It is astonishing to see the market narrative shift in the space of only a few months from “inflation is coming” to a growth scare. In late March, the 10-year Treasury yield topped at over 1.7% and the 2s10s yield curve was steepening. Today, the 10-year has decisively broken support and the yield curve is flattening, indicating fears of slowing economic growth.

In late May, I forecasted bond market price strength and called for a counter-trend rally in growth stocks (see

What a bond market rally could mean for your investments) but the latest move in both yields and growth appear exhaustive. As evidence of the change in psychology,

Bloomberg reported that put option premiums over calls on the 10-Year Treasury Note have vanished. Traders are now paying more for call options than put options.

Here are seven reasons why investors should fade the growth scare.

Lack of cross-asset confirmation

The bearish scenario, which is becoming the consensus one, would see a stalling in economic growth and momentum, causing the Fed to take a more dovish tone, Treasury yields to pull back, the yield curve flattens, put upward pressure on the USD, which would be negative for commodity prices. Growth stocks would regain market leadership as investors pile into growth stocks when growth becomes scarcer, and value stocks lag owing to their high cyclical exposure.

While investors have bought growth stocks because of the perception that growth is becoming scarce, many other cross-asset signals have not confirmed the growth slowdown. While the 10-year Treasury yield has broken technical support, the USD Index is still trading below a key resistance level. If the global economy is indeed slowing, the USD would be an important safe haven asset that should be rallying hard.

Commodity prices are also not signaling a major deceleration in growth. Commodities remain in an uptrend and they are holding above their 50 and 200 dma. In addition, the cyclically sensitive and base metals to gold ratio remains firm and exhibiting a positive divergence against the 10-year Treasury yield.

Value poised for a comeback

Another cross-asset signal can be found in equity style performance. The relative performance of growth stocks, as measured by the NASDAQ 100 to S&P 500 ratio, is correlated to bond yields. That’s because growth stocks are high duration assets that are more sensitive to changes in interest rates. Indeed, growth stocks have rallied on a relative basis as bond yields have fallen (inverted scale).

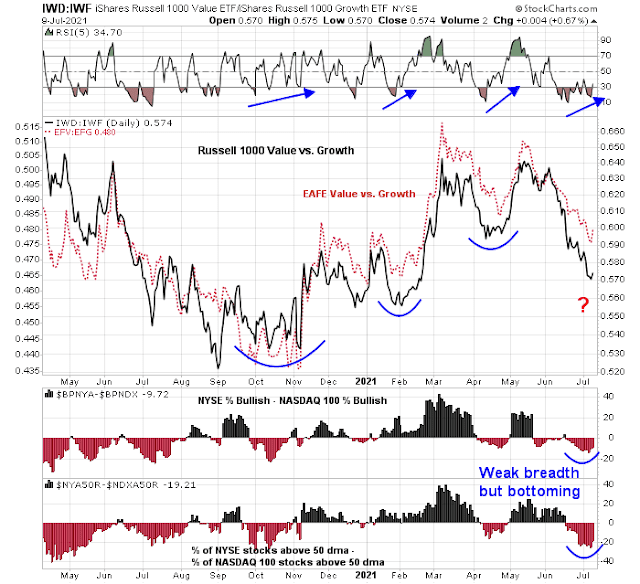

The relative performance of value to growth has gone global. Not only are value stocks lagging in the US, but internationally as well. A closer look at the Russell 1000 Value to Growth ratio shows a positive RSI divergence in favor of value. As well, the relative breadth of value to growth may also be bottoming.

A value hiccup in an uptrend

Jason Goepfert of

SentimenTrader believes the “Pounding of Value Stocks May Be Nearing an End”. The setback experienced by value stocks is occurring in the context of a relative uptrend, as defined by a rising 200 dma.

One difference with the recent losses is context – it’s happening in an uptrend. Unlike the large rolling 1-month losses during much of 2020, the 200-day average of the Value/Growth Ratio is rising.

If we focus on large declines in the ratio only within uptrends, we can see that losses this large have typically resulted in the trend reasserting itself rather than sliding into another long-term downtrend. The ratio was extremely volatile in the 1930s, so many of the precedents were triggered then.

Growth stocks are highly extended

I recently pointed out (see

U-S-A! U-S-A! But for how long?) that investors have piled into US equities as a safe haven in the current growth scare and the relative performance of US equities are highly correlated to the growth/value ratio. The relative performance of the S&P 500 is highly extended, though it staged an upside breakout through relative resistance.

Mark Hulbert observed that NASDAQ sentiment is at a crowded long condition: “Timers my firm monitors who focus on the Nasdaq in particular are, on average, more bullish now than on 94% of all trading days since 2000. (That’s according to my firm’s Hulbert Nasdaq Newsletter Stock Sentiment Index, or HNNSI.)”

One anomaly to the growth leadership is the lagging performance of speculative growth stocks. Even as the relative performance of the NASDAQ 100 rose, the ARK Innovation ETF (ARKK) weakened both on an absolute and relative to the S&P 500.

Earnings Revisions Are Strong

As we approach Q2 earnings reporting season, EPS estimates are also rising strongly. There are no signs of slowdown or deceleration.

Q2 earnings seasons may be a challenge because forecast growth rates are very high owing to low base effects. However, companies have historically managed expectations well so that they have beaten estimates.

In addition,

FactSet also pointed out that forward guidance is extremely strong. The risk of a disappointing earnings season should be fairly low.

For Q2 2021, 37 S&P 500 companies have issued negative EPS guidance and 66 S&P 500 companies have issued positive EPS guidance. If 66 is the final number, it will mark the highest number of S&P 500 companies issuing positive EPS guidance since FactSet began tracking guidance in 2006

Delta and Lambda: Under control

One of the reasons advanced for a growth scare is the rising prevalence of different COVID-19 variants which could lead to renewed lockdowns that put the brakes on a recovery.

Joe Wiesenthal documented the UK experience with the Delta variant, which has ripped through that country. The red line is the five-day moving average of new COVID cases, while the green line is the five-day moving average of COVID deaths. The UK is one of the most vaccinated countries in the developed world. Vaccines work to mitigate the effects of the pandemic.

As well, concerns over a new Lambda variant is beginning to appear. An article in

MedPage Today explains:

Yet another SARS-CoV-2 variant is making headlines, but experts reassure that early evidence suggests it can’t substantially evade vaccines — though it does have potential to become a variant of concern, one expert said.

The Lambda (C.37) variant, first identified in Peru in December 2020, now accounts for the majority of infections there, and is on the rise in other South American countries, including Argentina, Ecuador, Chile, and Brazil.

MedPage Today interviewed researcher Nathaniel Landau, PhD, a virologist at NYU Grossman School of Medicine, who found the new mutation appears to increase viral transmissibility and it is more resistant to current vaccines:

The novel mutations in spike may contribute to increased transmissibility, and could result in greater reinfection rates or reduced vaccine efficacy, the researchers reported. Their analysis showed that Pfizer serum samples were about 3-fold more resistant to neutralization, and Moderna samples were about 2.3-fold more resistant. Convalescent plasma was about 3.3-fold more resistant, while Regeneron’s monoclonal antibody combination had no loss of antibody titer, the group said.

Alarming? Well, not really.

“The typical titer for someone who is vaccinated is 1:2,000,” Landau told MedPage Today. “You can take that down to 1:500 and it will still kill the virus. … Natural infection titers tend to be 1:200, on average, and that’s still protective.”

“We’ve done this for Alpha, Beta, Gamma, Delta, and now Lambda,” Landau added. “The results we see are very similar for all these variants. We’re primarily looking at the mRNA vaccines, and vaccine-elicited antibodies do a good job of neutralizing all the variants.”

Bottom line: As long as there is progress in vaccinations, worries about another pandemic-induced slowdown are overblown.

Here comes the PBoC

Lastly, any growth deceleration will invite a policy response. There are already signs of a growth slowdown in China.

Reuters reported that a former PBoC official said he expects the central bank to engage in monetary stimulus in H2.

Sheng Songcheng, former head of the statistics department at the People’s Bank of China (PBOC), said China should “reasonably and appropriately” lower interest rate levels in the second half of this year as pace of economic growth might ease to 5-6% against the backdrop of fading low base effect.

Subsequent to the publication of that story, Bloomberg reported that the PBoC announced a surprise cut to banking reserve requirements.

The People’s Bank of China will reduce the reserve requirement ratio by 0.5 percentage point for most banks, according to a statement published Friday. That will unleash about 1 trillion yuan (US$154 billion) of long-term liquidity into the economy, the central bank said.

The cut will be effective on July 15, according to the statement.

Monetary accommodation is on the way.

Why are bond yields falling?

Under normal circumstances, falling bond yields is a signal that the market believes the economy is about to slow. If the fears of a growth scare are overblown, why are yields falling?

The market’s confusion can mainly be attributable to a misinterpretation of the apparent hawkish pivot from the June FOMC statement and dot plot. As a reminder, seven Fed officials saw rate hikes in 2022, compared to four at the March FOMC meeting; 13 saw rate hikes in 2023, compared to seven at the June meeting.

The misinterpretation stems from the mixed message owing to the divide that’s appearing at the Fed between the inflation hawks, who are mainly Regional Fed Presidents, and the doves, who are mainly members of the Board of Governors. The

minutes of the June FOMC meeting tells the story [emphasis added]:

In their discussions on inflation, participants stated that they had expected inflation to move above 2 percent in the near term, in part as the drop in prices from early in the pandemic fell out of the calculation and past increases in oil prices passed through to consumer energy prices…Most participants observed that the largest contributors to the rise in measured inflation were sectors affected by supply bottlenecks or sectors where price levels were rebounding from levels depressed by the pandemic. Looking ahead, participants generally expected inflation to ease as the effect of these transitory factors dissipated, but several participants remarked that they anticipated that supply chain limitations and input shortages would put upward pressure on prices into next year.

In their comments on longer-term inflation expectations, a number of participants noted that, despite increases earlier this year, measures of longer-term inflation expectations had remained in ranges that were broadly consistent with the Committee’s longer-run inflation goal. Others noted that it was this year’s increases that had brought these measures to levels that were broadly consistent with the Committee’s longer-run inflation goal.

Moreover, there was broad disagreement about inflation risk:

In discussing the uncertainty and risks associated with the economic outlook…Although they generally saw the risks to the outlook for economic activity as broadly balanced, a substantial majority of participants judged that the risks to their inflation projections were tilted to the upside because of concerns that supply disruptions and labor shortages might linger for longer and might have larger or more persistent effects on prices and wages than they currently assumed. Several participants expressed concern that longer-term inflation expectations might rise to inappropriate levels if elevated inflation readings persisted. Several other participants cautioned that downside risks to inflation remained because temporary price pressures might unwind faster than currently anticipated and because the forces that held down inflation and inflation expectations during the previous economic expansion had not gone away or might reinforce the effect of the unwinding of temporary price pressures.

Confusion at the FOMC and its communication policy has led to confusion in the markets.

In addition, when I issued the call to buy bonds in May, bond market sentiment and positioning was at a bearish extreme. Long bond sentiment has now surged to a bullish extreme.

In conclusion, I called for a bond and growth stock market rally in late May and those trades are on their last legs. The market is currently overreacting to a growth scare. Investors have piled into safe haven assets, such as US equities and growth stocks while broad equity market levels have not suffered much of a setback. Equity investors should rotate back into value and cyclical stocks in anticipation of better performance ahead.

Great call Cam on the bond rally. Talk about contrary, you were alone in the investment world on that one.

As we assess the Delta and Lamda damage, I think I and others are being lulled into thinking of this in Developed World terms where we have high vaccination and the variants cause fewer hospitalizations and deaths to single dosed people.

But in poorer countries with tiny vaccination rates, were are seeing a big surge. Also developed countries like Japan that successfully locked down very quickly on the original pandemic and then did not vaccinate, have seen a large surge in cases. Witness the emergency Olympic Tokyo situation. This is effecting the Far East region. It could derail the Resource Value sector if global demand for industrial commodities falls even as Developed Vaccinated World demand continues.

I agree that EM economies are especially vulnerable to these variants. The human cost is potentially horrendous. I have some friends in South Africa who tell me about the difficulties that they are encountering.

Not to be callous, but if I were to put on my investment hat, the market doesn’t really care very much about under-developed countries or even unvaccinated pockets of the US unless they are critical parts of the global supply chain.

Remember Ebola. What global GDP impact did that have?

Another thought on a Value revival is that Banks must be part of that or it fails. The momentum ranking of Banks has crashed. On an earnings basis they are extremely cheap and they have been unleashed by regulators to raise dividends and buy back shares.

A test of any Value sector is when the earning recovery from a recession low has run its course and then you have dividend yield as a driver not earnings growth.

The yield curve is flattening which is bad. Loan growth is way down. Trading profits can be hit or miss. Wealth management is a growth area. Loan defaults are extremely low. Fintech is a future problem.

These companies report earnings early. It will be key to see how investors react.

https://www.marketwatch.com/story/investors-now-see-stocks-as-money-pots-and-thats-just-not-in-the-cards-11625695703?mod=mark-hulbert

Should we be realistic about (and content with) modest gains going forward?

Good companion article by Hulbert.

https://www.marketwatch.com/story/the-most-important-predictor-of-your-retirement-financial-security-11625847569?mod=mark-hulbert

Excerpts from the article:

‘In my opinion, the best we can do to estimate equities’ longer-term returns is to rely on those indicators that historically have had the best forecasting track records. For this column I focused on eight such indicators that, as far as I can tell, are head and shoulders above all others. I listed the eight in a column two weeks ago.

‘Each of these eight indicators currently is forecasting that the S&P 500 SPX, +1.13% over the next decade will produce well-below-average returns. The median forecast of all eight is an inflation-adjusted total return of minus 2.8% annualized. If we add back in the 10-year breakeven inflation rate (the bond market’s best guess of what average inflation will be over the next decade), we get a forecast of minus 0.5% annualized between now and 2031—essentially, a forecast that the stock market, even with dividends added back in, will be no higher in ten years than where it is today.

‘You should know that this forecast comes with a large margin of error. But the investment implications are profound if this forecast comes even moderately close to being accurate. In that event, a 60% stock/40% bond portfolio would produce a nominal return of 0.3% annualized over the next decade, and a 70%/30% portfolio would produce a nominal return of just 0.1% annualized.

‘It could be devastating to many retirees and near-retirees if this forecast turns out to be accurate. But that’s not a reason to dismiss it. Hope for the best is not a viable strategy.

‘I think the better part of wisdom is to base your retirement financial security on the assumption that this forecast is accurate, making any adjustments to your retirement standard of living that this would entail. If the markets turn out to produce far better returns, you will be pleasantly surprised—and can spend your windfall then.

‘For my money, I would rather be pleasantly surprised than the opposite. Forewarned is forearmed.’

Note that I should have clipped the ‘+1.13%’ from the excerpt. That percentage refers only to Friday’s return on the SPX.

Not saying that some of the great traders here won’t do much better. Just saying that buy-and-hold may not be the best strategy over the next decade.

The US market is highly valued based on virtually all metrics. I have been saying that long-term investors should look outside the US for better value.

It doesn’t mean, however, that US equities won’t rise. They are likely to lag over a longer time frame.

John Mauldin said this about research that shows long term returns are poor when we start at a high level. This is his solution. Looks like what Cam and I do.

“One answer is stocks, but not all the time. “Market timing” is anathema to many financial advisors, and they’re not entirely wrong. Done badly (and most people do it badly) and with the wrong expectations, it will be worse than buy-and-hold. The key is to realize what timing can and can’t do. I don’t know anyone who captures all the upside and misses all the downside, but you don’t need to. Simply avoiding the worst part of major downturns helps. It helps even if it causes you to miss some gains when the cycle turns. Similarly, “rotation” strategies that stay fully invested but actively shift between market segments to follow momentum can have good results, too”.

To totally blow my own horn, I will say that I have an unmatched record of missing every crash with clients in the last thirty years, and had parties with clients in November 2001 at the bottom of the Dot.com Crash, party in December 2008, then January 2016 with the Energy/commodity Crash and finally selling 95% of stocks in client portfolios two days after the February 2020 Peak before the Covid Crash. I am scheduling a big client event in September as a delayed-by-Covid party celebrating that epic crash dodge.

To be very honest, it as not been difficult. It’s just that virtually nobody managing money, shifts out of the market to any meaningful way. People talk about it but don’t do it. Everyone in the investment industry is vested in investor clients staying in and “looking across the valley” when obvious signs of economic stress appear on the horizon. Since going through my first epic Crash back when Moby Dick was a minnow, I’ve been paranoid about the pain of going through another one. So I’ve continually studied new methods and use them.

So, unlike Mauldin, you can say you know someone that missed all those downsides.

I truly believe the next crash will be the Mother of them all.

BTW, I don’t see my Big Picture indicators currently showing economic, valuation, sentiment and factor stressors that would cause a bear market anytime soon.

Congratulations, Ken! Thanks for seconding Cam’s take re a continuation of the bull. I hope you’ll let us know when your indicators begin to show otherwise.

Yes, congratulations and thanks, Ken.

We saw this with people who retired or were laid off into an early retirement in 2008-9. Once one is within a decade of retirement, buy and hold is extremely risky. Further, dialing down stocks and dialing up the bond allocation has low returns and a different set of risks. Cam and Ken’s risk-based rotation strategies, if that’s an accurate descriptor, are the best way forward that I’ve found.

Ken, you’ve told us before, but where can we find your service/business offerings?

Thanks.