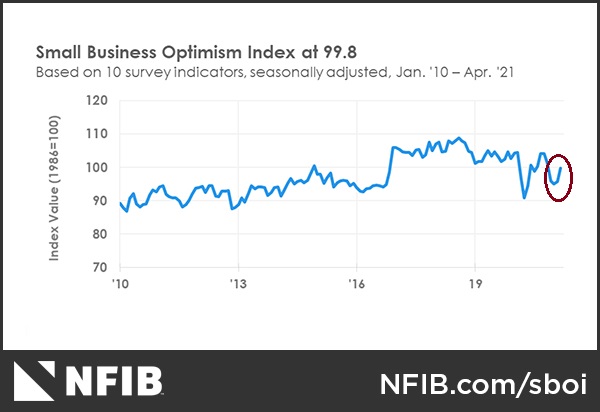

Investors received some data points today that is highly revealing about the economy. The most important was the NFIB small business survey. Small business sentiment is especially important as they have little bargaining power and they are therefore sensitive barometers of the economy. The other is the March JOLTS report of labor market conditions, which is a little dated but nevertheless revealing.

More NFIB details

JOLTS: A strong labor market

Ready to say adios to your job? You’re not alone. “The great resignation is coming,” says Anthony Klotz, an associate professor of management at Texas A&M University who’s studied the exits of hundreds of workers. “When there’s uncertainty, people tend to stay put, so there are pent-up resignations that didn’t happen over the past year.” The numbers are multiplied, he says, by the many pandemic-related epiphanies—about family time, remote work, commuting, passion projects, life and death, and what it all means—that can make people turn their back on the 9-to-5 office grind. We asked Klotz what to expect as the great resignation picks up speed.

A “Not Enough” recovery

The post-crisis economy was about too much — too much debt, too much housing, too much interdependence, too much, too much, too much.

The post-pandemic economy is taking shape as one in which there is not enough — not enough housing, not enough workers, not enough cars, chlorine, or crypto.

And this inversion of what is driving this cycle can help explain what we’re seeing from the labor market to the housing market to the stock market and beyond. And perhaps helps make sense of why everyone — professional investors, the general public, politicians, and so on — seems perplexed by today’s state of affairs.

To the extent that supply chain congestion and other reopening frictions are transitory, they are unlikely to generate persistently higher inflation on their own. A persistent material increase in inflation would require not just that wages or prices increase for a period after reopening, but also a broad expectation that they will continue to increase at a persistently higher pace. A limited period of pandemic-related price increases is unlikely to durably change inflation dynamics.

The Fed is sticking with its story that it will “monitor incoming data”, but policy is going to stay accommodative for the time being.

I will remain attentive to the risk that what seem like transitory inflationary pressures could prove persistent as I closely monitor the incoming data. Should this risk manifest, we have the tools and the experience to gently guide inflation back to our target. No one should doubt our commitment to do so.

But recent experience suggests we should not lightly dismiss the risk on the other side. Achieving our inflation goal requires firmly anchoring inflation expectations at 2 percent. Following the reopening, there will need to be strong underlying momentum to reach the outcomes in our forward guidance. Remaining patient through the transitory surge associated with reopening will help ensure that the underlying economic momentum that will be needed to reach our goals as some current tailwinds shift to headwinds is not curtailed by a premature tightening of financial conditions.

Current $SPX decline may have a way to go before it bottoms out. $SPX is s still well above its 50 day ma. The 5 day RSI has not dropped below 30 into oversold territory. Also, at other recent pullback lows, daily volume appears to have peaked at over 3 billion shares traded at or near the bottom. Yesterday’s volume was 2.43 billion shares.

Excellent report Cam. The Small business confidence portrays well for the US economy and your conclusion that these small business owners are confident because of uptick in business confidence shows an economy humming on well. After all 90% US business is small business.

Premarket:

Closing NIO +1.8%

Closing PLTR +2.9%

Closing VIAC +0.9%

Closing XLE +0.6%

Taking gains where I can.

Adding to QQQ.

Adding to XLF.

Closing XLF on the momentary spike.

Adding a third tranche to QQQ.

Adding a position in AMZN.

Closing KRE.

Opening a position in VT.

Reopening NIO/ PLTR.

Reopening KRE.

PICK.

Adding to XLI.

Always good to see a little panic in the first thirty minutes.

Closing DISCA.

GDXJ.

Not so great when early panic leads to further selling.

Cutting back on positions.

Adding back to a few positions.

My thinking (or my hope) is that the Naz has experienced enough damage over the past few days to support a ST bounce.

If the QQQ volume today is over 75 million shares, I’d tend to agree with you. There’s a good chance of that happening as it’s only 11 AM and volume for QQQ is already over 25 Million shares

Taking out Tuesday’s lows, which is likely triggering stops.

There are two strategic moves going for me – position sizing and the fact that I’m trading mainly broad sector ETFs.

Taking the hit on QS.

The dip below 4100 + recovery above should relieve some of the selling pressure. If we close below 4100 then it’s likely we’re headed much lower.

The SPX is headed for another breach of 4100.

That does it for me.

Out of all positions here. We all need an exit plan, and IMO diving below 4100 a second time is a bad omen.

50 day ma is at 4050.7. A close below that might open the floodgates.

50 day ma is at 4050.7. A close below that might open the floodgates.

Now that I’m out, I’m all for it.

Base case scenario is still the selloff that Cam’s expecting.

I tried to game a ST snapback rally and paid the price.

Have you tried day trading any of the short etfs? I’m tempted.

I have a rule against shorting. I categorically avoid it. I’ve learned from experience that it requires the kind of mental perspective that I’m just not good at.

I have just bought long SPY. For 1-2 days bounce.

OK, good luck.

All significant corrections begin this way. And of course, all false breakdowns begin this way as well. It just feels closer to the real deal this time.