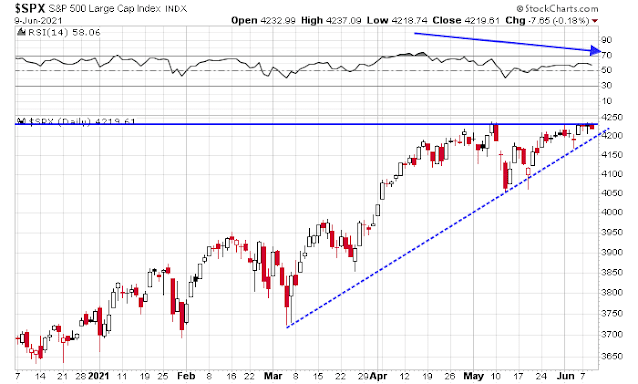

Mid-week market update: Traders have an adage, “Bulls make money. Bears make money. Pigs just get slaughtered.” It’s time for equity bulls to be near-term cautious on stocks, though I expect any market weakness to be relatively shallow.

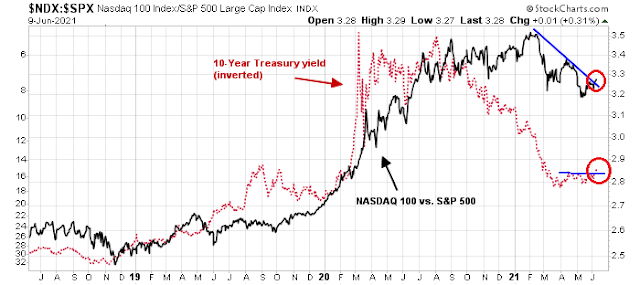

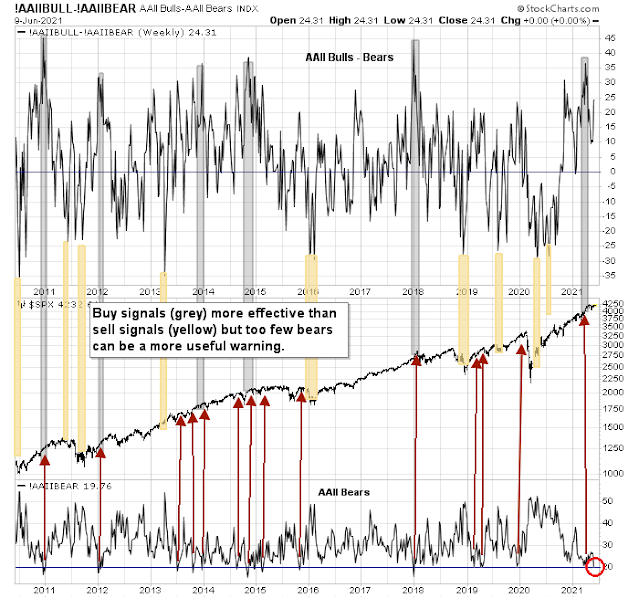

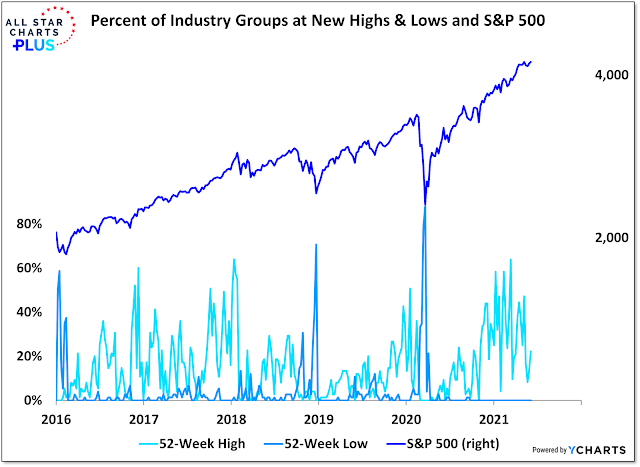

Sentiment and technical warnings

Fundamental catalysts

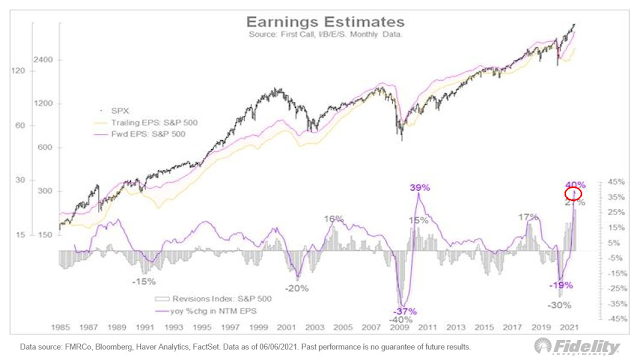

We remain concerned that after the most positive earnings revisions quarter on record, next year’s consensus forecasts are now above what our analysis suggests is achievable for the first time since the recovery began. More specifically, we think margin assumptions are too high given the headwinds from inflation and taxes that have not been baked into estimates.

Jurrien Timmer at Fidelity also observed that the rate of earnings estimate revisions is peaking and rolling over.

Further to yesterday’s note about labor market pressures (see NFIB update: Revenge of the Proletariat?), Joe Wiesenthal at Bloomberg highlighted a comment from Fed watcher Tim Duy about the resilience of labor market shortages [emphasis added].

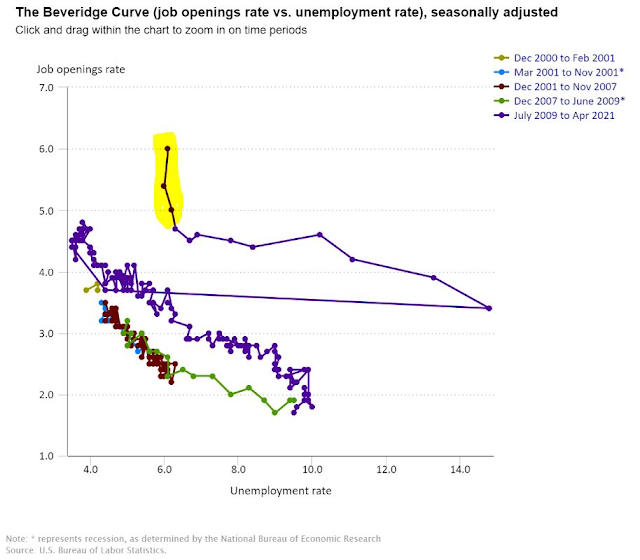

One indicator that economists like to look at is the so-called Beveridge Curve, which plots the unemployment rate against the rate of job openings. Historically there’s been a somewhat stable relationship between the two. Job openings go up and the unemployment rate goes down, as you would expect. But as with everything else weird about this recovery, that’s breaking down.

As you can see here on the chart from the BLS, job openings are soaring (see the highlighted part) while the unemployment rate holds steady.

In a note to clients this morning, Tim Duy of SGH Macro Advisors notes that this new weird shape of the curve holds true even if you look at alternative measures of non-employment besides the standard U-3 measure: “it appears that labor market frictions not related to unemployment insurance appear to have been increasing. That’s not exactly great news if you are expecting the end of enhanced UI benefits will dramatically ease labor market frictions.”

Obviously there are a lot of people who assume that the labor market will go “back to normal” once the UI expansions expire, childcare becomes easier, the pandemic starts to fade and so on. But at the moment, things are still looking pretty unusual.

Today’s missive is right on. “Lying Flat Tribe” is coming to America, aka permanent non-employment. One obvious thing to come is collapse of small physical stores. E-commence will greatly expand. And pace of automation will be accelerated. It is wise for Biden admin to tone down the 24/7 “tax, tax, tax” nonsense. Market is starting to send signals.