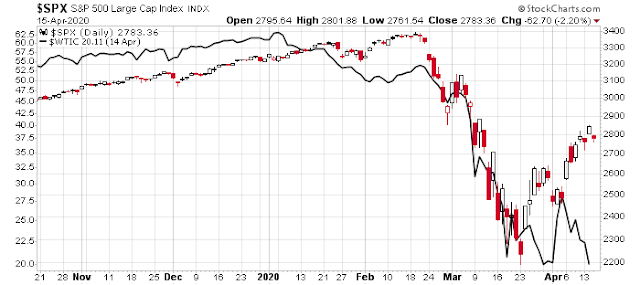

Mid-week market update: Back on March 9, 2020, which seems like a lifetime ago, I declared a recession (see OK, I’m calling it). The call was based on the combination of a coronavirus epidemic in China that disrupted supply chains that began to spread to other countries, and tanking oil prices due to a Saudi-Russia price war. Since then, stock prices cratered, and recovered to stage a strong rally on the back of fiscal and monetary stimulus.

During this rally, what the market seems to have forgotten about is the recession, which has historically been bull market killers. Moreover, recessionary bear markets take a considerable amount of time to resolve themselves.

In the short run, a number of worrisome divergences and risks have begun to appear during the course of the latest stock market rally.

Can the market ignore $20 oil?

The first divergence is stock and oil prices. Despite the news of a massive OPEC+ deal to cut output by 9.7 million barrels per day, oil prices continue to be weak. Remember, falling oil prices in 2015 led to a mild industrial recession.

As well, CNBC reported that skidding demand from the COVID-19 pandemic has erased 10 years of oil demand growth.

The International Energy Agency (IEA) said Wednesday that it expects the coronavirus crisis to erase almost a decade of oil demand growth in 2020, with countries around the world effectively having to shut down in response to the pandemic.

A public health crisis has prompted governments to impose draconian measures on the lives of billions of people. It has created an unprecedented demand shock in energy markets, with mobility brought close to a standstill.

The price war didn’t help matters, but the truce concluded to cut production may not be enough as demand is still far short of supply. The WSJ reported that oil producers is running out of storage, which is creating the unusual problem of negative prices in some grades.

While U.S. crude futures have shed half of their value this year, prices for actual barrels of oil in some places have fallen even further. Storage around the globe is rapidly filling and, in areas where crude is hard to transport, producers could soon be forced to pay consumers to take it off their hands—effectively pushing prices below zero.

Can the stock market ignore $20 oil? Is this a negative divergence that investors should worry about?

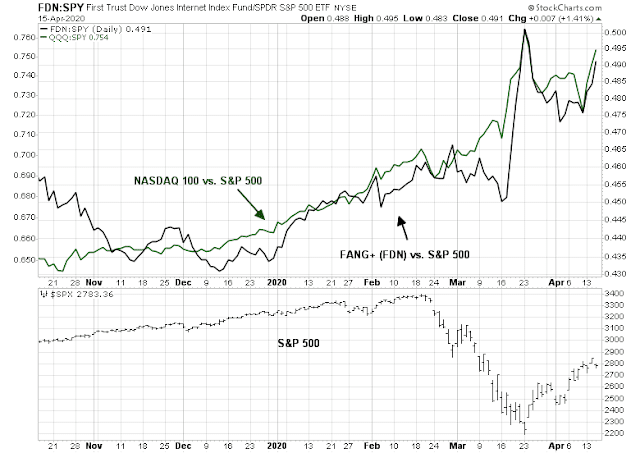

The work from home illusion

As many of us hunker down and work at home, the shares of Amazon and Netflix reached fresh highs as investors piled into these stocks as a work from home (WFH) refuge. Indeed, the NASDAQ 100 and FANG stocks have maintained their leadership during the latest period of market turmoil.

However, there are troublesome signs that this narrow leadership has become increasingly unhealthy for the stock market. The market concentration of the top five names (MSFT, AAPL, AMZN, GOOG/GOOGL, FB) is now higher than it was at the height of the NASDAQ Bubble.

As John Authers of Bloomberg recently warned that an over-reliance on past winners is not necessarily a winning investment strategy:

Generally, buying the largest stock in the S&P 500 over history has been a bad idea. Such stocks have nowhere to go but down. Just in the last 30 years, General Electric Co. and International Business Machines Corp. both spent a lot of time at number one, as more briefly did Coca-Cola Co. and Cisco Systems Inc. In the case of FAMAG, buying the leading juggernauts, holding them, and waiting for them to extend their lead over everyone else has been the right strategy for at least half a decade.

When you buy a stock you are buying a share of its future profits, not its past. Are these companies really going to stay this dominant into the future? A market this narrow suggests that some bad news, or reason to shake confidence in one or more of the FAMAG stocks, could shock the whole market. While confidence in them remains this strong, though, the main index is unlikely to go back to its lows of March.

There are signs that the beneficiaries of the WFH investment theme could be about to break. The WFH trend is mainly a middle class and affluent white collar trend, but these jobs are not immune from the downturn. The WSJ reported that jobs that were previously thought to be safe are now the subject of a second round of layoffs:

The first people to lose their jobs worked at restaurants, malls, hotels and other places that closed to contain the coronavirus pandemic. Higher skilled work, which often didn’t require personal contact, seemed more secure.

That’s not how it’s turning out.

A second wave of job loss is hitting those who thought they were safe. Businesses that set up employees to work from home are laying them off as sales plummet. Corporate lawyers are seeing jobs dry up. Government workers are being furloughed as state and city budgets are squeezed. And health-care workers not involved in fighting the pandemic are suffering.

The longer shutdowns continue, the bigger this second wave could become, risking a repeat of the deep and prolonged labor downturn that accompanied the 2007-09 recession.

The adage that it’s a recession when your neighbor loses his job but a depression when you lose your job is starting to dawn on a lot of people. A Ziprecruiter survey indicates that the slowdown is also hitting white collar jobs, such as professional and business services, finance, and IT.

The slowdown is affecting even previously “safe” professions like law:

Law firms have had to reduce staff and cut pay as courts are largely closed, settlement discussions are on pause and few new deals are being struck.

New York City-based Cadwalader, Wickersham & Taft LLP, a 400-attorney firm specializing in financial services, has reduced associate salaries by 25% and partners are not currently receiving compensation. Firms typically lay off attorneys only as a last resort, but another New York-based firm, Pryor Cashman LLP, is furloughing some associates. A spokesman said it expects to recall them soon.

Baker Donelson, a 700-lawyer firm with some 20 offices in the Southeast and mid-Atlantic region, has reduced compensation for associates and staff by 20%. Timothy Lupinacci, the firm’s chairman and chief executive, said some clients have asked the firm to stop work or defer payments. “Law firms are not going to be top of the priority,” he said.

How we work from home isn’t the problem, said Karen Richardson, executive director at the National Association of Women Lawyers. “It’s: Will there be work for us to do?”

This second wave of layoffs will undoubtedly reduce the demand for WFH services from providers such as AMZN and NFLX. Moreover, March retail sales printed a downside surprise of -8.7% this morning, indicating a weakening economy.

When this all break the stranglehold of the FANG+ names? Watch carefully, and stay tuned.

Bullish exhaustion

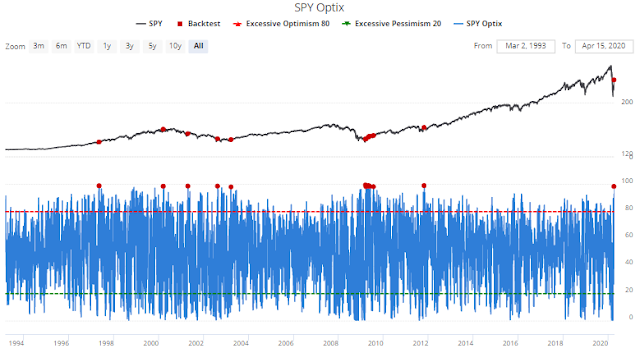

From a tactical perspective, SentimenTrader observed that their Optimism Index (Optix) had spiked to an excessively bullish short-term optimism level. Such readings have usually resolved themselves bearishly over a one-week horizon in the past.

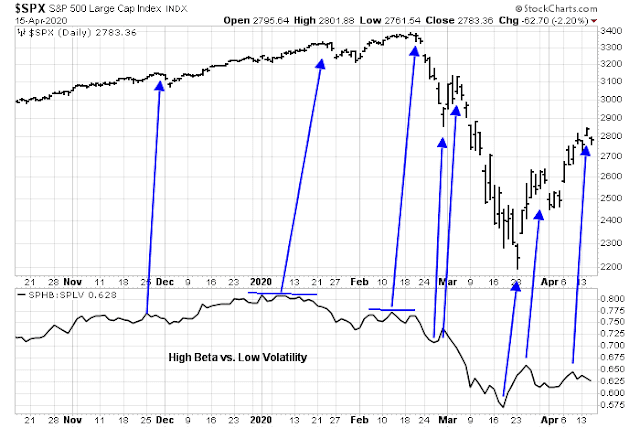

In addition, my short-term indicator of High Beta to Low Volatility stocks is turning down, indicating a loss of equity risk appetite.

The combination of last Monday’s failure to flash a Whaley Breadth Thrust buy signal (see Fun with analogs and breadth thrusts) and this week’s market action are indicative of bullish exhaustion. In the short run, the path of least resistance is down.

Disclosure: Long SPXU

I can confirm in my corner of the world that white collar working like myself are seeing layoffs, and that the 2nd wave is real.

Law firm friend’s company laid off most of the staff outside of the partners.

Couple of tech firms we work with are getting ready to do layoffs as part of their earnings release.

My firm did a 15% lay-off as part of “an acceleration of planned resource optimization.”

All of my friends that had been between jobs when this hit have either had offers rescinded or interviews delayed.

Its going to get worse with each successive week that the economy is shutdown.

I have a few friends in oil and gas, and they’re either been laid off or counting the days.

I just finished a presentation by one of my favorite political commentators, Ian Bremmer, head of the Eurasia Group. He made a simple, forceful, almost stupidly obvious statement on how this ends: N95 MASKS FOR EVERYONE.

It WORKS, in Taiwan, S. Korea, Hong Kong. Taiwanese students wear masks all day long and even have little dividers between students during lunch and yet there are no large breakouts.

The problem is cultural. We in the west think they are somehow emasculating or something like that. We know that staying home works. Ian’s simple message is that with reasonable care and universal mask wearing, we can drastically cut the “R nought” of CV19. It doesn’t mean we’re all going to pack into rock concerts or airplanes again soon, but opening up more of the economy sooner can absolutely happen if we use common sense.

Finally, on a personal note, I had to go in for the dreaded “swab”. Let me tell you, it was not fun, and neither is this “flu”. I had visions of going to the hospital to see doctors in “Ebola space suits”. Nope. Just ordinary N95 masks, goggles and gloves.

” N95 MASKS FOR EVERYONE.”

Exactly. It’s so damn obvious. Make it the law.

Or, a great depression. What we’re choosing. To protect the idiots in charge from a speck of accountability.

I don’t know why they were even debating whether masks were effective. Of course they are! But you also need eye protection as you can get the virus through the eyes.

I had to go to Costco this week to pick up some medicine at the pharmacy. I went during the senior hour 8-9 AM. Most people had masks and regular glasses and some with surgical gloves. A few weren’t even wearing a mask including the employees which surprised me. I was wearing my black N-99 mask and 3-M glasses that have a seal around the eyes. I looked like a bank robber or a alien robot. LOL

Many people were flocking to the paper isle but I managed to grab a large bag of Charmin TP and some Bounty paper towels. I was actually surprised they had any name brands available. Probably not for long.

Yesterday when the market was at its recovery high from the March 23 low, I was reading the IMF report on how we are going into the worst global economic crisis in history including the Great Depression. I decided to calculate the drop in the S&P 500 from year end 2018 to yesterday and found it was down 11.8%. I could not believe my eyes. This was one of the most absurd things I’ve seen in my career. Only 11.8%!!!

Just think about this. Entering 2020, S&P 500 earnings were projected to grow about 10%. Now they are expected to fall 10% and many strategists think the number will be much lower. We expected a growing US and global economy with the friendly Fed lowering interest rates and Trump a stock market cheerleader to the November elections. We, instead have a disastrous pandemic with a global business freeze of unknown length and depth. We don’t know the long term social consequences. We have a panicked Fed desperately trying to stave off financial collapse.

And with this the market is down only 11.8%???? Hell, at the beginning of this year, there were lots of learned commentators who thought markets needed a 10% correction because the market was richly priced even with a favorable outlook.

To me, this means investors are wildly optimistic and oblivious to the reality of what nastiness is about to hit us. They have their head buried in the sand and their asses are about to get kicked.

Thanks Ken!

We’ve only seen the tip of the iceberg in terms of fallout. I’m sure there will be ripple effects and unintended consequences none of us are able to foresee at this point. We all have friends, neighbors and acquaintances who are (rightfully) worried about putting food on the table and keeping a roof over their heads – furthermore, they have little to no control over the outcome(s). This is no ordinary recession.

Cam, I am wondering if the “two red days in a row” indicator would be appropriate here to signal immediate market weakness. Similar to how you used the “two gree days in a row” back in late March. Thanks.

Thoughts about “dark pool buying” as it relates to SPX price? I’ve seen this referenced frequently recently. Thanks.

I failed to see the logic behind lockdown as currently implemented. When you plan things, you need to see two steps ahead. What’s next if you don’t test people in large enough number? We need to know who is already immune, at a minimum, and who is positive. It does not take trillions of dollars. There is no leadership in each and every level of our government. These people are more concerned about staying in office or being criticized or trying to look capable; just take the easy way and defer everything to EXPERTS. A little common sense and a tiny piece of brain would go a long way. America used to be a can-do country, now we are a can’t-do and can’t-think country with citizens of really poor quality. Like being stupid is real cool.

I completely concur with Ken’s comments. What people are missing is the part about cash flow. Whether for a family or a business, cash flow is everything. It’s analogous to blood flow to the brain, i.e. once it’s cut off, even for a short while, damage is done that is irreparable. That’s what’s happening across the entire economy, across all sectors, and across the entire planet. Even if someone could flip a magic switch and eliminate the virus today, enough damage has already been done. Likely 2/3 of the job losses at the lower end of the economic spectrum are permanent losses. Small and mid-sized businesses are not equipped to handle being closed for even a few weeks, much less a few months. The jobs that existed before will simply not be there when this all blows over, if in fact it ever does. All of this will be reflected in corporate earnings over the next couple of quarters and the entire market will re-price to reflect that reality, I fear. The notion of a V-shaped recovery is absurd, and is akin to “old generals fighting the last war.” This is NOT the last war. We’ve never been in a war of this nature and there’s no precedent for the level of economic destruction that is being wrought. The notion of the market being a discounting mechanism is correct in principle, but the recent run-up off the March 23 bottom is discounting the mistaken notion that this is like the previous bears of 2000-2 and 2007-9. Not one thing about this situation is remotely like either of those.

Marvin, perfectly well said.

“Even if we execute properly, the recovery will take time and a best-case scenario is a ‘U’ shaped recovery,” he wrote. “The much talked about ‘V’ shaped recovery is no longer in the equation because of the unprecedented combination of negatives with this crisis,” he said, referring to hope for a recovery that is sharp and fast.

https://www.marketwatch.com/story/the-next-45-days-are-the-most-critical-period-in-us-financial-history-says-stock-market-expert-who-profited-in-1987-and-2008-crises-2020-04-15

A nice perspective on reopening America.

“Contrary to what some lawmakers imagine, America’s current pause is substantially self-imposed.”

https://freebeacon.com/coronavirus/lawmakers-want-to-reopen-america-but-it-may-not-so-be-easy/

What if the government told everybody to go back to work and nobody showed up? Maybe then the stock market would figure out the seriousness of the situation.

Opened short position at , 2775, non-leveraged. About the same spot as last week.

if its not obvious, i was stopped out yet again. This market is tough.

Alex- if Cam is doom and gloom, why is his disclosure long SPXU ??? Shouldn’t he be long SPXS?? It’s leveraged 3X.

SPXU is inverse 3x leverage.

Though I agree with most of the above comments, does it not worry anyone that there is not a single positive response or outlook? Does this speak to sentiment?

Kevin, if we found ourselves not agreeing with Cam’s assessment of the market we wouldn’t be here. So, the answer is “No.”

Stay flexible and be ready to change your thinking when incoming data invalidate your base case.

It’s a strong tape right now, and I would be careful shorting right now (one of the few times I have to disagree with Cam) – I think we’re likely to see SPX 2950 before we see 2550. Just my opinion, of course.

https://www.statnews.com/2020/04/16/early-peek-at-data-on-gilead-coronavirus-drug-suggests-patients-are-responding-to-treatment/

This is a big deal IMO.

Uncontrolled single arm study without a control group, not preventive, and these results alone are insufficient to change course of the economy reopening. but yes will lead to a bounce. if a randomized controlled trial were to come out showing benefit that would be different.

True – it’s a cohort study without a comparable control arm and thus we cannot determine whether the improvement is due to remdesivir to due to chance. In that sense, it’s similar to studies undertaken with Kaletra or hydroxychloroquine.

However, it’s an important observational study with encouraging results and a high percentage of positive outcomes – and it’s all we have at the moment.

I meant to say ‘or due to chance.’

In the context of a pandemic that has virtually shut down the global economy – the smallest glimmer of hope that we may have turned a corner is enough to rally the markets.

I agree with Cam that we’re likely to retest the March lows at some point – but that’s a process that may take months. In the meantime, the tape tells me we may see a significant throwback to the upside. As Kevin pointed out earlier, if everyone expects a retest it’s unlikely to unfold immediately.

“We have seen people come off ventilators a day after starting therapy.”

“Most of our patients are severe and most of them are leaving at six days…”

I think the results are quite promising. Since there were 125 patients, I won’t attribute it to chance.

Well, I have heard that most people who go onto ventilators do not survive. Only 2 died from 125 severe cases. That’s less than 2%. I don’t know what the mortality rate is among those who fall seriously ill.

It is not preventive. But the availability of a therapeutic drug will nudge the politicians to open up the economy.

https://twitter.com/nunziato_frank/status/1250972614048301056

Thread:

From an anesthesiologist friend that works in a top hospital.

Columbia Med school grad….Chimed in about the Gilead study:

I saw that. Hopefully it works. On the other hand, no control group, their exclusion criteria were basically people you know would do worse, and the data/talk from China and Italy wasn’t great.

Plus, it’s still an IV drug given for 5 days and you’d still overwhelm healthcare systems if people kept getting infected.

Doesn’t change the trajectory of the disease other than perhaps decreasing mortality for ICU patients.

Which is still VERY QUESTIONABLE….

But unless it can treat patients outside the hospital or reduce infection which it can’t, I’m not seeing how it changes what will happen….Other than provide optimism.

Their exclusion criteria was basically people who had multi-organ failure.

We know from tons of data that the biggest risk of mortality was presenting with exactly that.

That’s called a SOPA score.

So if you exclude the high risk and don’t have a control group, what exactly are you proving?

Cam: What’s SOPA?

Probably SOFA -> sequential organ failure assessment score.

It sounds very promising. I was unable to get a feeling for the time frame for it to become approved from that article.

The original NEJM article was published almost a week ago:

https://www.nejm.org/doi/pdf/10.1056/NEJMoa2007016?articleTools=true

What’s different today is the ‘presentation’ of the findings +/- the addition of comments gleaned from a video discussion +/- an anecdotal account by one patient’s family-> all of which makes the data simultaneously more accessible and more impactful to investors.

The Dow Ind. are up 900 points in late night trading on the story.

Need a control arm for it to be FDA approved. It will definitely lead to some short term optimism. However we need widespread testing and/ or a vaccine to reopen. Remdesivir was trialed for SARS and Ebola and was not particularly effective. May end up being “better than nothing”– won’t know until a randomized controlled trial is conducted.

Agreed – however, this is a forum for discussing the impact of news on investor psychology. In that sense the Stat News release is ‘a big deal.’ I’m sure someone somewhere is in the process of designing a full-scale clinical trial, but by the time results (positive or negative) are released the markets will have already run away to the upside or downside.

True and absolutely agree with your points above that this case series of patients is going to boost markets. Just pointing out the facts of the clinical data. Gilead has declined to add a control group as of now. Again better than nothing but definitely will not allow millions to return to work.

Gilead has in fact just released comments that basically repeat the points you have made, and futures have pulled back accordingly.

Thanks rxchen. It may well be effective, and will absolutely move markets upward, but definitely need more info to see how much it moves the needle in the long run.

Has anyone computed the doubling rate of market divergences?

Futures pulled back? I don’t think so – SPX +83.

This could well be another “market only looking at good news”. As earnings season gets into full swing, headline news may well flip market sentiment. We are still in a headline driven market – the economics of what is going on just does not support this ebullience.

Yes – pulled back -briefly ~22 points, only to recover its composure. Pretty good tell re current sentiment. There is absolutely no ‘reason’ why the indexes should have rallied as much as they have. It’s just the nature of the market – it will do what it wants, and we just do the best we can to divine the next move.

These type of bear market rally can go on for a bit. We are now in the market index as we were in 3/24/08. How long did that bear market rally last? about 2 months until the average true range trailing stop flipped again on 5/23/08 and then the market eventually bottomed in the great recession on 11/26/08. The bulls have done well, SPX ATR trail support at 2739 not really tested these past 2 sessions.

If you believe we are headed down, and you predict a free fall, why are you long SPXU?

Alex- if Cam is doom and gloom, why is his disclosure long SPXU ??? Shouldn’t he be long SPXS?? It’s leveraged 3X.

Michael, SPXU is an inverse ETF leveraged 3 times. If the market heads down, Cam makes 3 times the drop in the S&P500.

SPXS is also leveraged 3X. Two similar products from different ETF managers.

My error. Was thinking of SPXL.

Even if you are bearish it is not a good idea to hold spxu or spxs for extended period of time. Math has proved that. 3x products were new during GFC. Tons of people bought and held 3x shorts back then (thinking it was a done deal) and lost a lot of money. There are a lot of enraged people on all kinds of discussion boards. It was funny if not surreal.

Some smart people finally laid out math for people to see. Still people didn’t believe math. Just strange. When you are so sure of something it could be a blow to your psychology when it did not happen. Back then I adopted a strategy of shorting both spxl and spxs at the same time in equal amount when vix reached fever pitch. You will never get a margin call this way no matter how much you margined out since two amounts more or less cancelled out daily. The math is to let huge daily whipsaw cause big decay for both products at the same time. You can plot them in any charts and see for yourself. From 2/24 thru today, spxu returned -17.62% and spxl -50.73%. So you are up 68.35% minus some borrowing interest with minimal risk (risk: when someone recalls their spxu or spxl). Granted , the big money can’t perform this trade.

It was a nice gain and then vix started to moderate and the decay started to flatten. And Fed started to throw kitchen sinks. It was time for another strategy. This is not to say it was easy. Active management is required.

People sued the companies and the companies amended the prospectus describing the products as daily rebalanced. These are still the same products today and people still don’t believe math. Wall street still is pushing misleading and defective products.

Correction: up 68.35% divided by two.

This is a case where market may stay irrational longer than you can stay solvent. It’s a pain trade right now for anyone believing market is going to crash or at least test the lows. It requires extreme discipline and patience.

Cam Hui on the Dan Proft radio show! Goto time index 1:36:00

https://www.danproftshow.com/episode.php?episode=april-16-2020

Just for fun… nothing said you haven’t already heard here…

I think I mis-interpreted Cams newsletter. Did you say short Oil, not the S&P, Cam?

Paul Singer says his gut feeling is that 50% decline from market highs is still coming.

https://www.marketwatch.com/story/man-who-warned-of-the-coronavirus-crisis-months-ago-says-gut-tells-him-a-50-or-deeper-decline-in-stock-market-from-the-february-top-likely-2020-04-17

I don’t disagree with Singer – there’s really no way that markets simply head to new highs without a deeper decline. I don’t think it will resemble the March decline, however – more likely a slow grind down over weeks to months. May even start today.

I agree. The Fed can’t carry the market all the way to new highs with deteriorating fundamentals.

https://www.bloomberg.com/news/articles/2020-04-17/oxford-vaccine-veteran-lays-out-coronavirus-immunization-plans

This is the question I have. Suppose Gilead’s drug remdesivir or some other drug works. It does not even need to be administered via IV in a hospital setting. It can easily be taken at home. It will do wonders in saving lives but will it change the trajectory of the economy? Will people stop worrying about catching virus and resume their normal lives? Will we see restaurants, theaters and stadium full of people in not too distant a future?

We have treatments for many diseases but people don’t rush and go out to catch them.

Probably not – but if I were out of work right now it would make sense to front-run where I think new jobs will be created and either seek training for those jobs and/or start a business geared towards needs in those areas.

Rxchen2, Sorry. I’m just asking if the availability of a therapeutic drug to cure some severe Covid-19 cases changes the market forecast outlined here by Cam.

I would agree with both Ellen and Wally that an effective treatment for severe cases would not change anything. Reopening the economy to the point where life becomes ‘normal’ would require mass vaccination.

(a) The common flu has a fatality rate of ~0.1%. And it’s estimated that 8% of the population will come down with the flu each year. We’ve become accustomed to living normal lives around that scenario – we get our flu shots every October.

(b) Covid-19 has a higher fatality rate, with most estimates in the 1% to 2% range. In the absence of a vaccine, under normal living conditions a very high percentage of the population would come down with it. That kind of death rate is simply unacceptable. Put another way – we don’t see hospitals and morgues overwhelmed with seasonal flu cases the way we have with Covid-19.

So to answer your question – unless an effective vaccine can be mass produced within the next 2-3 months, I don’t see any way to avoid the kind of economic numbers that Cam has put out. Earnings will decline, multiples will contract, and many companies/ business will never recover. What Ken stated earlier makes sense – for US indexes to only have pulled back to May 2019 levels? That’s not sustainable.

Awesome! That’s the perspective I was looking for. Thanks much.

It looks like the SPX will close above its 50 sma. Does this change the outlook?

Yup. The Dow is just under the 50 and the Naz broke it earlier in the week.

The daily price action just makes no sense at all.

Is it possible that the Fed is directly buying stocks and ETFs to prop up the market? Or indirectly by instructing their lackey banks to do so with liquidity? Is there anything that require them to announce such actions?

There is “dark pool” buying by large institutional investors. I don’t know what the implications are but the dark pool seems to be providing a cushion in the market that may not otherwise exist. I’m trying to learn more about it.

Dark pool is hard to trace that’s why they are dark. The goal of dark pool is to not affect cash market pricing, so leaving not much trace. If you examine market price movement for the last several weeks you will see the damage is pretty much over the overnight sessions. During cash markets the A/D line is steadily rising which tells you shares are being accumulated. We don’t care who is buying as long as buy volume is bigger than sell volume.

We speculated that new case numbers can trigger algos into buying. It happened. And we speculated dropping vol will trigger algos releveraging. It happened. Now comes steady drumbeat of more news and data. If A/D line continues to trend up. It will be self-reinforcing. Check $NYSI. Don’t fight Fed and algos. Let them be your friends.

Thank you.

Banks are not buying. They are busy setting aside loan loss provisions. You can listen to bank’s earning calls this week. Fed bought some credit market ETFs. Fed is not BOJ yet.

Oh dear, stocks are going up, but I think they will go down, so I can’t buy in.

Oh dear, stocks are going down, but I thnk they will go down some more, so I can’t buy in.

What does a long term investor do at this point, or do we all become madcap traders? V difficult…

No Joyce, it is not that difficult. It all depends on your time frame. Bank on 5x rally from this cycles bottom to the next peak (we saw that from 2009-2020; 666 to 3400 17% annualized gains).

It’s possible that many are thinking like you D.V., and we are getting this rally.

D.V., where do you see the bottom in this cycle? I agree the starting point is very important and so is catching that.

Sanjay, you don’t have to catch the starting point so long as you can be assured that it is in the rear-view mirror and that’s the problem. Have we seen the bottom or have we not? Right now, most of us here are betting that we have not.

Sentiment trader has been putting out post after posts of how the average investor out there has simply ignored the market volatility. Jason Goepfert has also talked about how something in this time frame is amiss as the average Joe six pack has taken this volatility in her/his stride. The data provided by Sentiment Trader is contrarian bullish.

https://www.sentimentrader.com/blog/mom-and-pop-are-not-interested/?utm_source=Daily+Report+Lite&utm_campaign=68de798f63-Mom-and-pop_are_not_interested&utm_medium=email&utm_term=0_1c93760246-68de798f63-1270438493

As an aside, Jacksonville, Fl. beaches opened today, for “essential activities” like fishing, swimming, surfing, walking, biking, hiking etc. Would other Florida beaches be far behind and let Jacksonville be the only city make money?

https://www.cnn.com/2020/04/17/us/jacksonville-florida-beach-reopen/index.html

Are we going to have a FOMO to reopen the economy? The idea that US needs to open for business is being fomented by leadership, right or working, time will tell.

https://www.yahoo.com/finance/news/u-retirement-savers-stayed-calm-160017214.html

https://www.yahoo.com/gma/country-grows-more-pessimistic-return-normalcy-post-coronavirus-100000760–abc-news-topstories.html

“Among those Americans who say their daily routine has changed due to the coronavirus, 31% believe a return to normalcy will come by June 1, compared to 44% who said the same at the beginning of this month. The June 1 date sharply divides partisans with 51% of Republicans and only 17% of Democrats thinking they will resume normal activities by then.”

Three in four Americans think they will be able to resume their regular routine by the end of the summer, which is down from 84% who said the same in an ABC News/Ipsos poll released on April 3.

” the newest poll, two-thirds of Democrats (66%) and an overwhelming 93% of Republicans view the end of the summer as the timeframe for a return to normal”.

The Gilead rally:

https://www.fiercebiotech.com/biotech/gilead-clinical-data-hint-at-efficacy-remdesivir-covid-19

https://www.nejm.org/doi/full/10.1056/NEJMoa2007016?query=featured_coronavirus

A lot has been written on the Remdesivir drug (by Gilead), so I will not repeat here. Lack of randomization, lack of a second placebo arm are all valid criticisms. One of the biggest criticism of this study is lack of viral load studies, before and after administering Remdesivir. Furthermore, the drug has significant side effects. Proper drug trials can take months if not years.

In conclusion, what has been published in NEJM remains highly questionable regards the drug’s effectiveness.

Some of the most dazzling rallies are seen in bear markets, and we may be seeing one of these. There were many reasons for this which I will not be repeating.

The US is banking on a “soft lock down”. This is one assumption that seems to be behind this rally. One needs to ask the question what happens if this lock down gets prolonged?

Though the Sentiment Trader data is there, it may prove to be short lived. There is loss of small business confidence, major hit to US builder confidence, massive expansion of US debt to GDP now approaching 18% (see Schwab commentaries for this). The next data point I am waiting for is margin loans.

Major economies outside the US have engaged in larger stimulus (20% of GDP) than the US, the US is only at 10% of GDP so far (see Schwab commentaries).

US market cap to GDP is no where close to market bottoms (Warren Buffets favorite indicator).

One of Wall Streets worst secret is a 50% correction once a decade, and we have not had one since 2009.

I am penciling in 3020 on the S$P 500 here, which is where the market broke out in October 2018. There was a triple top here, before the market broke out (Cam advised buying into this break out).

Despite all what has been posted by Sentiment Trader, if this lock down continues longer, bank on a 50% loss from 3400. Let us watch these levels carefully (next being 61.8%, around the 3000 level off the top of my head). All said, stars seemed to be aligned to promote this countertrend rally, a rally to bail out and raise more cash.

Of course, a lot of what I have written is not applicable to investors with longer term horizons. In this current countertrend rally, if gold pulls back to say the 1500 level it may be a good time to raise gold positions (UGLD) as a hedge. Using the Fibonacci ratio of 1.62, starting from a 1200 $ bottom (in 2011), gold has the potential to reach 2000$. Again, what I have written here is difficult to be certain. Watch the tape, and be mindful of your risk exposure. There is a fair chance we may still continue to rally, especially if some portions of the US start to open for business. There are lot of factors here, but this seems a rally to sell into.

Cam’s graphs in the “Fun with Quants” shows such countertrend rallies usually last a few months with choppiness. We are only a few weeks into this countertrend rally. That said, we have no historical perspective here either as everything is so compressed in time. The 30% loss was driven by trading algorithms. So is probably the countertrend rally. One of our readers talked about a “strong tape” on Friday and not to short this rally. They were right. Market closed on Friday close to the day’s high. Watching the close of the market and news flow.

Should the trading account be included in the list of COVID-19 fatalities?

Lol! It’s seems to be in the ICU

“I’m not telling you it’s going to be easy – I’m telling you it’s going to be worth it.” ― Art Williams

Mr Ciovacco seems to have gone from fairly pessimistic to fairly optimistic. His recent post shows that he thinks the indicators are all on the side of the bulls.

https://www.youtube.com/watch?v=74SJTOrE5z0

IMF says we are in the worst recession in forever. Not even really started yet.

No real double bottom in SPX – or things are happening so fast, there was the bottom on March 23rd and the second “bottom” was April 1st. This would be the fastest recession in history, wouldn’t it? All done and dusted between February 20th and April 7th or thereabouts. I blinked and missed it. How about you?

This chart bothers me no end!

https://pbs.twimg.com/media/EV0BSveU8AUWMq8.jpg

That said, here are some of the comments made by the viewers of Chris Ciovacco’s video;

“Last week you gave us all kinds of reasons to wait for the worst. Now with “Maximum Flexibility” you are giving us all kinds of reasons for a full on bull market. And next week when market dips, will you give us some new historical data that points to other directions”?

“this clown just went against everything he said in his last video”.

“7-days on without any material change in fundamentals and your analysis is a completely different sentiment. Last week it was all negative. This week its all positive”.

In all honesty, I like his analysis but in this case, he is focussed purely on charts and not on fundamental, bottoms up analysis like the looming earrings recession, worsening GDP growth, etc. What he seems to be doing here is using analog comparison, much like Cam’s previous post of “Having fun with quants”.

Bear markets produce dazzling rallies that trap investors precisely at the wrong time. The graph I posted here shows precisely that. Pay attention to what he has shown, none of the “bottom indicators” that he has shown were clean bottoms. These indicators vacillated around the bottom both in 2002-03 and 2007-09 for a while.

Yes, his message is clear cut, and that is a good message, that “be open to all possibilities”. Put another way, do not be a permanent bull or bear. That said, only time and further data will set the direction of the markets. I remain somewhat circumspect for now.

Question for Cam: Why is the current 23rd March bottom not a retest of December 24th 2018 low?

From a technical perspective, that question makes perfect sense. From a macro and fundamental perspective, the two downdrafts are not connected and have different roots.

The 2018 mini-bear was mainly attributable to excessive valuation, and the sell-off was sparked by a growth scare. The latest episode is a recession sparked by

1) COVID-19 in China disrupting global supply chains

2) oil price war which tanked the energy sector

3) COVID-19 pandemic in the rest of the world, which led to lockdowns that crashed economic growth

Thanks, Cam.

https://www.longtermtrends.net/market-cap-to-gdp/

I think I am going to frame this chart!

I know that market cap to GDP was once Warren Buffett’s “favorite” metric, but his partner Charlie Munger debunked that a few years ago.

Market cap to GDP is really another way of expressing the price to sales ratio. But here is the problem:

P/E = Price / (Sales * net margin)

Net margin rates have been rising, though operating margins have been relatively flat. The rise in net margin can be explained by lower tax rates and lower interest costs.

Thanks, Cam.