While I may be jumping the gun on my model readings, I’m calling a recession.

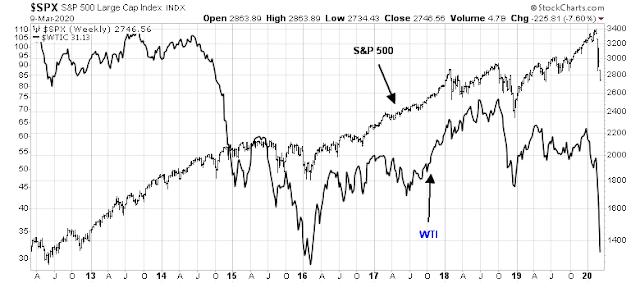

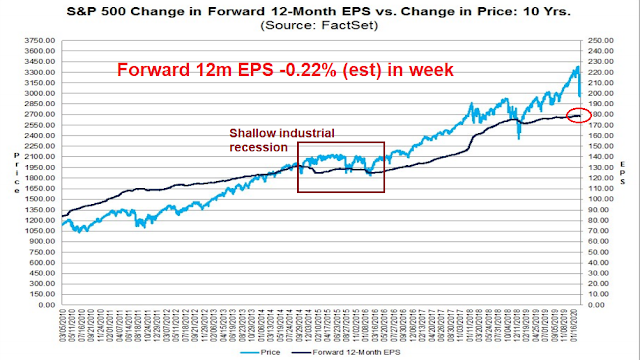

Remember when oil prices tanked in the second half of 2014? The economy experienced a shallow industrial recession in 2015.

While history doesn’t repeat but rhymes, the price war that erupted over the weekend between Russia and OPEC is another threat to the growth outlook. Combined with the already fragile state of the economy from the coronavirus induced supply chain slowdown, it is difficult to see how the US economy can avoid a recession. George Pearkes at Bespoke came to a similar conclusion (via Business Insider).

Recessions are bull market killers

Remember, the historical evidence indicates that recessions are bull market killers.

The economy was already weakened by coronavirus induced supply chain disruptions. The latest Fed Beige Book stated that “economic activity expanded at a modest to moderate rate over the past several weeks, according to the majority of Federal Reserve Districts”, with an important caveat:

There were indications that the coronavirus was negatively impacting travel and tourism in the U.S. Manufacturing activity expanded in most parts of the country; however, some supply chain delays were reported as a result of the coronavirus and several Districts said that producers feared further disruptions in the coming weeks…Outlooks for the near-term were mostly for modest growth with the coronavirus and the upcoming presidential election cited as potential risks.

There were 9 references to covid-19 and 48 references to coronavirus in the report.

Now the economy is getting hit with an oil price war. The last time oil prices cratered in 2014, the economy experienced a shallow industrial recession in the following year. Today, earnings estimates are already starting to decline owing to coronavirus related concerns. It is difficult to know the full extent of the damage right now, but we know that it will be negative.

As a reminder, I highlighted the possible effects of a coronavirus sparked recession based on a 2005 CBO study (see A Lehman Crisis of a different sort):

The Congressional Budget Office conducted a study in 2005-06 that modeled the effects of a 1918-like Spanish Flu outbreak on the economy. The CBO assumed that 90 million people in the U.S. would become sick, and 2 million would die. Those assumptions are not out of line with current conditions. The population of the US is about 330 million, so an infection rate of 27% (90 million infected) and a fatality rate of 2% (1.8 million dead) are reasonable assumptions.

The CBO study concluded that a pandemic of this magnitude “could produce a short-run impact on the worldwide economy similar in depth and duration to that of an average postwar recession in the United States.” A severe pandemic could reduce GDP by about 4.5%, followed by a V-shaped rebound. Demand shocks would also be evident, with an 80% decline in the arts and entertainment industries and a 67% decline in transportation. Retail and manufacturing would drop 10%.

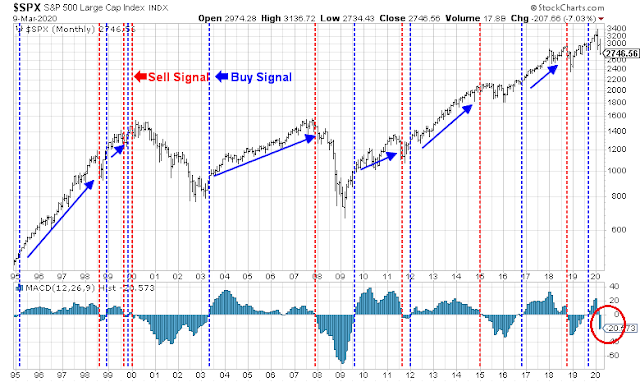

On the weekend (see Has the bull caught the coronavirus), I estimated the downside risk for the S&P 500 at 1600 to 2165, which represents a peak-to-trough drop of -36% to -53%. That is now my base case scenario.

I also observed that the monthly MACD indicator had flashed sell signal, but it is not confirmed until we see the month-end closing price. While I am keeping an open mind, it would take a significant rally to avoid a sell signal by month end.

A recession is on the way, and so is an equity bear market.

For investors

Accounts with long-term horizons should therefore assume maximum defensive positioning, as defined in their investment mandates, in their portfolios.

I have an Ultimate Market Timing Model that is based on the following two components:

- A Trend Asset Allocation Model which applies trend following techniques to a variety of global equity and commodity prices. That model has flashed a risk-off signal for several weeks.

- A macro-economic overlay designed to spot a recession.

In the long run, equities have shown strong returns in the absence of existential social risks, such as war and rebellion. Trend following model signals can be overly frequent and misleading for investment accounts with long-term horizons. The combination of a macro overlay to a trend following model is therefore an ideal solution for long-term investors who don’t want excessive trading in their portfolios.

In light of the recession call, the Ultimate Model signal has moved from risk-on to risk-off. It should remain risk-off until the Trend Model reverses itself.

There will undoubtedly be rallies, and bear market rallies tend to be of the “rip your face off” variety. Investors should take such opportunities to sell into strength and reduce their equity positions.

For traders

In the current environment, traders should focus more on risk than return. While this may sound obvious, it bears repeating. Volatility rises in bear markets, and traders should therefore adjust their position sizes accordingly for risk control purposes. As well, traders should pay special attention to above comment about “rip your face off” rallies.

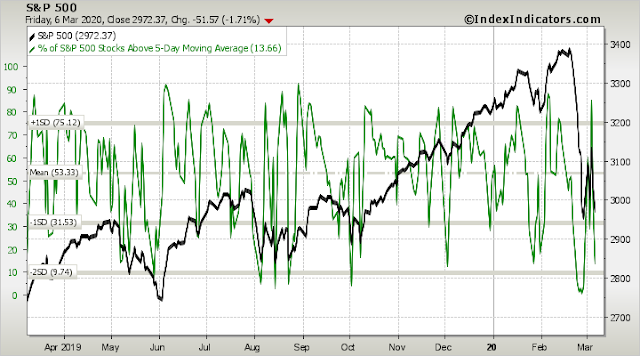

In the short run, the market was already oversold on Friday and the market is poised for a relief rally. While Index Indicators has not updated their readings at the time of publication, short-term breadth will be even more oversold.

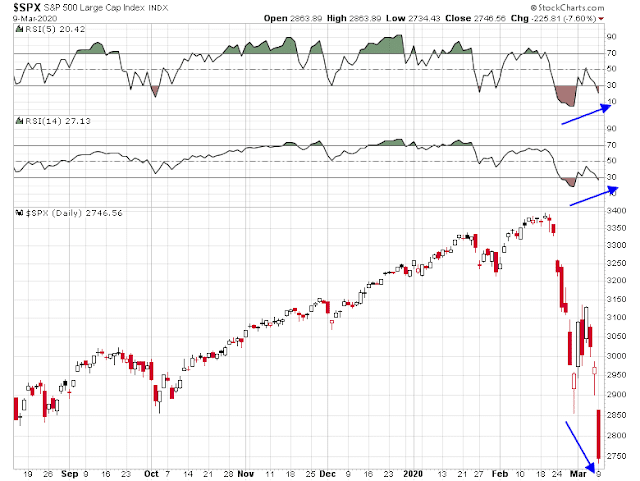

Sentiment readings are so stretched that the market is poised for a 1-2 month face ripping rally (see A stock market roller coaster). We just don’t know when it begins. In light of the negative development on oil prices, it was no surprise that the market fell. What was a surprise was the index exhibited positive RSI divergences while making new lows.

Chad Gassaway pointed out that the short-term record of post -7% single-day losses has been bullish. If history is any guide, we should see a rebound that peaks out after three days with a high win rate.

My inner trader initiated a small long position last Friday, and he added to his long today in anticipation of the relief rally.

Disclosure: Long SPXL

When I was much younger, the father of a friend used to tell us that he was always more concerned about the return OF his money than the return ON his money.

FDR said he wanted a one-armed economist because his always said “On the one hand, on the other and.”

Thanks for the straight call.

I believe we are seeing the first ‘social media’ recession. The expert providers of social media have us clicking on gruesome and scary flu images that make us more fearful than we should be logically. But logic be damned. We are panicking on Wall Street and Main Street. The result is a recession.

The panic on Wall Street is aided by ETFs that are so easy to bail from on an urge. .

Nixon said that his economists weren’t always right but they were always sure.

Cam, your posts on how your trend strategy may work or not work as an allocation guide (60/40; 40/60; 20/80; SPY/IEF) was very useful. Do you have any explanation to understand how could we apply the change in the Ultimate market timing model? Would you expect turning those same allocations upside down to work? (so 80IEF/20SPY when trend is bearish and 40IEF/60SPY when trend is bullish)

There are at least two decisions in forming a portfolio. What to buy and sell, and how much to buy and sell. I focus mainly on the what.

I know nothing about any of my readers. I don’t know how old you are, what your income needs are, how much risk you are willing to bear, what your tax situation is, or even what jurisdiction you are in. I therefore cannot advise you.

The trend strategy model portfolio is only a proof of concept based on a standard 60/40 allocation used by many. It does not mean that 60/40 is appropriate for you, nor does it mean that you should swing 20% around a 60/40 because 20% may be too much, or too little for you.

I can therefore only give you the signals of what to buy and sell. You have to decide on how much to buy and sell. The Trend Model gives off signals 3-5 times a year. The Ultimate Timing Model does the same thing, but it is designed to only flash a signal every few years so that an investor doesn’t have to whip his portfolio around.

Thanks Cam. Rather than personal advice I was asking for your thoughts on how should the Ultimate Model Signal could be applied to allocation. While the trend asset allocation model works better applied to asset allocation, the trading model as long/short, what do you envisage as the ultimate market timing model: is it an on/off the market or a long/short the market?

(My own neutral allocation is not 60/40, but it was still useful to see how you built the proof of concept)

Another question, do you still see non-US markets overperforming US markets?

US equities are highly valued compared to other regional markets, but you also have to consider the outlook for each region. Europe looks cheap, but it is still struggling with the coronavirus. Asia may be interesting as coronavirus infections seem to be bottoming out, but you have to consider the risks of a China and China related play, as well as the usual data opacity with Chinese statistisc.

Cam, I’ve noticed the last two weeks that the Dollar has cratered to levels not seen since 2018. It looks like the foreign flight to U.S. assets has ended and reversed. Do you have a different take on the Dollar’s collapse?

Risk/on and risk/off

I love the comment: While this may sound obvious, it bears repeating.

Can anybody make a case for the 40 (bond) portion of a 60/40 portfolio?

To me, rates-wise, this feels like roughly a mirror image of ’80-’84 coming up.

I would have made that exact comment when the 10-year yield was 1.25%, and yet here we are. Bonds are a ballast for the equity portion of the portfolio.

But how long are we here? The $64 question.

I don’t think we will turn Swiss.

My 40 is all in cash. I’m usually wrong, tho.

I like to look at the difference between the yield on the 10-year bond and its 200-day sma. On 9 March, when the yield dropped to 0.5%, that difference was -72%. The previous record, set in 2009 and tied in 2011, was -40%. Bonds are overbought to an unprecedented degree so I lightened up, especially selling TIPS (inflation not being the concern at the moment). So money markets are where I am now.

‘Just hours after Santa Clara County reported its first coronavirus-related death, the county has implemented a mandatory ban on all large gatherings.

‘The ban, which will begin on Wednesday, will span until the end of the month and apply to events with more than 1,000 attendees, county officials announced at a press conference Monday evening.

‘The ban will apply to San Jose Sharks games and other events planned for San Jose’s SAP Center. But it will not be enforced at airports, shopping centers or any place where people are in transit, officials said.

‘All events at the SAP Center have been canceled for the month of March, which includes three Sharks games, two Barracuda games, five nights of Cirque de Soleil, four performances by Motivational speaker Tony Robbins and a Marc Anthony concert, according to the website.’

So what happens? The first 1000 gets into the arena of a Sharks game? Or do the just bar all fans and televise it only?

I interpret the announcement to mean the games have been canceled and will probably be rescheduled for April.

Didn’t know that Mr. Robbins coming into town to pump Valley millionaires up for four nights in a row. This Valley needs some serious adjustment.

Cam, is it possible for you to send a Trading alert when you increase your position in your trading account as you did yesterday? Thank you.

Following Sunday post’s discussions I propose:

The RSI divergence smell test –

a) Applies to monotonic momentum (ripple excluded)

b) Visual validation

For Traders section – failed (a): not monotonic.

A 5,48% bounce from Monday’s close would put us around 2895 on SPX and close the gab to Friday.

gap

Cam, today’s (March 10th) market rebounded on the side of the historical 84% (good call on SPXL long), however the question will the US or any other fed/gov intervention (market or virus) be strong enough to calm the investors and prevent another big sell off later this week or next week?

Just lost all the rally and tagged yesterday’s low. The bounce looks anemic which is bad news unless some buyers show up soon.

Looks like they showed up 😉

Cities outside the Bay Area are getting the cancellation memo:

https://www.marketwatch.com/story/sporting-events-are-being-canceled-or-will-be-held-without-fans-amid-coronavirus-concerns-2020-03-10?mod=mw_latestnews

https://www.marketwatch.com/story/the-stock-markets-wall-of-worry-still-isnt-high-enough-to-signal-a-buying-opportunity-2020-03-09?mod=mark-hulbert

I’m looking to go to all cash soon and just wait out this disaster.

The volatility is just crazy.

Volatility on futures is very high. In my view market is trying to find the direction and reacting on headlines.

It’s a heck of a deal when Congress needs Nancy Pelosi to go along with the tax relief or it isn’t going to happen. I think she will NOT let the President have a win to save the economy or the stock market.

Stenny Hoyer just said the tax cuts are a non-starter in the House.

Here is another bit of news you may not have heard. From a Daily Beast article: Congressional Republicans were told in a meeting, “There’s a good chance most people in the United States will eventually be exposed to the novel coronavirus, according to one former official. ”

Some stats I saw last week indicated that there has been an 8% death rate from the virus for those in their 70’s.

Good chance is an understatement. Company notified our team that we would be working from home for at least the next 3 months.

Three months is very long, even longer than the quarantine period in Wuhan. Did they share any data / reasons for this long period?

Minimizing the risk that the entire department getting sick at the same time. It would be total chaos if everyone was out at the same time versus some still being able to work.

https://twitter.com/WalterDeemer/status/1237484071304953858

Here is what he said 38 minutes ago:

“95% downside day at 10:45 am. Internals still more powerful on down days than up days. Need to come into balance to indicate bottoming process.”

I took a chance that this three day low is going to hold. Got a tight stop for a small loss if they break it down through.

That didn’t last long. LOL The Dow Industrials are sitting right on the 1000 dma if anyone cares.

I’m going to just sit back and wait for the Zombie Apocalypse.

Agree, sit tight. I cut my losses Yesterday and it was painful but necessary.