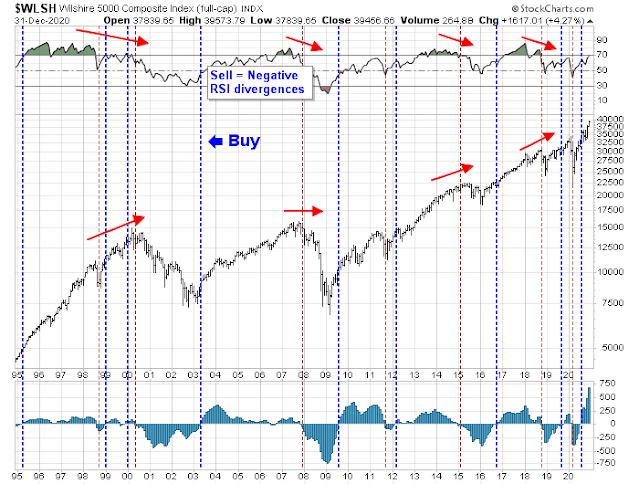

The nature of the market advance has been extraordinary and relentless. From a long-term perspective, the monthly MACD model flashed a buy signal last August for the broadly-based Wilshire 5000 and there are no signs of technical deterioration. This is a bull market, but sentiment has become sufficiently frothy that a reset is overdue.

- A “China is slowing” scare

- USD strength sparking emerging market weakness and a risk-off episode

- Rising real yields creating a headwind for equities

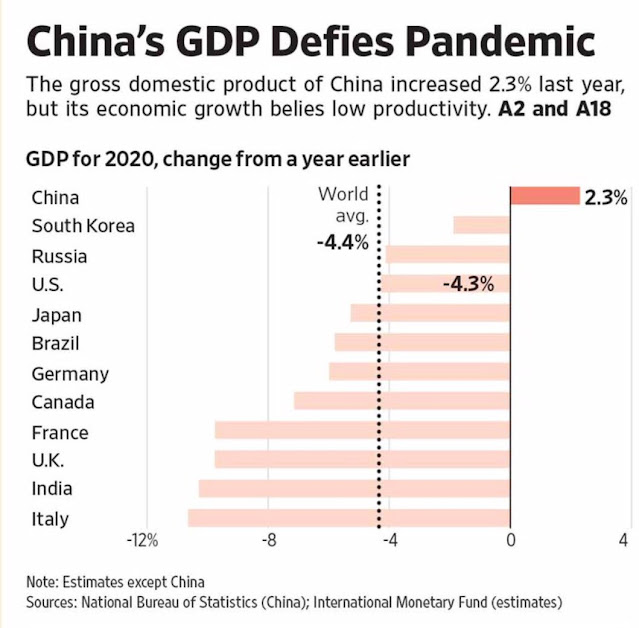

A slowing China?

Looking at the determinants of Chinese aggregate growth, we find that the drivers have changed both with respect to economic variables and across provinces. Before 2010, growth was driven predominantly by rural population moving to cities, as well as by investments and productivity. After 2010, growth through reallocation of labor has run its course to a large extent and growth has become more dependent on government expenditures, credit growth and house prices. Moreover, these new growth determinants seem to apply more homogeneously to the majority of Chinese provinces. A natural question is whether such determinants can sustain growth persistently?

In the wake of the pandemic, Beijing went back to its old quick-fix mal-investment playbook to boost growth. Expect that 2021 GDP growth to be driven by more consumption. Under such a scenario, consumer demand should strengthen, and agricultural commodities should be strong, but industrial metal prices could soften. This has the potential to lead to a “China is slowing” scare among investors.

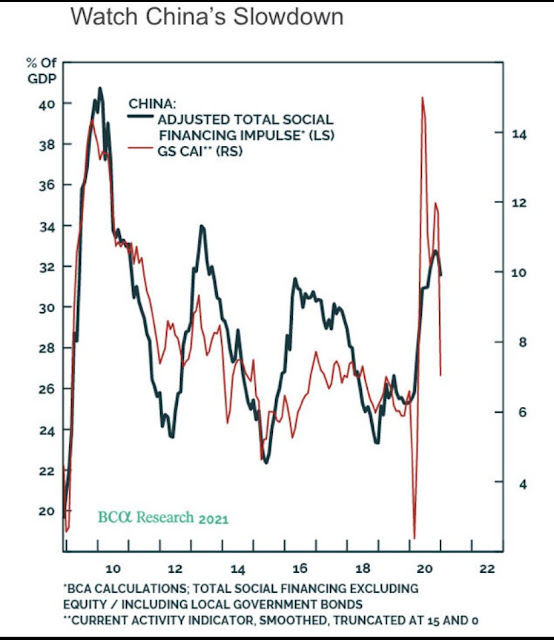

Keep an eye on the evolution of credit growth, as measured by Total Social Financing (TSF). TSF growth is already showing signs of slowing. While any slowdown is expected to be temporary, further deceleration could upset the global reflation and cyclical recovery consensus and spark a risk-off episode in the financial markets.

Will USD strength = EM weakness?

Another concern is the upward pressure on the USD, whose strength could spark a period of emerging market asset weakness.

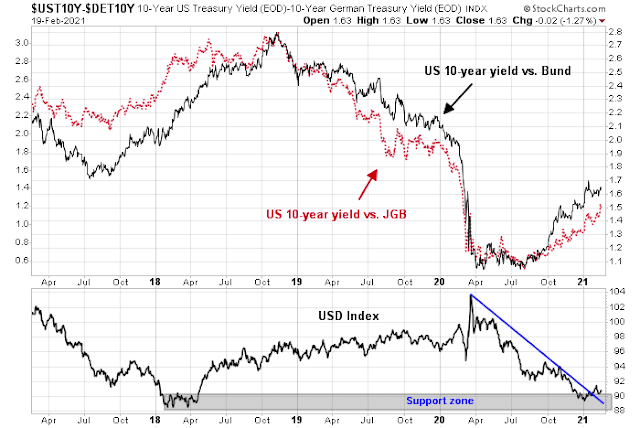

There are several reasons for a USD rally. As bond yields have risen, the yield differential between USD assets and EUR and JPY assets has widened. All else being equal, this will attract more funds into Treasuries. Already, the USD Index has bounced off a key support zone and rallied through a falling trend line.

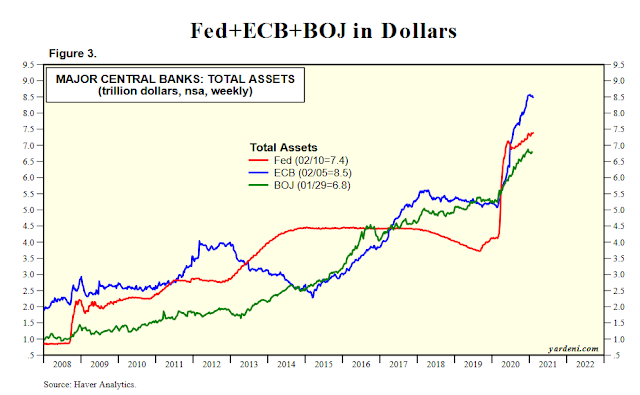

The pace of relative easing will also be on the mind of market participants. While all major G7 central banks are expected to continue to ease, the pace of asset purchase will diverge. In particular, the European Central Bank is expected to expand its balance sheet at a faster pace than the Fed, which will put downward pressure on the EURUSD exchange rate.

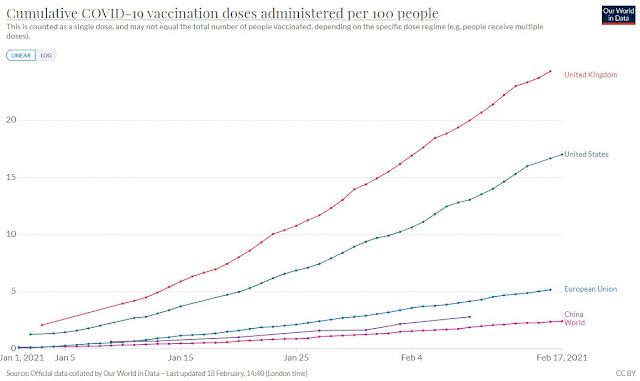

As well, there is an enormous gulf in the pace of vaccinations between the US and the EU. Several central banks, such as the Federal Reserve and the Bank of Canada, have tied the pace of vaccinations to the path of near-term monetary policy. Therefore a differential in vaccination rates will affect the relative rates of monetary easing. This will undoubtedly widen the rates of pandemic-related growth in 2021, which will show up in the FX markets.

In addition, the divergence in fiscal policy between the US and the eurozone will also put downward pressure on EURUSD. The Biden administration is planning to inject some $2.8 trillion in 2021 in discretionary fiscal stimulus, consisting of the $900 billion passed in December and a proposed additional rescue package of $1.9 trillion. By contrast, the eurozone, which consensus expectations calls for a double-dip recession, only plans to inject just €420 billion, made up of funds from national fiscal authorities and Next Generation EU (NGEU) borrowing.

Rising real rates

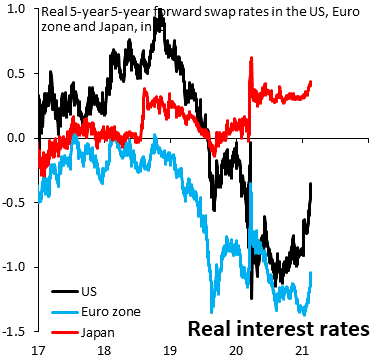

Finally, rising real rates could be another spark for a risk-off episode. Robin Brooks of the Institute of International Finance pointed out that the 5×5 forward swap rates indicate a sharp rise in real yields.

Rising real rates is associated with a stronger USD and lower gold and other commodity prices. USD strength, whether it stems from rising real yields or other reasons such as growth and yield differentials, would put downward pressure on EM assets and create headwinds for other risky assets such as equities.

- A “China is slowing” scare

- USD strength

- Rising real yields

Sold off the crypto stocks Friday (MARA, EBON). Total allocation stands about 20% now – mostly large cap and ETFs (AMZN, MSFT, GOOGL, XLE, XLF, VOO).

AMZN, MSFT, and GOOGL are basically the standard oil of this modern era. They generate over 70% of global distributed compute power.

TSMC (10), NVDA (10), AMD (10) are now on my watch list to buy on any dip for LT holds.

When interest rates rise or fall there can be opposing reasons. If rates rise is it because of increased demand compared to supply or is it because the borrower’s credit is less good?

Looking at the USD compared to Yen, from Oct 2017 to Mar 2018, the yield on the USD went up compared to the yen, but the exchange rate was in decline. The same happened in the 2nd half of 2020, although this year the yen is appreciating.

The USA has a negative trade balance while the eurozone and Japan are positive. This should depress the dollar.I’m not sure what the reason is for US rates staying positive, but the net effect must be to support the dollar. Look at the Turkish lira and rates there.

It’s similar to what happens in a recession, rates crash and yet the economy still continues to tank.

So I would interpret the changes in yields as a sign of weakness. So if a strong dollar is bad for the market, is a weak one good? Does any of this make sense?

Do we blame central banks? I don’t know how huge the cumulative trade deficit is, but back in the day when the US was the greatest creditor and had positive trade balance, I get it that the dollar was strong, but now?

It must be the reserve currency status that allows this somehow, but at some point things have to give…it could happen in decades or fast, like that Hemingway quote.

The 30 and 10 Year looks like the beginning of a parabolic move. Something’s got to give at some point.

Looking at TLT, the price has moved down sharply, but it is now at support from the highs of the summer of 2019, and in 2019 after the high it dropped close to the highs of 2016. So do we get a bounce here?

Can they raise rates? What will happen to home building and home sales, and of course all the debt.

There is so much damage from Covid, just think of all the small businesses like restaurants that have been snuffed out, you can’t just restart that.

We recently refinanced, a 30 year fixed at sub 3% is a good inflation hedge, but for the self employed getting a refi is harder now, will this be the same for small business loans?

Hospitals have been stuffed with Covid patients and regular surgery which pays well has been impeded. Remuneration for Covid does not cover the horrible length of stay and treatments required by many of these patients.

Also unknown is how consumers will respond once Covid is under control, although I expect human nature to eventually exert itself. People enjoy eating out, they enjoy entertainment, but what about new habits? Will changes like work from home, less business travel, fear of travel persist? Unknown.

Of course, in the past the Fed has been blamed for raising rates and causing a recession, maybe they do it again.

My impression is they won’t. We already had a tough election, there are many unhappy campers out there, campers with guns I might add. They will do stimulus spending.

There is the public peace at risk. This is why all the support that was put out, I don’t see that reversing any time soon.

This is like watching those circus performers who spin plates on small poles. They add another and another and move more frantically around the spinning plates to boost each plates spin. Eventually they have an amazing number and the performer can’t keep up.

I truly believe that the extreme monetary policy experiments going on in the world by Central Bankers and left of center governments have truly unknowable financial consequences even as they have humanitarian goals. Trying to logic out this part versus this other part is not only impossible (even for the Central Banker gnomes) but likely will lead one astray.

This insane monetary environment is only guided by momentum-style investing. It reveals the dynamic of what is happening even if the dynamic is new or seemingly impossible.

I remember at one time Zimbabwe had the best performing market, of course the USD value of it kept dropping. The same thing happened in the Weimar Republic, so yes the market can keep going up.

This abasement of currency is not new, and all of those empires that did it failed to thrive.

It’s like a sinking ship, one end goes up…for a while. Gotta keep an eye on the vulnerable and low-vol huh?

I have my poorman’s versions of SPYG:IWM and SPLV:IWM etc but they are not as good as yours, but I can get indicators on them which I watch.

Just a general thought: I’m getting exhausted with innovation stories and I sense the innovation stocks are getting tired as of the last couple of weeks.

FAANGs and batteries and clean energy and Robinhood attacks, and Bitcoin and ………..!!!

I just want to crawl into a dull corner of the market where stocks will make decent gains without having to reinvent capitalism, Old Age not New Age. Companies that have factories and actual places that customers come to. Banks, restaurants, industrials, material, mines, equipment makers, car makers, stores. Boring things that will do great when customers come out of lock downs and the pandemic is behind us. Things that pay dividends.

The innovative stories are anything but boring. They are a thrilling ride that is now having my adrenaline supply used up. Maybe that is just me. My experience has it that if enough people want off the excitement of the rollercoaster, the fun ends.

Does anyone else feel this?

That’s funny – I was thinking just the opposite. Most of the innovation names crashed last week – and IMO began to find their footing again on Friday.

One theme I’ve noticed is that people do in fact become tired of the way things are – and a countermove of some kind does occur – only to find that the countermove was over-sensationalized and in fact nothing has changed.

One recent example would be the stories re HP/ Oracle/ Tesla leaving Silicon Valley. That made headlines for a few weeks. Now we’re starting to see the contra-headlines-

https://www.marketwatch.com/story/silicon-valley-is-not-suffering-a-tech-exodus-and-money-is-flowing-in-at-record-rate-for-a-fortunate-few-11613760421

I’m a Luddite.

I think BTC has had such a meteoric rise because it is detached from physical reality. Equities also suffer from this, but not as much.

What is gold telling us? 10 years ago an ounce of gold would have bought how many bitcoins? Approx 40 thousand? which is now 2 billion….umm…I repeat…umm

Most of us live in a real world, a world where we eat, need things, things that break down and need replacing…and at some point we will be back there…because it is the real world.

Yes real is boring, but it is real.

The comparable advantage of outsourcing is real, it’s why jobs went elsewhere. So I agree that mining and makers of real things are the safe zones. Just for the record I consider products like Microsoft’s real because they are useful and used. So I stick to things that are useful. Casino style tiny bets, yes for entertainment, I can’t resist.

There is an irony that stocks like NFLX or TSLA will need to increase Revs and earnings hugely to ever make sense, so there needs to be some inflation in the mix, only inflation depresses stock prices…you are right to feel exhausted….insanity is only fun for a while

Not a day goes by without someone announcing their intention to start production of EVs. Porche announced their plan to be all EV by 2025 recently. Hordes of startups are involved. Companies like Apple are looking at ways to participate. This is where organic growth is instead of reaching prior prepandemic levels alone. This is where capital is being allocated. I can give many examples of such innovations.

There is room for boring as well. IMO, In ten years, new innovations will be where you can earn CAGR in excess of 20 percent. I find it exciting even though I have more years in my past than in my future!

I have a lot of reservation about BEV mass adoption. Even with massive gov subsidy it is still much more expensive than ICEs. The last two years EV sales actually went down in US. Of the whole world the only people we should listen to is: Japanese. You know what I mean if you are in the business world. Nobody beats Japanese in terms of business intelligence research. When Toyota chief said BEV is a lot of hot air, it is wise to listen.

Just use common sense:

1. How many people can charge BEV at home?

2. Those who cannot need to accept spending 30+ mins in a charging station. How many charging stations are there? Is this gonna fly?

3. Most average Joe’s wouldn’t give a damn at such a high stick price.

4. Is the power plant capacity enough? Can the grid handle the load? How about during power outage? Do EVs actually reduce total carbon footprint?

Tell ya. The great state of CA will put on a hefty new tax on EV, since they don’t use gasoline. And Gov will eventually remove the subsidy if enough people actually buy EVs. Car manufacturers will probably make a U turn and retreat from 100% EV plan. Too bad if they retrofit the lines for 100% EV already.

Many Q’s and gov and public treat it as inconvenient and don’t want to face it. At most it is replacement of ICEs and only a very modest growth industry. Why it deserves so much investment?

Recently there are ridiculous reports from ARK and some sell side pumpers. The funniest states that India will be the next EV hot market and TSLA will be setting up shop there. The whole India sold a few thousand EVs last year and mainly from TTM.

And then the robo-taxi meme got mentioned again. For all of TSLA’s glories they are stuck at level 2 (on a 5 scale) for a few years now. In fact nobody gets to level 3 at this moment. It will never gets to level 5. Forever, unless you lower the bar or you have a quantum leap. Just use a super simple upper-bound math analysis you will reach the conclusion. But it does not stop Musk from saying TSLA going to achieve level 5 at the end of the year. What year? He says that every year. I can also tell you NASA and Space X and the re-suable rockets story. Another boondoggle. Perhaps next time. Perhaps Paypal story. Or his hair transplant.

See, maximum randomness. It is getting very interesting. Gov is seemingly losing control of everything, and the civilians are increasingly segregated into opposing camps waiting for triggers. If you are ambitious and math inclined you would realize the current setup is the best time to make a lot of money. And then quit. The next downturn is going to be shocking to everyone. I don’t want to think about it. I have a lot of fear that I have never had before.

Two things we always carried on car road trips in India long time ago were a metal canister of ‘petrol’ and a canister of water, in case the engine overheated. Petrol pumps were few and out of petrol many a times. Fast forward-no one does it anymore.

The car was an aspirational item but became common.

I would disagree with the BAML survey conclusion that “the only reason to be bearish…is there is no reason to be bearish.” If that’s the case, then why are so many analysts/traders concerned about the supposed over-exuberance of current sentiment surveys? That tells me that most fund managers may be levered long – but with one foot out the door. In which case there’s room for more upside (probably much more).

It’s entirely possible that what we’re seeing right now is the advent of a new secular bull that takes the indexes out of a 20-year trading range that began in 2000. In order for that to happen, there needs to be an UPTREND.

And the definition of an uptrend is a sustained move up in the face of sustained skepticism.

Case counts and deaths due to Covid-19 have dropped precipitously over just the past 2-3 weeks, at least here. I realize that traders already anticipate a return to normal life – but I don’t think it will really hit them until they see restaurants and hotels opening up in their hometowns and air travel begins to resume in earnest.

No reason to be bearish = No managers are bearish in the survey