Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Bearish

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Returning to normal?

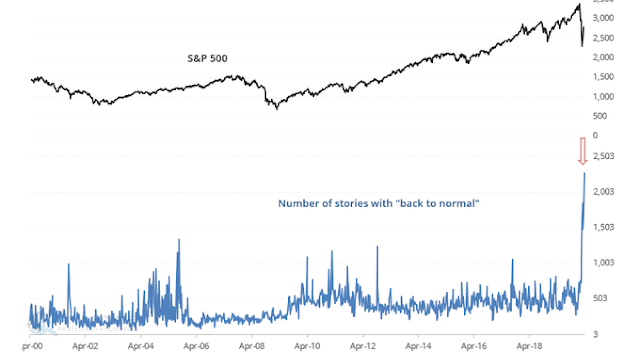

SentimenTrader highlighted a surge in media stories with a “back to normal” theme. He added that “Many of these stories are from the same people calling for another market crash at the bottom in late-March”.

He also observed that hedgers (not HF speculators) are long equity futures up to their eyeballs. Past episodes have been resolved with market rallies. However, I would note that there is a catch. Past signals have either been coincident with market bottoms, or slightly late.

Is the market back to normal, or are we just late in the reflex rally?

Bullish with a *

The tape has been bullish for the last two weeks, and I would characterize the tone as bullish, with an asterisk. While the short-term action has taken a risk-on quality, there are plenty of intermediate term warnings which have no obvious short-term bearish catalysts.

The S&P 500 has advanced while supported by rising RSI momentum. The stochastic has been unable to recycle from an overbought condition, which could indicate the start of a series of “good overbought” readings that accompany a market grind-up. Arguably, there is a minor negative 5-day RSI divergence, which could be a concern if it develops further.

The stock/bond ratio has also broken out of an inverse head and shoulders formation. The measured upside target calls for a 6% gain in the stock/bond ratio, which could foreshadow even a greater gain for stock prices. For example, stocks could rise by 8% and bonds fall by -2% and the ratio could reach its target.

“This will not end well” warnings

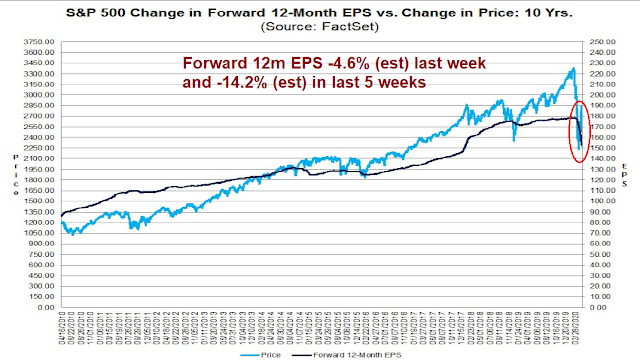

On the other hand, the current environment is beset with numerous longer term “this will not end well” warnings that do not have obvious short-term bearish catalysts. One concern is the divergence between stock prices and earnings estimates, especially as Q1 earnings season gets underway. Stock prices have recovered part of their losses, but forward 12-month estimates are skidding badly. Something’s got to give.

The combination of rising stock prices and falling estimates is bringing the Rule of 20 into play. As a reminder, the Rule of 20 flashes a warning whenever the sum of the market P/E and inflation rate exceeds 20. As of Friday’s close, the market’s forward P/E ratio was 19.0. While I would normally use CPI as a proxy for inflation, CPI is a backward looking number and overstates the inflation rate in a potentially deflationary environment. I substituted the 5-year, 5-year forward inflation rate expectation instead as a more forward looking indication into the Rule of 20 calculation. The result was 20.4, which is above 20 and represents a valuation warning signal for equities.

Excessive valuation can take some time to resolve. While this is useful to long-term investors, high valuations are not actionable short-term trading signals. However, there are also some warnings from a technical analysis perspective.

David Keller pointed out that “secular bull markets have seen monthly RSI remain above 40, while secular bears have seen that level broken early on. The bad news is the first selloff 1929 didn’t break RSI 40 either 🙂 Just a reminder that selloffs can get a lot worse!”

From a shorter term perspective, bad breadth is raising a cautionary flag. The NYSE Advance- Decline Line has not confirmed the recent highs and lags the market. In addition, the price momentum factor (bottom panel) is exhibiting a worrisome pattern of lower highs and lower lows. However, these kinds of negative divergences can last for weeks or even months before they resolve bearishly.

As well, can anyone explain why defensive sectors like consumer staples, utilities, and real estate are in relative uptrends even as the stock markets rose? Defensive stocks are supposed to outperform when the market falls, and lag when the market rises, not the other way around. I fully understand why healthcare stocks are showing relative strength in this environment, but what about the other defensive sectors?

In addition, Jim Bianco pointed out that while NY and NJ infection rates appear to have stabilized, the same cannot be said about the rest of the country. Another shoe may be about to drop, especially if individual state governors decide to relax social distancing guidelines.

On a knife edge

Looking to the week ahead, the jury is still out on whether the bulls or the bears have the upper hand. As the SPX tests the 50 day moving average (dma) from below, here are some key questions that need to be answered.

The market is overbought, but is the overbought condition bearish, or a signal of a series of “good overbought” conditions that accompany a grind-up advance?

Short-term market internals like equity risk appetite are showing mixed signals. Which way will it turn?

My former Merrill Lynch colleague Fred Meissner suggested that one way to watch for a long-term bullish revival is to monitor the behavior of small cap stocks. Small caps (bottom panel) have usually outperformed as the economy emerges from recession. In fact, fresh bulls are normally marked by changes in leadership, but the old leadership is still intact: US over global stocks, growth over value, and large caps over small caps.

As the index flirts with its 50 dma, my inner trader is listening to the market to determine its outlook. The rally off the March lows was mainly a short covering rally. Short interest is now at multi-month lows. While a low level of short interest could ultimately prove to be bearish, there is no bearish catalyst on the immediate horizon.

While we cannot know how all traders are positioned, we do know that commodity trading advisors (CTAs) are roughly neutrally positioned. Economic momentum, as measured by ISM, is negative, but price momentum is positive.

While my inner trader has been short the market, he is waiting for a sign from the market action early next week. If the rally were to continue, he will cover his short positions and step to the sidelines. On the other hand, the market appeared to be topping out last week until the Gilead drug remdesivir news hit the tape late Thursday.

My inner investor remains highly skeptical of this rally. He is in a position of maximum defensiveness and he has selectively sold call options against existing longs.

Disclosure: Long SPXU

Explain defensive performance: My theory is that participants know a downturn is coming, but the music is still playing. Musical chairs, so dance defensively.

I don’t understand your question.

Not a question, an answer.

or as it was put in the movie “Margin Call”: “All I hear is silence”

https://www.youtube.com/watch?v=UOYi4NzxlhE

Dear Cam, I am also skeptical about the rally (but I made the same mistake in Jan2019). Do you have any levels for shorts liquidation or does it depend on the market behavior. From an intermediate term perspective I see a high risk of the people behavior in the US (Florida – beaches without masks, protest actions without masks and distance, …). What do you think? Thx for answer and thank you very much for your posts.

I have generally agreed with Cam’s analysis, and in hindsight short covering has undoubtedly driven the market off the lows. But that is also how rallys begin. In the last week or so good news has been seen as very good (Gilead) and bad news ignored (earnings, economy, Trump). That is the definition of a bull phase. Hasn’t this episode been all about momentum, both on the downside and now on the upside, that technical and fundamental analysis has missed?

I agree with you, that traditional analysis has missed this momentum driven event.

In retrospect, we saw the same in the last quarter of 2018 (High momentum and reversal).

Once this countertrend rally peaks out, we will get a better feel for the market. See Cam’s take on the next week. That said, some of the larger US states are opening for business (Texas, Florida ? Caliphornia). Ohio is closed but tugging at the leash to open (Golf courses are open in some parts FWIW, Lol). All of this is news that has the potential to promote a rally (!). Whether we get a second Corona wave, will determine whether the market takes it on the chin and if this current countertrend rally is a bear trap.

Personally, I am holding on to long positions, but barely, and very nervously and rather sell into strength and raise more dry powder. I remain highly skeptic of this rally, and have drawn a line in the sand at 3020 (S&P 500).

Well-respected technician and trader Peter Brandt sold every last share in his retirement account. Sees a massive H&S on S&P500. The right shoulder may peak between 2,800 and 2,950.

https://twitter.com/RealVision/status/1251503370747154434

Oh, wow!

Thanks.

Hi Cam,

You say ” there is no bearish catalyst on the immediate horizon.”

I would have thought in “normal times” the massively negative earnings reports coming up over the next couple of weeks should be enough of a catalyst.

Maybe people are looking too far “over the horizon”

Here’s a fearless prediction:

Corona Virus Vaccine by September – SPX up 5% Monday.

https://www.bloomberg.com/news/articles/2020-04-17/oxford-vaccine-veteran-lays-out-coronavirus-immunization-plans

This was the same UK researcher who said she was 80% sure of success. The vaccine had only been tested in animals, so they are very early in the testing process.

Reading between the lines, they are looking for funding and hence the hype.

DJIA CFD contract +20 points so very flat.

https://www.ig.com/en/indices/markets-indices/weekend-wall-street

Interesting to see on this link….. 52% of client accounts are short on this market.

Thanks Joyce- that headline could certainly raise optimism in the very short term, but “80% chance of a vaccine in 6 months” leaves just enough room for uncertainty to walk back the claim when it does not happen. Unfortunately I am seeing a theme with the Gilead Stat News article, the non-peer reviewed wildly optimistic Santa Clara article hyped by Wall St Journal, and claims of a vaccine in months. All pushing the most optimistic scenario as though it were fact, clouding the reality of what we are facing. It is hard but try to ignore the cheerleaders who mix science with business interests.

As an essential worker who just went back to work this weekend, I can tell you that we need testing period. Otherwise it is extraordinarily difficult to navigate the most basic aspects of any job. https://www.theatlantic.com/ideas/archive/2020/04/were-testing-the-wrong-people/610234/

After watching this I may never talk to anybody in person or eat out again.

https://abc13.com/6111559/

US Site for COVID-19 infection rate:

https://rt.live/

Lol, I get you. I just think of happy thoughts whenever I eat out or order food online hoping that my positive karma will prevent the deliverymen from spitting or eating my food.

Benny, I haven’t eaten out or ordered takeout for over a month. I’m learning I can live with the wife’s cooking. LOL

Wally, you are right– some people may not realistically be able to do those things for a long time. If I did not have to work (I am in healthcare) I would not.

Ellen, I know that you said that you are working because you have to…. but, THANK YOU!

Thank you @jyl087! I am a physician, mostly outpatient but I have to go in for inpatient sometimes as I did this past weekend.

I think we may be looking at a new penny stock market. Imagine that the Fed and Congress have dumped somewhere between $5 trillion and $10 trillion dollars into the economy. Now, how much of that has found its way into the stock market which is around a $30 trillion market? If $5 trillion from the Fed and Congress flows into the stock market is that enough to push stocks back up to previous levels?

We know certain groups like pensions cannot divest themselves of stocks so how much does it take to push stocks to new highs? Are we dealing with Tulip Mania in a world gone mad? And had we better just jump on this bull freight train or at least get out of the way?

Good summary of likely timelines for ‘back to normal’ based on interviews with people in public health, epidemiology, medicine, and history:

https://www.nytimes.com/2020/04/18/health/coronavirus-america-future.html

Thanks for sharing this! Nice to get the experts’ views without the hot takes regarding magic bullets from Gilead, Wall St Journal takes on epidemiology, CNBC, etc painting an optimistic spin to keep the party going longer. There could well be a medical breakthrough but until that occurs and until we do wide testing we do not have any idea if or when that will happen.

I don’t put a lot of faith in what the NYT prints. I think we need to adopt the Swedish model (not the girl). Put everyone back to work, live life as normal but keep your distance and wear a mask. Then let the chips fall where they may – it will be over sooner that way, too.

Death rate is much higher in Sweden compared with neighboring countries by an order of 10.

Wasn’t it you who pointed out that they count it differently including nursing home deaths?

No. They also do not admit people over the age of 70 to the ICU in Sweden. I’d be careful being too sanguine with that approach if you care about anyone over age 70.

LOL, Ellen. Maybe it was Joyce. BTW, I’m over 70. Bring it on. It’s going to be 2 years before we see an effective vaccine, if ever. Studies are showing the antibodies are already in at least 1/3rd of the population.

Wally, I think this is the article you were referring to.

“Every time the government discovers that someone who had the virus has died, that person is registered as a COVID-19 death if it happened within 30 days of the diagnosis—even if the cause of death was cancer or a heart attack.

It means that Sweden reports the number of people who die with COVID-19, not of COVID-19.”

https://reason.com/2020/04/17/in-sweden-will-voluntary-self-isolation-work-better-than-state-enforced-lockdowns-in-the-long-run/printer/

Not going to get political but I personally trust the epidemiologists and virologists over a Reason.com author who works for the Cato Institute. lol

That’s one of them, Sanjay. Thanks.

Whatever, Ellen.

Reliable epidemiology studies at NEJM etc suggest ~ 13-15% immunity in the hotspots, 0.6-1.5% immunity in areas that are not hard hit. that would mean several rounds of what we saw in NYC to eventually achieve herd immunity at 60-70% without a vaccine. People talk a big game about “let’s open up,” but when it comes to their own lives they probably would run to the hospital at the first opportunity and not decline to be treated. Respectfully I don’t think people outside of healthcare who say things like “let’s open the economy” even know what they are saying. COVID is a gruesome and disgusting way to go and I would not wish it on anyone.

You are watching a lot of Americans go down the tubes as the lockdowns continue. And a lot of them are young people stuck in apartments with no way to pay rent, feed their kids, make the car payment, etc. Lockdowns should be voluntary. Everyone doesn’t have the monetary reserves that I and probably you have to wait this thing out. They also don’t have the space or the temperament.

When (if) this is all over there is going to be a lot of soul searching about the damage done not just to the economy but to people’s lives. How about printing a comparison of traffic deaths saved vs. virus deaths, etc? The lockdown is also unconstitutional according to more and more legal scholars. It is going to reach SCOTUS either before or soon after this is over.

Canada is giving its citizens $2000 per month to pay bills until this is over. The choice need not be to work and die or stay home and go broke. Fed just bailed out defunct companies with tax dollars, surely a brief period of universal basic income to keep the economy going would make sense. And honestly COVID is horrific. People drown in their own pulmonary fluid and die alone in their rooms with no funeral, no visitors.

$2,000 a month isn’t enough for most people to survive on and pay their bills. It also doesn’t keep the economy going. Besides, basic income is a dangerous path to start down even under these conditions. Increasing unemployment bennies is probably about as far as we should go go support families.

I’m well aware of the methods of death from lung, heart and other organ failure. But the choice isn’t between go to work and die or stay home. That is ridiculous.

Not that generous. CAD 2K every 4 weeks for a maximum of 16 weeks if you lost your income over COVID19. Includes self employed. With exchange rate at 0.71 that’s about USD 1400.

It’s all those living in apartments who live paycheck to paycheck who are hurting. I think if the economy is opened and masks required by most retailers and employers the contagion rate is not going to be a lot different than it is now.

I think mandatory mask usage (even with weak filters) would have significant effects on cov19’s transmissibility by way of limiting face contacts and limiting spread of larger droplets.

There are a lot of misinformation about the situation in Sweden which is a pity, because it could be a good example for a way out, if it’s successful. Sweden admits any age to ICU and there is free capacity. The latest antibody testing points to 20-30% of the population in Stockholm to have had or currently have Covid-19. Also, the Swedish way in this is not life as normal. It relies on people taking personal responsibility, which means as an example that restaurants are mostly open, but suffering and people work from home as much as possible. Vacation travel to popular areas during easter were down 90% not beacuse it wasn’t allowed, but because of personal choices. The best forecasts, both mathematically and testing, is still for herd immunity (60%) in Stockholm at the middle to end of May. From what I understand in the news is that Denmark got a wake up call when their antibody testing showed an estimated 3% immunity and it seems that they are starting to lean the Swedish way, but Norway will stay stricter for much longer.

https://www.project-syndicate.org/commentary/swedish-coronavirus-no-lockdown-model-proves-lethal-by-hans-bergstrom-2020-04

Agree. Thanks Cam!

I find this graphing approach useful: https://ourworldindata.org/grapher/total-covid-deaths-per-million?tab=chart&yScale=log&time=2020-03-27..&country=SWE+NLD+BEL+DNK+USA+GBR+NIC

It is interesting because many of these countries in particular have taken such different approaches.

I also find this viewpoint very refreshing https://www.youtube.com/watch?v=UcvIQJ-QurQ

Everyone has their own opinion and stats.

“From these simulations, it is clear that the Swedish government anticipates far fewer hospitalisations per 100,000 of the population than predicted in other countries, including Norway, Denmark and the U.K.”

https://www.forbes.com/sites/davidnikel/2020/03/30/why-swedens-coronavirus-approach-is-so-different-from-others/#367ca9e5562b

Quite so…this is from a UK commentator…(interesting side note, he is the brother to the fiery Christopher Hitchens (now deceased). They must have had interesting family dinners as one was a radical atheist and this commentator is Anglican 😉

https://hitchensblog.mailonsunday.co.uk/2020/04/i-find-it-incredible-that-it-is-now-five-weeks-since-i-wrote-here-we-have-gone-quite-mad-i-know-that-many-people-are-thi.html

Interesting article, Donald. A bit of a British slant from this guy obviously writing in Britain.

The one takeaway from the entire article, at least for me – don’t underestimate the virus.

To each their own but I will take Dr. Fauci over Dr. Phil every time. We need more testing before we open up. Period.

The Swedes may have significantly different demographics and attitudes. And that 75% drop in mobility cited below does not inspire confidence.

https://www.bloomberg.com/news/articles/2020-04-19/sweden-says-controversial-covid-19-strategy-is-proving-effective

” Pomeroy pointed to some Swedish characteristics that may be helping the country deal with the current crisis. More than half of Swedish households are single-person, making social distancing easier to carry out. More people work from home than anywhere else in Europe, and everyone has access to fast Internet, which helps large chunks of the workforce stay productive away from the office.

And while many other countries have introduced strict laws, including hefty fines if people are caught breaching newly minted social-distancing laws, Swedes appear to be following such guidelines without the need for legislation. Trips from Stockholm to Gotland — a popular vacation destination — dropped by 96% over the Easter weekend, according to data from the country’s largest mobile operator, Telia Company. And online service Citymapper’s statistics indicate an almost 75% drop in mobility in the capital. “

Sad to see this.

Exclusive: Neiman Marcus to file for bankruptcy as soon as this week – sources

https://www.reuters.com/article/us-neimanmarcus-bankruptcy-exclusive-idUSKBN2210CW

I know this store is on his way to demise, with or without this virus. When you see thriving Walmart, dollar stores, Costco, you know NM is going in the wrong direction. I remember NM is because I constantly received promotional emails back in Internet bubble days when I was a young engineer. The emails include peddling trips to Caribbean resorts like the one owned by Jeffrey Epstein. One mail caught my eyes and it was NM selling a submarine. I didn’t know why I received those kind of mails. But I figured out either our company got hacked or some HR or IT people did some illicit deeds, since I was working for a promising pre-IPO company. Some of my co-workers even went to Europe looking at some castles to buy. Many years now, quite of a few of them have lost their fortune and others actually doing much better. But I never forgot about NM selling a submarine.

That’s quite a story. I worked for a promising start-up a while ago as well as an engineer. A few of my colleagues borrowed and spent money they expected to receive in the future. But, never heard of anything like this.

It was surreal. Freeways in Silicon Valley are jammed any moment. People are comparing the sizes of their yachts. Sky is not the limit anymore. Can’t even find an apartment to rent. Restaurants are full. People at next tables are all some kinds of CxOs. Whatever, you got the idea. Went watch a movie one day and saw the company Exodus Communication nearby. On their the parking lot you only found brand new cars in BMW, Mercedes, Porsche and Ferrari. Its CEO, a woman based in NYC, commute weekly to Silicon Valley. Before movie starts, you are forced to watch long strings of commercials featuring companies looking for talents. A lowly starting engineer at SDL (only one of two companies in the world which can produce laser diodes used in optical networking gears) has an option worth 40 MM. Companies would send string quartet early morning to your doorstep to play for you and hopefully you will join them. Head hunters went into warp drive. I won’t continue. It is a bygone era to never return.

Every morning I went to work, people are checking stock prices. Work efficiency goes up and down following stock prices. If you call meeting before 1pm (pacific time, when market closes), nobody would show up. Even Dr. Koop joined the mania. Heard of Dr. Koop dot com?

Just looked up drkoop.com. Not surprising at all.

I was one of the first employees and helped shaped the strategy to provide SaaS (a decade before it became an acronym) platform to offer backoffice services to telecom businesses. Every employee we hired added ~$1M to company valuation irrespective of qualifications.

That was a good time to make some quick money, and set aside for bad times, like now.

I think I remember when they put up the sub for sale. I think it was a publicity stunt because they got stories about it in quite a few online news outlets.

I think NM has gone down the same path of J.C. Penny’s, Sears, Macys and others who used to be big name retailers but are either in bankruptcy or teetering on the edge.

Post-bankruptcy, they will all re-emerge but with a much smaller footprint. Should be good for the remaining survivors (ROST, SFIX, JWN, etc.)

Along w/ 24-hour fitness. Just the beginning

Mike Wilson from Morgan Stanley argues that investors are seeing 2020 as a “write-off” and are focusing on 2012 as “the year that counts” – he recently lifted his year-end SPX target to 3000 due to the stronger than expected monetary and fiscal intervention. He is bullish on small caps. While it remains to be seen how this plays out, the most recent Fed QE “tapering” is already being reflected in short-term gold weakness.

Jan – See my commentary from Saturday addressing Mike Wilson’s bullishness. Top down consensus 2021 EPS is 150. Even if you look over the 2020 valley market is trading at 19.2x 2021 earnings. Not cheap. If you use his 3000 target forward P/E is 20.

A 35% drop in crude oil and how is this bullish? The market is reacting by bouncing off overnight low.

The drop is mainly in the front contract because there is nowhere left to store the oil. I suspect the same will happen to other contract months as they roll to the front of the line.

WTIC front month ~7.90.

Probably back to 20 when it rolls over?

Crude trading at $1, LOL Heading to below zero before contract expires.

0.69->hard to keep up with this stuff!

-1.57->is that a first?

https://www.marketwatch.com/story/oil-market-in-super-contango-underlines-storage-fears-as-coronavirus-destroys-crude-demand-2020-04-17?mod=article_inline

https://www.marketwatch.com/story/us-oils-may-contract-has-just-gone-negative-plunging-154-and-trading-at-negative-10-a-barrel-2020-04-20?mod=bnbh_mwarticle

I may pump the water out of my pool and fill it with oil. LOL

I think the market should be a lot weaker given this oil price collapse. So, I’ve started lightening up my short position. It seems the Fed has taken control of the stock market. This should mark the top of the market for the rest of you. LOL

Yes that seems to be the only explanation

By the way, you are welcome. It seems that I’ve effectively put a cap on the market.

“Sweden’s Chief Epidemiologist: Our Open Approach To Virus Seems To Be Working”

https://www.dailywire.com/news/swedens-chief-epidemiologist-our-open-approach-to-virus-seems-to-be-working?utm_source=whatfinger

Well, the numbers and graphs don’t seem to support the Tegnell position very well:

https://www.worldometers.info/coronavirus/country/sweden/

The deaths per million (159) put them about 9th for larger population countries, and, interestingly, higher than the US (127).

And the US can hardly be called a copybook way of managing the effects and spread of this pandemic.

Does the 300% drop in Oil (May, the contracts in the far out months are down as well) prove that the fundamentals will eventually win despite the efforts of the Fed and the OPEC+?

May be this historic event will awaken the investors from their slumber?

Not buying this rally yet while being aware of the adage, “don’t fight the Fed.”

If there is a big shakeout in the fracking industry, one wonders how much debt will become unrecoverable. Must be a tad more than a couple of billion, I would thnk.

Congress will put up another $350 billion for small business on Wednesday. What’s a couple billion here or there?

Yes, Joyce. It is going to be more than a few billions.

https://www.ft.com/content/0b944cd4-7f01-11ea-b0fb-13524ae1056b

Neal Kashkari, current (not former) Chairman of the Federal Reserve Bank of Minneapolis, is advising banks to stop paying dividends and raise equity. He didn’t even mention the losses in the fracking industry which will dramatically shrink in coming months and probably (a few) years.

We have already heard stories about how US small businesses, having laid off their staffs, tell their landlords they will not pay rent until the crisis passes. The landlords then tell their bankers they will not make the mortgage payment. Multiply that example by thousands. The economic costs of the crisis eventually roll up into the banking sector.

Stress test modelling by the Minneapolis Fed indicates that under severe Covid-19 scenarios, large banks, those with assets greater than $100bn each, could together lose hundreds of billions of dollars of equity capital.

https://freopp.org/a-new-strategy-for-bringing-people-back-to-work-during-covid-19-a912247f1ab5

https://www.mercurynews.com/2020/04/20/feud-over-stanford-coronavirus-study-the-authors-owe-us-all-an-apology/

Can’t read that article, RX, unless I subscribe to Mercury News.

Thanks rxchen. That Santa Clara data still needs peer review! The Stanford investigators know that and they pre-released it anyway prior to peer review to make headlines. Flaws have been pointed out already. UCSF has superior coverage given its history with the HIV/ AIDS epidemic– follow Bob Wachter MD on social media for evidence-based updates.

Thanks. The guy’s twitter feed is a gold mine.

No problem! Wachter is brilliant! And the information is reliable, accurate, and parsed out well. Glad you enjoyed it 🙂

Some details of the objections here:

https://statmodeling.stat.columbia.edu/2020/04/19/fatal-flaws-in-stanford-study-of-coronavirus-prevalence/

Thanks!

Tony Dwyer, Sr. MD and Chief Market Strategist at Canaccord Genuity, surrendered to the Fed today. He was a steadfast believer in a retest until now. He is no longer expecting a retest and wants to get aggressive from now on. The market may retrace to 2,500 in his view but he’d be buying.

Don’t fight the Fed.

https://twitter.com/CNBCFastMoney/status/125234609593968230

“What If The Lockdown Was All A Big Mistake?”

https://thewashingtonstandard.com/what-if-the-lockdown-was-all-a-big-mistake/?utm_source=whatfinger

Hmmm… I would have to ask Italy, Spain and New York about that… not to mention Singapore and Japan.

LOL After all the article was written by Ron Paul.

Maybe the libertarian “Live Free or Die” needs to be changed to “Live Free and Die” in the covid era?

Can’t tell at this point if bad news is just the norm, or if its always been this way.

https://www.marketwatch.com/story/oxford-university-coronavirus-vaccine-to-begin-human-trials-on-thursday-as-uk-throws-everything-at-vital-breakthrough-2020-04-21?siteid=bnbh

At last count, there were about 200 initiatives all over the globe. Don’t get overly excited about any single trial unless it starts to show results.

Here is a list of the more promising treatments and vaccines being tested: https://graphics.reuters.com/HEALTH-CORONAVIRUS/yxmvjqywprz/index.html

As a reminder, it does not pay to hurry and cut corners. Google the Guillain-Barré Syndrome and the swine flu vaccine of 1976.

yep vaccines take 12 mo minimum due to safety testing. Listening to Fauci on this, that is Jan Feb 2021 at the earliest.

An antiviral treatment could be sooner. So far remdesivir randomized controlled trial not available so any excitement about it is premature.

“Scientists at Oxford have previously said the aim is to produce a million doses of the vaccine by September.”

Do the Brits have a legal way to bypass the testing that is required by the FDA in the U.S.? If so, I don’t think the FDA will approve it for use here.

P.S. Maybe most of Hollywood would fly to England to get the vaccine only to find out there is a nasty (and deadly) side effect for many. That may not be a bad thing.

In spite of the difficulty in finding a vaccine for this coronavirus there is hope that something novel will be found given our state of technology today that will be effective. It seems to me that if something is found that will impart immunity to this virus it may have an added benefit of giving us immunity to the common cold.

But, I don’t believe this is going to be easy or even possible since we have been trying to cure or create immunity for the common cold (which is a coronavirus) for decades unsuccessfully.

Time to short?

Market breaking down technically, but looks oversold. We should bounce on Wednesday, which could be a decent short sale entry point.

Cam, how does the internals look today? Good time for a short entry point>

Rising trend line broken yesterday. Today’s bounce not a big surprise as market was oversold.

Not a bad short entry point, but I wouldn’t go all-in.

Thanks Cam.

Thanks, great call.

This may be a reason that an effective vaccine will never be found. Just like the common cold, we may be living with this forever.

https://www.foxnews.com/science/coronavirus-mutated-at-least-30-different-strains-study-finds

What’s your take on this, Ellen?

https://www.marketwatch.com/story/fda-approves-first-coronavirus-test-that-allows-self-swab-at-home-2020-04-21?mod=mw_latestnews

If its covered by insurance, should be a step forward. I’ve used LabCorp for testing before. Reputable company.

Good to know, Alex. I think the the convenience and relative comfort of self-testing more than makes up for the longer turnaround time.

Looks promising, rxchen! We need testing and contact tracing and this is a first step.

I used LabCorp once for some tests. To make a long story short, they made a mistake on one of my tests that ended up costing me a couple thousand dollars out of pocket. They refused to cover my costs for their error.

Mr. Ciovacco is increasing the odds of a retest now.

Failed breakouts…

https://www.ccmmarketmodel.com/short-takes/2020/4/21/market-failures-near-key-levels

https://www.marketwatch.com/story/cdc-director-warns-second-wave-of-coronavirus-could-be-even-worse-2020-04-21?mod=mw_latestnews

Most reliable estimates so far are 13-15% seroprevalence of antibodies in the worst hotspots, 1.5% or less seroprevalence in low prevalence areas. I don’t see how we avoid another season of it. If we got really lucky the virus would mutate or someone develops a therapeutic drug. but that is not the base case.

Interesting study. Might explain a lot of variability that confuses many questions. NY strain may be very virulent.

Coronavirus’s ability to mutate has been vastly underestimated, and mutations affect deadliness of strains, Chinese study finds

https://www.scmp.com/news/china/science/article/3080771/coronavirus-mutations-affect-deadliness-strains-chinese-study

Allan, I think we need to start being careful where we get our news about the Coronavirus. China, Russia and maybe Iran seem to be putting out FAKE NEWS aimed at America.

https://www.msn.com/en-us/news/us/chinese-agents-spread-messages-that-sowed-virus-panic-in-us-officials-say/ar-BB131WjA

Absolutely agree.

These comments by Dr Fauci et al from Feb 28 seems pretty level headed, and it written in a reputable source. I think in times like these we must almost triangulate each source to validate it:

“….On the basis of a case definition requiring a diagnosis of pneumonia, the currently reported case fatality rate is approximately 2%.4 In another article in the Journal, Guan et al.5 report mortality of 1.4% among 1099 patients with laboratory-confirmed Covid-19; these patients had a wide spectrum of disease severity. If one assumes that the number of asymptomatic or minimally symptomatic cases is several times as high as the number of reported cases, the case fatality rate may be considerably less than 1%. This suggests that the overall clinical consequences of Covid-19 may ultimately be more akin to those of a severe seasonal influenza (which has a case fatality rate of approximately 0.1%) or a pandemic influenza (similar to those in 1957 and 1968) rather than a disease similar to SARS or MERS, which have had case fatality rates of 9 to 10% and 36%, respectively.2

The efficiency of transmission for any respiratory virus has important implications for containment and mitigation strategies. The current study indicates an estimated basic reproduction number (R0) of 2.2, which means that, on average, each infected person spreads the infection to an additional two persons….”

https://www.nejm.org/doi/full/10.1056/NEJMe2002387

https://www.wsj.com/articles/u-s-adversaries-are-accelerating-coordinating-coronavirus-disinformation-report-says-11587514724

“Our federal constitutional rights don’t go away in an emergency.”

https://www.foxnews.com/politics/barr-doj-may-side-with-citizens-who-sue-states-over-coronavirus-restrictions

Global infection rate seems to be increasing.

https://www.worldometers.info/coronavirus/