What should investors make of the market’s recent air pocket and subsequent recovery? John Autthers, writing at Bloomberg, proposed an analytical framework where investors view the coronavirus outbreak mainly as a China problem. The MSCI World with China exposure (blue line) has been far more volatile than the MSCI World Index (white line). The companies with high China exposure have tanked in response to the virus scare and dramatically underperformed global stocks.

While global investors fret about the economic impact of China’s slowdown in the wake of the coronavirus infection, the PBOC has responded with a tsunami of liquidity to support the market. Moreover, extraordinary measures have been put in place to forbid short selling, and to discourage major shareholders from selling their shares. In response the Asian stock markets have rocketed upwards after a brief corrective period, and global markets have followed suit with a risk-on tone.

These policy responses beg two obvious questions. Is the melt-up back? If the market is focused mainly on China and the coronavirus, should investors even try to fight the PBOC?

A coronavirus report card

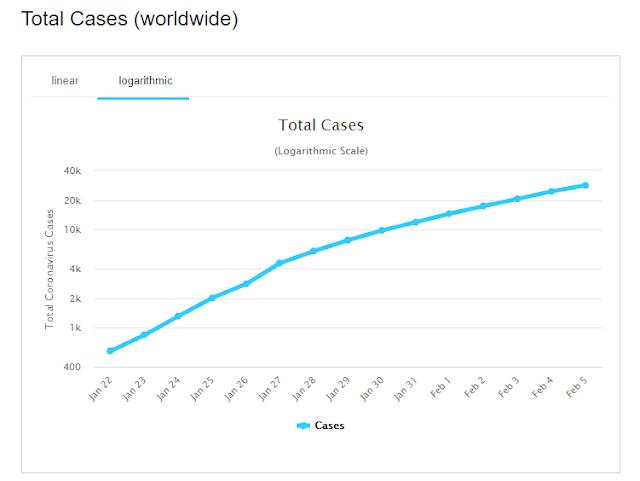

Let’s start with a report card on the progression of the coronavirus. Worldometer maps the growth of cases, and the growth rate is starting to level off, which is good news.

However, we are now entering the second phase of the outbreak, where the world begins to distrust Chinese statistics, and anecdotal evidence of undercounting and other official misdeeds start to pile up.

Chinese social media was inundated with an outpouring of anger and grief over the death of Dr. Li Wenliang. Li warned other medical staff about the coronavirus, but he was admonished by the police for “making false comments” that had “severely disturbed the social order”. Li caught the virus, and died recently in hospital. He was 34. WeChat has taken steps to censor comments about Li Wenliang, and the protests have the potential to spiral out of control.

The BBC recently reported undercounting of infections in Wuhan (see “We’d Rather Die At Home Than Go Into Quarantine”). While mildly infected cases are quarantined, seriously infected patients cannot find hospital beds and therefore are not counted in official statistics. The Guardian also documented how local party cadres took the best face masks for themselves while doctors and other medical staff had to make do with second rate equipment and protective clothing.

Ambrose Evans-Pritchard at the Telegraph cast doubt on the veracity of official Chinese statistics:

Are they reading dispatches by Caixin and others revealing a desperate shortage of testing kits and tales of the walking afflicted (transport has been stopped) queuing for hours at hospitals, only to be turned away and sent home to die undiagnosed. These glimpses of truth are about to vanish. The propaganda police have ordered those within their direct reach to conduct an “editorial review”.

The coronavirus numbers are fiction. Far more have died than 490. A Lancet study last week by the University of Hong Kong estimated that the Chinese authorities have understated the epidemic tenfold. It calculated even then that the true figure for Wuhan cases was likely to be 76,000, and that Chongqing and Changsha are already riddled with the disease.

“Independent self-sustaining outbreaks in major cities globally may become inevitable,” it said.

Views differ but it is striking how many global experts say it may already be too late to stop the spread. “It’s very, very transmissible, and it almost certainly is going to be a pandemic,” said Anthony Fauci, head of the US National Institute of Allergy and Infectious Disease.

A Johns Hopkins model of the outbreak shows that the modeled infection cases to be far higher than the reported case.

A Taiwanese website suggested that it found evidence of manipulation of coronavirus statistics, though the account is verging into tinfoil hat conspiracy theory territory.

As many experts question the veracity of China’s statistics for the Wuhan coronavirus outbreak, Tencent over the weekend appeared to inadvertently release what is potentially the actual number of infections and deaths — which are far higher than official figures, but eerily in line with predictions from a respected scientific journal.

As early as Jan. 26, netizens were reporting that Tencent, on its webpage titled “Epidemic Situation Tracker,” briefly showed data on the novel coronavirus (2019-nCoV) in China that was much higher than official estimates, before suddenly switching to lower numbers. Hiroki Lo, a 38-year-old Taiwanese beverage store owner, that day reported that Tencent and NetEase were both posting “unmodified statistics,” before switching to official numbers in short order.

Netizens also noticed an Enron-like fatality rate in official Chinese statistics. The number of deaths worked out to exactly 3.1% on a daily basis for the January 22-24 period, and dropped to 2.1% from January 30 to February 2. The Tencent “leaked” figures were much higher by comparison.

The mortality rates for the numbers briefly shown on Tencent are much higher. The death rate for Jan. 26 was 2,577 deaths out of 15,701 infections, or 16 percent.

The death rate for the Feb. 1 post was 24,589 deaths out of 154,023 infections, which also comes out to 16 percent. The death rates briefly shown are clearly vastly higher than the official percentages and substantially higher than SARS at 9.6 percent, but lower than MERS at 34.5 percent.

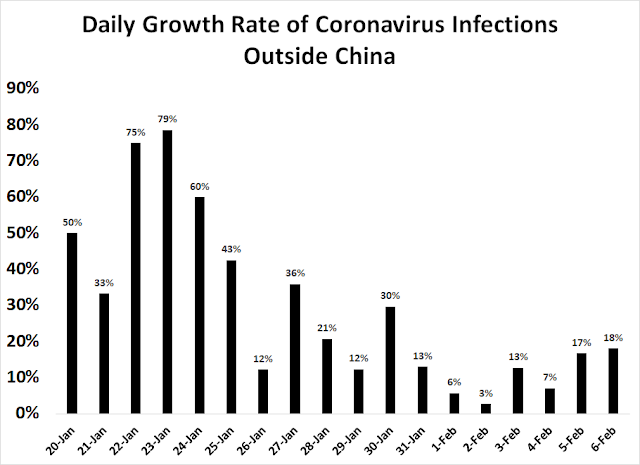

There is another solution if you don’t trust Chinese statistics. The Johns Hopkins CSSE website breaks out the growth rate outside China. While the history of the data is short it’s still early, the growth rate has been relatively steady, and results are inconclusive.

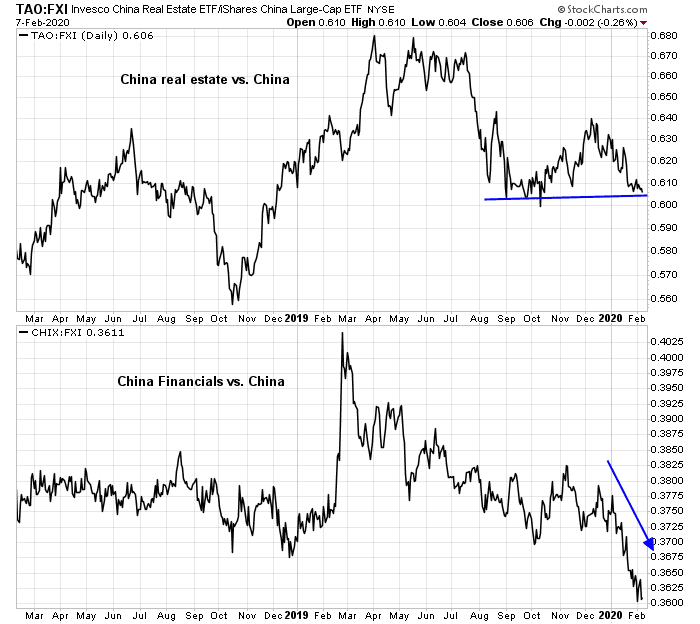

In response to the nervousness over the economic slowdown, the PBOC has unleashed a shock-and-awe liquidity campaign on the financial system. This has put a floor on stock prices, but market internals are mixed. The highly cyclical real estate industry, whose sales have cratered to zero during the outbreak, has seen its relative returns lag the market, but it is stabilizing at a relative support level. By contrast, the relative performance of banking stocks have been plummeting, indicating heightened concerns over financial system stability.

The view from outside China

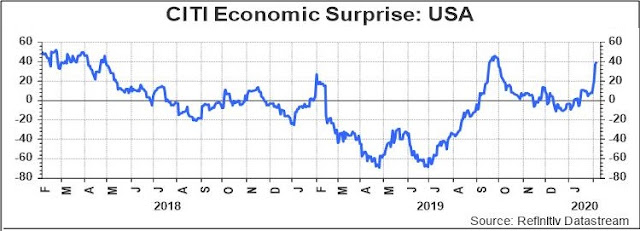

The picture outside China has been mixed to positive. The pre-outbreak macro outlook has been mostly positive, as evidenced by the upside surprise in both ISM Manufacturing and Services. The Citigroup Economic Surprise Index, which measures whether economic data is beating or missing expectations, has been surging.

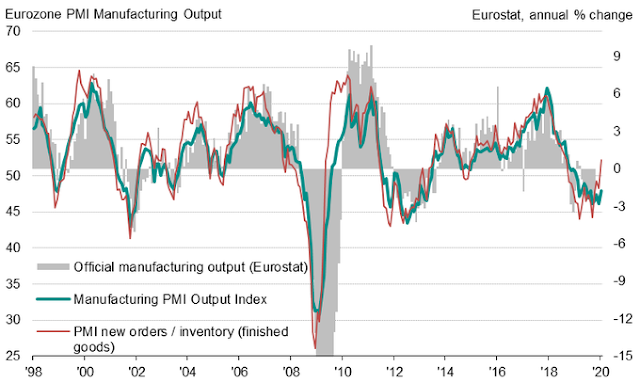

Last week’s release of Eurozone PMI has also been encouraging for the manufacturing sector. In particular, the new orders-to-inventory ratio, a key forward-looking indicator for factory production, rose to a 2.5 year high.

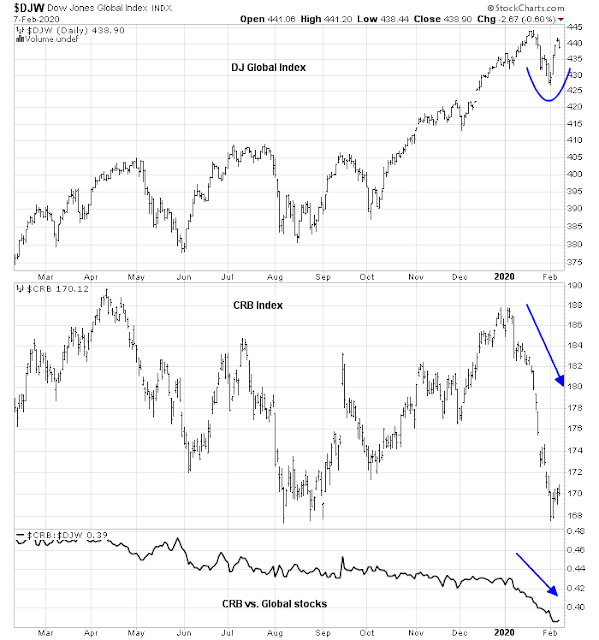

The real-time relative performance of cyclical exposure has been mixed. While equity prices corrected and recovered, commodity prices, which are highly sensitive to the global cycle, have fallen dramatically.

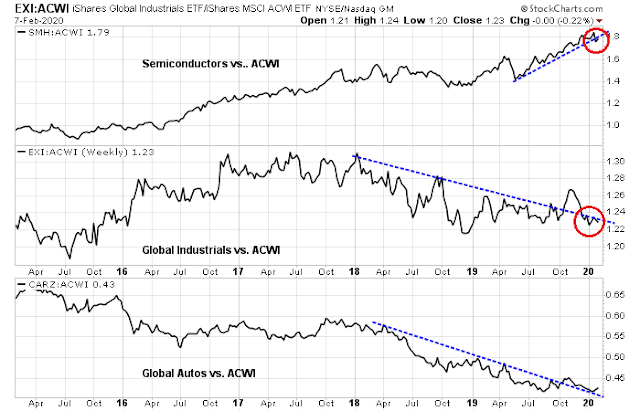

While the weakness in commodity prices could be attributable to economic weakness in China, the relative performance of global cyclicals have been neutral to negative. In particular, the semiconductor stocks, which had been market leaders, have pulled back below a key relative uptrend.

Climbing a Wall of Worry?

Sentiment model readings are also a mixed bag. On one hand, the latest cover of the Economist may have provided the classic contrarian magazine cover indicator for the markets (see A key test: The Zero Hedge bottom?).

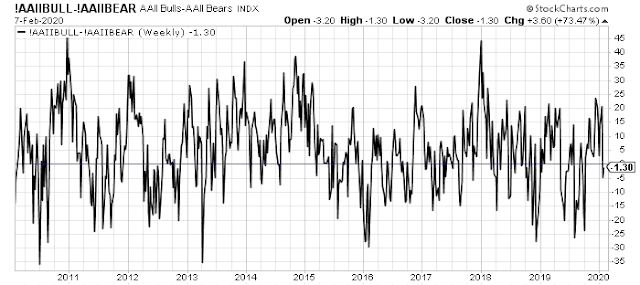

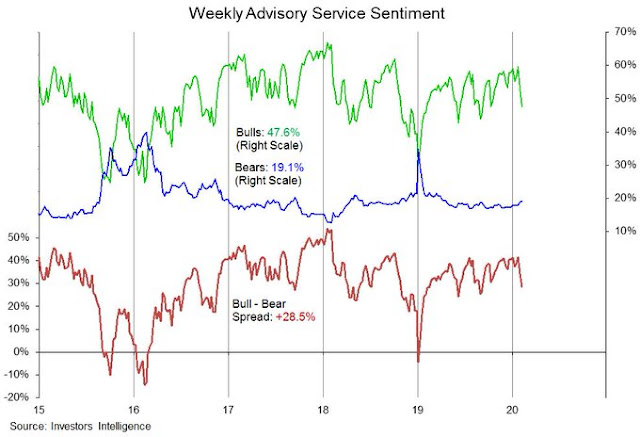

On the other hand, sentiment readings such as the AAII Bull-Bear spread fell to neutral and reversed bullish again before fully resetting to a bearish extreme.

Citigroup strategist Tobias Levkovich, who is the keeper of the Citi Panic/Euphoria Model, stated in an interview that too many clients were itching to buy the dip. Capitulation did not occur in the most recent pullback, and there are too many bulls.

Pretty much every client we talk to wants to buy the dip, and that is not comforting. It implies that people are very long the market and are willing to let share prices go higher. When we are asked what factors made the Panic/Euphoria Model move into euphoric territory, we highlight one of the inputs (though several caused the shift), as it looks at premiums paid for puts versus calls, and the prices have dropped for puts. Fewer deem the need to pay up for insurance, which indicates substantive complacency. Accordingly, the qualitative/anecdotal evidence is supporting the more quantitative approaches.

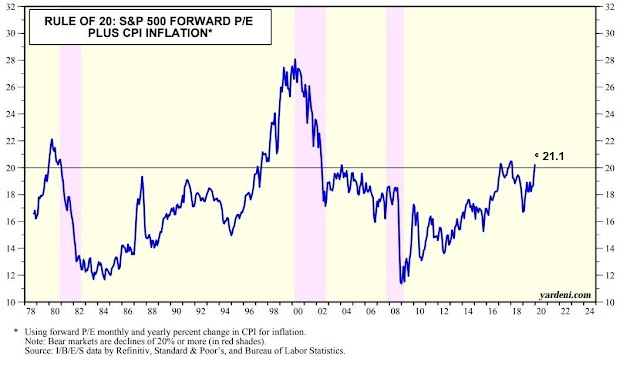

While such a sentiment backdrop could underpin a FOMO buying stampede, the S&P 500 is now trading a forward P/E ratio of 18.8. The Rule of 20 Indicator, which flashes a warning when the sum of the forward P/E and CPI inflation rate exceeds 20, is now at a worrisome bull cycle high of 21.1.

A renew melt-up?

I began this publication with the rhetoric questions of whether the melt-up has returned, and should investors fight the flood of liquidity from the PBOC. The jury is still out on those questions.

The short-term bull case is supported by abundant central bank liquidity, and emerging evidence of a pre-coronavirus cyclical rebound from non-China economies. On the other hand, bullish sentiment did not fully reset, and valuation is extended.

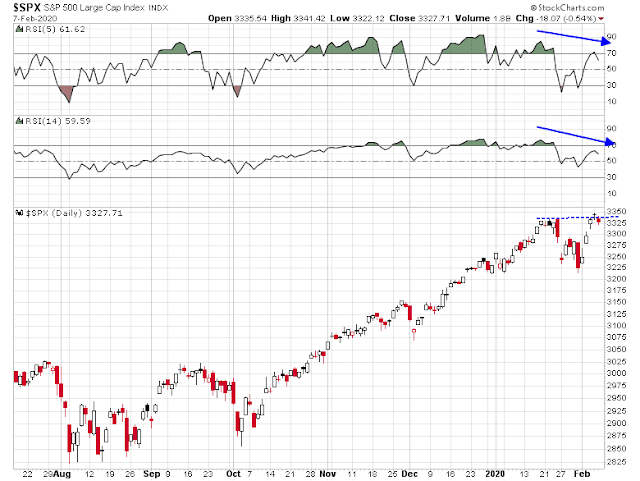

Should the animal spirits return and drive stock prices upward, watch for fresh highs accompanied by a negative divergence in the NYSE McClellan Summation Index (NYSI). Similar divergences were in evidence at the last two major market highs. Advances under such a “false rally” scenario in the past two tops saw a three-month gap between the first NYSI high and the final stock market top. If the past is any guide, this would put timing of the next major top in April.

As well, watch sentiment models, such as II sentiment, to return to bullish extremes for the signs of a top.

On the other hand, the latest rally could just be a simple bull trap. The latest advance was accomplished with negative RSI divergences.

In light of the risks evident in the market, we suggest that investment oriented accounts maintain a neutral risk position, with an asset allocation roughly in line with policy asset mix.

Stay tuned.

Are you still long SPXL?

Yes I am. Likely support at around 3300 if the market weakens further.

What’s interesting about the Wuhan coronavirus story is the emotional intensity of public reactions to it. It’s reminiscent of the AIDS epidemic of the 70s/80s/90s, which was characterized by confusion, fear, and distrust – both among the public and among health care professionals.

Will The Economist cover end up a contrarian indicator, or might it go down as an example of a prescient cover story that actually asked the right question?

Here’s an issue than may get market’s attention…

“More and more signs that China’s return to work on Monday will be very limited: part of Guangzhou has reportedly asked companies to “voluntarily” delay restarting until March 1. Severe punishment for those that open before then and thereby impede virus control efforts.”

I don’t see how they get people back to work as infection, response and isolation are all still rising. Experts predict the peak is likely months away.

The auto sector supply chain most concentrated in Wuhan/Hubai province. So, German, Korean, Japanese, US car factories should be first to stop.