Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Bull or Bear?

The first real shots in the Sino-American Trade War were fired last week when the US imposed a series of tariffs on $34b of Chinese goods at 12:01 ET on July 6, 2018, and the Chinese retaliated with tariffs of their own. For investors, the current environment presents a dilemma.

On one hand, the prospect of a protectionist curtain descending around the world is bearish for growth, and for equity prices. On the other hand, the near-term outlook for economic growth and earnings are bright. In the absence of trade tensions, US stock prices should be breaking out to new highs.

The conundrum can be illustrated by the readings of the Fear and Greed Index, which is stuck in neutral and showing no signs of momentum nor direction. Is a Trade War Apocalypse just around the corner, which will collapse the index to new lows; or is this a case of sell the rumor, and buy the news? Arguably, the market’s rangebound behavior in 2018 is attributable to the earnings growth vs. trade jitters dilemma.

We examine the bull and bear cases.

Bull case: Global reflation

Last week, I asked if global markets could continue to rise if non-US markets and economies are weak (see A looming global recession, or buying opportunity?). I concluded that there were nascent signs of a turnaround abroad. This week, we are getting confirmation of a global reflationary rebound.

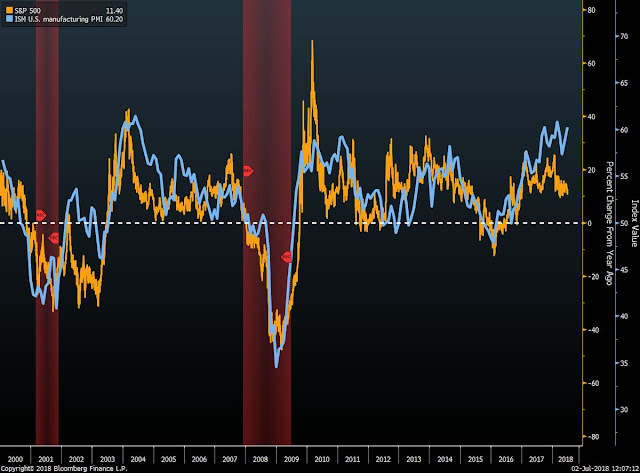

Start with the US, which has already been showing signs of economic strength. This chart of ISM (blue line) and SPX (orange line) may be all investors need to know about the stock market. ISM Manufacturing roared ahead and beat expectations, and we are seeing a continued positive divergence that is equity bullish.

Friday’s June Employment Report confirmed the upbeat assessment of the American economy. The report delivered a Goldilocks not-too-hot-not-too-cold reading for equity investors. Non-farm payroll beat expectations, and the figures for previous months were revised upwards. However, Average Hourly Earnings was tame, which was a signal that wage growth is not accelerating and does not pressure the Fed to turn more hawkish on monetary policy.

Other internals were also solid. Even though the unemployment rate rose, it was attributable to a rise in the participation rate. Moreover, the flow of “not in labor force” to “employed” rose. These conditions will give Fed policy makers some comfort that there is still slack in the jobs market and there is no urgency to accelerate the pace of monetary policy tightening.

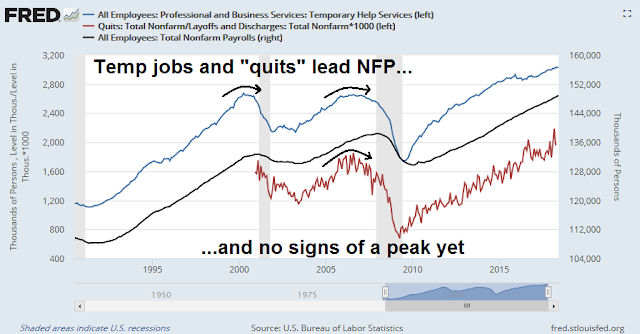

There were also other signs of solid non-inflationary growth. Temporary jobs and quits from the JOLTS report have historically led civilian employment, and the latest jobs report show no signs that temp jobs are rolling over.

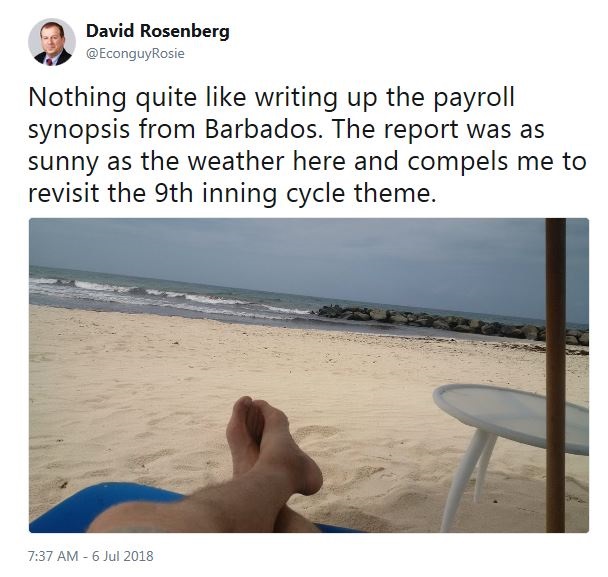

It was a solid jobs report that keeps Fed policy on track, and gave the hawks little ammunition to tighten faster. The report was so positive that it prompted David (the world is collapsing into recession) Rosenberg to reassess his bearish outlook for the economy.

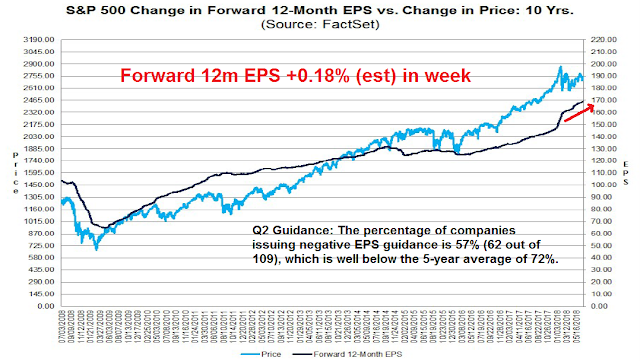

On a bottom-up basis, there was also good news. The latest update from FactSet shows that forward 12-month EPS is still rising, indicating positive fundamental momentum. Moreover, Q2 EPS guidance is coming at better than the historical average, which should make for a positive tone for the upcoming earnings season.

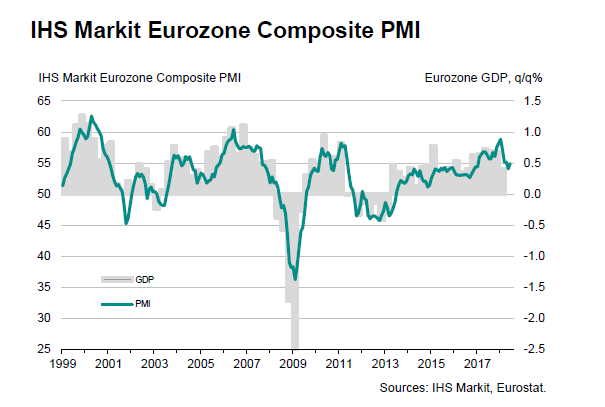

There was also good news over in Europe. Weakness in the eurozone Manufacturing PMI was offset by strength in the Services PMI, and the resulting Composite PMI showed signs of stabilization and rebound.

The turnaround can be best seen in the Citigroup Europe Economic Surprise Index.

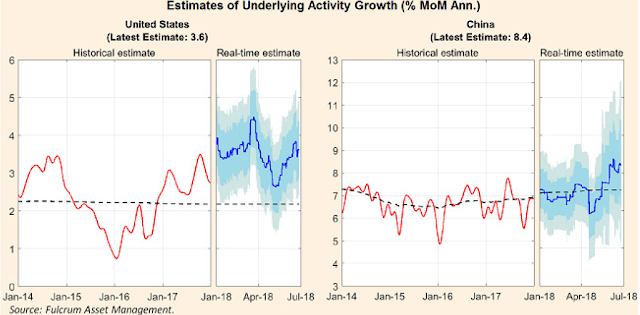

Notwithstanding the rising trade tensions, there were signs of a rebound in China as well. Last week, I highlighted analysis from China Beige Book of unexpected growth acceleration. Gavyn Davies confirmed that view in the Financial Times:

In China, our nowcast is much more surprising, because it reports an update in growth to above 8 per cent, while most other economists are talking about a slowdown in retail sales and fixed asset formation, with estimates of the GDP growth rate dipping to about 6.5 per cent.

The unexpected strength in Caixin China PMI is also supportive of the rebound thesis.

In light of this evidence of a synchronized upturn in economies of the three global major blocs, global stock prices should be staging a reflationary rally.

The bear case: Tariffs, tariffs, tariffs…

The bear case rests on the risks of a trade war. Even though widespread opposition from business groups is building against Trump’s tariffs, both the US and China appear to be digging in their heels in their negotiating positions.

The main damage from the trade war can be found in a deterioration in business confidence. The latest FOMC minutes reflect the heightened angst as expansion plans are put on hold [emphasis added]:

Participants reported that business fixed investment had continued to expand at a strong pace in recent months, supported in part by substantial investment growth in the energy sector. Higher oil prices were expected to continue to support investment in that sector, and District contacts in the industry were generally upbeat, though supply constraints for labor and infrastructure were reportedly limiting expansion plans. By contrast, District reports regarding the construction sector were mixed, although here, too, some contacts reported that supply constraints were acting as a drag on activity. Conditions in both the manufacturing and service sectors in several Districts were reportedly strong and were seen as contributing to solid investment gains. However, many District contacts expressed concern about the possible adverse effects of tariffs and other proposed trade restrictions, both domestically and abroad, on future investment activity; contacts in some Districts indicated that plans for capital spending had been scaled back or postponed as a result of uncertainty over trade policy. Contacts in the steel and aluminum industries expected higher prices as a result of the tariffs on these products but had not planned any new investments to increase capacity. Conditions in the agricultural sector reportedly improved somewhat, but contacts were concerned about the effect of potentially higher tariffs on their exports.

Reuters reported that the Chamber of Commerce has launched a campaign against Trump’s tariffs. Will he listen to this Republican leaning group ahead of the mid-term elections?

The U.S. Chamber of Commerce, the nation’s largest business group and customarily a close ally of President Donald Trump’s Republican Party, is launching a campaign on Monday to oppose Trump’s trade tariff policies…

“The administration is threatening to undermine the economic progress it worked so hard to achieve,” said Chamber President Tom Donohue in a statement to Reuters. “We should seek free and fair trade, but this is just not the way to do it.”

There are signs that these complaints are falling on deaf ears. Axios reported that, despite widespread polling that the Democrats will retake control of the House and challenge for the Senate in November, “President Trump and some West Wing officials believe Republicans will hold on”. In fact, “Trump is already holding frequent rallies in key areas for the midterms, and will travel even more after Labor Day. He relishes the fight, and loves the idea that he’ll save the House for Republicans.”

Why listen to these defeatist business groups when you think you will win?

At the same time, The Economist reported that Beijing thinks that they can outlast Trump in a trade war of attrition:

An authoritarian regime can limit and dictate the public discussion. After the stockmarket tumbled, authorities warned journalists against citing the trade conflict as an explanation, according to a directive published by the China Digital Times, a website that tracks government censorship. Reporters were also ordered to emphasise the economy’s bright spots. In America, meanwhile, the hurly-burly of its public discourse has been on display. On July 2nd the US Chamber of Commerce, the country’s biggest business group, launched a lobbying campaign to explain how tariffs would hurt the economy. Republican lawmakers in Congress are criticising the president’s trade policies more openly than heretofore—though on past form, if Mr Trump pushes ahead, they will probably fall into line.

Another source of confidence for China is the knowledge that it is not fighting America alone. From steel tariffs on Japan to threats of auto tariffs on Europe and negotiations that might wreck the North American Free-Trade Agreement, Mr Trump is taking on every one of America’s allies. China has tried to rally them to its side. It has asked the European Union to join it in condemning Mr Trump’s trade actions, according to Reuters (the EU declined because of its own trade grievances against China). Even as it raised tariffs on soyabeans from America, it removed them from soyabeans from India, South Korea and others in Asia. Xi Jinping, China’s president, has hinted that its markets will become more open to non-American firms.

There have been many macro models of the effects of a trade war (see my January publication Could a Trump trade war spark a bear market?). The latest estimate from the Bank of England assumes a 10% across the board tariff. It would take 2.5% off GDP, and the secondary effects would roughly double the costs. Moreover, the effects would be felt all around the world.

Bank of England simulations suggest that the impact of narrow, bilateral tariff increases through direct trade channels would tend to be small – reflecting the small share of overall exports affected – and would be largely confined to the countries directly involved. However, a larger, increase in tariffs of 10 percentage points between the US and all of its trading partners could take 2½ per cent off US output and 1 per cent off global output through trade channels alone, although the impact on the UK is smaller reflecting a greater exchange-rate driven boost to net exports.

It would be a very bumpy ride. If the US were to take a 5% hit to GDP growth, it could easily crater stock prices at a magnitude similar to the Great Financial Crisis, if not more.

Market implications

After reviewing the bull and bear cases, what should investors do? The answer is tricky, because navigating between the bull and bear cases is a study in policy direction and investor psychology.

In the realm of policy, will one side blink in this mano-a-mano war of nerves, as Trump did with in the case of ZTE?

The next data point to watch is NFIB small business optimism, which is due to be reported Tuesday morning. Should confidence show signs of collapse (and the headline gets widespread play on Fox News), it would put pressure on Trump to find a face-saving compromise.

One other issue that investors should consider is how the markets will start to discount the effects of the mid-term elections in November. As the summer progresses and should it become evident that the Democrats will control the House, how will the market react?

An Axios article recounted the advice of the Bush 43 White House OSG (Oh Sh** Group) that was formed in preparation for a Democratic victory. They had this advice for Trump aides:

- Democrats now will have subpoena power: “Oversight committees are going to bombard you with calls for testimony and documents,” requiring massive West Wing legal bandwidth.

- Democratic chairs can suddenly go after your spending, your email, your calendars, your notes.

- “Things that might get a pass — or be one-day stories, or wiped under the rug — when you have the same party can suddenly became major stories. Every single thread, happening anywhere in the government, gets pulled.”

- Democrats are likely to pick “weak members of the herd” — vulnerable Cabinet members — and go after them from all directions.

- “Clear the decks now of anyone you think is going to cause more pain and embarrassment than you’re willing to spend.”

- “The confrontational footing is a huge distraction. You have to structurally prepare for how you’re going to deal with ongoing battles where suddenly you’re not setting the agenda.”

- “Figure out which issues you’re going to fight on, and which Democratic issues you can try to co-opt and make progress on.”

In other words, governing will become far more difficult that it is today. Not only will it be impossible to get any legislation passed, the Mueller probe, if it’s not concluded, will likely take on a new life of its own. In addition, the Fed will likely have inverted the yield curve by late 2018 or early 2019, which is a recession and equity bear market warning.

The market environment will become increasingly hostile. Don’t be surprised if the markets get spooked by such a scenario in the next few months.

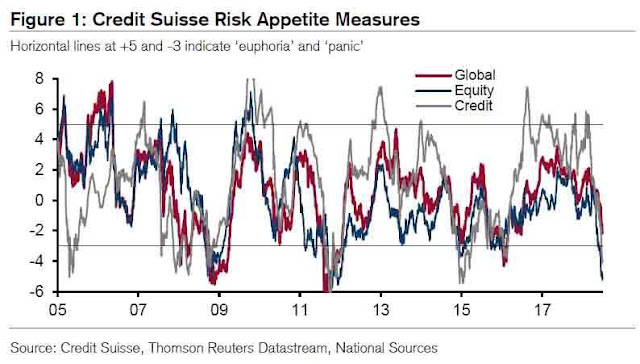

On the other hand, the Credit Suisse Risk Appetite Indicator is already in the panic zone, indicating that much of the downside has already been discounted. In light of the upbeat near-term reflationary environment, risky assets like equities are poised to stage a rip-your-face-off rally on any hint of good news.

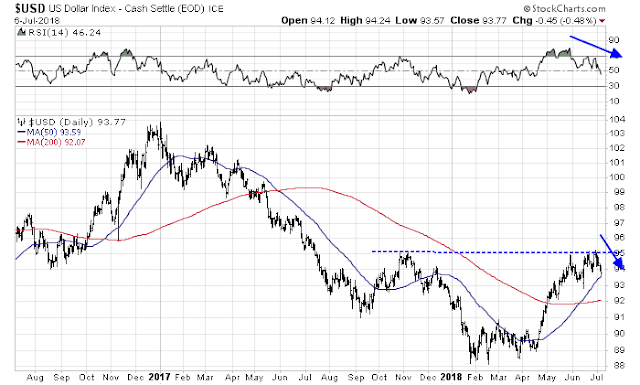

I observed last week that the USD is technically vulnerable, and USD weakness would be supportive of non-US asset prices. As well, a falling greenback would take some of the pressure off trade tensions. The USD Index has reacted as expected as it was rejected at a key resistance level while exhibiting a negative RSI divergence. The index is now testing its 50 day moving average (dma).

A last hurrah?

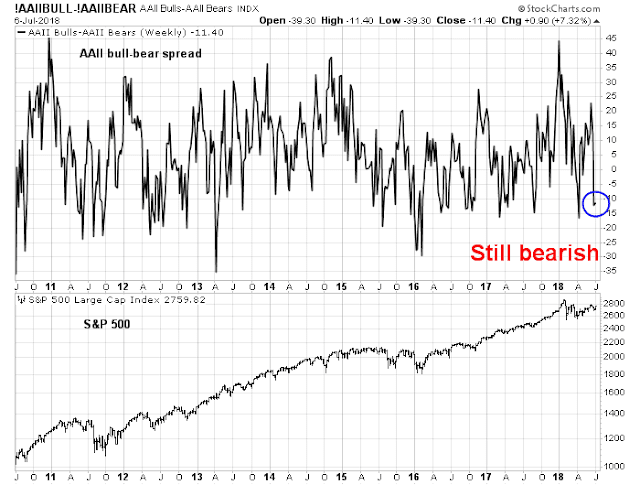

In conclusion, the strength of the bullish and bearish cross-currents makes it difficult to make a definitive market forecast, but my base case scenario calls for a last hurrah equity rally in the next few weeks. Sentiment remains bearish, indicating significant upside potential on any bullish catalyst. Last Friday’s imposition of tit-for-tat tariffs, along with the better than expected June Employment Report, may have triggered a buy the news rally.

Sentiment has become sufficiently washed out and that even Mexican stocks staged a relief rally.

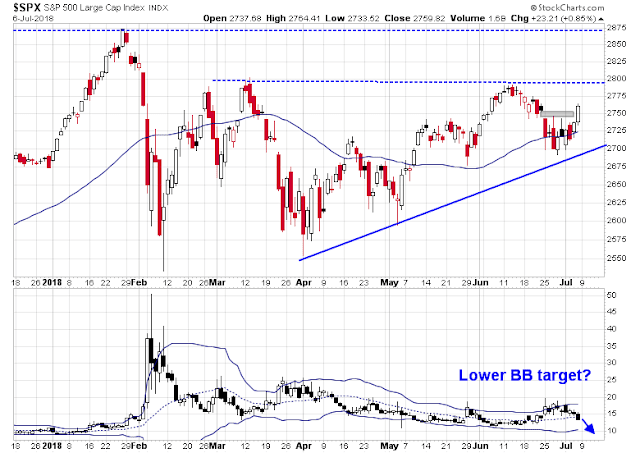

The SPX impressively regained its 50 dma and broke out through the 2740 resistance level, and filled in a gap at 2740-2755. The bulls now have control of the tape, and the next resistance level can be found at about 2800.

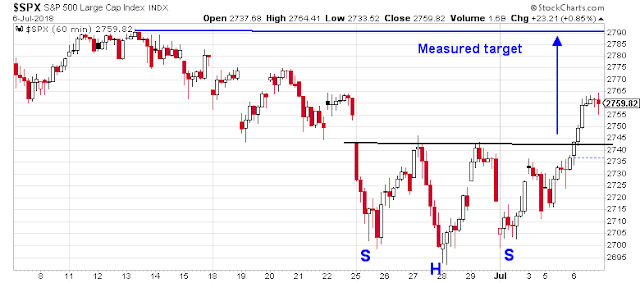

The short-term outlook also confirms the longer term bullish picture. The SPX staged an upside breakout from an inverse head and shoulders formation on the hourly chart last Friday. The measured target is resistance at about 2800.

In the absence of any major bearish surprises, I would expect that the market to grind upwards and possibly test the January highs. The bearish tripwire that I would watch for is whether the VIX Index can fall below its lower Bollinger Band, which can be a signal of a rally exhaustion. As well, I would watch for either overbought readings or excessive bullishness as the index tests key resistance levels.

The week ahead

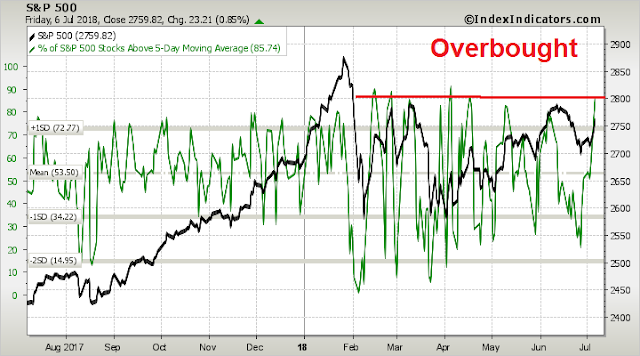

However, in the short-term (1-2 days), the market may have run ahead of itself and need a pullback or sideways action to consolidate its gains, based on the % of stocks above the 5 dma.

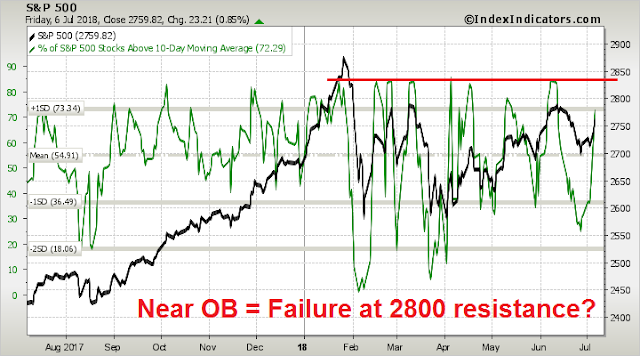

Longer term indicators, such as the % of stocks above the 10 dma, suggest that the market may initially get rejected at resistance at 2800.

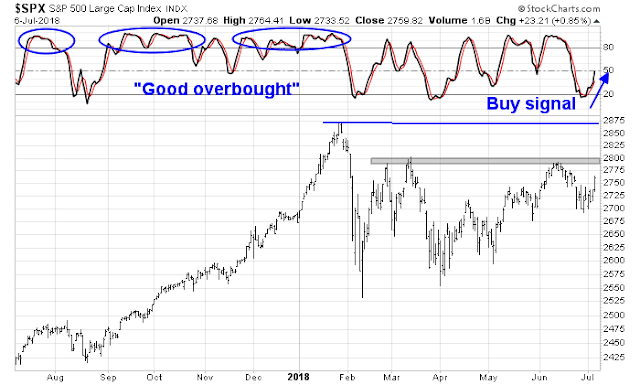

The market flashed a buy signal when the stochastics rose above an oversold level in late June. However, the challenge for the bulls will be to sustain some upside breadth and momentum in order to flash a series of “good overbought” readings.

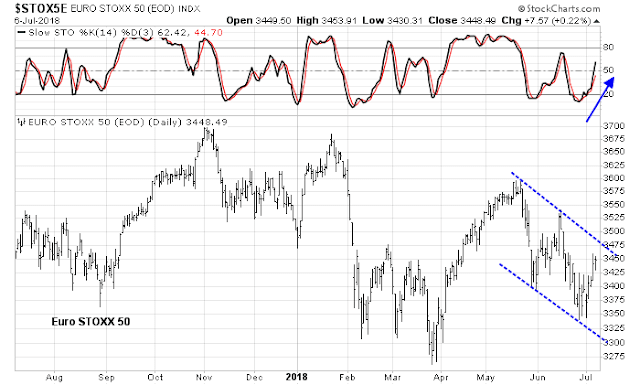

If the global reflation theme is truly in play, then much will depend on the participation of non-US markets. The Euro STOXX 50 has already flashed a buy signal. Watch for a possible upside breakout from its downward sloping channel, which would be positive for the bull case.

The Shanghai market (bottom panel) remains in freefall, but the Chinese stock market is dominated by individual traders and can only be characterized as a casino. Meanwhile, the closely China-related Hang Seng Index, however, is on the verge of delivering a stochastics buy signal. Watch for possible bullish development!

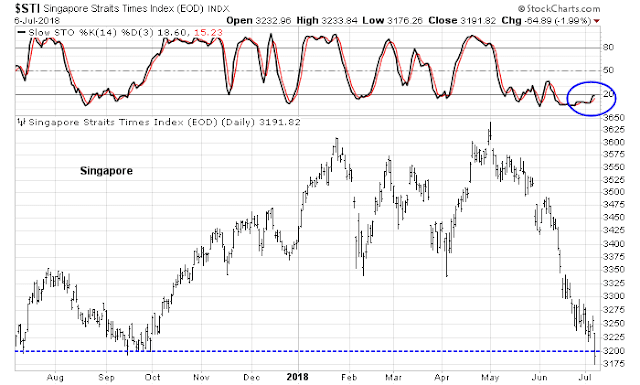

Similarly, the Singapore market is testing a key support level and may be on the verge of flashing a buy signal.

My inner investor remains constructive on equity prices. My inner trader added to his long positions early last week, and he is prepared to buy more should a pullback occur. However, volatility risk is rising because of trade and foreign policy uncertainty. Traders are advised to adjusted their positions in accordance with the heightened risk environment.

Disclosure: Long SPXL

Market could easily hit 2800 and then overshoot about 3% to the January peak. But let’s take a look at where the investment world environment was then versus now.

Then, there was a big global synchronized economic growth outlook. Now global growth projections are falling and many countries are in difficulty.

Then there was no trade war rhetoric. Now the war has started and likely escalating.

Then we had Yellen, a super dove with a dove Fed committee. Now we have a monetary policy hawk with a hawk Fed committee set on raising rates faster than the market is expecting.

Then we had an unbridled tech boom. Now we have Zuckerberg and social media in the legislative cross-hairs of governments. The vital global supply chain of tech equipment may be disrupted by trade wars.

Now we have Mueller circling ominously closer to the President.

Now we have Trump turning his back on G7 allies economically.

The run up in stock prices late last year in a string of ‘good overbought’ signals was due to a perfect outlook and a tax-cut earnings boost. It led to a peak in investor optimism that won’t be here again any time soon, maybe not for years.

In 2017, it was more profitable to buy the dips than shorting the rallies. My guess is the opposite this year.

There is always bad news – always – AD line is making new highs – I see new highs soon.

David Rosenberg was (one of) the last bear standing out there. Now that he has thrown in the towel, may be a warning of a peaking market.

We shall find out soon, as earnings unfold.