The San Francisco Fed recently created a Daily News Sentiment Index, which is derived from 16 major newspapers. In the space of a few weeks, market psychology has turned from “the market is going to retest the March lows” to “the Fed is supporting prices, valuation doesn’t matter, the economy is recovering, – Buy”.

Regular readers are well aware of my increasing cautiousness about taking equity risk (see The 4 reasons why the market hasn’t seen its final lows and The bull case and its risks). While the economic recovery thesis is emphatically not my base case scenario, its’ time to conduct a review for investors and traders who would like to take that walk on the Dark side. How should investors position for an environment driven by Fed liquidity, and improving COVID-19 news. Even if you are cautious, these recovery candidates offer signposts of the market’s perception of the economic recovery theme.

I conclude that investors who would like to participate in the economic recovery investment theme should consider:

- Technology and Healthcare as price momentum plays

- Cyclical stocks as recovery plays

- Value stocks, and bank stocks in particular, as turnaround plays

- Diversifying US equity holdings into Europe and EM

However, there are a number of key risks to such an investment position. Even if the economy were to successfully reopen, the Fed has voiced its concerns about the economic aftershocks that could last for several years.

From a historical perspective, a similar fake-out rally occurred in Q2 2008 after the failure of Bear Stearns. Stock prices bounced, but later went on to make significant new lows after investors became overly complacent after believing the Bear Stearns failure took systemic risks off the table.

In light of the highly stretched nature of equity valuations and uncertain growth visibility in the current environment, the risks of a repeat of that episode is high.

Improving internals

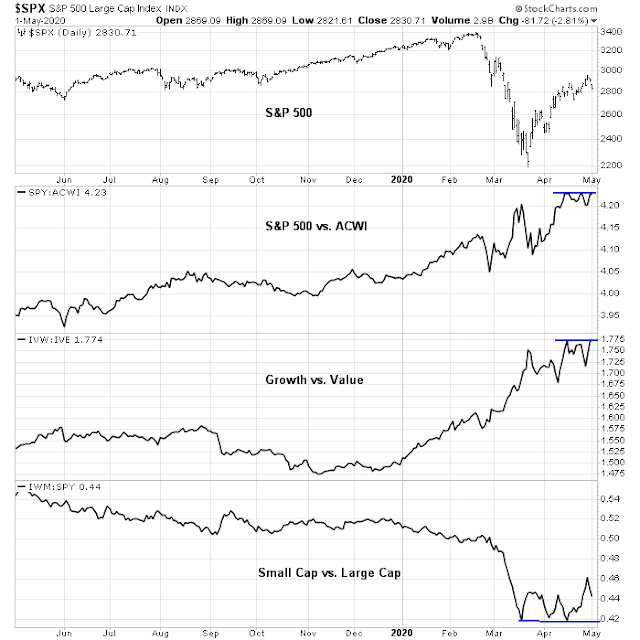

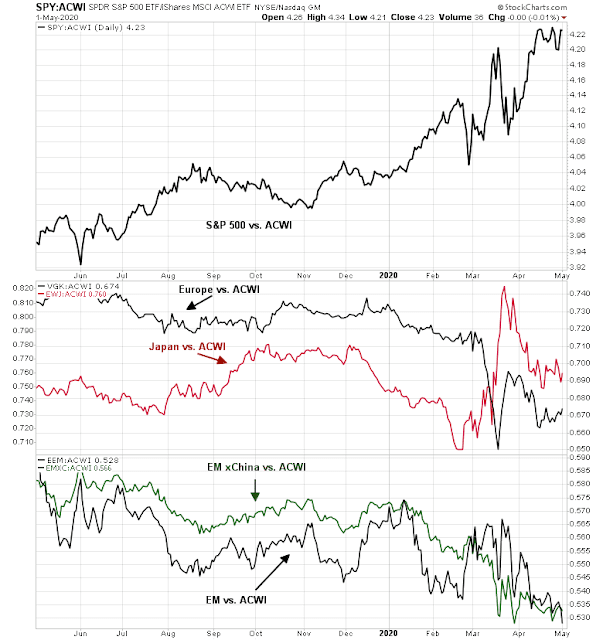

From a factor return perspective, there are signs of a shift in tone. Most importantly, the leadership of US over international stocks, growth over value, and large caps over small caps are all showing signs of possible reversals. Changes in leadership often accompany major market bottoms, with the caveat that they are necessary conditions, but not sufficient conditions for a turnaround.

Similar signs of a possible turn can be observed in the currency markets. In particular, EM currencies, EM bonds, and EM stock and even frontier markets relative performance have all begun to stabilize.

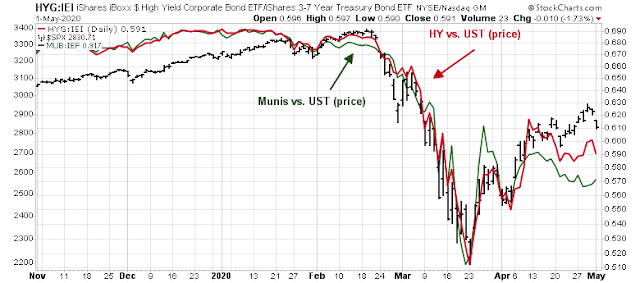

Credit market risk appetite is a little more mixed. Both the relative performance of HY (junk) bond and municipal market are flattening out.

Even the ratio of cyclical to defensive stocks appear to be turning up, albeit in a very choppy fashion, which is also supportive of the recovery scenario.

Momentum winners

What should investors buy if they believe in the economic recovery theme? Here are some suggestions, and some factors to monitor.

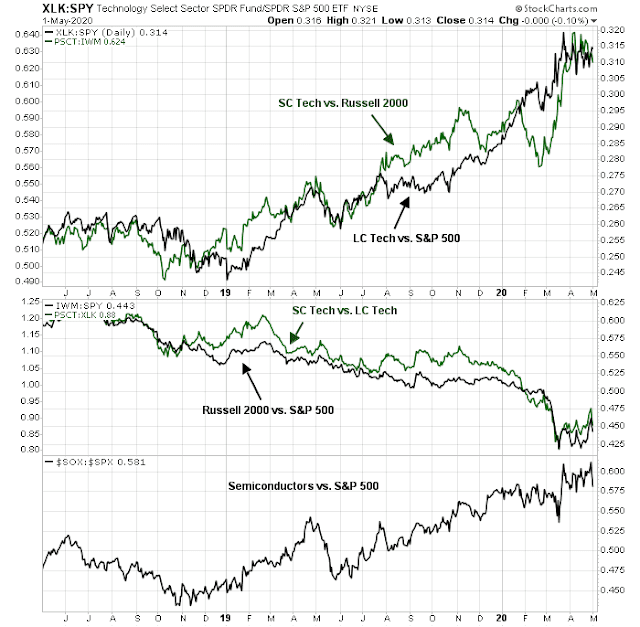

Let’s start with the momentum winners, which should continue to beat the market regardless of whether the bulls or bears are in control. One winner is the technology sector, both in large and small cap stocks. Both large and small cap technology stocks have beaten their respective benchmarks. As small caps have begun to show some life, small cap technology stocks have also begun to lead their large cap brethren, though this is still a nascent theme that should be watched carefully. Within the technology sector, one standout has been the cyclically sensitive semiconductor stocks, which have been on a tear.

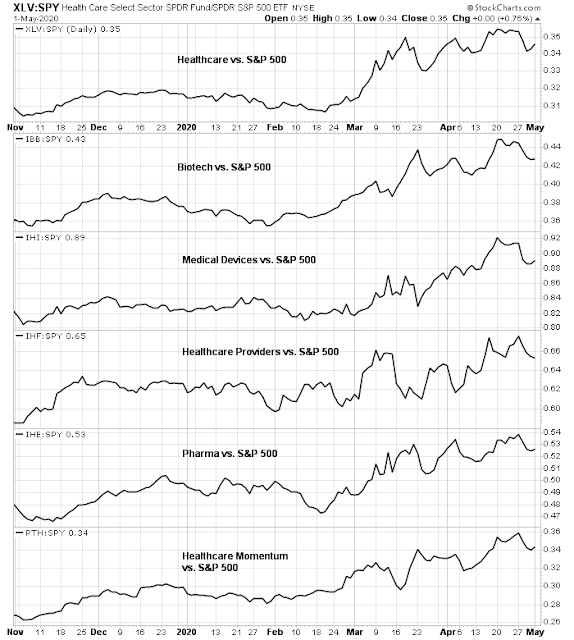

Another winning sector to watch are the healthcare stocks. While the performance of this sector has come off the boil, this sector has been a winner in the current environment, which is not surprising. There isn’t much to distinguish between the returns of the industry groups within this sector, and even healthcare providers are leading the market. One ETF to watch is Healthcare Momentum (PTH), which could also be an interesting candidate for investors who want to buy this sector.

Cyclical turnaround candidates

Investors who believe in a recovery can also consider cyclical stocks. Industrial, home building, transportation, and even leisure and entertainment stocks have all begun to exhibit better relative strength. Watch these industries for signs of a cyclical turnaround.

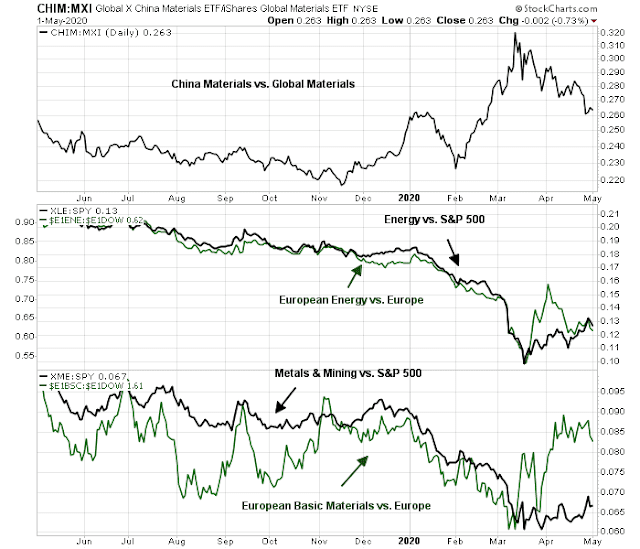

As well, late cycle resource extraction stocks are also showing signs of life. Even energy stocks are turning up on a relative basis. In particular, European basic industries are outperforming, and, to a lesser extent, US mining stocks. The one fly in the ointment is Chinese materials, which have been lagging global material stocks. The relative weakness of Chinese material stocks is disappointing, as China has been early in coming out of the pandemic.

One of the leadership themes that had been performing well, but has begun to roll over, is US over international stocks. Investors who are looking for a recovery can also consider allocating funds out of the US into non-US equities. Nascent relative strength winners are Europe, and EM.

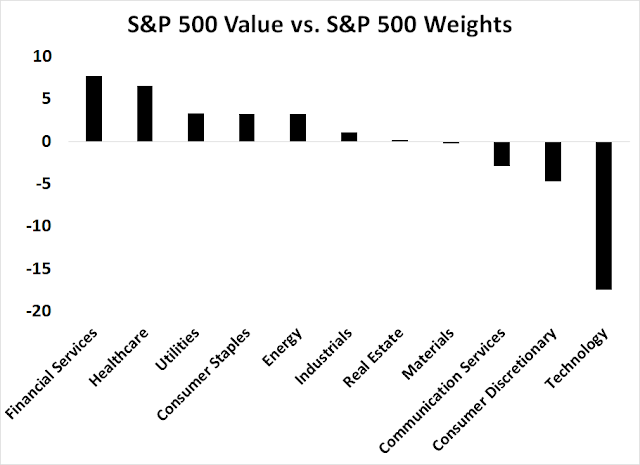

Another factor that has been turning up is value/growth relationship. Value stocks have been lagging for so long that the relative performance ratio has become extremely stretched. Here are the biggest sector exposures of large cap value stocks against the index. The biggest overweight positions are financial and healthcare stocks, and the biggest underweight positions are consumer discretionary (AMZN) and technology stocks.

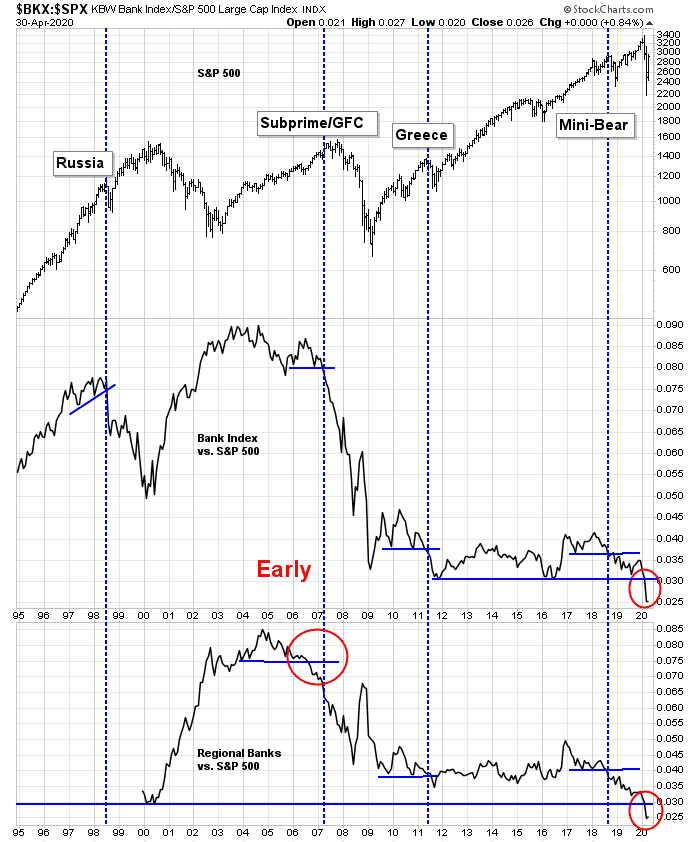

Since we have already discussed the healthcare sector, a discussion of the financial services sector is in order. As the following chart shows, the relative performance of bank stocks, and regional banks in particular, has been highly sensitive to bull and bear cycles. Investors who expect a recovery scenario are also betting on a revival of banking profitability. In the past, recessions have seen credit crises. With the Fed all-in on monetary policy support, the market is discounting that there will be no credit crisis this cycle. With rates at the zero bound, an overweight position in financial services is also a bet that the Fed will not resort to negative rates as a policy lever. We have seen how negative interest rates have devastated banking margins in Europe.

In summary, investors who would like to participate in the economic recovery theme should consider:

- Technology and Healthcare as price momentum plays

- Cyclical stocks as recovery plays

- Value stocks, and bank stocks in particular, as turnaround plays

- Diversifying US equity holdings into Europe and EM

Key risks

Here are the key risks of the bullish investment theme. The biggest risk was outlined by the Federal Reserve in an unusual observation about the COVID-19 pandemic in its latest FOMC statement:

The ongoing public health crisis will weigh heavily on…the economic outlook over the medium term.

In other words, while the Fed is prepared to stay easy over the next few years, it is worried about the economic aftershocks of the pandemic. Reopening the economy does not mean recovery.

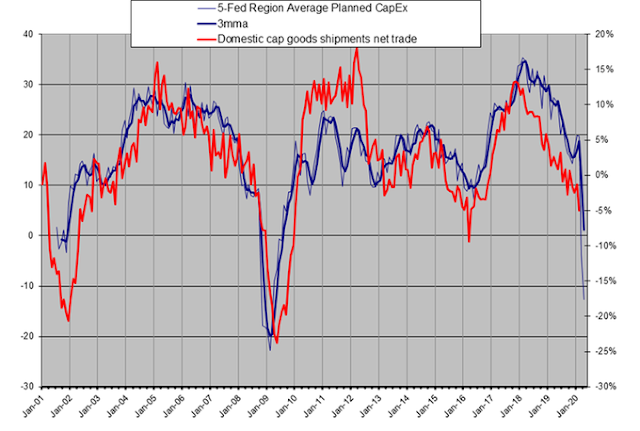

Here are some tough questions that those who want to buy into the recovery theme need to answer. If reopening the economy does mean recovery, why are capital expenditure plans so weak? For investors, what does this mean for cyclical stocks?

In addition, the jobs market has been devastated. The Conference Board’s Consumer Confidence Labor Differential, defined as jobs hard to get – jobs easy to get, hit a brick wall and plunged. Can efforts to reopen the economy restart employment that quickly compared to historical experience?

In the wake of the FOMC meeting, Jay Powell stated that while the Fed has plenty of bullets left to fight the slowdown, there are limits to Fed policy. The Fed can extend loans and make loans cheaper, but it cannot issue grants, nor can it supply equity to failing businesses, or repair individuals’ balance sheets. As the economy hit the COVID-19 brick wall, companies drew on their bank credit lines and commercial loans surged. This begs the question of whether the market can avoid a default crisis in the face of the loan demand spike and cratering economic conditions.

As well, can the profit cycle be radically shortened compared to historical experience?

The Bear Stearns fake-out

What about the risk-on rally?

Ben Hunt at Epsilon Theory offered a historical parallel from 2008, the Bear Stearns fake-out.

Bear Stearns was enduring an old-fashioned run on the bank in March of 2008 (it was hedge funds taking their money out of the prime brokerage that killed the company), the overall market was in a severe correction. Not a bear market, mind you (no pun intended), but a severe correction. When Bear went out, the S&P 500 was down 18% from the October highs and down 12% from the Jan. 1 year start…

And then we had the Bear Stearns Bounce.

The overall market came roaring back over the next 8 weeks, so that by May 19 the S&P was only off 1% for the year. Still down 8% or something like that from the highs of 2007, but no one cared about that. Long or short, you get paid in this business on the calendar year, and every January 1 is a clean slate. Shorts like me who were feeling pretty pleased with themselves on March 17 were enduring a crisis of confidence on May 19, and the longs who were despondent in March were feeling prettay, prettay good in May.

Why did the market come roaring back from mid-March to mid-May? Because narrative.

Because according to every market media Missionary, Bear Stearns was the bad Wall Street apple in an otherwise reasonably decent Wall Street barrel. Oh sure, there were still problems here and there in mortgage portfolios, and sure we were in a recession, but there was no longer a risk of the system falling down. Eliminating Bear didn’t mean that the tough times were over for the financial system, but it did mean that the crisis was over.

Sacrificing Bear Stearns to the regulatory gods meant that – and I’ll never forget this phrase – “systemic risk was off the table.”

What happened next was, as they say, history. Hunt made a Bear Stearns analogy to the improvement in COVID-19 cases and deaths in today’s news backdrop.

It’s the fact that we really and truly flattened the curve and we really and truly avoided a healthcare disaster in San Francisco and Kansas City and Nashville and Los Angeles and Birmingham. It’s the fact that New Orleans and Houston did not become New York City. It’s the fact that NO city in the United States suffered an overwhelmed medical system except New York City.

And now that the worst is over even in the uniquely hard-hit area of New York/New Jersey … now that our daily death rate has peaked at 2,000+ Americans dying every freakin’ day from this disease, so that improvement to “only” 1,000+ Americans dying every freakin’ day becomes the “good news” that allows markets to climb a wall of worry …

“Yay, systemic risk is off the table!”

Indeed, there are parallels between the Bear Stearns bounce and factor performance today. As the market rallied during the Bear Stearns bounce, market leadership began to change, just as we are seeing today.

Even some of the narrative sound familiar. Bloomberg reported that Goldman Sachs justified its bullish about-face by pointing out that the market is looking through the economic damage of 2020. Look through the valley, because tail-risk is off the table.

U.S. stocks may be able to look through a dismal earnings season or two, and the deepest economic contraction in modern history, according to analysis by Goldman Sachs Group Inc.

That’s based on historical analysis that suggests equities price in macroeconomic performance over a two-year horizon. As long as projections are — as they indeed are now — for the economy to rebound after the current and coming period of pain, then stocks don’t need to fall, the Wall Street bank concluded.

“Investors usually discount at least the next two years of macroeconomic performance, suggesting markets may continue to look through bad news over the near term if it can reasonably be expected to reverse in the coming quarters,” Zach Pandl, co-head of global FX and EM strategy, wrote in a research note Monday.

Consensus top-down EPS estimates for 2021 is about 150, which makes the FY2 P/E 18.9. If you believe that buying the market at that earnings multiple is perfectly valid in light of all the risks, I have a few technology darlings from the late 1990’s left in my desk I can sell you. They’re really cheap – you can have them at the special price of a 50% discount from their Tech Bubble highs. The list includes Lucent, Nokia and, Nortel Networks, among many others.

Investment implications

In conclusion, investors who would like to participate in the economic recovery investment theme should consider:

- Technology and Healthcare as price momentum plays

- Cyclical stocks as recovery plays

- Value stocks, and bank stocks in particular, as turnaround plays

- Diversifying US equity holdings into Europe and EM

However, there are a number of key risks to such an investment position. Even if the economy were to successfully reopen, the Fed has voiced its concerns about the economic aftershocks that could last for several years.

From a historical perspective, a similar fake-out rally occurred in Q2 2008 after the failure of Bear Stearns. Stock prices bounced, but later went on to make significant new lows after investors became overly complacent after believing the Bear Stearns failure took systemic risks off the table.

In light of the highly stretched nature of equity valuations and uncertain growth visibility in the current environment, the risks of a repeat of that episode is high.

Please stay tuned for our tactical market comment tomorrow.

While it is possible what we are seeing today is a “Bear Stern moment”, there are also significant differences.

What happened in 2008 was a structural failure of the US financial system (intrinsic shock).

What we are seeing today is an extrinsic shock to the global economy. The financial plumbing behind the US economy is still running as planned. Yes, there are issues like the BBB and CCC bond markets that have taken it on the chin. Yes, there is a $ squeeze, within the US and more so overseas. Yes, there are major issues in the Energy segment. Yes, there will be forced liquidations in the Oil and Gas and US retail sector, which was necessary. Yes, Q2 earnings will look ugly. We all know this.

1. What we do not know is if the Pandemic is past us or not. If the pandemic stretches on, yes, there will be much deeper correction. Let us become vigilantes and monitor the developments if durable solutions are in the pipeline (drugs that treat Covid19), in the short term and vaccines that create herd immunity in the long term), and how fast can we get these solutions.

2. If the President restarts the trade war with the Middle Kingdom (China), there will be a big price to pay (we saw this play out on Friday).

In some ways, the 2020 correction seems to rhyme the 1987 correction; quick, sharp and deep. 1987 seems like the one in modern history that comes to mind, when we saw a 20% intraday correction.

rxchen2 says:

April 30, 2020 at 7:01 am

That’s probably a good observation, Sanjay. My highly subjective take right now:

SPX ~2850 a short-term buy.

SPX ~2750 an intermediate-term buy.

SPX ~2650 a longer-term buy.

SPX <2550 probably something we'll see at some point later this year.

I'm also a guy who changes his take almost on a daily basis – but the numbers above are what I have in mind right now.

rxchen2, I like the way you are thinking. That said, we may be seeing a Megaphone pattern developing, and final lows if this pattern develops completely is likely to be in the 1600-1800 range (2016 low, peaks of 2000 and 2007 as support @ 1550). Just sayin'.

https://fred.stlouisfed.org/series/SP500

The Megaphone Pattern??!!! That’s a new one. We may need to rename that the D.V. widening range pattern. 😉

Lol.

Whether this is a bear market rally bound to fail and crash down to historical mean valuations (SP around 1650) or just a quick 1987 style crash no one knows. We can all make good cases for both, but in the short term the market doesn’t care . I do know 10 year prospective returns (which are quite accurate) for the US are approx 0% at these levels. Thus, agree that shift to overweight EM makes sense along with maintaining a decent cash position to take advantage of potential significant downturns.

https://www.morningstar.com/articles/962169/experts-forecast-long-term-stock-and-bond-returns-2020-edition

BlackRock Investment Institute

Highlights: 6.1% nominal (non-inflation-adjusted) mean expected return for U.S. large-cap equities over the next decade; 6.5% for European equities; 7.5% for emerging-markets equities; 1.7% for the aggregate bond market (September 2019).

J.P. Morgan

Highlights: 5.6% return assumption (nominal) for U.S. equities over a 10- to 15-year horizon; 3.4% nominal return assumption for U.S. investment-grade corporate bonds over a 10- to 15-year holding period (November 2019).

Morningstar Investment Management

Highlights: 1.7% 10-year nominal returns for U.S. stocks; 2.1% 10-year nominal returns for U.S. bonds (Dec. 31, 2019).

Morningstar Investment Management’s outlook for U.S. stocks and bonds was fairly pessimistic at this time a year ago, but it’s gotten more downbeat still. It’s forecasting a 1.7% return for U.S. stocks over the next decade (down from 1.8% a year ago) and just 2.1% for U.S. aggregate bonds, down from 3.3% a year ago.

Vanguard

Highlights: Nominal U.S. equity-market returns in the 3.5% to 5.5% range during the next decade; 6.5% to 8.5% returns for non-U.S. equities (for U.S. investors); 2% to 3% expected returns for U.S. fixed income (December 2019).

Morningstar and GMO (Jeremy Grantham) are the most bearish.

From January 2020, before the crash.

https://www.multpl.com/shiller-pe

Although CAPE ratio is elevated, one needs to look at the underlying inflation and monetary conditions.

I think there’s a ticking time-bomb in both residential and commercial real estate markets which will have a major impact on the credit markets and travel straight to the banks. As states force openings, which force people back to work, those that don’t go back fearing for their health, will be dropped from UC. This was planned from the beginning to minimize costs to the states. FL, TX and Iowa have already openly stated they will vigorously enforce this policy. Large numbers of residential renters will be unable to pay their rent.

Listening to many restaurant owners, the story is similar in the end result. What restaurant can reopen expecting 25-50% capacity, but still will pay 100% of the rent, insurance, fixed costs, etc. That’s assuming they can get 50% of the public to dine out before large scale testing (or a vaccine) is available. Many restaurants will not reopen, landlords are going to get hammered, and mortgage defaults will skyrocket.

The final straw is the office workers that will continue to work at home for the foreseeable future. Businesses will see major opportunities to cut “facility expenses” and increase productivity. Cut out the 1-2 hour commute and most people will spend that time working. Huge reductions in the commercial footprint will put more negative pressure on commercial landlords. Local restaurants that provided meals to these former (commuting) office workers also are unable to stay afloat.

The size and scope of this impact to credit markets and the banks is not known, but I think most of the talking heads are underestimating the impact and resulting default rates.

This is a very astute comment. Add the state/local government cuts that are coming, and a pivot towards less aid in Washington as the deficit hawks start squawking again, and the economy has some major headwinds coming. Hope this all plays out differently.

I think that the rsk to commercial real estate is very real. I drove through our local city the other day.

The major shpping malls are closed.

The “main street” restaurants, stores and businesses are closed.

it seems to me that, even with business rent subsidies in effect, the probability of trouble in the REITs cannot be underestimated. Minimum would seem to be REIT dividend cuts (already started), and possibly mortgage defaults if this goes on much longer (3 to 6 months?).

Banks have been pushing up loan default reserves. Anybody know if the reserves are big enough? Also, the reserves are “hypothetical”. If th defaults actually occur, the cash flow hit becomes very real.

To quote myself previously – “No Prob – stimulus will cure all”.

But will it?

As I pointed out, the BKX/SPX is signaling significant stress in the financial system. We haven’t had the “credit event” that has marked past recessions.

Could CRE or the muni market be the next shoe to drop? Can the Fed supply enough liquidity to rescue the markets?

Inquiring minds want to know.

I see the same here. Local parks have been taped off. Most of the custodial staff at the local schools have been ‘temporarily’ furloughed. None of the University of California campuses are able to say whether remote instruction will continue in the fall, or whether on-campus housing will open. Dentist/optometrist/physical therapy offices/clinics are closed. Empty parking lots/garages all over.

Lots of construction taking place on city streets and freeways, though – taking advantage of the decrease in traffic. Construction on the new Facebook campus in Burlingame has been scaled back, but appears to be ongoing.

Agree few are thinking about this except the doomsters who may be right.

I was looking at Boeing. The bond market enthusiastically gave them $25 B at 5% to tide them over, plus $14 pulled on loan facilities. Already a huge inventory of 747 Max. 88% of tickets are pleasure travel. Short or long?

The Congressional response to the shutdown has thus far been entirely (and appropriately) oriented towards ST survival. It will be interesting to see what they come up with in terms of helping businesses adapt to an altered reality.

I agree, also, Michael. I think the real estate market is in trouble and especially the commercial market. I don’t think Congressional stimulus and Fed stimulus can keep the country afloat. If we see even the slightest up tick in infections/deaths this summer we are going to have a crisis somewhere. Keep you powder dry, my friends.

While Humble Student appeals to the “right brained” mind set, the “great enemy” of the “rational animal” is emotion. Thus, the appeal of an algo based investment system that mitigates or removes emotion from the investment process. A service called Sector Surfer (www.sumgrowth.com) has a number of algo based programs, one of which is called “Sector Nectar,” a star performer. In general, Sector Surfer makes investment decisions once a month, near month end. It quantitatively selects the ETF that has the strongest trending characteristics. Sector Nectar is up 24% so far in 2020. Here are the ETFs that it has owned: January and February: IGV: March: VGT: April: RYE; May: XBI. It hasn’t been all smooth sailing. It was up 14% YTD through February 19th but suffered a large drawdown from then through March 20th when it was down YTD 20%. It recovered during the late March surge to being down “only” 9%. In April RYE returned 29%, and so far in May XBI is down about 5%. The reason I bring this up is that biotech was mentioned in Cam’s narrative above.

The CIDRAP Viewpoint was a very good read (originally referenced by Wally with a direct link to the report by Mike). Not only is the viewpoint well-researched, it’s very well-written (if I were a college essay instructor I’d give an A+).

Their conclusions are summarized into three scenarios, all with a duration of 18-24 months.

My take would be that if the pandemic unfolds as a series of ‘peaks and valleys’ or a ‘slow burn’ -market pullbacks will be relatively shallow – but for an extended period over the next two years.

Whereas a ‘fall peak’ scenario would cause a retest of the March lows followed by a significantly lower low.

Investors would probably prefer the former. From a trading standpoint, a steep decline to SPX 1600 would be a gift.

The CIDRAP summary was helpful and accurate. Thanks to Mike and everyone else who cited it.

Highly recommend this one, being shared in infectious diseases listservs. https://www.nbcnews.com/news/asian-america/famed-hiv-researcher-race-find-covid-19-treatment-n1197631

Very informative intervew – thanks.

Np!

Not sure if the below article is accurate in referring to Fed cut “EQUITY” stimulus by more than 86% this week, but one thing for sure is that the current mkt is mainly supported by Fed liquidity and potential Covid-19 cure. Much like Cam’s view, the author also says many other indicators are suggesting lower SPY before valuation increases.

https://www.investing.com/analysis/fed-cut-equities-stimulus-86-this-week-and-stocks-are-falling-200523327

Just to make it clear, there are no signs of a COVID-19 “cure” on the horizon. For all the hype about remdesivir, it only provides tail-risk protection, but here are the problems with the drug:

1) It doesn’t prevent infection

2) It is administered through an IV, which means the patient takes up an ICU bed

3) If public health policy allows the infection rate to skyrocket, the drug treats you (hopefully) stops you from dying, but it doesn’t mean that the healthcare system doesn’t get overwhelmed, nor have we seen any studies about it prevents the other nasty effects of COVID19, e.g. stroke risk and kidney damage

If the trials are successful, then it is a useful tool, but it’s not a silver bullet.

Agree with Cam and as a point of clarification there is no proven mortality benefit with Remdesivir, though it is difficult to tell with some of the press releases. It may reduce duration of illness but not shown to change mortality.

Does this drug hasten death? If it shortens illness length

and it’s reasonable to conclude you must die before the drug cures you, this must be the case, no ?

Otherwise it lowers mortality. Go figure.

lol

limited supply, international supply chain, 6 month manufacturing time.

Not gonna work to only supply the US when other countries help make it.

lol, and as Ellen said, “but not shown to change mortality.” Really? You’d think that would be needed to move the entire stock market.

Thanks for making the clarification Cam. Though, I have to say the mkt these days seem to react to any progress made in this area, including “useful tools”. With the emergency FDA approval on Friday (after-market), I look forward to seeing if the market will react positively or simply ignore it as it’s priced in already.

Reposting from our fellow subscriber (progress on vaccine):

https://vac-lshtm.shinyapps.io/ncov_vaccine_landscape/

https://www.cnbc.com/2020/05/02/warren-buffett-built-up-cash-bought-only-small-amounts-of-stock-during-the-stock-market-rout.html

https://www.marketwatch.com/story/buffett-dumps-entire-airline-stake-saying-the-world-changed-for-airlines-2020-05-02?mod=newsviewer_click

All we really need to do is read the headlines.

https://www.marketwatch.com/story/buffett-says-he-hasnt-made-any-big-investments-because-we-dont-see-anything-that-attractive-2020-05-02?mod=newsviewer_click

I just can’t buy the story that the decline is over. Late last week the market started reacting to earning, sales and bad economic data for the first time in weeks. My gut feeling is that we are about to suffer a crisis somewhere and it is going to tank the market.

Can Congress and the Fed keep the markets from falling out of bed again? I think we are going to find out.

Has anyone here ever followed DIX/ GEX as short term indicators of directionality? See more here:

https://squeezemetrics.com/monitor

Can anyone point me to a website that shows country-level stock market indexes in the local currency (vs. in dollar terms)?

Check some of the Twitter feeds.