Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

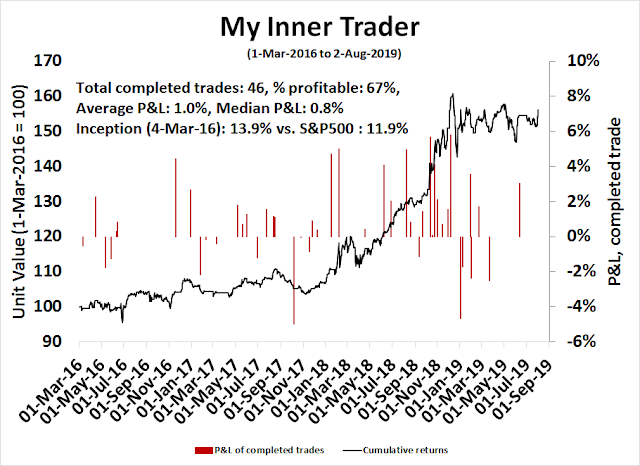

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

What Powell couldn’t say

The message from Jerome Powell’s post-FOMC press conference was confusing. The overall economic outlook was positive, but the Fed was nevertheless cutting the Fed Funds target rate by a quarter-point. It was advertised as an “insurance” cut. Powell went on to spook the markets by stating that it was not the start of an easing cycle, but walked that partially back by holding out the possibility of more cuts.

What is going on?

Josh Barro, writing in the New York Times, read between the lines and outlined what Powell couldn’t say. The Fed was reluctant to cut rates, but it believed that monetary policy was forced to offset the negative effects of the trade war.

One of the key factors the Fed must respond to is the specific economic mess Trump creates when he upsets the global trade regime, and the size of that mess requires a qualitative assessment. Powell can’t say “We’ll cut rates in September if Trump threatens Xi Jinping seven times on Twitter, but not if he only does it five times”; he’s going to have to make a judgment call about where we stand with trade (and about how businesses and investors are responding based on their own assessments about where we stand with trade) when the time comes.

“I would love to be more precise, but with trade, it is a factor that we have to assess in a new way,” Powell said, diplomatically. “It is not something that we have faced before and we are learning by doing,” he said at another point.

Powell also made it clear that the Fed is staying neutral and not taking sides in the trade war:

“We play no role in assessing or evaluating trade policies other than as trade policy uncertainty has an effect on the U.S. economy in the short and medium term,” he said. “We are not in any way criticizing trade policy; that is really not our job.”

The two dissenting votes against the rate cut was evidence of the reluctance of Fed policy makers to ease interest rates. In addition, former New York Fed president Bill Dudley, who was able to speak more freely, wrote in Bloomberg Opinion that he believed that only one cut was necessary.

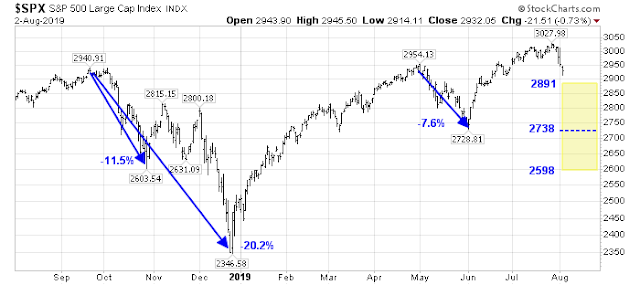

After analyzing all the risks and calculating possible downside risk, I conclude that the stock market is poised for a correction and a valuation reset. Based on recent and past history of corrective episodes, I project a S&P 500 downside target of 2598 to 2891, with an average of 2738, or a -9.3% drawdown. From a valuation perspective, this translates into a forward P/E ratio of between 14.7 and 16.4, with an average of 15.5.

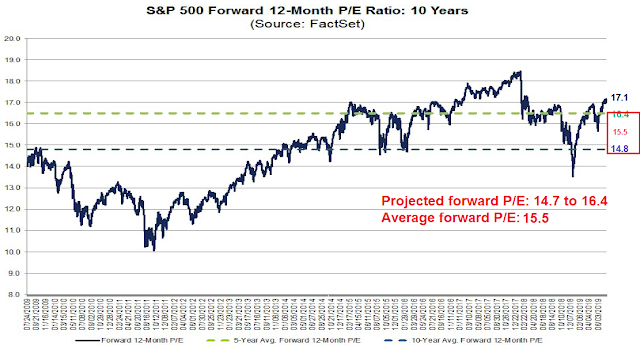

Assuming the economy manages to sidestep a recession, these projections appear to be reasonable, as valuations would bottom out at between slightly below its 10-year average or at its 5-year average. It would represent a valuation reset that presents itself as a buying opportunity.

Like the Federal Reserve, I am data dependent, and all bets are off if an actual recession were to develop.

Rising risks

Here is the Fed’s dilemma. The American economy is sputtering, but still growing. On the other hand, trade tensions are threatening to derail the global economy. Even before US negotiators went to Shanghai for another round of trade talks last week, Trump tweeted out that he does not expect a deal to be signed until after the 2020 election [emphasis added]..

China is doing very badly, worst year in 27 – was supposed to start buying our agricultural product now – no signs that they are doing so. That is the problem with China, they just don’t come through. Our Economy has become MUCH larger than the Chinese Economy is last 3 years….

..My team is negotiating with them now, but they always change the deal in the end to their benefit. They should probably wait out our Election to see if we get one of the Democrat stiffs like Sleepy Joe. Then they could make a GREAT deal, like in past 30 years, and continue

…to ripoff the USA, even bigger and better than ever before. The problem with them waiting, however, is that if & when I win, the deal that they get will be much tougher than what we are negotiating now…or no deal at all. We have all the cards, our past leaders never got it!

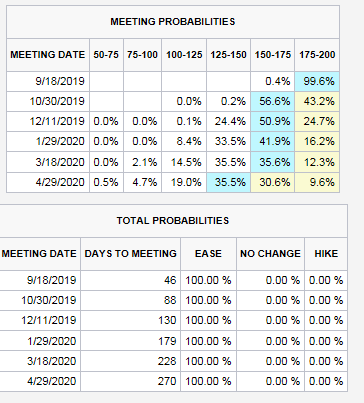

In the wake of Powell’s forward guidance, the market’s expectations of a third rate cut evaporated. . According to the CME’s Fedwatch Tool, it began to discount one more cut at the September meeting, and the odds of the third rate cut was pushed out to 2020. Needless to say, this was contrary to Trump’s desire for deeper and more monetary easing.

Right on cue the next day, Trump the Tariff Man doubled down on his trade war belligerence by announcing on Twitter a 10% tariff on an additional $300 billion of Chinese imports on September 1 [emphasis added].

Our representatives have just returned from China where they had constructive talks having to do with a future Trade Deal. We thought we had a deal with China three months ago, but sadly, China decided to re-negotiate the deal prior to signing. More recently, China agreed to…

…buy agricultural product from the U.S. in large quantities, but did not do so. Additionally, my friend President Xi said that he would stop the sale of Fentanyl to the United States – this never happened, and many Americans continue to die! Trade talks are continuing, and…

…during the talks the U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%…

…We look forward to continuing our positive dialogue with China on a comprehensive Trade Deal, and feel that the future between our two countries will be a very bright one!

The stock market had been rallying on Thursday in the aftermath of the FOMC meeting, but Trump’s tweet instantly torpedoed stock prices, and the odds of three rate cuts in 2019 was back on the table. So much for “one and done”.

In addition to the US-China trade war, the trade spat between South Korea and Japan has the potential to disrupt the global supply of semiconductors. For readers unfamiliar with the dispute, a South Korean court ruled last year that Japanese firms had to compensate Korean workers forced to work in Japanese factories during Japan’s occupation of Korea in 1910-1945. Japan disputes the compensation claim, and argues that a post-war settlement had already been reached. Tensions rose, and Japan restricted the exports of key high tech materials for semiconductors to South Korea. Talks to calm matters broke down, and Japan removed South Korea from a list of countries with minimal trade restrictions. The removal of South Korea from the list creates a non-tariff barrier. and implies that any Japanese exports will have to be screened to ensure that they are not used for weapons or military applications.

When Trump tweeted that an agreement was out of reach until the election, escalation was inevitable. There is a growing consensus in Washington that China is becoming a problem. Moreover, the Democratic contenders for the presidential nomination are increasingly showing their protectionist stripes. The Democrats televised two series of debates between a large group of candidates last week. While some of the more centrists in the first night were supportive of open trade, Bloomberg reported that Bernie Sanders and Elizabeth Warren, who are considered on the left wing of the Party, campaigned on a theme of inequality and anti-globalization:

“For decades we have had a trade policy that has been written by giant multinational corporations to help giant multinational corporations,” Senator Elizabeth Warren said. “If they can save a nickel by moving a job to Mexico, they’ll do it in a heartbeat.”

“If anybody here thinks that corporate America gives one damn about the average American worker, you’re mistaken,” said Senator Bernie Sanders. “If they can save five cents by going to China, Mexico, or Vietnam or anyplace else, that’s exactly what they would do.”

More specifically, Warren has unveiled a policy platform based on economic nationalism. In the second night of debates, every single candidate, including front runner Joe Biden, cheered the death of USMCA, despite House Speaker Nancy Pelosi’s declared desire to approve the treaty. In addition, Biden stated that he would oppose TPP in its present form.

Protectionism is on the rise in Washington. Regardless of what happens in negotiations, Trump will be under increasing pressure from the Democrats to be tough on China and other trading partners in 2020.

Fading business confidence

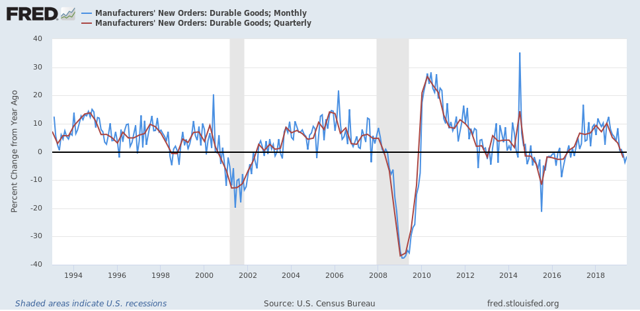

The rationale behind the Fed’s “insurance cut” is the effect of the trade war on business confidence. New Deal democrat recently wrote that while the household sector remained strong, the producer side of the economy, or the corporate sector, is suffering from fading business confidence which is showing up in durable goods orders.

The risk is tanking business confidence could drag the economy into recession, though he did have a caveat to his analysis:

Note that in the last producer-led recession, in 2001, durable goods orders had declined over 10% prior to its onset. At the moment, the quarterly average decline is a little under half of that.

The softness in durable goods orders is confirmed by weakness in the small business survey of capital expenditure plans. Small business data is particularly useful at turning points, because they have little bargaining power and they are highly sensitive barometers of the economy.

The Chemical Activities Barometer has shown itself to be a leading indicator for industrial production, is weakening, indicating further softness in the months ahead.

China’s surprising response

Across the Pacific, Beijing’s response to the weakness in its economy has been surprising. China Daily published an announcement that China would not respond with further monetary easing, but rely on fiscal stimulus in H2 2019:

China will not change its real estate policies to provide short-term stimulus to the economy, but instead will make fiscal policy more effective and “keep liquidity reasonably ample” in the second half of this year, participants in a top leadership meeting said on Tuesday.

“The long-term management mechanism of the real estate sector should be implemented and the industry will not be used as means to stimulate the economy in the short term,” Xinhua News Agency reported on the meeting of the Political Bureau of the Communist Party of China Central Committee. Xi Jinping, general secretary of the CPC Central Committee, presided over the meeting.

“Proactive fiscal policy and prudent monetary policy should be well implemented,” the report said. “Fiscal policy should be strengthened and made more effective, and the tax and fee reduction policy should be implemented more thoroughly.”

Participants agreed that “monetary policy should be neither too tight nor too loose, and liquidity should be kept reasonably ample”, the report said.

This is a surprising development on a number of levels. In the past, the authorities have resorted to monetary pumping to economic weakness, which has buoyed the highly leveraged property sector. The October 1 anniversary of the founding of the PRC is fast approaching, and no one wants to see the economy falter ahead of the celebration. Either Beijing believes the economy is recovering, or it is taking a serious risk with its economy.

To be sure, there are signs that growth deceleration is moderating. Both official and Ciaxon manufacturing PMI came in ahead of expectations, but readings were below 50, which indicate contraction. Services PMI were in expansion territory, but they were slightly below expectations. The main takeaway is stabilization.

Signs of stabilization could also be seen in China’s Economic Surprise Index, which measures whether high frequency economic releases are beating or missing expectations.

The lack of monetary pump priming can be seen in the real-time relative performance of Chinese real estate stocks.

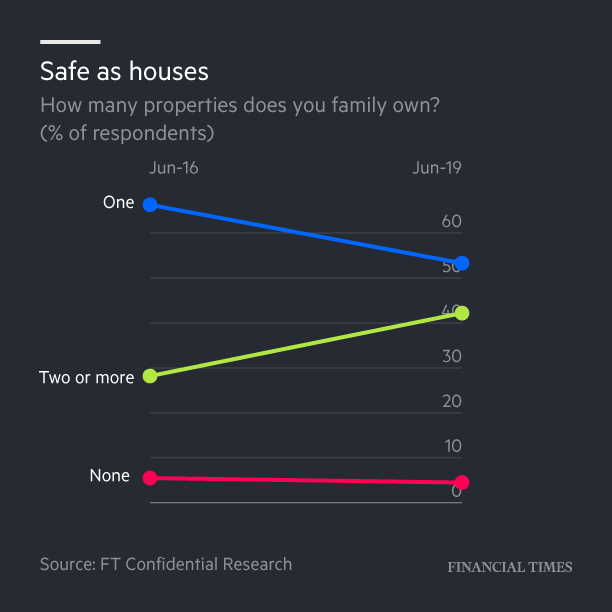

The PBOC is taking a big risk by foregoing monetary stimulus to support the property sector. Not only are real estate developers high leveraged, and therefore vulnerable to default risk, the real estate sector is large, and Chinese households have ploughed their savings into real estate. The Financial Times reported that the number of Chinese households owning two or more properties has risen to 40% from less than 30% in three years. While Beijing has a stated policy of rebalancing the growth driven of the economy from infrastructure to the consumer sector, the health of the property market is a key indicator of household wealth.

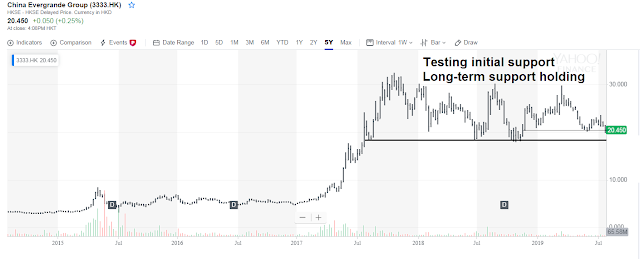

If the highly leveraged property development sector were to wobble, the entire house of cards could come tubmling down. I am monitoring the share price of selected Chinese developers listed in Hong Kong. So far, so good. All of them are holding above key long-term support levels, but this will be something to keep an eye on.

China Evergrande (3333.HK)

China Vanke (2202.HK)

Greentown China Holdings (3900.HK)

Country Garden Holdings (2007.HK)

Estimating downside risk

In light of these risks, my base case scenario the US equity market calls for no recession, but a correction and valuation reset. Based on recent experience, I try to estimate the downside risk.

In many ways, the current setup is reminiscent of 2015, when the market advance began to stall in the first few months and flashed a series of negative divergences (see Why I am bearish and what would change my mind). The index went on to weaken in a shallow manner, bounced, and finally corrected by -14%.

More recent episodes saw pullbacks of -7.6%, -11.5%, and -20.2%. If we were to throw out the -20% loss and because it represents a major bearish episode, which is unlikely, we project a range of 2598 to 2891, with an average of 2738, or a -9.3% drawdown.

We can also see the scale of a projected pullback from a valuation perspective, if we were to assume that forward 12-month EPS were to remain unchanged, which is a reasonable starting point as estimates have been falling in the last few weeks. The market recently peaked at a forward P/E ratio of 17.1. The aforementioned technical projects would see the market bottom at a forward P/E ratio of between 14.7 and 16.4, with an average of 15.5.

Assuming the economy manages to sidestep a recession, these projections appear to be reasonable, as valuations would be bottom out at between slightly below its 10-year average, or at its 5-year average. It would represent a valuation reset that presents itself as a buying opportunity.

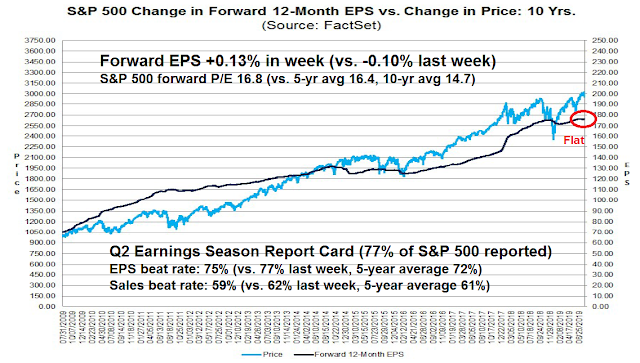

This exercise at estimating downside risk involves many moving parts, whose futures are not known. Will the trade war escalate further in 2019? How many more times will the Fed cut rates for the remainder of this year, and will it matter? If the Fed is easing into a slowing economy and falling earnings estimates, investors are likely to focus more on the deteriorating outlook more than interest rates, at least in the short run. We can see that forward EPS are flat in the last few weeks, which is creating a headwind for stock prices.

Like the Federal Reserve, I am data dependent, and all bets are off if an actual recession were to develop.

The week ahead

Looking to the week ahead, it is obvious that the market had sustained considerable technical damage. While I had estimated the intermediate downside risk, it is less clear what the short-term outlook is.

For some context, I had a question from a reader in response to a previous post, A (deceptive) long-term buy signal:

I’d like a little bit of clarification…. you wrote the two opposite things in the latest post.

“Should stock prices weaken, the risk of a deeper pullback is high. The equity position of trend following CTAs and risk parity funds are at a crowded long reading.”

“My inner trader is short. Any pullback is likely to be relatively shallow. Initial SPX support can be found at about 2950, with additional support at about 2910.”

I am afraid that I did not answer him in a clearer manner. The apparent contradiction is a difference in time horizons. My base case scenario calls for a deeper intermediate term correction. The first comment referred to a longer term outlook, but for a trader with a 3-5 day time horizon, the market is likely setting up for a short-term bounce as it is at or near my initial downside targets.

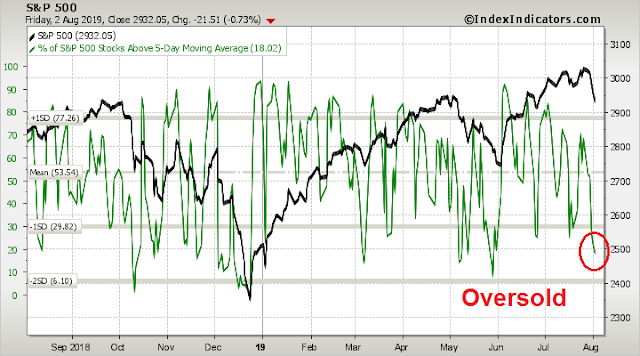

We can see the typical behavior of the market after the VIX Index spikes after a period of relative calm. The VIX spends several days above its upper Bollinger Band (BB), and the market becomes highly oversold on 5-day RSI (marked by shaded areas). This is followed by a short relief rally where the VIX falls below its upper BB, and a subsequent decline to further lows. The index is currently nearing a test of its 50 dma, and sits just above a Fibonacci retracement level at about 2910. Expect some minor weakness to start the week, followed by a bounce.

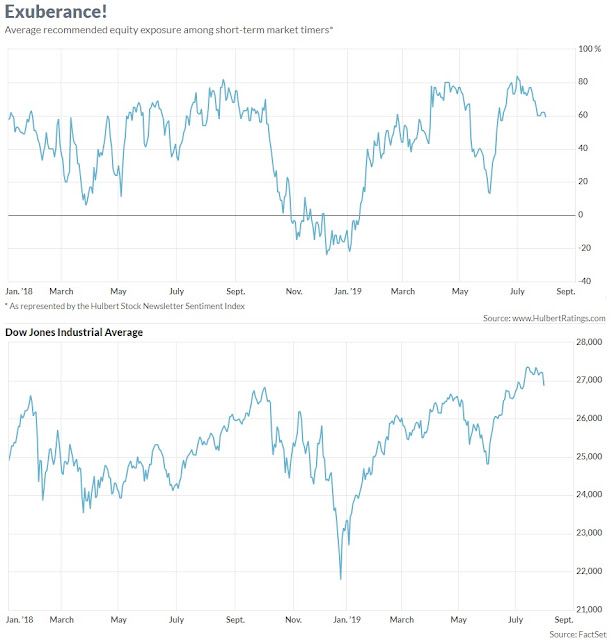

This is likely the start of a multi-week corrective episode. I had been tactically cautious in these pages for the last few weeks, and I had warned about numerous cases of excessive bullishness and negative technical divergences. Most recently, Mark Hulbert observed that his Hulbert Newsletter Stock Sentiment Index was in overly exuberant territory, and the market was ripe for a pullback. Under such circumstances, stock prices are unlikely to turn up again without a sentiment reset.

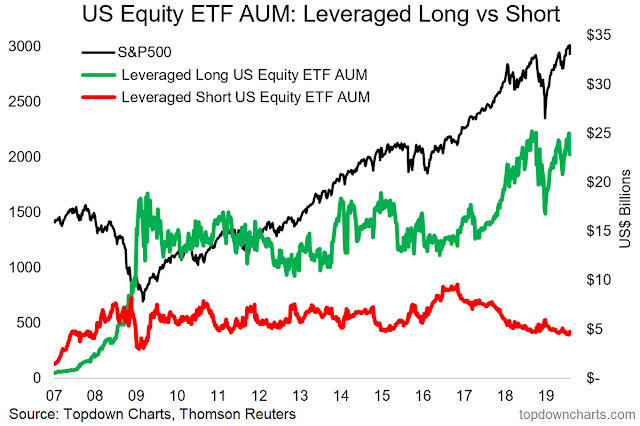

Callum Thomas also pointed out that the AUM of leveraged long equity ETFs are at an extreme level compared to leveraged short ETFs. The combination of extreme sentiment and sudden stock market air pocket argues for a sentiment recycle.

Similarly, I am waiting for the Fear and Greed Index to fall under 20, where the market had bottomed out in the past.

In the short run, momentum has become excessively oversold that a relief rally can happen at any time.

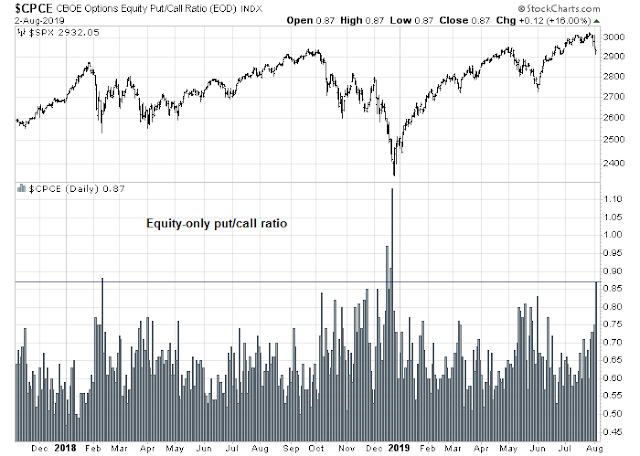

The equity-only put/call ratio spike Friday to levels last seen at the February and December 2018 bottoms. While daily put/call ratios are not precise timing tools, it is a sign that panic was in the air.

In short, last week`s downdraft has caused sufficient technical damage that it is difficult to see how the bulls can quickly regain control of the tape. That said, the market structure is setting up for a bounce, followed by further declines, which is likely going to see further lows of unknown magnitude, and in an unknown time frame.

My inner investor remains neutrally positioned. The current episode of weakness is probably just a blip and represents a typical market pullback. If investors cannot stomach this kind of minor volatility, then they should not be taking equity risk in their portfolios.

My inner trader is short. Should stock prices weaken further early next week, he is prepared to take partial profits in his short positions. On the other hand, if the market were to stage a relief rally, he stands ready to add to his bearish positions.

Disclosure: Long SPXU

You make very good points, but I doubt that Trump will let the market fall apart as he sees it as his approval rating.

Trump has mastered the art of manipulation, in modern markets of algo trading. It is quite simple. You can’t have a market going vertical. It needs to be managed in a way that we see higher highs and higher lows, culminating in an ATH before election 2020. What we are seeing now is a re-run of May-June drama this year.

Calling Ken, can you please share your opinions?long time no see.

What was your time horizon on the P&F chart of 4100 on the S&P 500 that you published recently?

P&F charts have no time horizon. That’s not a bug, it’s a feature.

Remember how they are constructed. You don’t get another box until price moves by a specified amount. From a purely mechanical viewpoint, a new box could occur in a day, or a year. That’s why time in P&F charting is flexible.

I see. So, regardless, is there a way to estimate the time frame?

There are a couple of things to consider:

1) The P&F price objective was based on a S&P 500 breakout past 2950. Now that the index is below the breakout level, is this pullback just a just a blip, or something more serious? In the latter case, the breakdown below 2950 negates the upside target.

2) Put it another way, is this the start of a major bearish episode, or a run of the mill correction?

I suppose EPS going forwards are a good way to figure out, based on a market multiple (15-17). By some metrics, this market may be range bound between 2400-3000 (you have talked about it earlier).

Seems like the (surreptitious) long term buy signal you talked about, may be off the table for now.

It is only Tuesday, let us see what the rest of the week brings.

China pairs a second shot across the bow (halt on US agricultural products) with a denial of the first shot (currency devaluation). They’re playing a slow and deliberate hand – in my opinion a perfect foil to the US approach.

Remind me to never take your market analysis lightly, Cam. I should have lightened up much more than I did as the market went on up.

I agree with Wallace. After today’s 700 point correction, is this looking like the start of something more of the major bearish aplitude?

Cam,

Have you followed any of Kyle Bass’ commentary on China? He believes they are running out of dollars and that they are short of many essentials like energy.

See analysis from Chris Balding. Beijing won’t let CNY fall very much further.

https://twitter.com/BaldingsWorld/status/1158510203920244736

Thank you. Kyle Bass thinks China has run out of the firepower to control their currency and that it would float to 7.4.

SPX/DJIA futures off an additional -1.8% after hours.

Pretty wild action.

CNBC Markets in Turmoil

https://twitter.com/sentimentrader/status/1158474025351503872

So the first broadcast is generally followed by additional downside. A second or third program several days/weeks later does a much better job of signaling a bottom.

Question 1: Should any EPS projections take into account the dilution from buybacks? Take a look at the graph on page 4, figure 8.

https://www.yardeni.com/pub/ts84cc.pdf

Question 2: As S&P 500 TOTAL SHARES OUTSTANDING decrease from buybacks, don’t earning reports become “Fake News”?