Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Where’s the Bubble?

Ben Carlson at A Wealth of Common Sense recently detailed the four criteria for a market bubble:

In a recent conversation with Meb Faber, William Bernstein discussed how his criteria for seeing a bubble has more to do with sociological factors than econometric indicators. Here are his four signs of a financial market bubble:

(1) Everyone around you is talking about stocks (or real estate or whatever the fad asset of the day is). And you should really start worrying when the people talking about getting rich in certain areas of the market don’t have a background in finance.

(2) When people begin quitting their jobs to day trade or become a mortgage broker.

(3) When someone exhibits skepticism about the prospects for stocks and people don’t just disagree with them, but they do so vehemently and tell them they’re an idiot for not understanding things.

(4) When you start to see extreme predictions. The example Bernstein gives is how the best-selling investment book in 1999 was Dow 36,000.

He said he’s not worried about a bubble at the moment but seeing 3 out of these 4 conditions being met would be a warning sign.

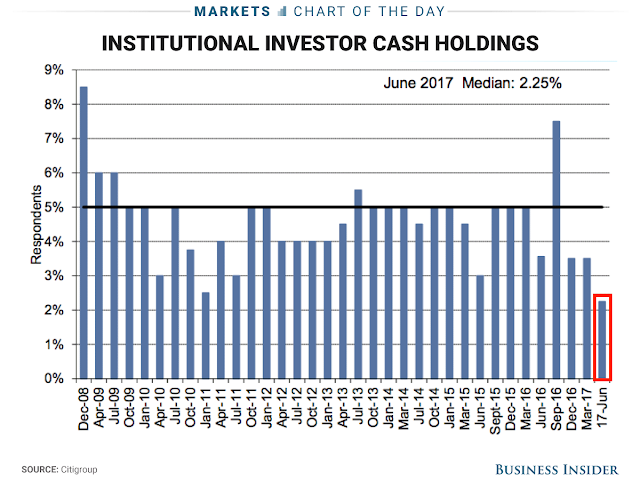

Despite my series on investor sentiment, Things you don’t see at see at market bottoms (which had four editions that were published 13-Jul-2017, 7-Jul-2017, 29-Jun-2017, and 23-Jun-2017), market psychology has not reached the “OMG I have to quit my job/mortgage the house to buy/trade the hot asset of the day”. While there are some excesses, such low levels of institutional cash (chart via Business Insider), the lack of over-the-top froth suggests that the next stock market downturn from a recession may be relatively mild in the manner of a 10-20% decline seen in the 1990 bear market.

While I am somewhat sympathetic to that view, investors who are looking for signs of froth are looking in the wrong places. One of the processes that occur in recessions the correction of excesses in the past expansion. Most of the real excesses are not to be found within US borders, but abroad.

The China Bubble

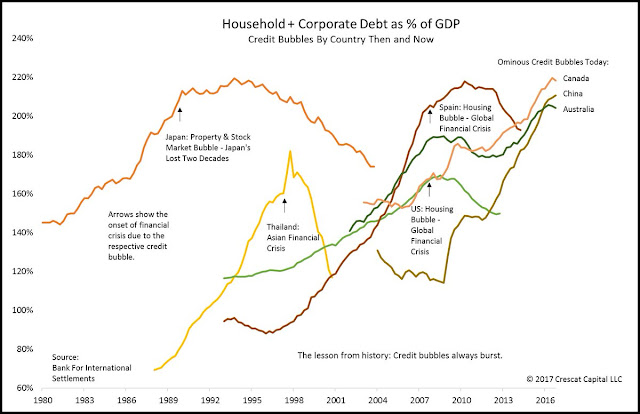

I have detailed in these pages of the risks posed by excessive Chinese debt (see How bad could a Chinese banking crisis get?) and outlined some scenarios of how it could all unravel (see How a China crash might unfold). This chart from Kevin Smith of Crescat Capital shows how the China bubble has migrated, mainly through hot-money flows into Australian and Canadian property (also see my post How China’s Great Ball of Money rolled into Canada).

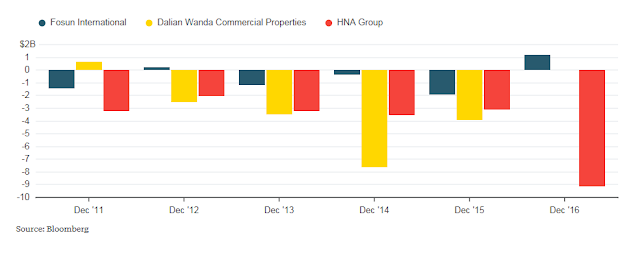

One of the signs of excesses that accompany a market top is a surge in mergers and acquisition activity. Does this Bloomberg chart of Chinese outbound acquisitions count?

Chinese insurance conglomerates have been going on a shopping spree for overseas assets. One worrisome aspect of these deals is a pattern of the lack of positive free cash flow by acquiring companies, indicating that purchases have to funded by ever growing levels of debt from the banking system.

Business Insider recently detailed the vulnerability of the global financial system to changes in credit availability from China:

There is a new worry coming out of China, and it’s slowly taken hold of Wall Street.

The country’s government is cracking down on massive financial firms that have grown by making acquisitions overseas. You’ll recognize some of these names; Anbang Insurance, which recently bought the Waldorf Astoria; HNA; Fosun; Rossoneri; and Wanda.

So what happens to these overseas acquisitions if the money dries up?

Now, that doesn’t mean these companies will go bankrupt. Credit Suisse pointed out that the Chinese government isn’t interested in shocks to the system either, so it may backstop disaster (and it may not). Even so, that means these once high-flying international dealmakers are now pariah’s in China’s banking sector and will have to use their cash reserves to pay down debt for no-one-knows-how long.

“If they cannot honour their financial obligations, there is a chance that it could create a domino effect on other institutions/individuals which have lent money to them,” said Credit Suisse. “Among them, the development of Anbang Insurance is worth the most attention, as it probably is having the closest relationship with retail investors through its insurance products. ”

This relationship is likely why Anbang Chairman Wu Xiaohui — who last year met with President Trump’s son in law, Jared Kushner, about investing in Kushner’s real estate company — was taken into custody by Chinese authorities earlier this year. Anbang also has a 20% stake in China’s largest private bank, China Minsheng Bank.

Wu’s disappearance happened much like most executive disappearances do in China. It started with a rumor, which was countered with a denial, until finally the story was eventually confirmed.

Sometimes that’s how bankruptcies start too.

This table from a separate Bloomberg article shows how solvency ratios for Chinese insurance companies have deteriorated.

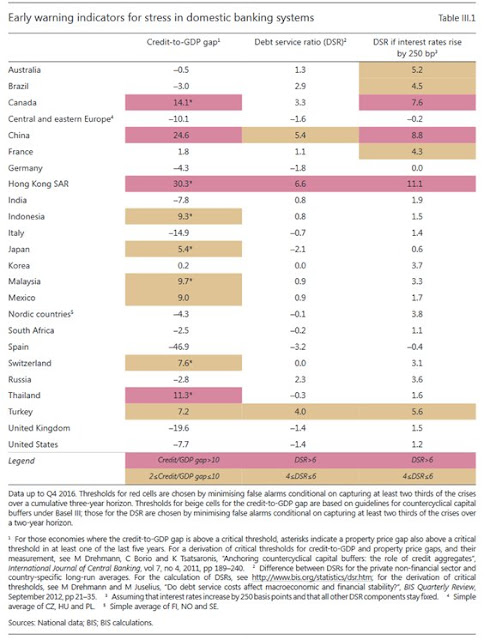

The risk is a series of cascading defaults with unknown effects on the global financial system. The latest report from BIS warned about high indicators of stress in the banking systems in China, Hong Kong, and Canada, which is one of the countries with high debt levels shown in the Kevin Smith chart above.

Earlier this year, International Business Times reported that the IMF cited the risk of a global recession should China experience a hard landing because of extensive financial linkages with the rest of the world:

An economic crisis in China could result in a world-wide recession, warned the International Monetary Fund (IMF). This was because China’s financial links with the rest of the global economy was set to increase, the organisation said ahead of its spring conference in Washington next week. “It is likely that China’s spillovers to global financial markets will increase considerably in the next few years”, the IMF said.

Canada and the Quinoa Problem

Canada can be regarded as a case study of the aforementioned linkages, largely because of a flood of Chinese money into the property markets in Vancouver and Toronto.

The causes of the Canadian property bubble (yes, it is a bubble) comes from the combination of several factors. First, excessive demand from foreign buyers, mainly from Mainland China. The price rise was further exacerbated by low interest rates, which pulled in local speculators who piled into the market. If you are looking for the William Bernstein criteria of a bubble, come to Vancouver or Toronto:

(1) Everyone around you is talking about real estate. (One of the major issues in the last provincial election in British Columbia, which is where Vancouver is located, was housing affordability).

(2) When people begin quitting their jobs to enter real estate. (One acquaintance quit his job in a high yield management organization to get into property management.) And you should really start worrying when the people talking about getting rich in certain areas of the market don’t have a background in finance. (As a point of reference, WorkSafeBC is the provincial agency that deals with worker injuries and disabilities).

(3) When someone exhibits skepticism about the prospects for property and people don’t just disagree with them, but they do so vehemently and tell them they’re an idiot for not understanding things. (Unusual contortions by local real estate boosters to justify why Vancouver houses are more expensive than New York and beachfront Malibu).

(4) When you start to see extreme predictions.

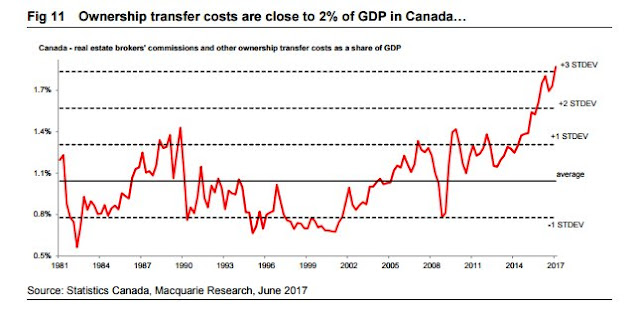

Amber Kanwar of BNN recently pointed out that real estate transfer fees are roughly 2% of GDP in Canada (compared to about 1.5% in the US at the peak of the last bubble).

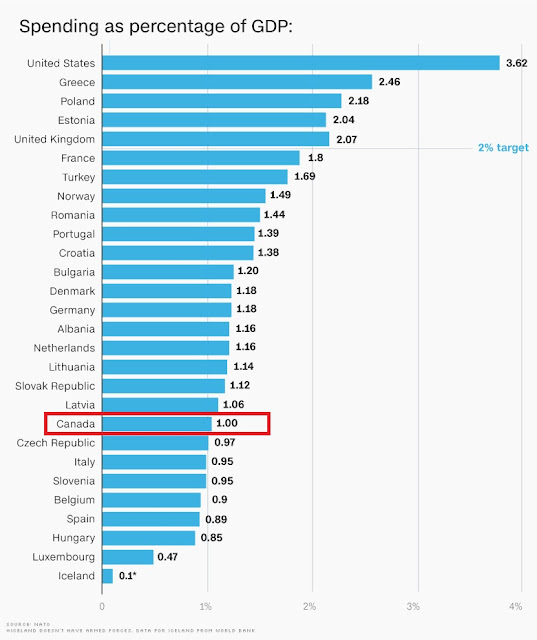

To put the 2% of GDP into some context, NATO countries are targeting defense spending of 2% of GDP. As the chart below shows, Canada is only spending 1% of GDP on defense, which is especially important given Donald Trump’s complaints about defense spending levels of NATO members. In effect, real estate transfer fees are twice the size of the Canadian defense budget.

BNN also reported that 27% of Canadians are in over their head on their mortgage obligations, and this was before the BoC raised rates last week:

An alarming number of house-poor Canadians are teetering close to the edge in terms of meeting their debt obligations, according to a poll conducted on behalf of MNP. The report from the chartered accountancy firm says even a modest increase in interest rates could push many homeowners over the edge.

“Three in ten home owners say that they will be faced with financial difficulties if the value of their home goes down,” the report read. “Even if home values don’t decline in the near future; more than a quarter of Canadians (27 per cent) who have a mortgage agree that they are ‘in over their head’ with their current mortgage payments.”

In the meantime, the property markets in Vancouver and Toronto suffer from a “quinoa problem”. Quinoa was originally grown in the Andean regions of Peru, Bolivia, Ecuador, Colombia, and Chile. When the West discovered quinoa as a food source, foreigners began to bid up the price of quinoa, and local inhabitants could not afford to use it as a food source. The same thing has happened in Vancouver and Toronto. As local residents began to get priced out of those cities, developers began to market new construction offshore. As an example, see this sponsored article in SCMP in Hong Kong extolling the virtues of Vancouver and Toronto property.

These kinds of financial excesses not only put the Chinese economy at risk, but contagion risk has spread to countries that have seen a surge of Chinese demand for property. Indeed, the IMF has expressed concerns about risks from high housing prices in Australia, Canada, and New Zealand.

European banking not fixed

I had originally envisaged a global slowdown sparked by Fed tightening that slows the American economy and then spreads to China through the trade channel. The emergence of over-leveraged Chinese financial conglomerates with overseas interest raise the risk of contagion through the finance channel as well. In particular, financial stress would be heightened in Hong Kong because of the HKDUSD peg as rising US interest rates will force HK rates upwards.

Under such a scenario, the eurozone banking systems is a source of concern. Vítor Constâncio of the European Central Bank recently openly worried about nearly €1 trillion of unresolved non-performing loans in the eurozone banking system. That’s because Europe never fixed the problems of excessive bank leverage that caused much of the problems in the last crisis.

The “financial innovation” of CoCo bonds, which were supposed to have more equity-like characteristics and be part of the Tier 1 capital cushion, does not seem to solved the problem of shoring up bank capital. FT Alphaville recently detailed the unforeseen consequences of CoCo bonds (AT1) with the failure of Banco Popular.

One flaw with additional tier 1 bonds is that, while they have in-built triggers which boost a bank’s capital ratio, they also act as extremely effective triggers, or warning signals, for depositors to place their cash elsewhere.

The effect of the secondary market for AT1 here exacerbates the existing problem of publicly traded banks, which may be vulnerable to retail or corporate withdrawals in the instance of a sudden share price collapse. If AT1s were hit while the bank were still running, its easy to imagine an extremely negative response from depositors.

Once the prices of the AT1 bonds started to fall, depositors took that as a signal to bail, which exacerbated the solvency problems faced by Banco Popular.

Bottom line: While recessionary effects are likely to be mostly contained within US borders, the same cannot be said outside the US. While the most likely trigger is rising US interest rates, we cannot forecast their effects, largely because the nature and magnitude of the transmission mechanisms. Will the primary effects occur through the trade channel, or financial channel? We have no idea.

So far, this is a “this will not end well” story with an unknown trigger, and unknown timing. Investors should be aware of these risks, but not overreact.

The path forward

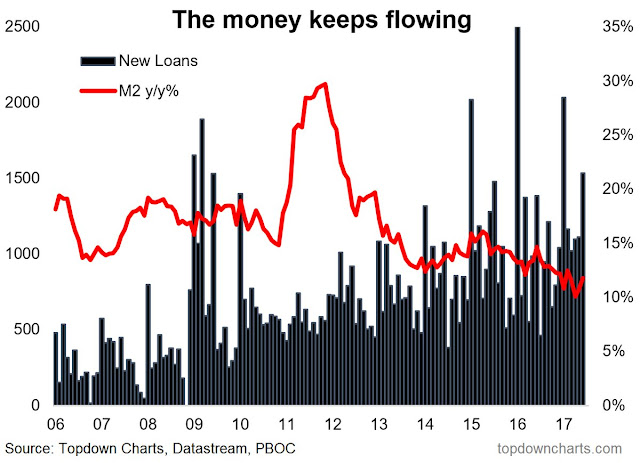

For now, investors should remain calm. Beijing still has many levers to cushion a downturn. Callum Thomas at Topdown Charts pointed out that M2 money growth remains supportive of liquidity in China.

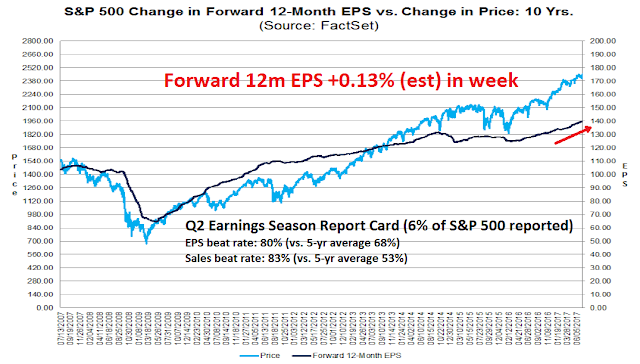

The latest update from John Butters at FactSet shows that preliminary Q2 Earnings Season beat rates for both sales and earnings are well above historical averages. More importantly, forward 12-month EPS estimates continue to rise, indicating improving fundamental momentum.

In addition, the latest update of insider activity from Barron`s shows that these “smart investors” are still buying.

In short, the intermediate term outlook remains bullish. Stay calm and stay long equities.

The week ahead

Looking to the week ahead, the SPX staged an upside breakout to an all-time high. The index appears to be overbought on the hourly chart and could see some weakness early in the week. In the past two months, RSI-5 readings of 90 or more have resolved themselves with either a sideways consolidation or a mild pullback.

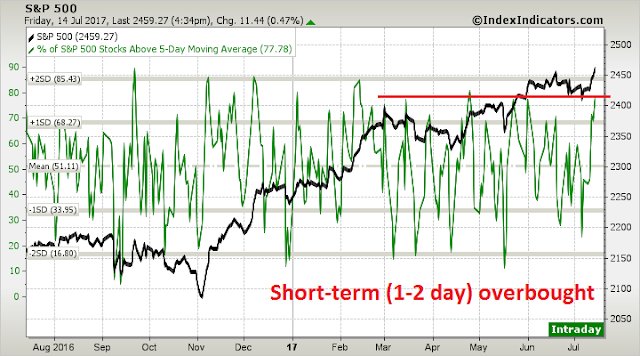

Short-term indicators with a 1-2 day time horizon from Index Indicators also show an overbought reading.

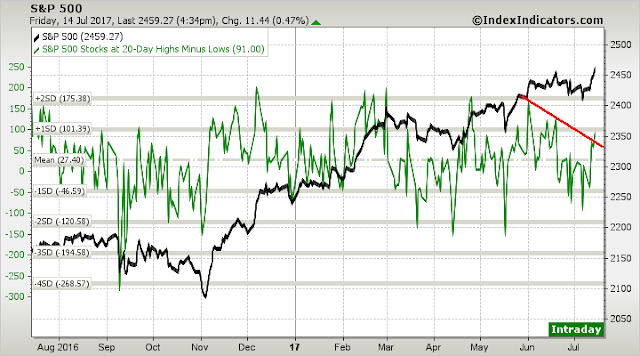

Longer term indicators appear to be constructive for the bulls and not overbought. Further positive momentum could carry the market to further highs.

Looking out to the next few weeks, the Fear and Greed Index remains at a neutral reading. As long as the positive fundamental backdrop remains in place, stock prices are likely to grind up to new highs this summer.

My inner investor remains bullish on stocks. My inner trader is bullishly positioned, but may pare back some of his long positions should the market remain strong on Monday in anticipation of a short-term pullback.

Disclosure: Long SPXL

A savvy money manager once said, ‘A bubble group is one that you get fired for not owning.’

I don’t see that yet but the seeds are there for US banks and technology plus possibly Europe.

Cam, how do you think the Canadian banks will come out of the inevitable Canadian real estate bubble deflating? Will this be a repeat of the US banks circa 2008-9 or are they better positioned now than the US banks were then? Thanks.

From a top-down macro point of view, the Canadian banks look scary. But a knowledgeable analyst I know who identified HCG as a short have said that he is not short the Canadian banks.

Maybe CMHC takes most of the hit? If that’s the case, I would be concerned about the CADUSD exchange rate should the Canadian housing sector turn down.