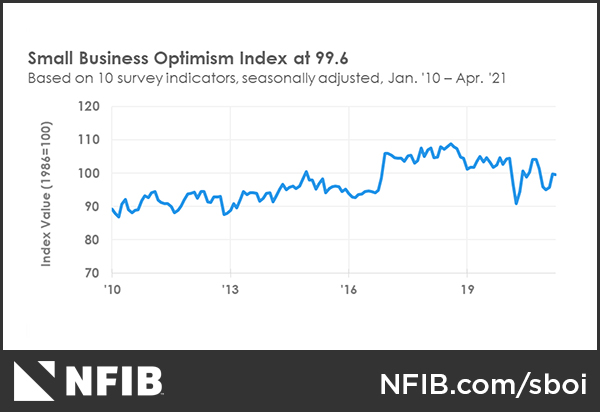

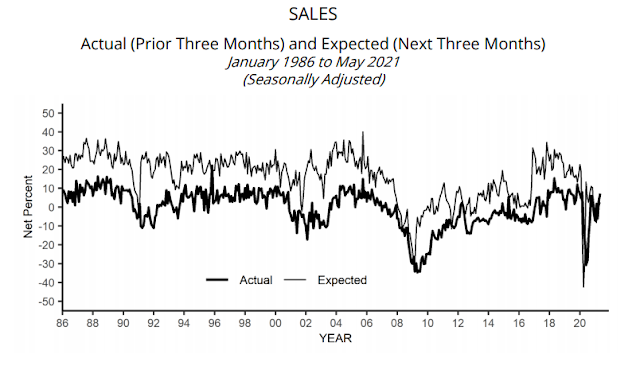

The monthly NFIB update is always useful as a window on the economy. Small businesses tend to have little bargaining power and they are therefore sensitive barometers of economic trends. A month ago, NFIB small business optimism surged (see NFIB conservatives grudgingly turn bullish). The latest report saw optimism stall as readings edged back from 99.8 to 99.6.

Economic strength + labor shortages

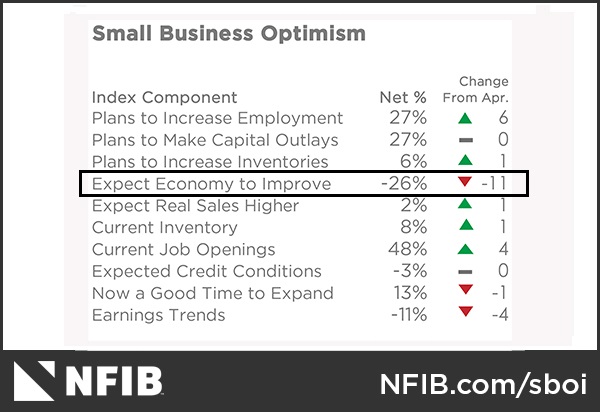

A record-high 48% of small business owners in May reported unfilled job openings (seasonally adjusted), according to NFIB’s monthly jobs report. May is the fourth consecutive month of record-high readings for unfilled job openings and is 26 points higher than the 48-year historical reading of 22%.

Small business owners continue to report finding qualified employees remains a problem with 93% of owners hiring or trying to hire reported few or no “qualified” applications for the positions they were trying to fill in May. Thirty-two percent of owners reported few qualified applicants for their positions and 25% reported none.

Eight percent of owners cited labor costs as their top business problem and 26% said that labor quality was their top business problem, the top business concern.

For investors, the questions to consider is how transitory are these labor problems and how will the Fed react?

Uneven wage pressures

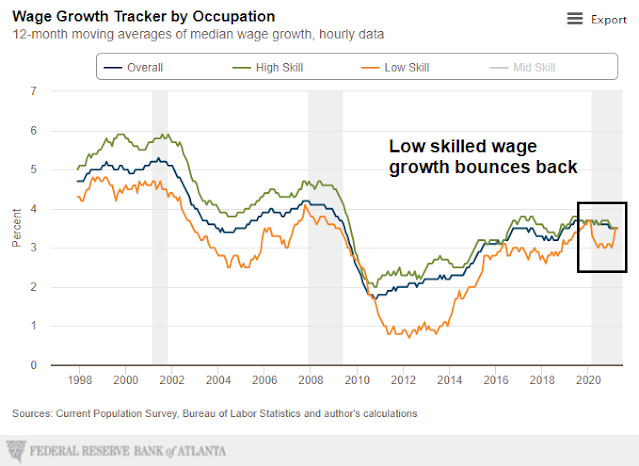

The Atlanta Fed’s Wage Growth Tracker sheds some light on this problem. Wage growth among low-skilled workers plummeted upon the onset of the recession, though high-skilled wage increases remained steady. As the economy reopened, low-skilled wage growth snapped back.

Is this a case of the revenge of the Proletariat? Labor market shortages are attributable to a combination of the lack of suitable child care for female workers, fear of the pandemic, and government wage supplement support. Disentangling and quantifying the effects of each of these components is a challenge for policymakers. We will know for sure the effects of government support once those subsidies run out in September.

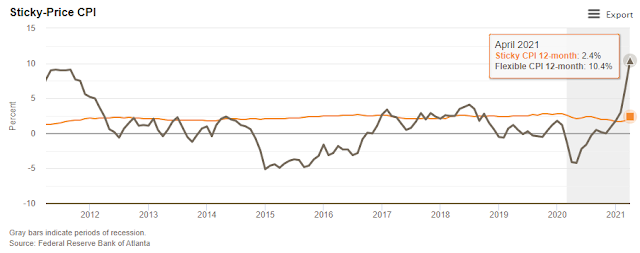

For Fed policymakers, the issue is whether these wage pressures indicate the start of a cycle of cost-push inflation. For the time being, they will regard these pressures as transitory unless proven otherwise. The Atlanta Fed’s Core Sticky-Price CPI, which is “a weighted basket of items that change price relatively slowly”, has been steady throughout the pandemic. By contrast, the Flexible CPI, which is “a weighted basket of items that change price relatively frequently”, has skyrocketed.

This is what transitory inflation looks like.

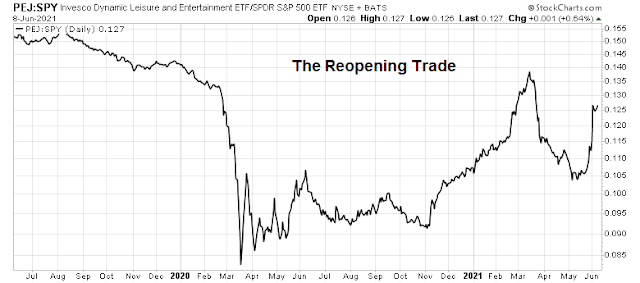

The reopening trade

For investors, they can look forward to an economy that’s reopening. The Transcript, which monitors company earnings calls, summarized the latest set of calls as a booming economy.

Summer has started and the US economy is booming. Economic activity is surging past 2019 levels. The numbers are staggering. GDP growth is expected to hit 7% this year led by consumer spending. Bank of America said that its consumer accounts are registering 20% more spend than 2019. There’s still plenty more liquidity too. This all seems incongruent with 10-year treasury yields that are 40 bps below where they were before the pandemic.

The reopening trade can be seen in the relative performance of Leisure and Entertainment stocks against the S&P 500.

The FOMC is meeting next week. While there will likely some discussion of tapering its QE programs, those actions have largely been discounted by the market. Expect further language about the transitory nature of price pressures.

I hope small businesses, that are desperate for workers, can survive until the government subsidies end in September. Covid should be in the rear-view mirror by then (it pretty much is now), and schools should be fully re-opened. Using the descriptive, Proletariat, brings to mind the Socialist/Marxist connotation. YIKES!

The cost pressures for the small businesses are real and significant. Add inability to hire, train and retain good people. Supply of needed goods is limited. The economy can only expand to it’s forecasted potential if these bottlenecks are resolved.

Lot of talk about taxes and capital gains that can affect the small businesses significantly.

Lot of frustration and anxiety.

Is there any evidence that NFIB surveys are negative when Democratic Party is in charge? Or any data on the political makeup of the NFIB members? And where does Marxism fit in? I find these comments out of character for this service.

I understand The Revenge of the proletariat was chosen for fun, not to be interpreted literally.

I respect and trust Cam and have been a subscriber since the beginning. These comments, although tongue in cheek, hit a raw nerve. In our fifty plus years in a small business, we took government help for the first time in 2020 and hopefully for the last time. Our politics are shaped by our values primarily and not by money.

I have maybe taken it too seriously but so be it.

https://www.marketwatch.com/story/the-s-p-500-now-is-top-heavy-in-5-big-tech-stocks-but-that-alone-wont-end-this-bull-market-11623187957?mod=mark-hulbert