Treasury Secretary Scott Bessent declared in an interview with Fox Business a surprising target. Bessent and the Trump Administration were mainly focused on lowering the 10-year Treasury yield and Trump is not calling the Fed to lower short-term rates. He also reiterated the Trump Administration’s objective of raising energy output and the extension of the TCJA tax cuts.

Here is the short-term report card. Since the Fed announced its jumbo half-point rate cut in September, the 2-year Treasury yield, which is a proxy of the market’s expectations for the terminal Fed Funds rate, has risen, and so has the 10-year yield. The 2s/10s yield curve steepened, indicating stronger growth expectations.

Since the election, the 2-year yield is roughly flat and the 10-year yield is up marginally. The bond market has shrugged off anxiety over the possible effects of a trade war, when President Trump announced a 25% tariff on Canada and Mexico, which was later walked back, and a 10% tariff on China. More importantly, the U.S. eliminated a de minimis tariff exception on the import of Chinese goods below $800. An entire industry had grown up to exploit this loophole by sending small individual packages to exploit this rule.

So far, so good. The bottom panel of the chart summarizes Scott Bessent’s main challenge in controlling the 10-year yield. The MOVE Index, which is the VIX of the bond market, had fallen since the election and readings are relatively low by historical standards. Bessent’s main task is to calm the bond market and keep anxiety levels low.

Bessent’s tools

Bessent has a number of tools available to him as Treasury Secretary. The first is to signal how he plans to manage the government’s debt. As the Treasury market is the largest and deepest bond market in the world, no government can control it without suffering consequences elsewhere, such as the exchange rate.

The latest Quarter Refund Announcement conveyed a “steady as she goes” message. The expected level of debt issuance is not significantly different than what was a year ago, indicating that Bessent doesn’t expect much progress on the deficit in the near term. In addition, the mix of the issuance of short- and long-term paper was about the same as what it was, despite widespread criticism that the Yellen Treasury was issuing too much short-term paper to boost banking liquidity instead of locking in rates in the longer end of the yield curve.

Bessent’s cautious approach of keeping long-dated Treasury supply relatively low has paid off in the short run, but long-term challenges remain. The non-partisan Congressional Budget Office estimates that fiscal deficits will exceed 5% of GDP for as long as the eye can see — and that assumes the TCJA tax cuts expire. This will put upward pressure on Treasury supply and the 10-year yield as a consequence.

Will supply overwhelm demand under such a scenario? There are some steps the Trump Administration can take to alleviate any potential supply-demand imbalance. Fed Governor Michelle Bowman, who is a front-runner to become the Fed Vice Chair for banking supervision, proposed raising bank leverage ratios in a recent speech:

Where we can take proactive regulatory measures to ensure that primary dealers have adequate balance sheet capacity to intermediate Treasury markets, we should do so. This could include amending the leverage ratio and G-SIB surcharge regulations for the largest U.S. banks. Adopting regulatory changes to mitigate these concerns may not be sufficient to ensure market liquidity, but it would be an important step toward building resiliency in advance of future stress events. In my view, it would be better to fix the roof now, while the sun is shining, by addressing over-calibrated leverage ratio requirements, and considering the unintended consequences of any future capital reforms.

Bowman made a similar suggestion in a speech in January 2024, in the context of addressing possible liquidity problems in the banking system before it occurs:

Looking Beyond Basel III: Leverage Ratio Requirements. Capital requirements are intended to be complementary—risk-based capital rules require banks to hold capital against more granular and specific risks, while leverage requirements operate as a backstop in the ordinary course of business. This arrangement works by design, but we have seen some cracks emerge, particularly around the impact of the 5 percent leverage ratio that applies to U.S. global systemically important banks at the holding company, commonly referred to as the enhanced supplementary leverage ratio (or eSLR). While risk-based and leverage capital requirements are intended to be complementary and promote the safe and sound operation of the banking system, the eSLR can disrupt banks’ ability to engage in Treasury market intermediation, which we saw occur in the early days of market stress during the pandemic. I consider reform of the eSLR to fall in the category of “fixing what is broken.” This is an issue that would be prudent to address before future stresses emerge that could disrupt market functioning.

What does the Fed do?

Even as Bessent focuses on the level of the 10-year yield, which he has no direct control over, he has to contend with the Fed, which controls the short-term rate. Vice Chair Philip Jefferson, who is part of Powell’s inner circle, said in a recent speech that he is in no hurry to cut rates because of the Fed’s data dependence [emphasis added]:

Over the medium term, I continue to see a gradual reduction in the level of monetary policy restraint placed on the economy as we move toward a more neutral stance as the most likely outcome. That said, I do not think we need to be in a hurry to change our stance. In considering additional adjustments to the federal funds rate, I will carefully assess incoming data, the evolving outlook, and the balance of risks

Jefferson’s go slow view was echoed by Dallas Fed President Lorie Logan in a speech last week. She could envisage a scenario in which she wouldn’t support further cuts:

What if inflation comes in close to 2 percent in coming months? While that would be good news, it wouldn’t necessarily allow the FOMC to cut rates soon, in my view.

Suppose, for example, that as the first quarter unfolds, monthly inflation figures come in at a 2 percent annualized rate, labor market indicators hold right where they were all fall, and consumer spending and business investment also stay strong.

I’d find it hard to say monetary policy was meaningfully restrictive in that scenario. One aspect of the global higher-rate environment is that the neutral interest rate appears to have moved up—though it’s uncertain exactly how much. On-target inflation alongside two quarters of stability in the labor market and demand would strongly suggest that we’re already pretty close to the neutral rate, without much near-term room for further cuts. On the other hand, if the labor market or demand cools further, that could be evidence it’s time to ease.

The January Payroll presented a mixed picture. Headline employment came in at 143,000 jobs, which was below the consensus estimate of 169,000, but revisions in November and December added a net 100,000 jobs and the unemployment rate fell from 4.1% to 4.0%. Average hourly earnings spiked in January, but the increase could be related to the cold weather. If sustained, it would represent an unwelcome hawkish development that would put rate cuts on hold. Overall, the report conveyed the picture of a tighter-than-expected labour market.

Trump policy headwinds

Bessent’s desire to maintain a low or stable 10-year yield also faces headwinds from some of Trump’s policies. In addition to the market’s trade war fears, which is a widely shared worry, we have warned in the past about the risks to inflation and economic growth from deportations (see Two Key Risks to the Bull That No One Is Talking About). Both of these issues have drawn increasing concerns on company earnings calls.

Bob Elliott, CEO of Unlimited Funds, highlighted a potential troubling development due to Trump’s strict immigration and deportation policies. Most of the job growth in the latest cycle is attributable to foreign born workers driven by strong immigration, which is about to end.

However, foreigners don’t seem to be pushing out the native-born workers, as the unemployment rates of both groups are very similar.

Not all foreign-born workers are illegal, but if Trump’s deportation policy is sufficiently large in scale, it would remove sufficient people from the workforce to create a worker imbalance and push up wages, which is consistent with Lorie Logan’s scenario of falling inflation and a tight labour market. Moreover, the workforce reduction would put downward pressure on economic growth potential. If labour supply were to stay flat or exhibit weak growth, productivity would have to do most of the heavy lifting if the economy were to grow.

Stagflation would the more likely outcome in such an instance.

Trump’s widespread use of the tariff weapon is also troubling. When he announced a 25% tariff on Canada and Mexico, a WSJ editorial called it “The Dumbest Trade War in History”. Wall Street strategists all marked up inflation forecasts and marked down growth expectations in reaction to the announcement. Trump acknowledged in a social media post that there may be “some pain” as a result of the tariffs.

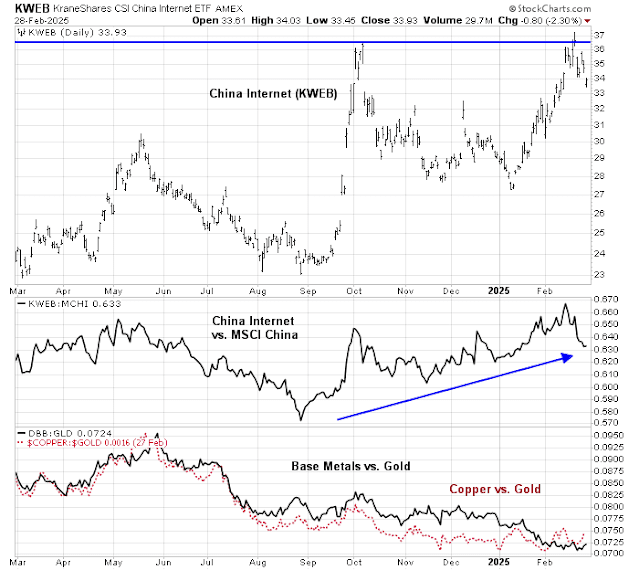

As it turned out, the tariff threat to Canada and Mexico was defused, though the China tariffs remain in place. China’s retaliation has been relatively light, unlike the last trade war when China targeted America’s farm exports, which had a widespread impact. This is a constructive sign that China is open to negotiations and not ready to engage in a full-scale trade war.

The question for investors is what Trump does next?

The 25% tariffs on Canadian and Mexican goods are only delayed for a month, and he has signaled that he is ready to turn his sights on the EU. The market was rattled Friday when he announced reciprocal tariffs on unspecified countries. He has also shown his willingness to use the tariff threat as a negotiation tool to force concessions in non-trade-related negotiations. Could he deploy such a threat to support his desire to take control of Greenland?

Trump has characterized “tariff” as “a beautiful word”. He has embraced its use as a revenue generation tool as a substitute for income taxes, which is a throwback to the 19th Century. In light of the U.S. Treasury’s budget pressures, excise taxes such as tariffs could be a tempting policy option to raise revenue, which is projected to boost inflation and cut growth.

Scott Bessent, writing as a hedge fund manager, admitted a year ago in a

client letter that “Tariffs are inflationary and would strengthen the dollar—hardly a good starting point for a U.S. industrial renaissance.” As well, USD strength is raising the risk of a sudden discontinuous devaluation on countries with Dollar pegs, such as Argentina, Egypt and Turkey, which would raise the risk premium in global financial markets.

The verdict

In summary, Treasury Secretary Scott Bessent’s stated objective of focusing on the 10-year Treasury yield is a sensible one, but he faces a number of key challenges.

The market is giving Bessent the benefit of the doubt for now. The bulls can rightly argue that inflation expectations have declined since the inauguration.

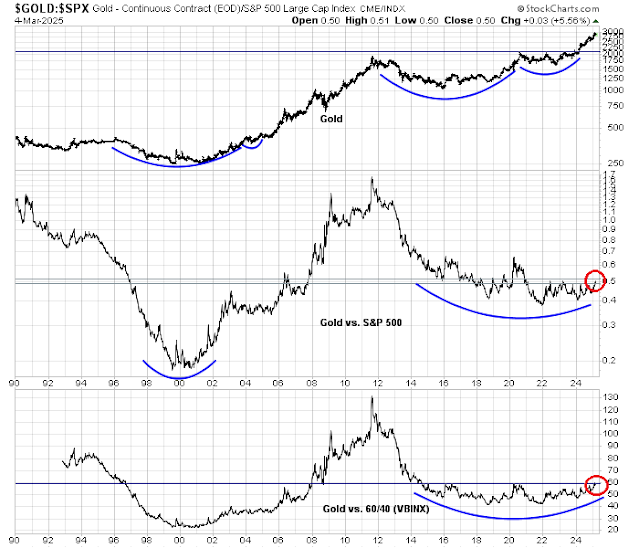

The bears will argue that gold prices, which are a hedge against unexpected inflation, have risen to all-time highs in all currencies.

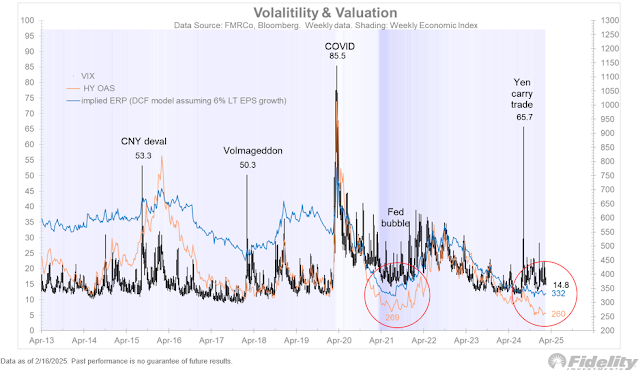

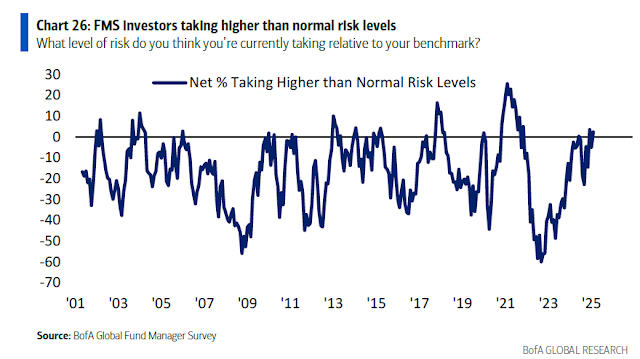

In the end, much depends on the future trajectory of the term premium, which is the compensation demanded by investors to extend maturity. Any spike in the term premium would pose a serious threat to the success of Trump’s economic agenda, potentially unravel the stability of the Treasury market and crater the appetite for risk assets. Even though the term premium has staged a short and shallow retreat, it remains at a new cycle high and risk levels are elevated.