Mid-week market update: It is always to discern short-term market direction on the day of an FOMC meeting, but a number of trends have developed that can support a short-term risk-on tone.

The most notable is the possible change in leadership. For quite some time, the trends of US over global stocks, growth over value, and large caps over small caps have been the leadership in the past bull market. I am starting to see signs of possible reversals.

In the past, changes in market leadership have marked market bottoms, and the emergence of new bull markets. This interpretation comes with the important caveat that leadership changes are usually necessary, but not sufficient conditions for major bullish reversals.

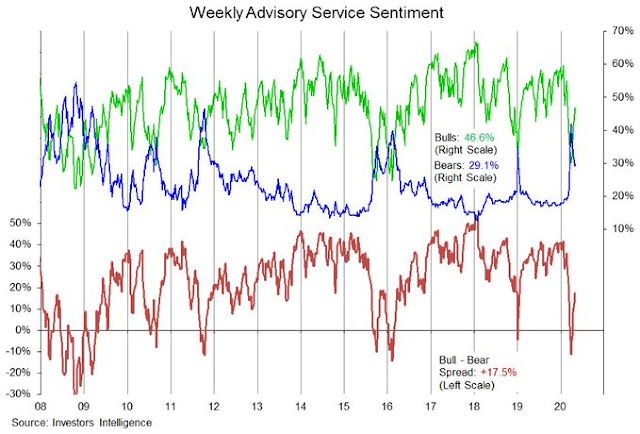

Better sentiment

The tone of sentiment surveys are also improving. II Sentiment is normalizing. Levels are returning to neutral, but not extreme enough for a crowded long reading. In light of the market’s positive momentum, prices have the potential for further upside.

Similarly, the Fear and Greed Index has recover to only 46 and it is not even about the neutral 50 line yet Momentum is positive and bullish enthusiasm could run much higher before sentiment becomes a concern.

What to watch

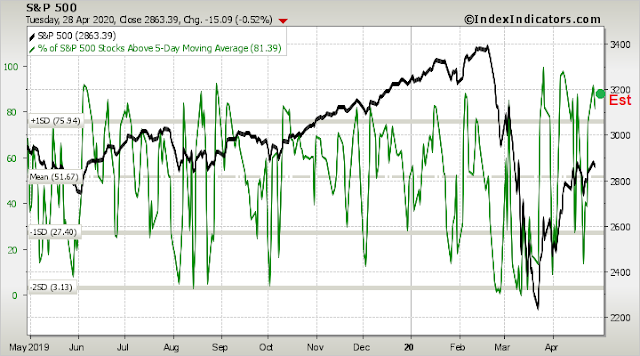

Here is what I am watching over the next few days. Short-term breadth is becoming overbought again, and the market could be due for a breather for the rest of the week.

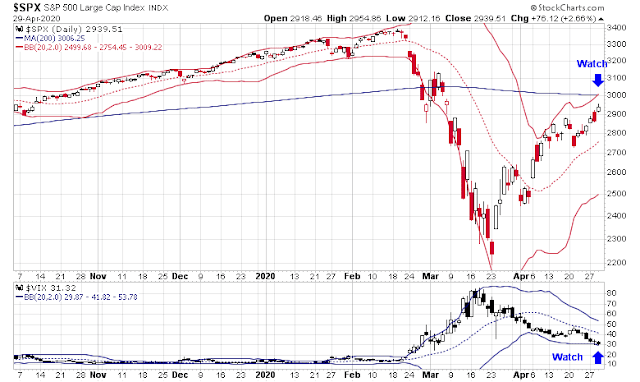

The next resistance can be found at about 3000, which is roughly the site of the 200 dma, as well as the market’s upper Bollinber Band (BB). How will it behave at those resistance levels? Upside potential may only be capped at 2% if the market is rejected at that resistance level.

Lastly, the VIX Index is nearing a breach of its lower BBB, which is a market overbought signal indicating a possible pullback.

Subscribers received an email alert yesterday indicating that my inner trader had covered his short position. While the trading model had timed the sell-off and initial rebound well, it badly missed the magnitude of this latest rally. My inner trader is temporarily staying on the sidelines in cash in order to re-evaluate the technical picture. If my intermediate term assessment of a second bout of market weakness is correct, there will be plenty of opportunity to re-enter a short position. However, we need the advance to exhaust itself first, and then to assess whether the most likely path is a period of sideways and choppy consolidation, or another panic sell-off to re-test the March lows.

So, FB, MSFT, TSLA are flying higher after hours. NQ futures spike up 60 points after 4 pm, ES was up 20 points on the news!

FB missed on earnings bur revenue was up. I think TSLA was an early indication that the markets can stay crazy.

I’m still sitting on a pile of cash earning basically nothing but to quote a friend, “I’m more interested in the return of my money than the return on my money.”

Of course.

FB, MSFT and TSLA are among the stocks that the market believes will not see a lasting damage to their business model and valuation. They have simply been brought back to the levels before the pandemic. A democratic win however could impact the likes of FB, MSFT, AMZN and AAPL.

Thanks Jan. A democratic win will be a classic “tax and spend” deal, and will cause much wider damage than what you have noted. That said, I have not studied Urban Carmel whether political parties make a difference.

Powell is only interested in enabling the functioning of the market (availability of the credit, etc.) and doesn’t care about the asset prices. At this rate, we will be hitting new highs in stock market as well as in unemployment rate soon.

Curious whether there is a way to quantify the impact of the Fed’s actions on the stock market (both actual and perceived). It doesn’t need to be perfect, just get to us in the right zip code.

I gave up on “waiting” for the down draught. I went back in with defensive stocks for dividends (with some helpful advice from a friend) at the end of last week. I need the income to live on, so I call it “my lifeline income”. So, approximately one third invested with income – expenses = 0. Currently up about 6% on invested money. Crazy. Will it last? No idea really, just have to watch and be ready to bail if things go south again, and ready to buy more if things go north (?).

The 200 day moving average line, to me, is not just a number, it is an average over the last year (about 200 trading days) of many things. I then compare today to the average daily experience over that year. So I ask myself, how does today’s economy compare to the average? How are earnings of companies compared? How is today’s outlook compared to the average outlook of the last 200 days. What is the forecast for dividends compared?

In all cases the current fundamentals fall far short from those over the last year. So the 200 day line is giant wall to me.

We discussed a few days ago, October 2019 breakout high of around 3020, that Cam advised buying into. There was a triple top at that level, that developed over a lengthy period of time. Let us see if we break above that level. We are literally a pip squeak away from that level. There is a lot of short covering that is probably going on here. Close of week would be interesting to watch and also Amazon (AWS in particular) earnings tomorrow (see Cam’s earlier post).

To be sure, Cam has warned that we are whistling past the grave yard, on narrowing leadership.

Why fight the market? Cam provided guidelines re when he planned to remove his recent hedge and alerted us yesterday. I’m pretty sure many other traders did the same. Now he’s turning his attention to the possibility of a continued rally.

The market couldn’t care less about my logic, the Fed’s logic, or that of any analyst/ economist/ fund manager. When we decide to time the market, that’s what we sign up for. It’s one reason why timing is so difficult.

There are clues in the price movements. It’s been a strong tape – if anything, it’s now even stronger. Are there reasons? There are as many reasons as there are traders. I don’t claim to know what they are, but I always try to come up with a perspective that helps me to predict direction and strength. After years of trading, I think we all develop an intuition that’s specific to our own trading styles/methods.

The ‘perspective’ that works best for me right now (which may not be accurate or even helpful to anyone else) is that most of the short-covering is over – it’s now under-invested funds that are doing the buying. Just an opinion.

I think the view is correct. Only big whales move the market consistently over long stretches of up move.

US is about to surpass 60k deaths, which was the projected conservative estimate back in mid-March.

Below, the graph of infections for the US does not look encouraging.

https://ourworldindata.org/coronavirus?country=USA

Based on the information above, I think reopening is premature and will increase the risk of harm to the general public.

As for the market, I haven’t re-entered short positions since I was last stopped out and have not re-entered the market with overnight positions. I am tempted to resume trading, but I am reluctant to hold risk overnight. Nothing makes sense.

How often do markets make sense? A narrative can be spun to justify about any valuation level. I can remember when valuations of dot.com companies were based on the number of page views…and investors bought it (with real money).

Price movements (at least in the short term) are often determined by emotions/ crowd behavior. I think you’re right to be prudent about overnight risk after a +35% move in the SPX – but that won’t stop the index from gapping up another +3% (or gapping down -3% for that matter) tomorrow if the right fear/greed dynamics are in place.

Personally, I believe that many people invest in the stock market simply because there is no alternative (the TINA argument).

Had I been smart enough to buy long-term Treasurys in 1981 paying 15% (or whatever it was), I would have outperformed the stock market for thirty years with almost no risk. What are Treasurys returning today?

Looking at the log graphs of U.S. deaths and of infections you can see that the rates have decreased to about zero or flat. We have not moved to negative yet the curves have just about flattened. That is what is being looked for to be able to open some aspects of the economy.

The datasets we’re using to base our policies is incomplete. Test coverage for the disease is not high enough to confidently isolate the majority of cases or even cover demand from hospitals.

Example, Georgia has one of the lowest testing rates, but is reopening anyway?

The policy response has been far stronger than expected. Medical response has strengthened in spite of slow start and will only get better as time goes on. So, even though we are in a recession, the escape from recession will be sooner than average. If markets look forward 6-12 months, they are anticipating growth resuming in 4th – 1st quarter. Earnings forecast is muddy but bets are in 150-160 with potential for upside surprise for 2021. Twenty times earnings in a growing economy is not unreasonable with abundant Liquidity. I am not waiting for tests of the lows.

Are you making a case for a V shaped recovery?

My view is that we don’t test the lows. There is a recent precedent for it in 2018-2019. The recovery will be faster than people anticipate. There will be back and forth on negative news and profit taking. I think that if the market stopped around 2200 in the worst of the liquidity crisis and in time of highest uncertainty, odds of getting back there are low. Barring another black swan of course.

We may not test the lows but we certainly could easily give back around 50% of the move off the bottom and be presented with an excellent buy point.

Of course!! Just have to grab it when it comes. That’s the hardest part for me. I am trying an approach: placing GTC order for stocks I want to buy and add at levels that make sense to me. Selling upside calls since I think risk is now asymmetrical.

Interesting contrarian idea.

Thanks all for the comments here. Very helpful. I see a lot of frustration. I think it is time to be a contrarian. I will be selling my longs over the coming days, and add to my hedges.

I agree with Ken and DV it will hard for market to cross 3,000 (giant wall of 200DMA, Oct 2019 breakout high, a big fat round number, possibly a big H&S going all the way back to Oct 2018).

I am watching the tape (see rxchen2) and trying to overcome my own anchoring bias (see Ken’s multiple missives on this topic). In short, if we break above 3020, it may be a rally to stay long, FWIW, gingerly with one foot out the door (Lol).

That’s probably a good observation, Sanjay. My highly subjective take right now:

SPX ~2850 a short-term buy.

SPX ~2750 an intermediate-term buy.

SPX ~2650 a longer-term buy.

SPX <2550 probably something we'll see at some point later this year.

I'm also a guy who changes his take almost on a daily basis – but the numbers above are what I have in mind right now.

Good trading ideas. I had 2850 today, that did not hit, but we are close in the Futures markets to this level!

Good ideas. Some of the companies I own are reporting next week; I hope this market can hold on for a few days more.

Gingerly is the word! I am very reluctant to make one-sided bet in this market.

https://threadreaderapp.com/thread/1255685440436269058.html

^^To make sense of Remdesivir, vaccine prospects, next steps for reopening please check out this thread.

Thanks, Ellen.

Shelter-in-place in the Bay Area will be extended through May 31, with a few modifications.

https://www.sfgate.com/bayarea/article/California-when-will-businesses-reopen-four-stages-15234495.php

Thanks rxchen. CA and WA have had some of the best outcomes here and will probably have the most resilient economy because we can open sooner when done safely.

I found Wachter’s take on the vaccine timeline and context of remdesivir to be very helpful. The 1% death rate overall sounds accurate to me based on all I’ve read– sadly much higher in people over 60. 1% is 10x the flu death rate. NYC has seen 0.2% of their entire population killed by this– that is with lockdown. Market is currently underestimating the lethality and overestimating odds of a vaccine in September.

Recommend this by Ben Carlson.

Over time, the Feds have, by their ‘whatever it takes’ actions, convinced the market that they have taken the prospect of depression-level outcomes off the table. Hence, over time, the market, at it comes to understand this, awards ever-higher multiples. Minsky-esque Moments Maybe, but no ‘big one’.

This puts a rising lower bound on valuation, but does it raise the upper bound? If not, then lower future returns should be expected.

https://awealthofcommonsense.com/2020/04/my-new-theory-about-future-stock-market-returns/

I just wonder if Americans are really just going to quietly accept the 2,3,5000 deaths per week cost.

i.e. Trump orders the JBS Worthington, MN workers back to work despite an outbreak and indemnifies the company. If they refuse, will the national guard force them to?

A lot could go really badly here.

BP just dropped its dividend for the first time since WW2 from 66 cents to 16 cents. Ouch. Stock should have risen on this news, but has fallen instead!

I am sure there will be more companies out there that do this. FWIW, some of the Muni funds are yielding 3% tax free (check VOHIX).

It is Shell oil not BP (BP has maintained it dividend). Be careful, dividend investors.

The Atlantic: “Georgia’s Experiment In Human Sacrifice” LOL

https://www.theatlantic.com/health/archive/2020/04/why-georgia-reopening-coronavirus-pandemic/610882/

Nixon: We are all Keynesians now

Trump: We are all Mayans now

Elon goes full Mayan:

“To say that they cannot leave their house and they will be arrested if they do, this is fascist. This is not democratic, this is not freedom, give people back their god damn freedom.”

https://twitter.com/Lebeaucarnews/status/1255644604256235522

He should go first! He can let us know how it goes.

One could view this rant as a shrewd move to win over conservatives who would otherwise view Tesla as a “liberal “ plot. I would bet that Tesla, which has been up and running for some time in Shanghai to be better than most in knowing how to open relatively safely.

Elon Musk’s Shutdown Rant Mocked by Mark Cuban, Embraced by Conservatives https://www.bloomberg.com/news/articles/2020-04-30/musk-s-shutdown-rant-mocked-by-cuban-embraced-by-conservatives

I agree with Elon. Since the CV (in CA), criminals are set free and citizens are kept in their homes. I live in the SF area and crime has sky rocketed. My sister was rob in the afternoon and many similar stories from friends. In the freeways, crazy drivers are drag racing. I walk and drive outside daily to keep my sanity. Shelter in place for me is: keep myself safe from the increased crime. CV; no afraid at all.

Is today the beginning of Cam’s Re-test move or do we need to see 3000 S&P first?

Nobody knows. My guess is – test of high tommorow / Monday and then down – max. 2700 – 2640.

I think we see the retest move staggered in a saw tooth pattern. I recall Cam firing alerts in rapid succession last year – maybe he’ll try it again .

Bannister said he had declined to raise his 2,950 target “as we await a shock…then the Fed.”

https://www.marketwatch.com/story/this-stock-market-bull-called-the-relief-rally-that-took-the-sp-500-to-2950-but-now-hes-reluctant-to-raise-his-target-2020-04-30?

First 2 days of May tend to have a bullish bias, according to Stocktrader’s Almanac. First half of Month usually better than the second half of the month. I guess some investors do not want to be long into next Friday’s employment report.

Cam would have some thoughts this Sunday. The value, small cap didn’t do so hot today.

Small-cap stocks were very extended and needed a breather. The pause that refreshes.

I wonder if this a trading market in the traditional sense. So much news driven. I am setting levels to take profits (3000) and have GTC orders to get in at lower levels. See how that plays out.

The intraday low on 2892 was close enough to short-term support @ 2887 to risk a partial position. If I had to guess, we see 3000 before 2850. JMO.

What I i meant to say was ‘close enough to ST support and held.’

Addking a second allocation after hours as the SPX pulls back to 2863. Any further adds will have to be on strength. My ST take would probably change if prices deteriorate much more on Friday – for now I just don’t think we’ve seen the end of this month’s bull run.

rxchen2, volatility (VIX=30-40) is dictating 2-2.5% moves. This is down from 4-5% intraday moves in March (VIX was 80+ then). Futures, as I write, are around 2840 (-2%), based on what the VIX would dictate.

rxchen2, volatility (VIX=30-40) is dictating 2-2.5% moves. This is down from 4-5% intraday moves in March (VIX was 80+ then). Futures, as I write, are around 2840 (-2%), based on what the VIX would dictate. I am watching the VIX index to decide on such (wider) trading bands.

SPX looks to open down -60 points – I’ll need to decide whether that invalidates the thesis behind my trade (a push up to SPX 3000).

There’s a decent chance that price attempts at least a partial gap-fill in the first 30-60 minutes. If that fails to materialize, I’ll be stopping out. I don’t give ST trades much time to play out – I’m not going to waste time fighting a position that moves against me – taking a loss immediately allows me to focus on the next trade (which may entail reentering the same trade at a higher price). Average basis SPY 287. Defined risk via position size and stop loss of 284. If 284 holds, great. If not, I’m out.

(My prior trade was long SPX ~2860->2912. When the index reversed intraday to close right back down ~2862, I thought about reopening…but didn’t. Naturally, the SPX gapped up >+2% the next day! Which may have led me to jump the gun ~2895 yesterday. It happens.)

D.V. – That’s good info re the relationship between VIX and percentage moves. Thanks!

I think it was Kevin Marder who pointed out recently that major accumulation days (in the Naz) outnumbered major distribution days in April – and on high volume. Unless that changes, it’s difficult to be bearish.

SPY currently @ intraday lows ~282.62. If it’s able to reverse and take out the intraday high ~286 I would consider reopening a position. That’s unlikely to happen – but that’s exactly why I would take the setup – it would take considerable buying interest to make that happen.

The market closed today close to its bottom. Market losses IMHO are due to President warning more tariffs against China. Mr. market is completely blindsided by this news hence the weak tape and weak close today.

We will have to watch next week, how news driven market drives the stock market. Yes, keep a close eye on the VIX if you are trader. Though the US is opening for business, let us see what happens in a couple of weeks, to see if the Covid cases increase or not.

https://www.marketwatch.com/story/gilead-plans-to-spend-50-million-to-test-and-manufacture-covid-19-drug-candidate-remdesivir-2020-04-30?mod

‘Company executives also said they are looking into developing inhaled or subcutaneous forms of remdesivir for COVID-19 patients. The drug, which is currently delivered to patients using intravenous infusion, will not be tested as an oral treatment.’

If GILD succeeds in delivering remdesivir via a metered dose inhaler or a simple injection that can be administered in a few minutes at a doctor’s office – and of course assuming the drug proves to be safe and effective – well that would significantly hasten the recovery of the global economy.

What does the market see (or foresee) that no one else is able to envision? There must be hundreds of innovations/ solutions yet to be discovered/ devised. The first take is often way off base – I think it was Ravindra who pointed out that humans have always risen to the challenge – the small businesses that drive the economy have no other choice if they are to survive. Who knows – the restaurants/ gyms of the future may evolve into far more efficient and profitable operations – the means and the ends are inconceivable to us now, yet the market undoubtedly recognizes that they will ultimately succeed.

It’s difficult to bet against a quicker-than-expected recovery. The global economy depends on it.

In that sense – the collective efforts of countless individuals/ small businesses bent on surviving/ thriving may pave the way for yet another ‘V’ recovery in the indexes.

Just saying.

Remdes does not change mortality per all current available data. Shortens duration of illness in the severely ill in intravenous formulation. We will see. Gilead certainly wants it to be the answer but my infectious diseases MD friends are skeptical that it is a miracle drug. There are a number of other candidates for therapeutics right now. https://www.sfchronicle.com/bayarea/article/New-UCSF-study-finds-potential-drugs-for-treating-15235804.php

Understood. There’s conventional wisdom – which is basically the best we can do right now – and then there’s the search for unconventional approaches.

What if we’re collectively looking in the wrong direction for an explanation? Personally, I’m skeptical re a ‘V’ recovery (either in the pandemic or the markets)- but I have to respect the possibility that one is underway, and if that’s the case then it’s worth exploring what we’re missing. Perhaps we’re underestimating the resilience and resourcefulness of the thousands of companies that are determined to reopen quickly, or the ability of scientists to fast track a vaccine. I don’t really know.

As I write this, futures are pulling back significantly and we may finally see an end to the phenomenal rally off the March lows…or not. It’s always instructive to step outside the prevailing arguments when trying to understand unexpected developments.

9/50 scientists on the NIH panel have financial ties to Giliad. $1000/treatment. Amazing the buzz Giliad has created with poor data. A clinical stage biotech would have crashed on a PR like that, lol.

Contrast to HCQ, at $.10/ pill. Not saying it works, but wouldn’t you want to get real data to see at that price?

In one of the reports on remdesivir I think I recall reading that it sped up recover but didn’t have an effect on the death rate. I thought that was a bit strange if I read it right.

Remdesivir is only the first step. The study so far has shown that patients recover faster but it has not been shown that it reduces the death rates. Also, it’s effective in roughly half the patients. So, it can play a role in the health system load. I think that it will not eliminate the need for steps we are currently taking to prevent infections. Who would want to get infected knowing that the drug is not a cure? Data from other trials may change this thought process.

There are other therapeutic approaches being investigated. The holy grail is a vaccine. That is still a while away. And once a vaccine is found how soon can you vaccinate the whole population?

I have faith we will find answers. Sooner than we anticipate. That’s the upside.

Optimism wins over pessimism hands down the vast majority of the time. That’s what I’ve observed over my lifetime.

Hulbert with an alternative take on whether markets will retest the March lows.

https://www.marketwatch.com/story/small-stocks-are-sending-a-big-message-about-a-retest-of-the-bear-market-low-2020-04-30?mod

Good information to know.

https://www.marketwatch.com/story/astrazeneca-teams-up-with-oxford-university-to-develop-coronavirus-vaccine-first-results-from-human-trials-expected-in-june-or-july-2020-04-30?mod=home-page

There are many such trials in the pipeline. I just posted this as an example of how this company expects some results by June or July.

https://www.ucdavis.edu/coronavirus/news/covid-19-vaccine-patch-delivery-technology-enters-preclinical-testing-uc-davis

This guys an amazing follow on twitter. Here’s a very clear take on the COVID situation and the choices, bias at work, tradeoffs. Very, very good.

https://twitter.com/vgr/status/1256068731882450944

Thanks. What is his background? Epidemiologist, virologist? Or entrepreneur? Very important to look for bias these days to get credible information.

Lots available from his twitter home page/bio. “Venkatesh Rao is a writer and independent management consultant. ” https://venkateshrao.com/

What’s your yardstick to detect bias?

thanks. If you are looking for credible information about the scope and magnitude of the COVID outbreak I would make sure to not listen to amateur epidemiologists with no background in that area. not saying he does not have other good insights but for matters related to vaccines, R values, hospital overwhelm, herd immunity etc should look to experts in the field. this person may have a take on the economic issues but may know little to nothing about the scientific aspects of the pandemic itself beyond what he has read online this past few months. Just a recommendation.

The market lows will be broken if this is true.

“The coronavirus pandemic is likely to last as long as two years and won’t be controlled until about two-thirds of the world’s population is immune, a group of experts said in a report.”

https://gulfnews.com/world/coronavirus-pandemic-likely-to-last-two-years-report-says-1.1588322949306

Once again:

“It is not 100 percent certain, but I can say the possibility is 99 percent,” he added, speculating that North Korea, which “is believed to be grappling with a complicated succession issue,” may officially announce the news this weekend.

https://www.foxnews.com/world/kim-jong-un-99-percent-dead-lawmaker-says

Wally, here is a link to that complete report. Ellen, if you get a chance to review it, I would appreciate your opinion. If it is valid, it will be a very nimble stock picker’s market for awhile, IMHO>

— https://www.cidrap.umn.edu/sites/default/files/public/downloads/cidrap-covid19-viewpoint-part1.pdf

Thanks, Mike. It seems the only thing that will stop one of those scenarios would be a vaccine that is distributed to everyone. This will likely happen at some point in the U.S.

Thanks Mike! will review and will share with an ID colleague in NYC for his thoughts.

St Louis FRED recession probability just went to 100%:

https://fred.stlouisfed.org/series/RECPROUSM156N

So with the shortest recession showing there in recent times was the 1980 recession (6 months)

It was Cam who called it first. I would like to give the credit to Cam. Thanks Cam.

I agree and did not mean to minimise that fact. The data from the FRED site joins up a lot of the data in an easy to see set of diagrams.

Agree; love the St. Louis Fed site.

and the stock indexes hit their lowest after the start of the recession, not before:

https://fred.stlouisfed.org/series/WILL5000PR

then interesting times ahead, I think.

And the old adage says, “May you live in interesting times.” I don’t think so. Give me the good old boring days of good health, fast women and smooth whiskey.

….Or was that fast horses and smooth women? Oh, what ever.

Lol, Wally. Got a favorite Whiskey or two?

LOL Actually I prefer Myers dark rum and a coke or Kahlua if not a beer.

I prefer dark rum (or rhum) too but with Reed’s ginger beer and more than a slice of lime. It is delicious.

https://www.drinkreeds.com/products/

Barbaoncourt is a pretty good dark rhum.

https://www.astorwines.com/SearchResultsSingle.aspx?p=2&search=07184&searchtype=Contains

Thanks Wally and Sanjay for educating me on the dark side of Rhums! Lol.

https://www.yahoo.com/news/denmark-says-coronavirus-spread-not-132512306.html

That’s encouraging. I still think the virus isn’t going to go away until there is a vaccine widely administered.

Good news. But they have only opened day care centers and schools for children followed by hairdressers and other small businesses.

Agree that this virus is not going to go away so easily.