In the past few weeks, a number of investors and strategists have turned bullish. I would like to address the reasoning for the bull case for equities, and the risks to the reasoning. History shows that recessions are bull market killers, and bear markets do not resolve themselves this quickly without a prolonged period of adjustment.

Here are the bullish arguments:

- The lockdowns are ending.

- A possible drug treatment breakthrough.

- The Fed is coming to the rescue.

- Investors are looking ahead to 2021, and 2020 is a writeoff.

Easing lockdown = Growth revival

One point made by bullish analysts is the coronavirus induced lockdown and distancing policies are easing. Confirmed COVID-19 case growth and death rates are leveling off and declining. Parts of Europe, such as Germany, are starting to ease their lockdown restrictions, and Trump has issued guidelines for a phased re-opening of the economy. These measures should lead to a growth revival, which would be bullish for stock prices.

The growth revival can be an important bullish catalyst, if it works. Bloomberg reported that there was an important caveat in the much publicized Goldman Sachs bullish U-turn. The bullish call was based on “no second surge in infections”.

A combination of unprecedented policy support and a flattening viral curve has “dramatically” cut risks to both markets and the American economy, strategists including David Kostin wrote in a note Monday. If the U.S. doesn’t have a second surge in infections after the economy reopens, equity markets are unlikely to make new lows, they said.

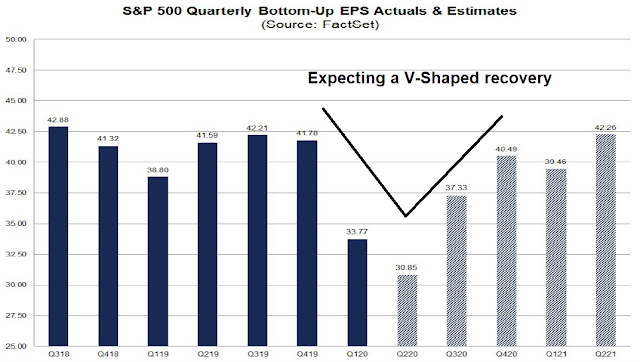

The Street is already penciling in a V-shaped rebound in consensus earnings expectations. Earnings are expected to bottom out in Q2, and return to normal by Q4.

How realistic are those expectations?

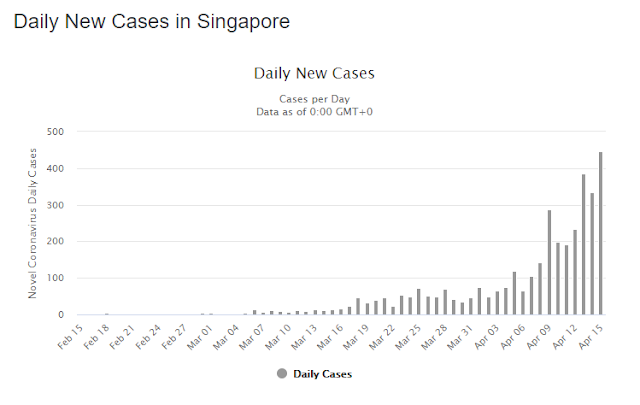

Ask Singapore about what happens if you try to open up an economy prematurely. David Leonhardt outlined the risks in a NY Times Op-Ed. The island nation’s response has been a model for other countries, and it was able to avoid many of the draconian distancing measures imposed elsewhere:

Singapore’s approach has certainly been aggressive — and more effective than the American approach. In January, as the virus was spreading within the Chinese city of Wuhan, Singapore officials began screening travelers arriving in their country and placing anyone who tested positive into quarantine. Singapore also quarantined some travelers who didn’t have symptoms but had been exposed to the virus. And Singapore tested its own residents and tracked down people who had come in contact with someone who tested positive…

Thanks to that response, Singapore had been able to avoid the kind of lockdowns that other countries had put in place. Restaurants and schools were open, albeit with people keeping their distance from each other. Large gatherings were rare. Singapore, in short, looked as the United States might look after the kind of partial reopening many people have begun imagining.

The preventive measures eventually failed, and Singapore has reverted to the standard lockdown methods used elsewhere:

But Singapore doesn’t look that way anymore. Even there, despite all of the successful efforts at containment, the virus never fully disappeared. Now a new outbreak is underway.

The number of new cases has surged, as you can see in the chart above. In response, the country announced a lockdown two weeks ago. Singapore’s “present circumstances,” Carroll writes in a piece for The Times, “bode poorly for our ability to remain open for a long time.”

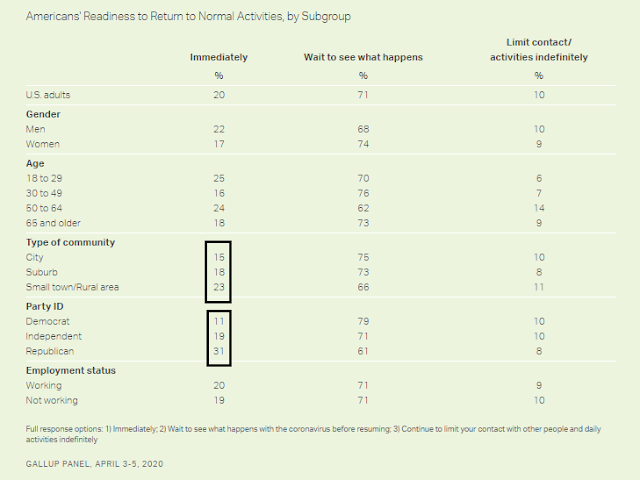

Even if lawmakers wanted to open up the economy, the inevitable questions come up of how willing are people to return to restaurants, movies, or to send their children to camp this summer. A recent Gallup poll found that only 20% of respondents were willing to return to pre-pandemic normal activity immediately.

Attitudes were most divided among the urban-rural axis, and by party identification. Still, only 23% of rural residents and 31% of Republicans were willing to return to normal immediately. These figures represent significant minorities of the population.

Other polls confirm the Gallup results.

- An Axios/Ipsos poll found a similar level of skittishness.

- A Harris poll found that most Americans wanted to wait a month before “starting to return to work and life as normal”.

- A Seton Hall poll found that 72% would not attend a live sports event like a football game unless a vaccine is found.

The polling data suggest that any effort to reopen the economy will not be instant. Even if the easing measures are successful, growth and employment are likely to return slowly.

For the last word on this topic, I refer you to Wall Street executive and Morgan Stanley CEO James Gorman. Gorman stated in a CNBC interview that he believes the economy will not return to normal until late 2021:

Morgan Stanley CEO James Gorman sees the coronavirus-induced global recession lasting for the entirety of this year and 2021.

When asked about how a potential economic recovery expected in the second half of this year would take shape, Gorman said that while he hopes it will be a sharp “V” recovery, in reality it will probably take longer to reopen cities and factories.

“If I were a betting man, it’s somewhere between a `U’ or ‘L’” shaped recovery, Gorman told CNBC Thursday in an interview. “I would say through the end of next year, we’re going to be working through the global recession.”

A treatment breakthrough?

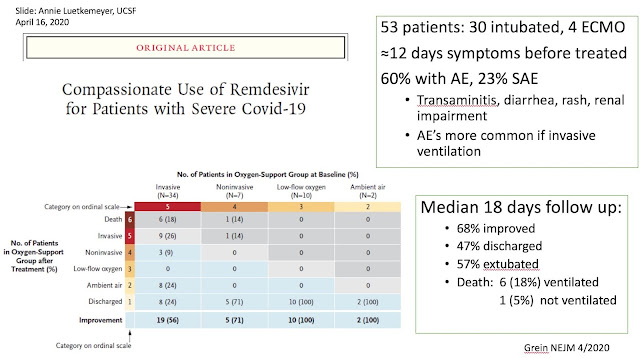

Some of the expectations about the pace at which the economy can be reopened could change. A report from Stat created some excitement after the market closed Thursday. There were reports of promising results from the Gilead drug remdesivir in the treatment of COVID-19 patients:

The University of Chicago Medicine recruited 125 people with Covid-19 into Gilead’s two Phase 3 clinical trials. Of those people, 113 had severe disease. All the patients have been treated with daily infusions of remdesivir.

“The best news is that most of our patients have already been discharged, which is great. We’ve only had two patients perish,” said Kathleen Mullane, the University of Chicago infectious disease specialist overseeing the remdesivir studies for the hospital.

Before anyone gets overly excited, these results are highly preliminary. This test had no control group. The drug is given intravenously, and hospitals would still be overwhelmed if public health policy allow the infection rate to surge. A New England Journal of Medicine article which outlined the “Compassionate Use of Remdesivir for Patients with Severe Covid-19” had considerably less exciting results, as “clinical improvement was observed in 36 of 53 patients (68%)”.

In addition, Gilead has a limited supply of the drug.

As of January 2020, we were not actively manufacturing remdesivir. The manufacturing supply chain was scaled to periodically make small amounts of product for a compound in early development. We had inventory of finished product to treat just 5,000 patients.

Since then, we have proactively and rapidly scaled our supply chain. As of late March, using the active ingredient we already had in our inventory, we have increased our supply to more than 30,000 patient courses of remdesivir on hand, assuming a 10-day course of treatment for patients. As new raw materials arrive over the next few weeks from manufacturing partners around the world, our available supply will begin to rapidly increase.

Even if the trials were proven to be successful, ramping up production will be a challenge. Gilead’s stated production goal, which may or may not be successful, is shown as:

- More than 140,000 treatment courses by the end of May 2020

- More than 500,000 treatment courses by October 2020

- More than 1 million treatment courses by December 2020

- Several million treatment courses in 2021, if required

In short, remdesivir is potentially a promising treatment, but production problems may make this a “too little, too late” solution in light of the number of widespread incidence of COVID-19 around the world. The time frame for the widespread availability of this drug isn’t significantly better than a vaccine, assuming that a vaccine could be found in a relatively short time. Moreover, the drug does not protect anyone against infection, or COVID-19. It is just a treatment for patients who are in ICU.

Assuming that remdesivir were to become an effective treatment with limited availability, here is what that means to the US economy over the next 6-12 months. Initial jobless claims have skyrocketed to all-time highs in recent weeks. The continuing jobless claims report, which is released in conjunction with initial claims, measures the devastation to the jobs market. Arguably, reported continuing claims is under-reported because the latest figures are inconsistent with the last few weeks of rising initial claims, and it is difficult to believe that people have magically found jobs in the current environment. In all likelihood, the lower than expected continuing claims figure is attributable to the inability of state bureaucracies to process the flood of claims.

Now imagine a best case scenario where the economy opens up again, and half of the laid off workers suddenly found jobs as the fear of dying from COVID-19 recedes. Even under this rosy scenario, continuing claims would be worse than the highest levels seen during the Great Financial Crisis. Are those recessionary conditions in anyone’s spreadsheet?

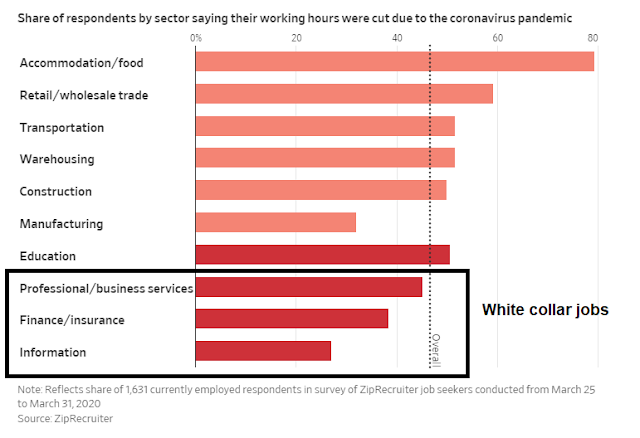

The economic impact of the job losses are probably higher than most analysts’ expectations. So far, the initial round of layoffs have largely been concentrated in low-wage service jobs. A recent WSJ article reported that a second round of layoffs is now hitting better paying white collar workers, which will have greater effect on consumer spending because of their (previous) higher spending power. No one is immune, Bloomberg reported that even Google has announced that it is significantly slowing its hiring for the rest of this year, and it has announced selected cost-cutting initiatives.

The Fed has your back

Another point made by the bullish camp is the flood of stimulus that has been unleashed by the fiscal and monetary authorities. In particular, the Federal Reserve and other central banks around the world have acted quickly to provide a tsunami of liquidity for the markets.

That’s bullish, right?

The answer is a qualified yes. Bear in mind, however, this latest crisis is different from previous recessions like the GFC. The COVID-19 recession began on Main Street, while most of the past recessions began on Wall Street. Fiscal and monetary measures can remedy financial recessionary conditions, but they have limited effectiveness if the crisis begins in the physical economy.

The question investors have to ask themselves is what this flood of stimulus will do to the Main Street economy. Congress and the Fed, despite all of their fiscal and monetary powers, cannot find a vaccine or a treatment. If the effect of these measures only act to compress risk premiums, which is important to financial stability, the stimulus is less likely to leak into the real economy.

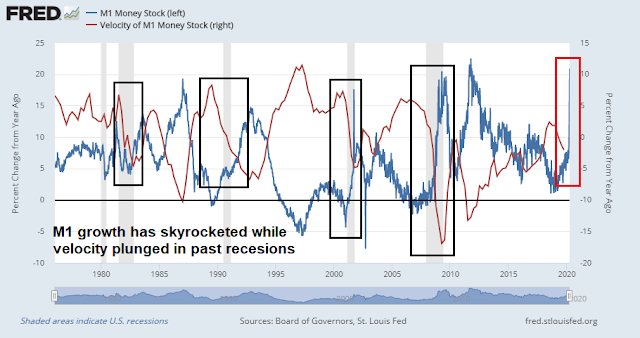

Remember the monetary equation, GDP = MV, where GDP growth is a function of money supply growth and monetary velocity. During past recessionary periods, the Fed has engaged in monetary stimulus, which boosted M1 growth (blue line), but monetary velocity (red line) fell. Will 2020 be any different?

Can stock prices regain their long-term footing without a revival in economic growth?

Look over the valley

The last major advice made by bullish analysts is to look over the valley. Equity valuation appears expensive now, but 2020 is said to be a writeoff and investors should be looking forward to the recovery in 2021.

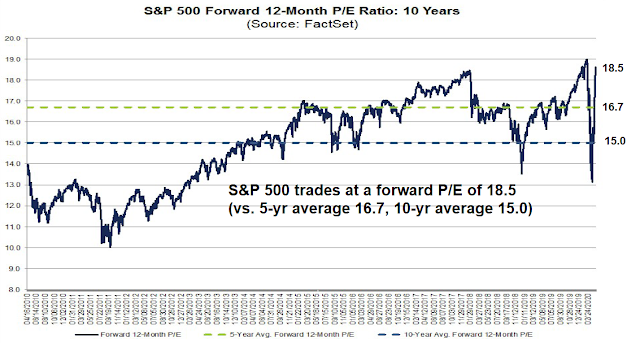

Here is the key risk to that bullish argument. The market trades at a forward P/E ratio of 18.5, based on bottom-up derived blended forward 12-month EPS estimates from company analysts. This valuation is higher than the 5-year average of 16.7 and 10-year average of 15.0.

Right now, bottom-up earnings estimates are little better than fiction because company analysts have little guidance from corporate management on the 2020 outlook, never mind 2021. On the other hand, top-down strategists have developed 2021 EPS estimates based on economic models, based on their best guess assumptions of the economy next year. The consensus top-down 2021 estimate is about 150.

Based Friday’s prices, the forward 2021 P/E ratio is a nosebleed 19.2. This begs a number of difficult questions for the bulls:

- How much more upside do you expect when the market trades at a forward P/E ratio that is higher than its 5 and 10 year averages? That’s assuming that earnings are in recovering in 2021. Should investors start to discount what amounts to a highly uncertain 2022 earnings two years in advance?

- If you accept that a forward P/E ratio that is above its 5 and 10 year average as appropriate, how do you model the Fed’s withdrawal of stimulus, which would expand risk premiums and therefore depress P/E multiple?

In conclusion, I find the risks presented by the bullish arguments unsatisfying. I continue to believe that, in the absence of a vaccine or immediate availability of a treatment that mitigates the effects of COVID-19, the US equity market faces significant downside risk (see The 4 reasons why the market hasn’t seen its final low).

Please stay tuned for tomorrow’s tactical market update.

https://www.yahoo.com/huffpost/florida-beach-reopen-coronavirus-mad-dash-075308141.html

Wow, what a contrast to the Bay Area, where county beaches and state parks were recently closed and locked down. Closer to home, all of the local school district campuses were taped off earlier this week to prevent continued use of playing fields and basketball courts. Governor Newsom was first to impose statewide social-distancing/shelter in place orders, and I suspect that he will be the last to lift them as well.

Seoul seems to be betting that mass testing will succeed in containing the virus:

https://www.bloomberg.com/news/articles/2020-04-18/seoul-s-full-cafes-apple-store-lines-show-mass-testing-success

I see a lot of people in South Korea not wearing masks in those pictures. I think it is just a matter of time before they face a new outbreak of the virus. We’ll see.

Can’t blame them. If I were close to the beach I would be out there, too. But I would have a mask on.

Thanks Cam. I always look forward to your articles. Agree re valuation but the market rose over the last several years despite historically high valuations on CAPE, market/GDP, etc. Some counterpoints: Seems everyone thinks a retest will occur which makes it contrarian bullish. Further, serology studies in Denmark, Iceland, and Bay Area imply fatality rate of 0.12% which makes remdesevir supply adequate for severe US cases. Also, combo of warm weather, public masks, and more aware public will almost certainly reduce cases. Sweden numbers show it can be controlled with sensible measures not shutting everything. Finally – with algo market the historical lengths of bear markets are no longer good guides to rely on as we saw with 33% drop in 34 days.

Actually, not everyone believes in a retest of the lows. The strategy teams at several major firms have turned bullish, such as GS, MS, and JPM.

As for the pandemic, SF was able to control the outbreak with strong stay-at-home measures. Sweden’s numbers are starting to deteriorate.

There is a lot of misinformation internationally about Swedens Corona situation. First of all, Sweden report most Corona deaths including at elder care homes, which not all countries do. Second the daily death rate is the reported death rate, which on the Swedish equivalent of CDC’s own homepage is attributed to the actual day of desease and it shows that the number of deaths have decreased steadily for about two weeks. This is confirmed by the number of people in intensive care, which is also declining and the expected surge in the last two weeks never happened. A randomised test a couple of weeks ago in Stockholm although limited to 734 people have led them to predict that Stockholm, hardest hit in the country, will reach herd immunity at the end of May. They point out that prediction is uncertain, though. They will continue to do randomised tests of larger cohorts every week going forward to get better estimates. Nothing is certain in this desease, but many things point to the fatality rate being much lower than commonly believed.

This Stanford study points in the same direction https://www.theguardian.com/world/2020/apr/17/antibody-study-suggests-coronavirus-is-far-more-widespread-than-previously-thought

Yes, Jan, this is an important study that shows the virus is far more prevalent in the population than first thought.

2. The case fatality rate is much lower than once believed based on this data from Santa Clara (!! Oops).

3. The only other data that rivals this study and is probably better than the Stanford data is from South Korea, where systematized population based testing was done. Unfortunately, I have not seen that the South Koreans have published their data.

4. If the Stanford data is correct, it will play into the hands of the naysayers, who have disbelieved quarantine, pooh pooed the idea that Covid 19 is not common flu. Politically, it will strengthen the case of DJT being reelected.

Here is a reference and a good discussion.

https://paloaltoonline.com/news/2020/04/17/stanford-study-more-than-48000-santa-clara-county-residents-have-likely-been-infected-by-coronavirus

This data from Stanford also questions the need for widespread population based testing. Furthermore, it also makes a case for a likely scenario where herd immunity may become prevalant much sooner than thought. There are further implications of this data, which I shall let the readers think over.

They tested all of the sailors and airmen on the aircraft carrier Theodore Roosevelt. The infection rate was high but most were symptom free.

https://www.reuters.com/article/us-health-coronavirus-usa-military-sympt/coronavirus-clue-most-cases-aboard-u-s-aircraft-carrier-are-symptom-free-idUSKCN21Y2GB

The symptom free characteristic may be attributable to the fact that these are mostly young men.

Here are the big policy question when it comes to whether to open up because the population has achieved herd immunity.

1) Was the test sample similar to the profile of the overall population?

2) These tests are only snapshots, so symptom free does not mean that people with the virus won’t develop symptoms later. There has to be monitoring to see how the infection affects those people over time.

3) Not at all clear whether people who were infected and symptom free have developed immunity, and how long the immunity lasts

The Mass. General study took samples from 200 residents on the street in Chelsea, MA. Participants remained anonymous and provided a drop of blood to researchers, who were able to produce a result in ten minutes with a rapid test.

Sixty-four of the participants tested positive – a “sobering” result, according to Thomas Ambrosino, Chelsea’s city manager.

https://www.foxnews.com/science/third-blood-samples-massachusetts-study-coronavirus

Jan and DV, the Santa Clara study is not yet peer reviewed and the statistical models have been widely criticized. Be careful with that particular study until it undergoes peer review.

UCSF Grand Rounds on the Epidemiology of COVID-19 from 2 days ago https://www.youtube.com/watch?v=04qsevCINhs&feature=share&app=desktop

Cam, all good questions. We still have more questions than answers.

Ellen, thanks for the comments. The Stanford study needs peer review, I agree.

Nice summary for the bull case. Thanks!

Thanks, Cam. That was a well researched and thought out newsletter.

Cam – Another great post. I think unless we have a vaccine or the data showing significantly lower mortality rate, I strongly believe the economy is heading to a severe recession in near-term at least.

However, I feel one issue that is not thoroughly addressed is the willingness of the Fed and the Congress to do “whatever it takes” and the resultant material and psychological impact on the investors and the market.

I also don’t think the Fed will withdraw stimulus for many years (over a decade?) to come. They haven’t withdrawn the stimulus injected during the GFC.

There will be more stimulus coming. America is only 18% of debt to GDP, as I write this. How about 50% debt to GDP or 100%? Why not?

That’s exactly what I am afraid of. This “pledge” may be pushing the markets up with momentum “algos” in the driver’s seat and the FOMO investors not too far behind.

I don’t think that is right, D.V. Our GDP is around $21 trillion and our national debt after these latest stimulus bills is around $24 trillion. That puts us over the 100% mark.

I don’t think D.V. was referring to the total debt, just the size of CV stimulus as a % of GDP.

Either way, there does not seem a logical limit on the size of stimulus given an eager Fed, an MMT-infected Congress and a debt-loving WH.

Anyways, just a reminder that the market can remain irrational longer than one can remain solvent.

Powell stated that the Fed’s financial support to the economy was unlimited. I don’t know if some of that was just rhetoric and if there would really be a point where they would feel they need to back off.

Thanks Sanjay for your insightful comments.

The proof is in the pudding. Actions speak louder than words. I think with their actions, the Fed has convinced the investors they will do “whatever it takes.”

Wally, you are right, the US debt to GDP is now past 100%. Thanks for pointing that out. That said, Covid related stimulus by the US is around 12% of GDP; Spain, France, UK, Japan and Germany are between 15-20% of GDP. This is what I meant to be saying, that the US could and will expand the current stimulus to much higher levels if needed. Here is the reference source;

https://www.schwab.com/resource-center/insights/content/market-perspective

Thanks, D.V. I see what you are saying now. The U.S. has a ways to go to equal the spending of some of the European countries and Japan. I guess that tells us that the Fed and our lawmakers won’t be shy if they think the economy needs trillions more in stimulus. All this shaking of the money tree worries me.

Thanks Cam, another great post.

I’m located in TX and our governor is easing restrictions next week. The related news regarding Singapore is alarming, and I suspect major urban areas will experience a sharp increase once these restrictions are eased.

As for bullishness, fundamentals still do matter. Its a question of when the market will factor in the risks outlined above. What’s the saying? “Sell in May and go away”

Speaking of “Sell in May and go away”

https://www.marketwatch.com/story/sell-in-may-and-go-away-is-a-warning-to-stock-investors-now-more-than-ever-2020-04-17?mod=mark-hulbert

The impulse to return to normal life is understandable, but viruses are good at exploiting the (highly predictable) behaviors of homo sapiens and the unintended consequences of human nature.

Of course, it’s the effect of the virus on the economy that concerns us. There’s a great deal of uncertainty and fear, and whether and how people return to normal spending is unclear. Anecdotally, we know of two graduating seniors who declined admission to Cornell in favor of staying closer to home – whether it’s fear of being away from home/ traveling to New York, or affordability concerns by parents, or something else entirely – well I don’t know. Just one example of a notable change in plans due to Covid-19.

We’re hearing some encouraging data, and some areas of the world are preparing to reopen. But I think the uncertainty and fear will continue for many more months, and depending on cultural norms and of course positive outcomes in regions/ countries that reopen early – consumer behavior may return to normal by next year. I just don’t think we’re going to see ‘normal’ this year.

What really strikes me is the contrast between San Francisco and New York. Mayor London Breed shut down the city several days ahead of Governor Newsom’s statewide order – as a result, San Francisco has ~20 fatalites, compared to >13,000 in NYC! The state of California reports a little over 1000 fatalties, compared to over 17,000 in New York. I’m sure the per capita comparisons are just as striking.

So I think it’s clear that social-distancing works. It comes down to weighing the pros and cons of containing the virus versus the economic devastation of sheltering-in-place. And I think the accuracy of earnings and market forecasts comes down to correctly predicting the behavior of governing bodies.

After further thought, let me amend my last statement. It’s not the decisions of governing bodies (re when to reopen the economy) that will determine a company’s bottom line this year or next – rather it will be when consumers decide to resume normal activities and spending patterns. Two entirely different decisions.

Charlie Munger, the genius half of Bershire Hathaway, said wisely, “If you want to know where someone is coming from, see how they are compensated.”

Goldman has clients who trade on which they make commissions. If they thought it best to park money in T-bills for three months, would they announce that?

Money managers of active mutual or private funds don’t want clients pulling money out to reduce risk. They too will be very positive.

Newsletters like Motley Fool make money giving long-only stock tips. They miraculously found these every day as the market plunged. Will they say “Stay out of this dangerous market” No, that risks losing subscribers.

Cam’s newsletter is different. He tells it like it is both up and down and his subscribers want to hear the good and the bad for his compensation and referrals for new subscribers.

With my clients, I’m totally compensated by a flat fee. My goal to earn more is to make more money. If that means being in cash or T-bills or bonds, fine, clients just want a return. And my stated policy with them is that I aim for an absolute return with minimal drawdowns. In my opinion, that is what investors want and very few portfolio managers offer. That will change due to client demand as investors become more risk averse after being bitten in 2008 and now 2020.

Are you saying there is a conflict of interest when in comes to Wall Street?

I expect you’re saying that tongue in cheek.

Yes, Lol.

BTW We should all show our appreciation for Cam’s incredible work by referring our friends and colleagues to his newsletter. After reading this newsletter, go into your email list and send a strong positive message to subscribe.

Cam, can we get you to authorize us to send out today’s letter as a sample.? Or offer a short trial for new referral?

it is difficult for me to modify the settings to open up articles before the 4-week quarantine period, but I suggest the following for free samples:

1) Last week’s bear case was summarized in Marketwatch:

https://www.marketwatch.com/story/why-the-stock-market-is-nowhere-near-a-bottom-and-investors-can-expect-a-massive-hit-2020-04-13

2) Anyone can see a preview of this week’s publication here:

https://humblestudentofthemarkets.blogspot.com/2020/04/the-bull-case-and-its-risks.html

Thanks Cam. I promise to email those with a positive message to at least a dozen people.

Another bull case is coming our way. It is the economic models, particularly the sensitive short-term ones, that have been highly successful in identifying bear market low points in the past. They are turning up in a similar way to previous low points but for the first time ever I don’t trust them.

Why, because a large part of these sensitive indexes are corporate bond spreads. At economic and stock market lows in the past, spreads that have blown out before the low, start to narrow fast. That happened at the beginning of 2019 for example. This was a true investor driven market value discovery event.

But the latest peak and sharp fall in spreads from BBB to CCC has been artificially created by the Fed buys massive amounts of corporate bonds even down to junk. This index used to be a true market price discovery and now it’s manipulated. When they have bought their maximum, we will get back to seeing where spreads should be given default risk in the real economy.

You can also see from the false positive from the yields spreads that this will give the A.I. models and algorithms a false positive too.

This is where judgement beats an algorithm. The Fed had never done this before and the machine bots haven’t been programmed to doubt the false data.

I think algos know. You can ask guys who designed the algos. But game theory would tell them not to care. To them, it is not false data. It is tradable data.

To elaborate on Jan’s posts and links on the Swedish Coronavirus model an interesting article in “Reason” discusses the Swedish model and it’s pros and cons concluding:

“We don’t know whether the Swedish model is better or worse yet. What we do know is that Sweden has not cracked down on basic liberties like others have, and has not wrecked society and the economy to the same extent. ”

https://reason.com/2020/04/17/in-sweden-will-voluntary-self-isolation-work-better-than-state-enforced-lockdowns-in-the-long-run/

Me personally, I’m a big fan of Swedish models.

My favorite Swedish twins here:

blob:https://www.youtube.com/9e16bc7b-370d-433d-b999-1fc80a3faf16

Re the many data points we have about the virus, as well as the nature of data itself, sharing some recent interesting comments from the San Mateo County Health Officer:

DATA. There has been some concern expressed that we’re not being transparent enough with the data. Everyone would like more data. Well, I too would like more data. There simply is not a lot of data either about the virus itself, how and why it spreads so easily, how and why it causes such devastating disease in some folks, or how it’s spreading here. For those who are deeply steeped in working with data, as I and my staff are, you know that datasets have their own personalities, their own strengths and their own weaknesses. You know that data can either lead you to an approximation of the truth, or data can mislead you and cause you to make incorrect conclusions and, therefore, take wrong actions. The data we have is, simply, very limited. This is based on the facts that many characteristics of the virus are unknown and that testing remains very constrained here. This requires us to synthesize estimates from very different sources of data that may be more qualitative in nature. For the data that is put up on our website, except for the hospital level data, which is mostly accurate, I tend to look at it skeptically, specifically the cases and the deaths, not because those aren’t accurate from what we know, but because they don’t reflect what’s actually going on very well. People generally want data to be able to make informed decisions about lowering their risk. The data we have, if it were to be presented to you on a more granular level, would be misleading, and I believe, downright deceptive. This is what I think you need to know. This virus appears to be wildly transmissible especially within households or congregate settings. Your risk from contracting the infection from any human you encounter in San Mateo County and outside your immediate household continues to be substantial unless you take all the recommended actions to protect yourself. I hesitate to give you the following numbers, because first of all they are a guess, and secondly because some will think they are too low to take action. My best guess is that approximately 2-3% of the SMC population are currently infected or have recovered from the infection. That’s around 15-25,000 people and they are all over the county and in every community. I don’t believe this number is off by a factor of 10, but it could be off by a factor of 2 to 3. Without the SIP, it could have well been over 50-75,000 by now, and that would have overwhelmed our healthcare system. So if you want to get a sense of how many infected or recovered cases are around you, just multiply your city population by 2 or 3%. My best guess on the number of people who are capable of transmitting the virus now is just under 1%, or approximately 5-7,000 people. These numbers are likely to be more accurate than the numbers we are sharing on our website. I know that sounds ridiculous, but these estimates are better than the direct counts that I can currently provide you. That’s the status of our testing data at the moment. I anticipate, and am hopeful, that our estimates will improve remarkably over time.

Scott Morrow, MD, MPH

San Mateo County Health Officer

April 13, 2020

More useful stuff on global data with helpful explanations re what the numbers can and can’t tell us.

https://ourworldindata.org/coronavirus

Cam-

Being an insider in the business yourself (or at least having been one) – how much of market movement can be attributed to insider trading?

The extent of the retracement rally we’re seeing is perplexing to just about everyone. In addition, Sentimentrader recently pointed to record long positions by hedge funds in equity futures. It becomes less perplexing if we wake up one morning to lets’ say news of direct purchases by the federal government of equity ETFs. It may not even be insider trading per se – simply the Fed placing a floor under the market by remaining silent while brandishing a large stick. That’s the kind of thing that keeps me from fighting this tape.

The goal of global central banks is to keep deflation at bay. I have said it many times before and I will say it again.

Central banks print money to stave off deflation, but look the other way when asset bubbles are formed. You may ask what asset bubbles? Tech bubble, circa year 2000 was one. Housing bubble circa 2005 was another. Treasury bubble as I write this is another. Has the Fed done anything about these? Nothing. Nada. Zip.

Now, let us look at the opposite . Whenever there is deflation (GFC, Corona pandemic), Central banks have eased monetary conditions.

So, the Fed looks the other way when asset bubbles are spawned and print money to stave off run away deflation when such asset bubbles are bust. Buy some gold, and do not sell.

When Powell says Fed resource is unlimited, and former fire fighting lieutenant Kashkari concurs, and Trump is hellbent on reelection, what would you do?

There is no more price discovery. The whole nation is financialized at every level and every market is tightly interconnected. When everyone’s (and America’s) future is so dependent on market performance, what do you think Government would do?

A concept of centralized asset administration by Government would have to be accepted in order to make money in the markets from now on. Pick you pill, red or blue.

Spot on. I rather pick a green pill!!

When Fed started buying HYG, you know game is on. When Financials and REITs start real moves you know game is really on.

Managing an economy simply doesn’t work. Look at USSR and Cuba. Too complex with too many unintended consequences. You end up playing Whack-a-Mole as problems arise unexpectedly.