As 2024 draws to a close, it is becoming clear that the U.S. equities have led the way for most of the year. The accompanying chart shows the relative returns of equities by major region against the MSCI All-C ountry World Index (ACWI). The U.S. has been the only safe-haven of growth as the economies of other regions sputtered.

This was the year of TINA (There Is No Alternative) for American equities. Can it continue into 2025?

The story of American Exceptionalism

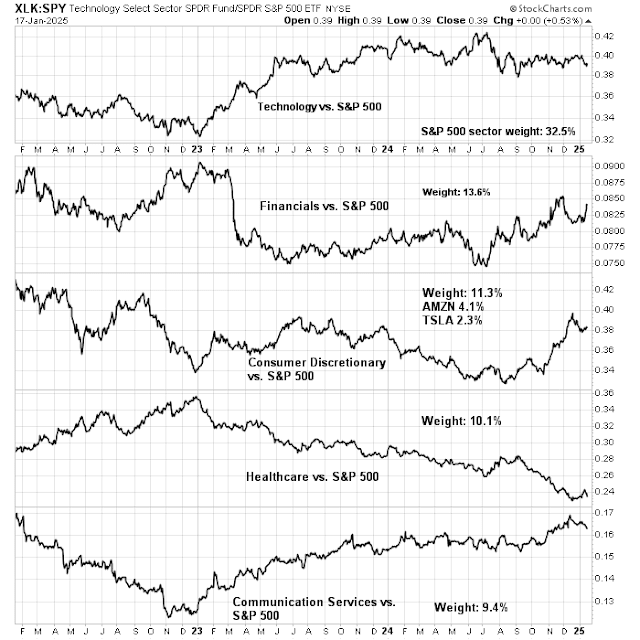

Much of the strong returns shown by U.S. equities is attributable to the Magnificent Seven.

Here is an example of how U.S. megacap growth has been dominant. NYU Stern professor Aswath Damodaran, who is considered to be the “dean of valuation”, characterized the Magnificent Seven as cash machines in a

Bloomberg TV interview, “As a value investor, I have never seen cash machines as lucrative as these companies are. And I don’t see the cash machine slowing down.” He went on to advise investors to buy Magnificent Seven stocks on a correction, “I’d suggest that when that happens you find a way to add at least one, maybe two or three of these companies because these are so much part of what drives the economy and the market.”

Across the Atlantic, Germany has been beset by manufacturing weakness and falling employment. France, the other major axis of Europe, is mired in a budget crisis as the yield spreads on French OATs blow out.

Asia isn’t faring much better. The Chinese economy continues to sputter. The BoJ is trying to normalize interest rates, but by tightening monetary policy in the face a trend of global easing, it is risking a disorderly unwind of the Yen carry trade. In addition, South Korea is facing a political crisis that’s rattled markets.

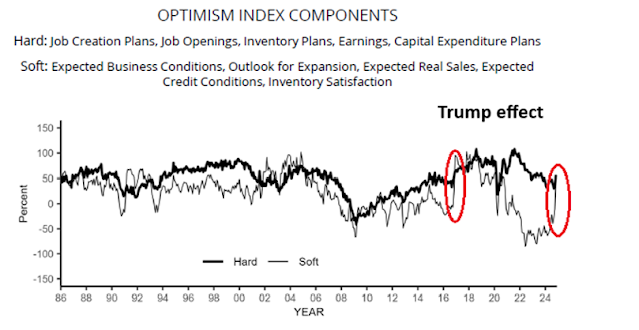

As a consequence, the USD is following the path set in 2016 after Trump won the election.

A different kind of cycle

For some perspective, here is why the current cycle is different and some of the conventional rules of thumb of investing are not applicable.

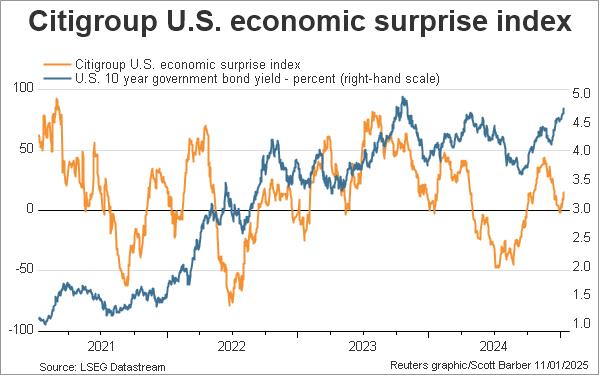

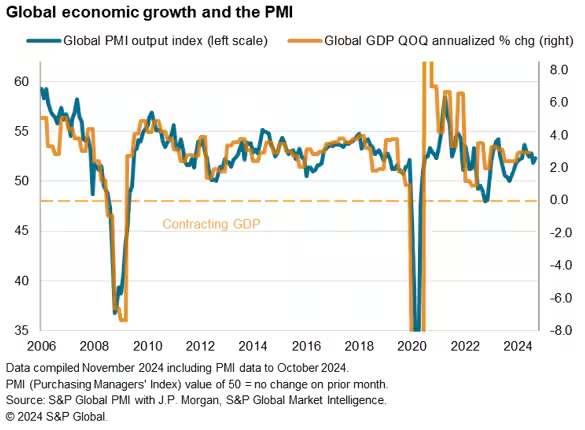

Global central banks are undergoing an easing cycle. In the past, instances of co-ordinated easing were signals of weakening growth. Instead, monetary easing is occurring against a backdrop of a reasonable global growth outlook, which is very different from past aggressive easing cycles.

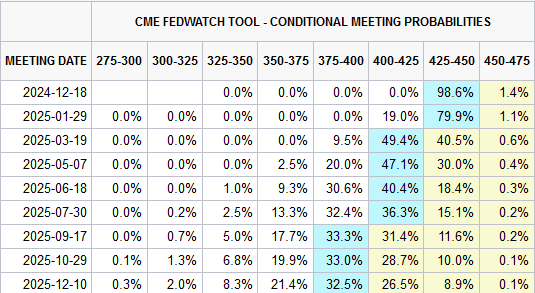

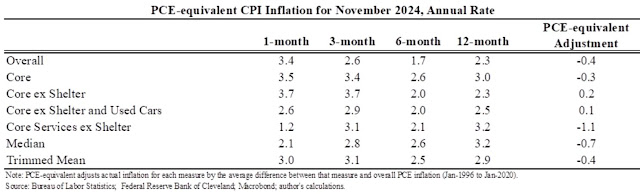

This time, the easing response to excessively tight monetary policy. Inflation, which had spiked in the wake of the COVID pandemic response, is now normalizing. Fed Chair Powell stated last week that the economy is strong and signaled the Fed is likely to slow the pace of easing, “The good news is that we can afford to be a little more cautious as we try to find” the neutral rate. The market interpreted his remarks as the Fed will cut by a quarter-point at the December FOMC meeting and ease on a gentler path in 2025.

Inflation surprises around the world have stabilized, which may be a concern as most inflation measures haven’t fallen to their 2% targets.

Financial markets have responded with a risk-on tone to these conditions. Most global stock markets are at or near either recovery or all-time highs. Yield spreads, with certain exceptions like France, are tight.

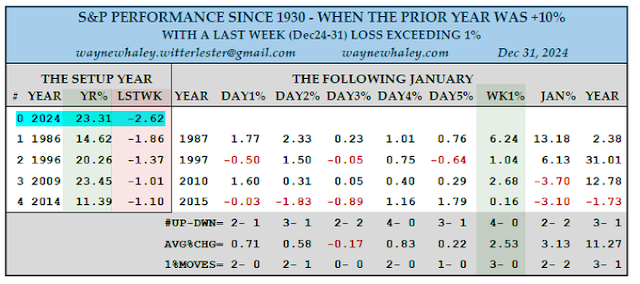

A year of transition

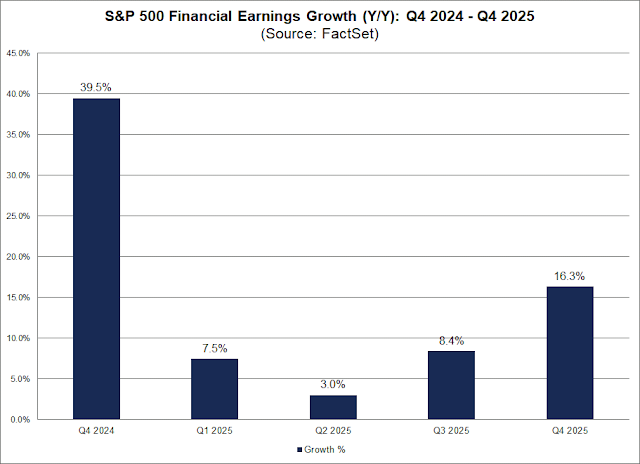

Here is the back-of-the-envelope math for my reasoning. The S&P 500 trades at a forward P/E of 22, which is highly elevated by historical standards, meaning that earnings growth will have to do most of the heavy lifting if stock prices are to advance. As there is no recession on the horizon, let’s pencil in 8–12% earnings growth, which is roughly nominal GDP (3% real + 3% inflation) plus 2–6% margin improvement. Subtract from earnings growth of 8–12% a P/E compression of 1–3 multiple points, you arrive at flat to slightly positive return expectations.

Despite the subpar S&P 500, investors can find pockets of opportunity. Regular readers know that I am a long-term gold bull, but the accompanying chart shows the big picture macro shifts in perspective. Here are the key takeaways:

- The Gold/S&P 500 is undergoing a multi-year bottom process, which is a signal of a slow shift from disinflation to reflation.

- Similar synchronized bottoming processes can be seen in size (small vs. large caps), value/growth and small-cap value/large-cap growth.

- While equity factor returns such as size and value/growth cycles are evident, gold is still dominant, as shown by the gold/S&P 600 small-cap chart (bottom panel).

I believe 2025 will be a year of transition for global markets: from large caps to small caps, from growth to value and from paper assets to hard assets, and gold in particular. From a contrarian perspective, even the perennially bearish David Rosenberg has thrown in the towel on his bearish stock market call and cited an “AI-induced model shift” as part of his reasoning.

What about the dominance of the Magnificent Seven that Aswath Damodaran gushed about? Analysis from FactSet shows that earnings growth expectations between the Magnificent Seven and the other 493 stocks in the S&P 500 are expected to narrow, especially in H2 2025. This argues for a gradual rotation from growth to value in the coming year. A similar dynamic can also be found in small cap against large caps, which much of the latter is dominated by the Magnificent Seven.

From a global perspective, U.S. equities are richly valued. The equal-weighted S&P 500 trades at a forward P/E of about 20, which isn’t cheap. Any way you look at it, if you exclude the Magnificent Seven or on an equal-weighted basis for the S&P 500, the price-to-book ratio of U.S. stocks is far higher than other developed markets, as measured by MSCI EAFE.

Opportunities are starting to appear in Europe. Historically, spikes in eurozone spreads have been good entry points into European assess. Tactically, it’s probably too early as the French contagion hasn’t spread to the rest of the eurozone. Wait for the panic over the next euro crisis. France is too big to save, which is precisely why the Eurocrat Establishment will save it.

As for Asia, I would prefer to wait for greater clarity on the Chinese growth outlook and how the BoJ normalizes monetary policy before becoming overweight in the region.

In conclusion, 2024 was a year of American exceptionalism and asset return domination, led by the leadership of the Magnificent Seven. I believe Magnificent Seven leadership is likely to fade in 2025. I expect that 2025 will be a year of transition from growth to value, large caps to small caps and paper to hard assets.