It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time.

I have stated that while I don’t believe that the stock market has made its final cyclical top, we are in the late stages of a bull market (see Risks are rising, but THE TOP is still ahead and Nearing the terminal phase of this equity bull). Nevertheless, psychology is getting a little frothy, which represent the pre-condition for a major top. This is just another post in a series of “things you don’t see at market bottoms”. Past editions of this series include:

- Things you don’t see at market bottoms, 23-Jun-2017

- Things you don’t see at market bottoms, 29-Jun-2017

- Things you don’t see at market bottoms, bullish bandwagon edition

- Things you don’t see at market bottoms, Retailphoria edition

- Things you don’t see at market bottoms, Wild claims edition

- Things you don’t see at market bottoms, No fear edition

- Things you don’t see at market bottoms, Paris Hilton edition

- Things you don’t see at market bottoms, CFD edition

As a result, I am publishing another edition of “things you don’t see at market bottoms”.

$1,000 gold bagel

The Westin New York will start selling a bagel with white truffle cream cheese and sprinkled with gold flakes for $1,000. This item was last offered on the menu in *ahem* 2007.

The timing of this menu offering speaks for itself.

Euphoriameter at a cycle high

Callum Thomas of Topdown Charts has constructed a “Euphoriameter”, which is a combination of forward P/E, VIX and bullish sentiment. Readings are at a cycle high and it is near the peak seen in the last market cycle.

Cash is trash

We are seeing numerous signs that retail investors are all in on equities. Consider this comment from Morgan Stanley CEO James Gorman on the company’s earnings call:

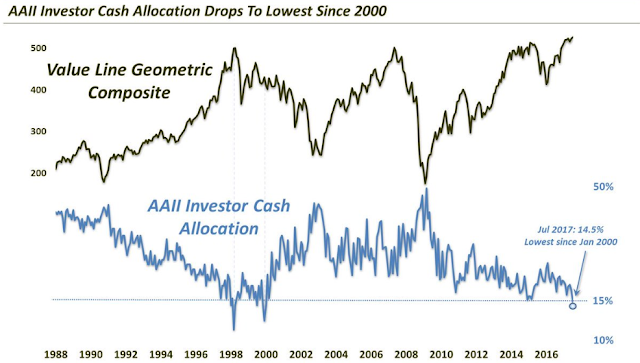

“We saw more cash go into the markets, particularly the equity markets as those markets rose around the world. And we’ve seen cash in our clients’ accounts at its lowest level.” –Morgan Stanley CEO James Gorman

These readings have been confirmed by the AAII asset allocation survey, which shows cash at lows not seen since the top of the NASDAQ Bubble.

A similar level of investor enthusiasm can be found in mutual fund cash data.

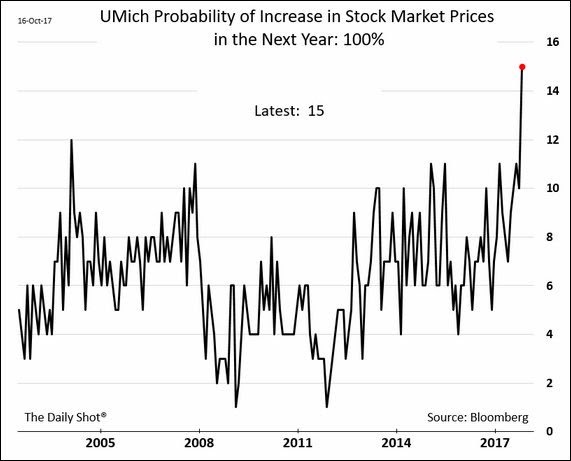

The latest University of Michigan investor confidence survey shows that respondents have 100% confidence that the stock market will not decline in the next year.

ICOs are the new black

Finally, Bloomberg reported that Initial Coin Offerings (ICOs) have raked in $1 billion in two months, and their total market capitalization now exceeds $3 billion.

For a primer on ICOs, please see Appcoins are the new snake oil, by Daniel Krawisz, published at the Nakamoto Institute.

With that in mind, Humble Student of the Markets would like to announce an ICO offering…

I’ll take $100,000 of those BitHui coins.

Is that USD or CAD 100,000? 🙂

100K in hard assets, not in fiat currency.