a huge balance of trade deficit, what will happen to inflation?

One thing bitcoin has underlined is that if people think they can buy and sell higher, they will. That includes bonds. Buy until rates go negative if you think the price will go higher.

If inflation takes a hold and people get in their heads that rates ARE going higher, will they start selling because they can buy back later at a lower price?

2023 balance of trade deficit is close to a trillion $. Almost 3000 for every man woman and child. Who is buying this stuff? If the dollar drops 10% what happens to inflation with this huge imported component of our economy? The dollar has been strong during this disinflation, if it weakens, what happens to inflation? It can’t be good.

For me, the canary in the mine is the shift to shorter term paper.