Remember when I called for a bond market rally (see What a bond market rally could mean for your investments). The 10-year Treasury yield broke support last week and shrugged off a hot CPI print. Is the bond market tempting FAIT, or the Fed’s Flexible Average Inflation Targeting framework?

Here are some of the broad market implications.

Transitory inflation

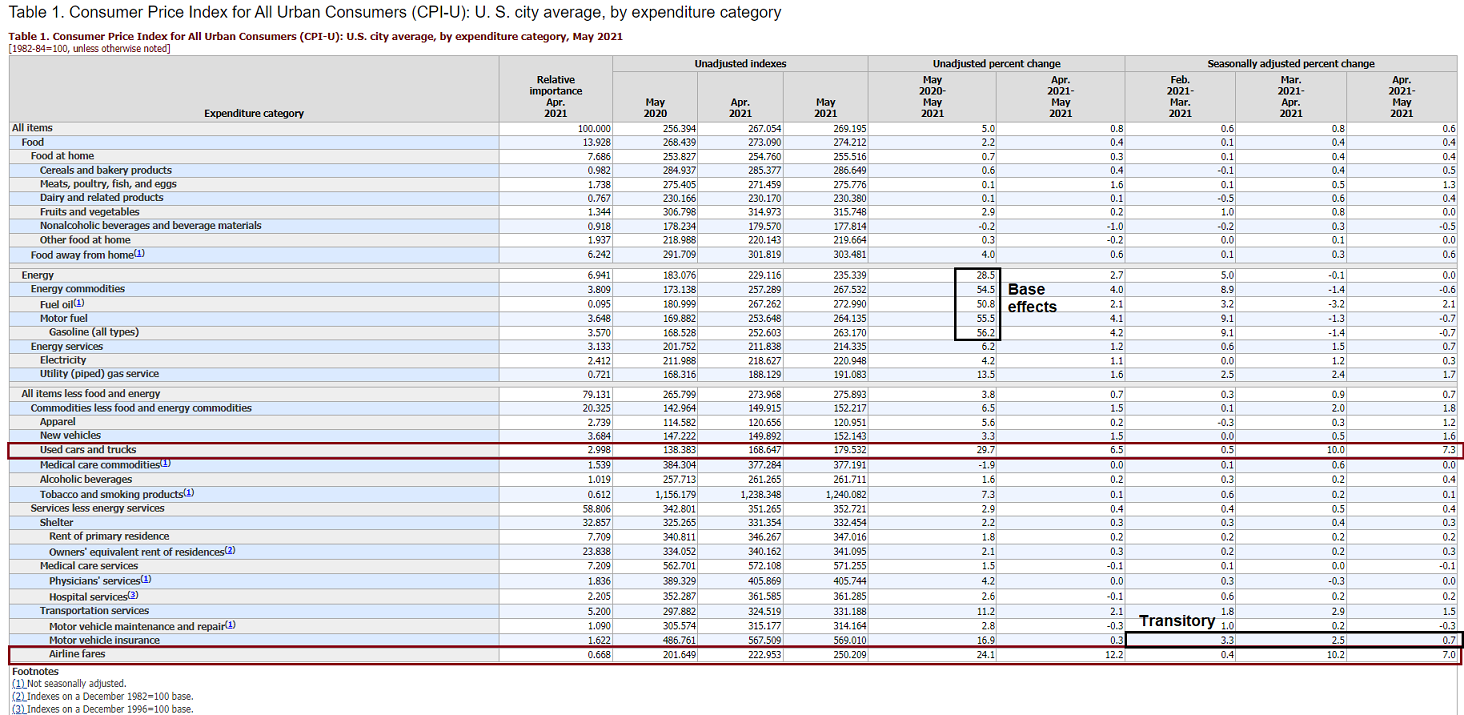

May CPI came in ahead of expectations, but more detailed analysis shows that the “hot” components were largely transitory in nature. Here are my main takeaways from that report:

- Headline YoY CPI was boosted by strong energy prices, which was a low base effect increase owing to very low prices a year ago.

- Standout strength in Core CPI was attributable to used car prices and airfares. The good news is that the pace of these prices increases have decelerated, indicating the transitory nature of these factors. As well, the CPI weights of airfares and used car prices account are relatively small.

- Other transitory factors include strength in auto insurance, but those price increases have decelerated in the last three months.

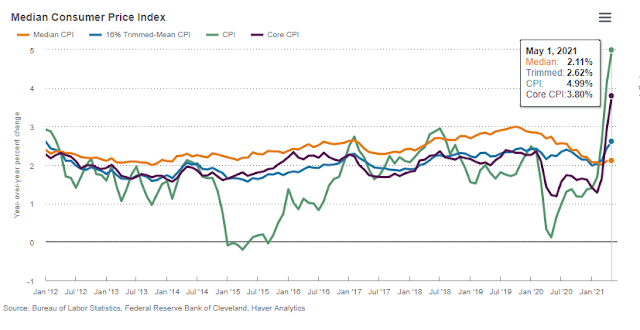

Ahead of next week’s June FOMC meeting, here is what Fed policymakers are seeing on their inflation dashboard. Headline and Core CPI have spiked, but more detailed analysis shows that price increases were attributable to transitory factors. The Cleveland Fed’s median CPI remains tame, indicating that price increases were attributable to outlying noise.

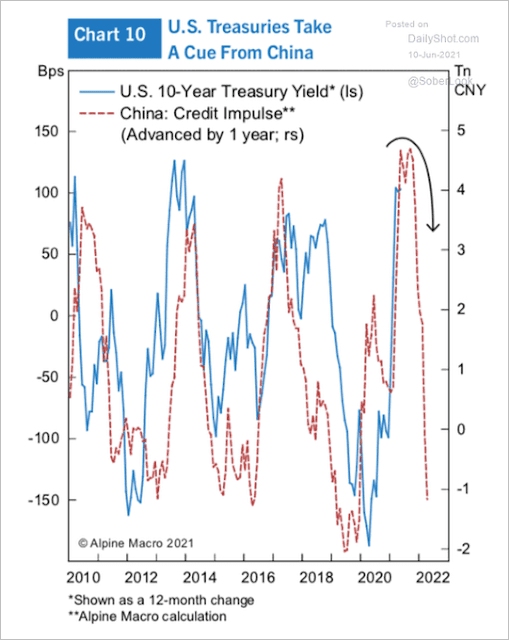

From a global perspective, China is experiencing a growth deceleration. As the slower growth bleeds into the world economy, it should also put downward pressure on Treasury yields.

This should be good news for bond prices. But what about stock prices?

Rising wage pressure

One worrisome development for the suppliers of capital is the undersupplied labor market, which is putting upward pressure on wages.

I know that I am repeating myself, but the latest

NFIB small business survey complained bitterly about employee recruitment and labor costs. These surveys are important because small businesses have little bargaining power and they are therefore sensitive barometers of economic conditions.

A record-high 48% of small business owners in May reported unfilled job openings (seasonally adjusted), according to NFIB’s monthly jobs report. May is the fourth consecutive month of record-high readings for unfilled job openings and is 26 points higher than the 48-year historical reading of 22%.

Small business owners continue to report finding qualified employees remains a problem with 93% of owners hiring or trying to hire reported few or no “qualified” applications for the positions they were trying to fill in May. Thirty-two percent of owners reported few qualified applicants for their positions and 25% reported none.

Eight percent of owners cited labor costs as their top business problem and 26% said that labor quality was their top business problem, the top business concern.

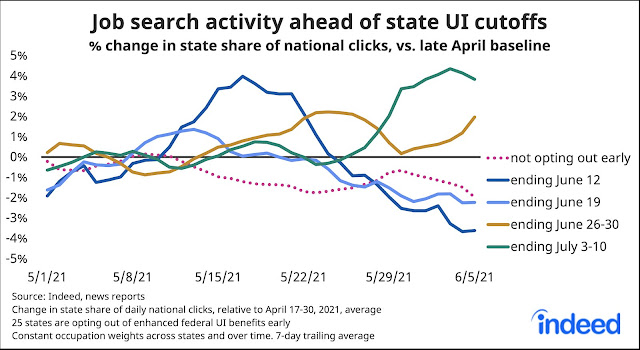

Could government support be encouraging workers to stay home? Will the economy see a flood of new workers flood the market when job benefits expire? The preliminary answer is no. Indeed tracked the job search activity of states that are cutting enhanced unemployment benefits on June 12. Job searches in these states have not picked up. In fact, they are below the national average.

Joe Wiesenthal at Bloomberg pointed out an unusual condition in the Beveridge Curve:

One indicator that economists like to look at is the so-called Beveridge Curve, which plots the unemployment rate against the rate of job openings. Historically there’s been a somewhat stable relationship between the two. Job openings go up and the unemployment rate goes down, as you would expect. But as with everything else weird about this recovery, that’s breaking down.

As you can see here on the chart from the BLS, job openings are soaring (see the highlighted part) while the unemployment rate holds steady.

Wiesenthal went on to highlight the analysis of Fed watcher Tim Duy, who believes that labor market shortages are here to stay.

In a note to clients this morning, Tim Duy of SGH Macro Advisors notes that this new weird shape of the curve holds true even if you look at alternative measures of non-employment besides the standard U-3 measure: “it appears that labor market frictions not related to unemployment insurance appear to have been increasing. That’s not exactly great news if you are expecting the end of enhanced UI benefits will dramatically ease labor market frictions.”

Translated, these conditions are putting upward pressure on wages. The open question is whether this will result in a wage-price spiral, or if this is a “once and done” upward adjustment in compensation. It’s possible that we are just seeing a one-time effect of wage competition at the low-end as large employers like Amazon and McDonald’s raised their employee pay.

Time will tell, but rising compensation costs are putting pressure on operating margins. As well, the risk is that an escalating wage-price spiral will force the Fed to raise rates in order to cool rising inflationary expectations.

What a bond market rally means

In the meantime, the bond market is buying into the Fed’s narrative of “transitory inflation” and yields are falling. As I pointed out in my May 29, 2021 note (see

What a bond market rally could mean for your investments), falling yields will translate into better performance by high-duration interest-sensitive growth stocks. Expect a temporary counter-trend rally by growth names.

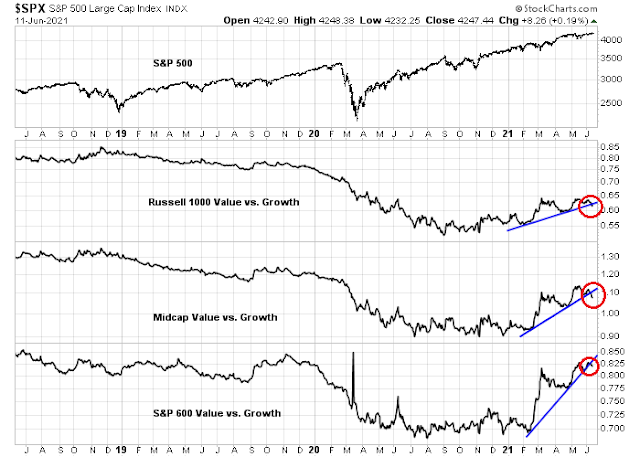

My investment style dashboard shows that the value-growth ratios are correcting across all market cap bands.

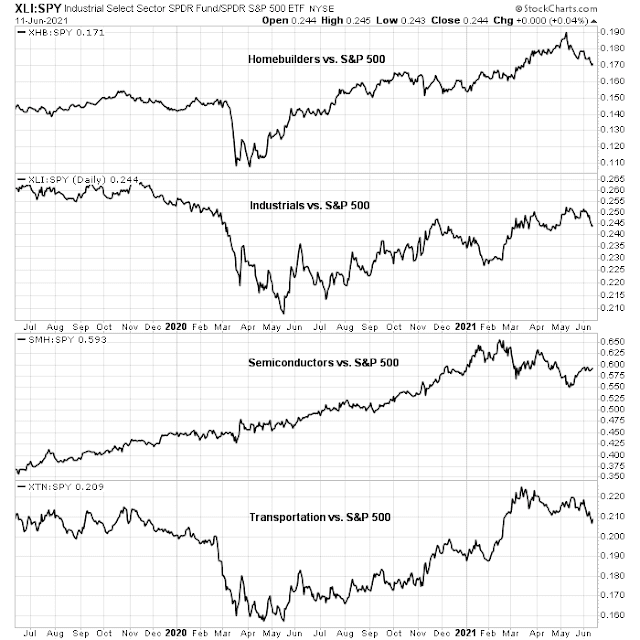

In addition, cyclical stocks are all rolling over in relative performance in some manner.

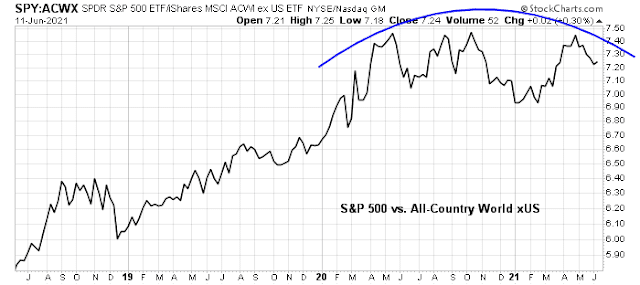

A global rotation

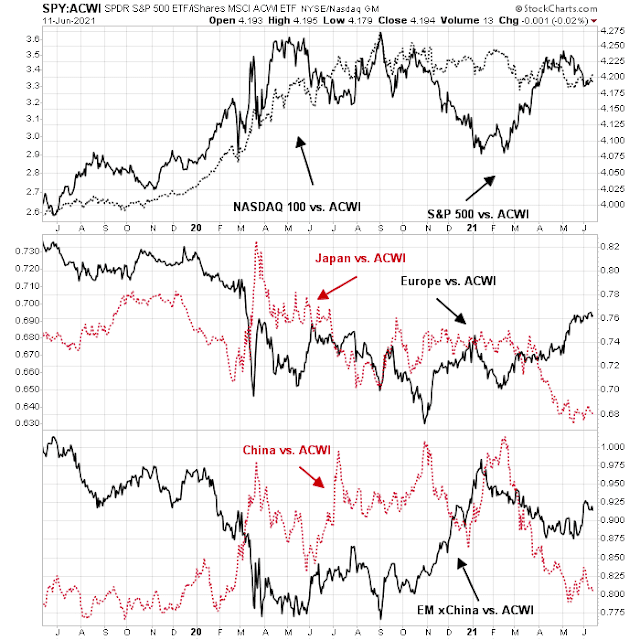

In addition, investors are rotating out of US equities. Here is a closer look at the relative performance of the major regions against MSCI All-Country World Index (ACWI). As US equities falter, Europe has caught a bid. Even Japan is turning up, and so are emerging markets, especially outside China.

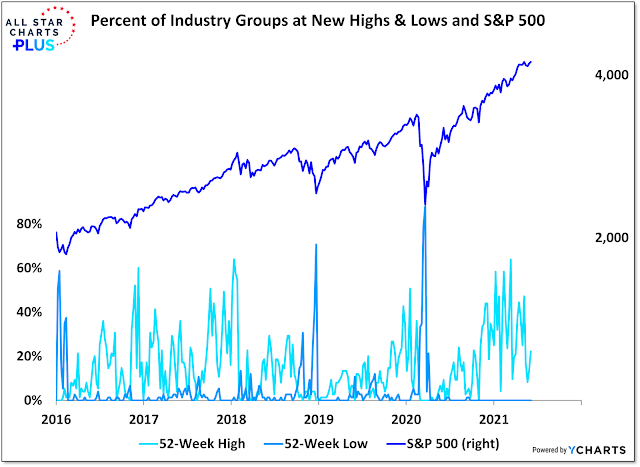

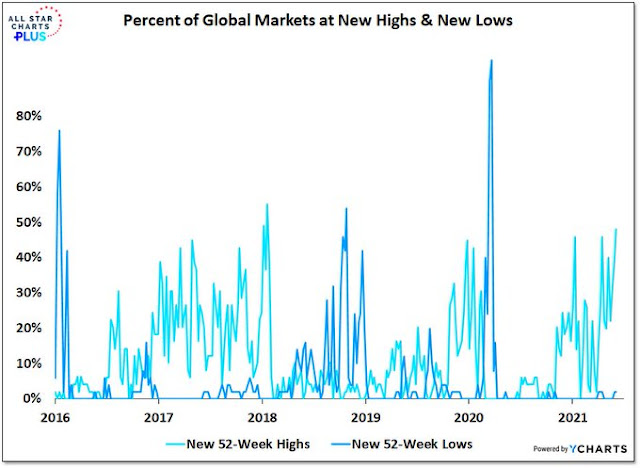

Willie Delwiche observed a marked difference between industry breadth in the US and abroad. The percentage of US industries making new highs has been declining.

On the other hand, the percentage of industries in ACWI making new highs has been holding up well.

Jens Nordvig wrote a

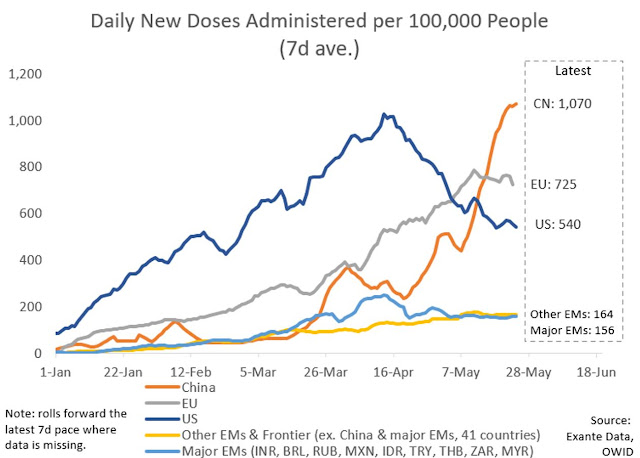

Marketwatch opinion piece which argued that “Global investors are losing interest in U.S. stocks and that will be a game changer”. Nordvig pointed out that equity fund flows into US equities fell dramatically in March. He believes “this is all logical since the rest of the world is catching up with the U.S. on the vaccine front”.

I believe the rotation is attributable to the wage pressures in the US, which will squeeze margins and the expectation that economic growth differentials between the US and Europe will narrow. Eurozone equities have staged a relative upside breakout against ACWI, with strength coming from France, Italy, and Greece. The most notable laggard is Germany.

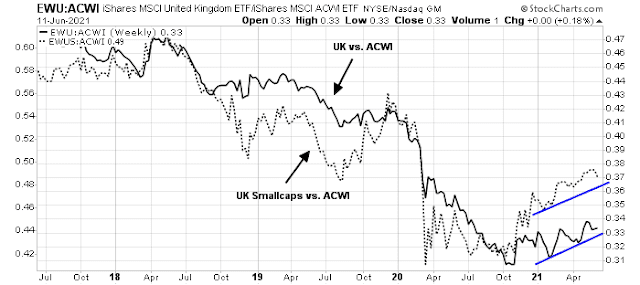

The UK is a more complicated situation. Large-cap UK equities have staged a relative breakout, and small-caps performed even better as Brexit jitters have diminished. Nevertheless, disagreements with the EU overfishing and the Irish border are issues specific to that market.

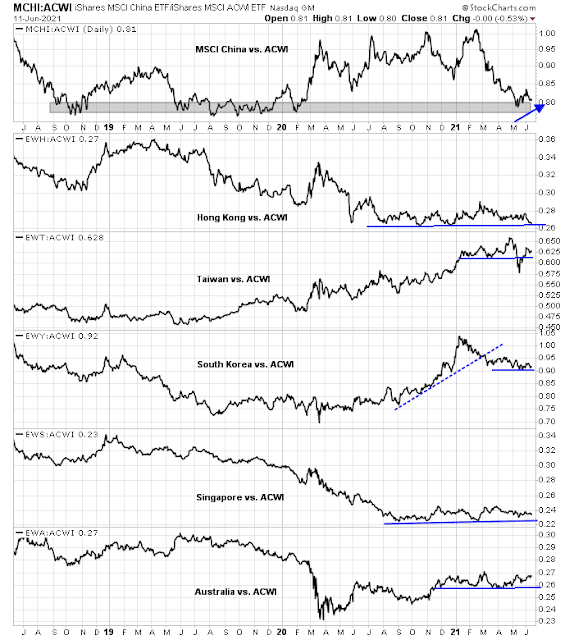

Over in Asia, the bleeding in China and China-related plays appears to have stopped despite signs of Chinese growth deceleration. Chinese stocks and the markets of her major Asian trading partners are all bottoming relative to ACWI. Selected markets like Taiwan and Australia are exhibiting some signs of relative strength.

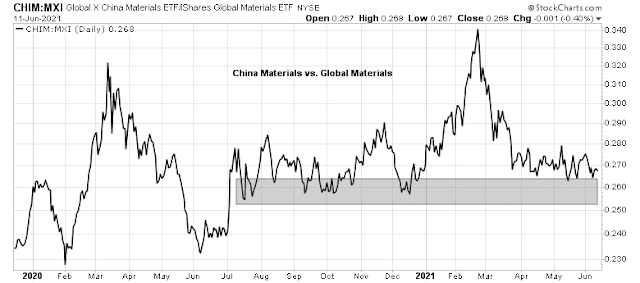

More importantly, Chinese material stocks are bottoming against global materials. I interpret this as an indication that the growth deceleration is over.

In conclusion, the US Treasury market has shrugged off inflationary worries and has begun to rally. This is creating a short-term tailwind for interest-sensitive growth stocks. The bigger picture that is investors are starting to rotate away from US equities because of lower growth differentials and expectations of margin compression owing to wage pressures.

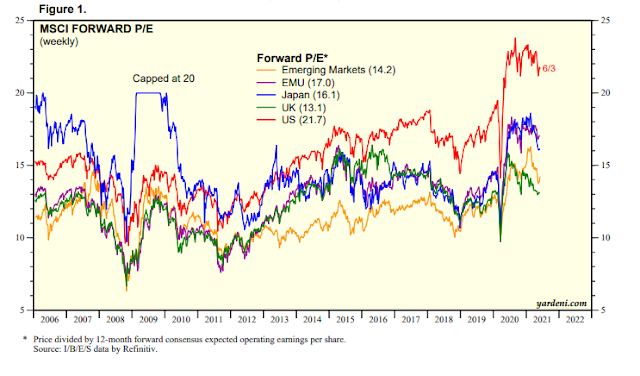

The valuation differential between US equities and the rest of the world is finally closing.

Inflation, excluding everything, is zero. As individuals, businesses, organizations and government, we experience different levels of price movements depending on what we spend the money on. Different regions of the country have different experiences.

To understand and manage policy and politics, government, economists have come up with an alphabet soup of acronyms like CPI, PCE, trimmed CPI, FAIT, and so on. Choose what fits the narrative or policy purpose at the moment. Mostly the consequences are unknown, bold forecasts to the contrary.

What is an investor to do with such dizzying uncertainties? Buy Gold, Crypto, commodities, TIPS, go long duration or short duration in equities, fixed income etc. are the clarion calls. If anyone can keep up and make the right call at each twist and turn, I salute them.

For me, it’s a steady path with broadly diversified portfolio. Cam provides guidance when major turning points are likely to dial back in or up on the risk. For that, I am very thankful.