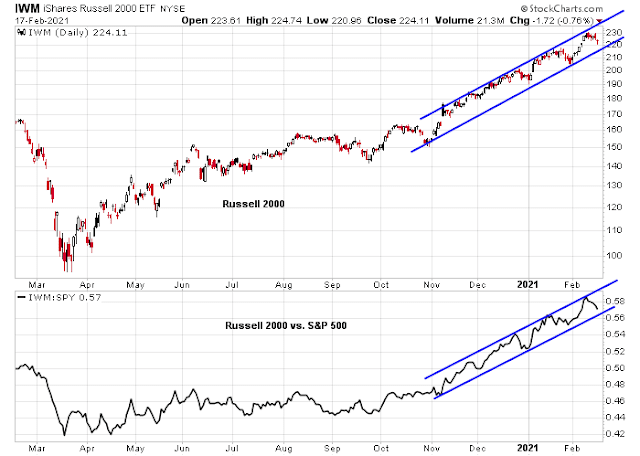

Mid-week market update: Instead of repeating endlessly the mantra of how frothy this market has become, I thought it would be worthwhile to take a look at one of the market leaders. Small cap stocks have led the market up during this recovery.

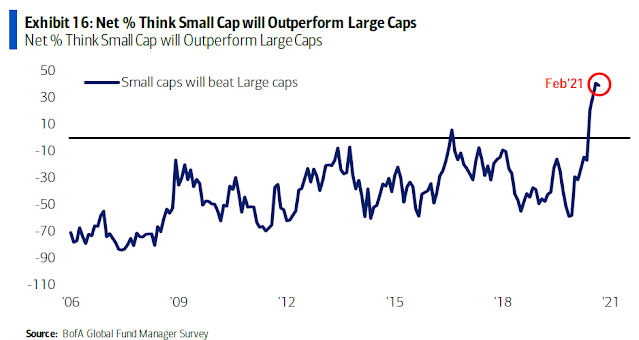

On the other hand, the latest BoA Global Fund Manager Survey shows that institutions are off-the-charts bullish on small cap stocks, which is contrarian bearish.

What are the risks and opportunities in small-cap stocks?

Party just getting started

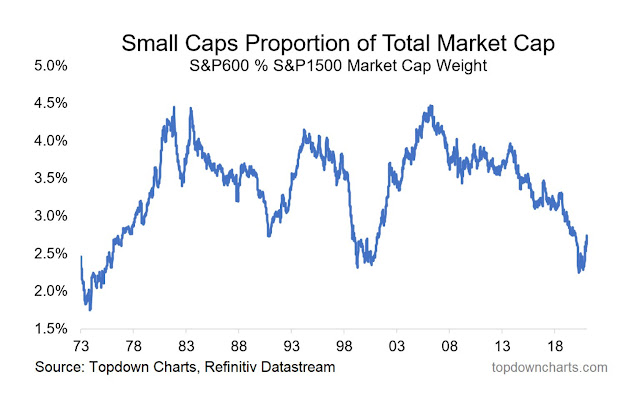

Arguably, the small-cap bull is just getting started. Callum Thomas at Topdown Charts highlighted the weight of the small-cap S&P 600 in the S&P 1500. S&P 600 weight recently made a relative bottom, but it has a long way to go before it even normalizes.

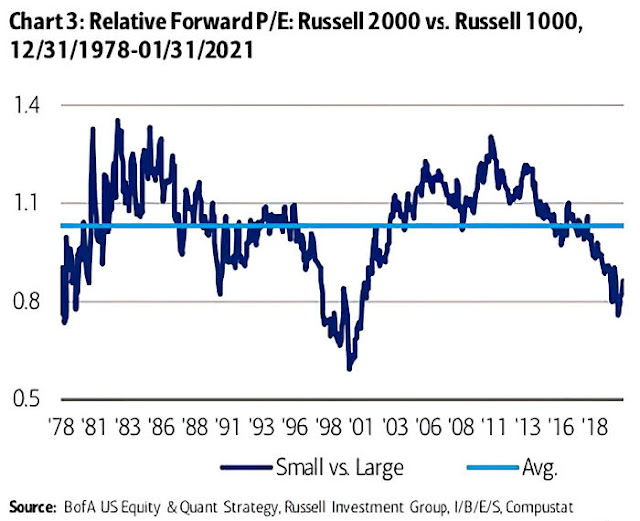

From a valuation perspective, the relative P/E ratio of the small-cap Russell 2000 to the large-cap Russell 1000 also made a recent cyclical low. The party’s just getting started.

How frothy is this market?

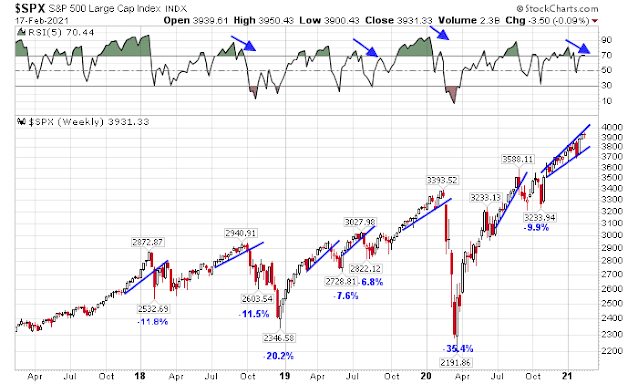

While the long-term outlook for small caps is bright, the elevated sentiment levels begs the question of whether traders should be concerned about the frothiness in the market. Even though small stocks are the market leaders, high beta small caps are not likely to perform well should the market correct.

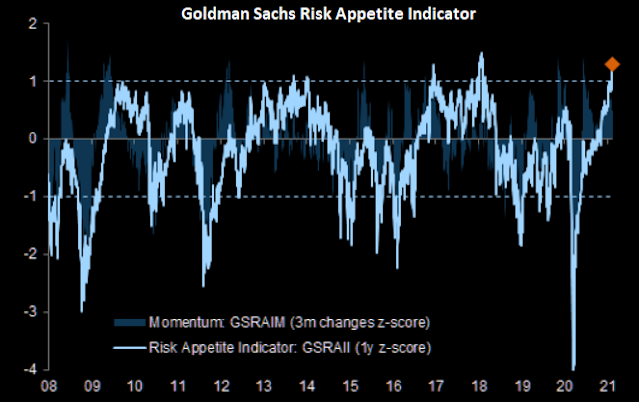

On one hand, bullish sentiment can be interpreted in a bullish way. Arbor Data Science pointed out that the spread between bull and bear searches is extraordinarily high. The last time the readings reached these elevated levels, the market continued to advance. These surges in bullish sentiment is not unusual during the initial phases of a new bull.

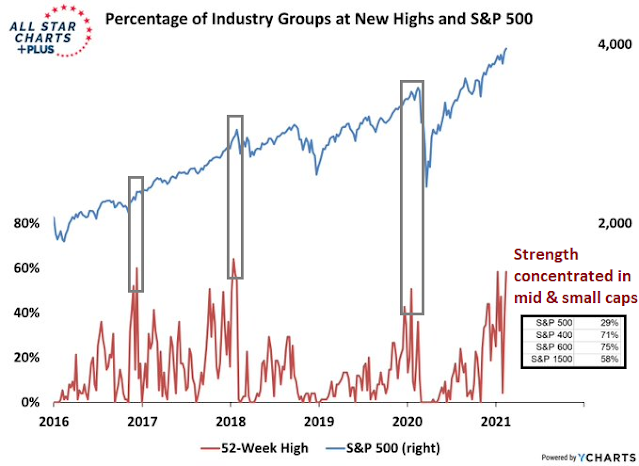

On the other hand, Willie Delwiche observed that the percentage of industry groups making 52-week highs were mostly concentrated in mid and small-cap indices. Though the sample size is small, similar high readings of industry highs have foreshadowed market pullbacks (n=3).

Due for a sentiment reset

Sentiment readings indicate that this market is eventually due for a reset. I am like the boy who cried wolf so many times that I am not sure if I believe the warnings myself anymore. First, the market reaction to this morning’s PPI and retail sales extremely strong prints were revealing. The immediate reaction was a retreat in both equity prices and bond yields. This calls into question of what was already priced in.

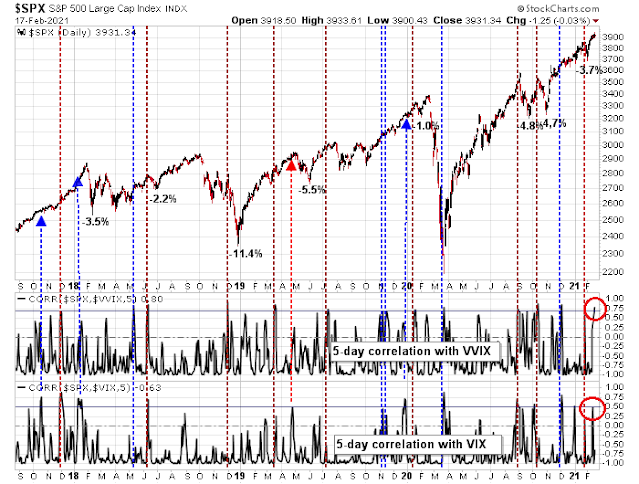

In addition, a technical cautionary signal comes from the rising correlation of the S&P 500 and the VIX Index, and the VVIX, which is the volatility of the VIX. In the past, spikes in correlation have resolved with 3-5% pullbacks.

Should the S&P 500 weaken further and breach the 3800 level, expect a correction of 6-12%.

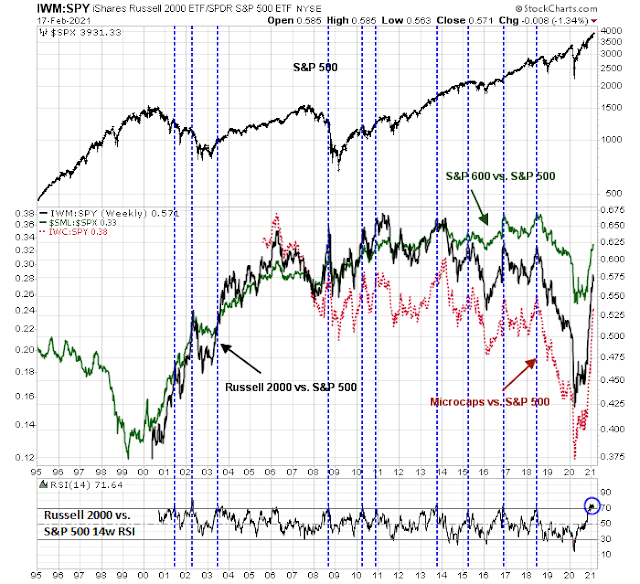

From a longer-term perspective, this chart of small to large-cap ratios makes it clear that we are just starting a relative bull cycle for small-cap stocks. The relative performance of microcaps (IWC), the Russell 2000, and the S&P 600, which has a higher earnings quality because S&P has a stricter inclusion criteria than the Russell indices, also show that the market experienced a quality effect for the past few years. Low-quality small caps began to lag as early as 2015, but they have snapped back in a convincing fashion in the past year. As well, the Russell 2000 to S&P 500 14-week RSI has become overbought, and that has been a signal in the past for a tactical reversal in relative performance.

I remain long-term bullish on small-cap stocks. Your level of commitment will depend on your time horizon. If the market were to go risk-off, small caps are likely to underperform in the short-run.

My time horizon is at least two to three years. I am not a trader. My question is how much of current valuations are driven by earnings and how much are driven by liquidity? I consider relevant Ms. Yellen position at the G7, encouraging other countries to “go big”. I see more liquidity coming in the rest of the world, driven by IMF´s SDRs. My guess is that a correction is not coming and valuations will continue to be high for stocks. Please do not take my opinion as an advice. Follow Cam, not me.

I see EM assets going up too. Sorry for being off topic, as usual

If you are talking about small caps, the valuation of mid and small caps are less demanding than large caps. See Yardeni’s analysis, figures 16 and 17.

https://www.yardeni.com/pub/peacockfeval.pdf

Earnings estimates are screaming upwards for all market cap bands too.

Thank you for this ” I am like the boy who cried wolf so many times that I am not sure if I believe the warnings myself anymore. “….Humility, I like it

https://twitter.com/ravishashi/status/1361027565922697221?s=21

Another perspective from Morningstar. Price to Fair Value ratios. Y axis is small cap, mid cap, large cap. X axis is Value, Blend, Growth. Mid cap growth is 23% overvalued while small value is 4% undervalued according to their analysis.

https://www.marketwatch.com/story/global-debt-surged-by-more-during-the-pandemic-than-the-2008-financial-crisis-iif-finds-11613577665?mod=mw_latestnews

More money printing to come.

I like hearing the broken record regardless. Keeps one from getting too complacent.

Red-to-green moves on QS and PLTR.

Two roundtrips so far. The ultimate goal, however, is to establish longer-term positions. What’s making things difficult is the tendency for everything to sell off when the market reverses.

I’ve had it with TLT. It may in fact take off tomorrow, but I won’t be along for the ride. Taking the -0.34% hit on the position.

Will be taking a -0.5% hit on RYGBX end of day.

Brutal selling in QS/ FECL/ TLRY/ PLTR as we approach the close.

Which prompts me to take starter positions for an overnight hold.

PLTR off after hours for a gain.

QS/ FCEL/ TLRY off after hours for losses.

RYGBX closed down -0.67%.

Back to 100% cash. I was fortunate to end the day with a minor gain.

Reopening a position in FXI.

Out of FXI.

Excellent information! thank you all.

For those interested in individual stocks, take a look at IONS and ALNY, in the anti sense mRNA space.

Ravindra

These would be under the growth and biotech sleeves of my portfolio. Still have not found a good solution for storing/parsing such information.

Thanks, D.V.

I will look at these two stocks. But my brain is allergic to bio- stuff.

I notice that QS/PLTR/FCEL/TLRY are all trading well above my after-hours exits last night.

On the other hand, I also notice TLT bidding -0.71% lower. The rout in bonds continues.

No point second-guessing my decisions. I’ve probably made (and continue to make) every mistake possible – probably b/c I’m human. I understand the emotions behind them, I try my best to fade them, but I know that many times it comes down to last-minute decisions where I do the best I can.

Right now, ~+4.2% ytd/ +12.6% since Sep 25. Not the kind of gains I’ll ever see in a CD and quite content with performance, mistakes and all.

Checking in with my own sentiment – I’m no longer bearish.

Having a tough time deciding where the SPY heads from here.

1. It’s holding above 3900. Is a move to 4000 next? In other words, has a 3-day chop sufficiently cleared overly-optimistic sentiment?

2. On the other hand, it’s rallied +20% off last October’s lows.

Rx,

Hope you got back in PLTR. I have been a long term investor, got in at $9.80 , So I just hold on, but I see you going in and out of it.

Right. I reopened a position ~25 as it was selling off in the final 15 minutes of yesterday’s session – then closed it ~25.82 after hours.

That’s OK. Plenty of time to reboard this one – maybe even today.

Good timing, Mohit! I was able to reload a starter under 28.

Reopening VTI here.

Obviously, I’m transitioning from bearish->no longer bearish-> bullish.

Reopening VTI here.

Reopening smaller positions in EFV/ VTV here.

Currently repositioned in VEU/ VTI/ EEM/ EFV/ VTV (in descending order).

The bears had at least three opportunities to take things down this week, a seasonally weak period. Many of the high-beta small caps did in fact sell off hard near yesterday’s close – enough to turn me bearish. So 60/40 odds that this week’s stumble was the pause that refreshes.

Adding XLE. I realize it’s at the intraday high and for the past year it’s been anathema to buy on strength.

Adding ASHR/ BABA.

Reopening QS here.

Reopening NIO here.

Reopening EEM/ VEU here.

‘We’ll have herd immunity by April’

https://www.wsj.com/articles/well-have-herd-immunity-by-april-11613669731

Bitcoin ETFs.

BITW (ten coins, but 95% BTC and ETH) went public around 30, shortly thereafter traded as high as 200(!) and then retreated back to the 30’s. Was in the 70’s a week ago, and now doubled in the last week. Premium to NAV has never been below about 50%, at the moment is 150% or more. ???

OBTC just out a few days ago, touts mgmt fee of .25%. Traded from 30 to 60, huge premium to NAV, now back below 30.

Meanwhile, GBTC and ETHE, trading at less than 10% premium to NAV (though has been higher in the past).

So either the BITW premium collapses again, or GBTC premium to NAV goes up at some point to match the others, meaning it doubles from here. Betting on the latter. YOLO.

Along with all of the other positions detailed earlier->

Spreading chips across the board at the close:

VTIAX (international) 32%

VTSAX (total US) 22%

VTRIX (international value) 22%

VVIAX (US value) 14%

VEMAX (emerging markets) 10%

Basically, I don’t think the next move is down. Next week may present the bulls’ best shot at blitzing the bears for a run at SPY to 4000.

JMO, as always.

https://www.foxnews.com/health/pfizer-covid-19-vaccine-85-effective-after-single-dose-israeli-researchers-find

Why bullish? The bears fumbled a great opportunity to build on yesterday’s selloff. So I think they’ve pulled in their horns and will try again…at higher prices.

Emerging markets and China finally pulled back to offer buying opps.