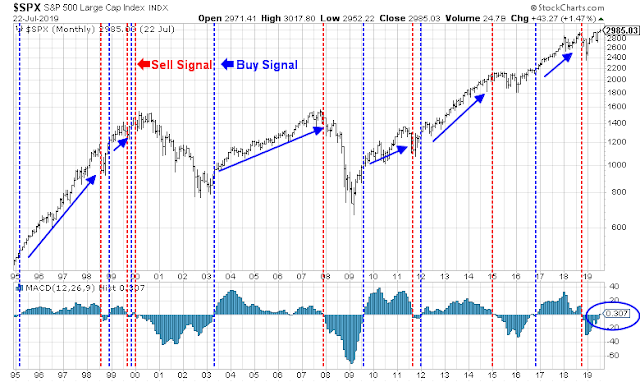

Mid-week market update: It is month-end, and the day after an FOMC meeting. Regular readers may recall that I have been monitoring the monthly MACD indicator for a long-term buy signal. Troy Bombardia recently highlighted what happens when the SPX flashes a long-term buy signal. Subsequent one-year returns have been almost all positive.

The verdict is in, the index has flashed a long-term MACD buy signal.

While the signal is constructive for the long-term outlook, let me temper your enthusiasm.

Looking for confirmation

The SPX buy signal has not been confirmed by other indices. I found that the monthly MACD buy signal works slightly better when applied to the broader Wiltshire 5000 (WLSH). WLSH did not confirm the buy signal.

As well, the buy signal was not confirmed by the even broader global index.

The Fed disappoints

I was correct when I suggested earlier in the week that the Fed might enact a hawkish cut (see A hawkish cut ahead?). Powell corrected market expectations by stating that the quarter-point cut was a mid-cycle policy adjustment, and not the start of a rate cut cycle. He did, however, hold out the possibility of further cuts, which will be dependent on incoming data.

The appearance of two dissenters to the easing decision, by KC Fed president Esther George and Boston Fed president Eric Rosengren, were signs that the FOMC is highly divided. The bar to further cuts will be high, and new data will have to deteriorate significantly for the Fed to cut further.

Short-term outlook

In response to the FOMC decision, the 2s10s yield curve flattened dramatically, indicating expectations of slower growth. Stock prices also adopted a risk-off tone. The SPX breached a short-term uptrend, indicating the bulls had lost control of the tape, and briefly tested secondary support at about 2950. In addition, the VIX Index rose above the top of its Bollinger Band (BB), which is an indication of an oversold condition. Past BB breaches have been resolve with a quick recovery, and more prolonged VIX spikes that were associated with deeper pullbacks, and it is unclear how the latest episode will turn out.

Troy Bombardia also studied what happens after the Fed cuts rates when the market is near an all-time high. It did not perform well over the next month, but longer term returns have been positive.

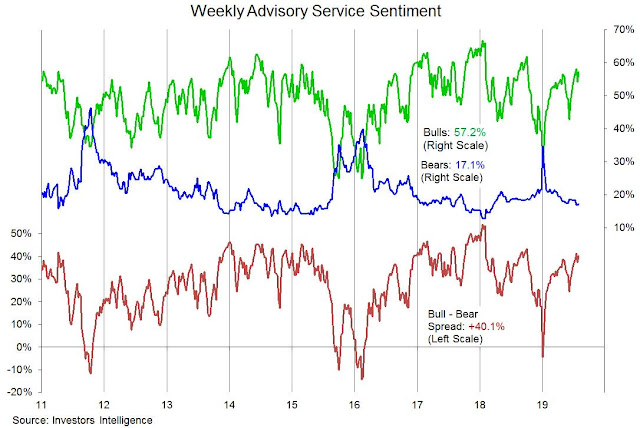

I remain short-term cautious. II sentiment is overly bullish.

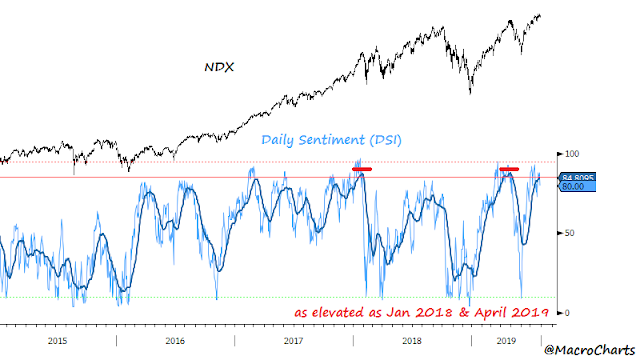

NASDAQ stocks have been the leadership in this latest rally, and NDX DSI is also somewhat stretched.

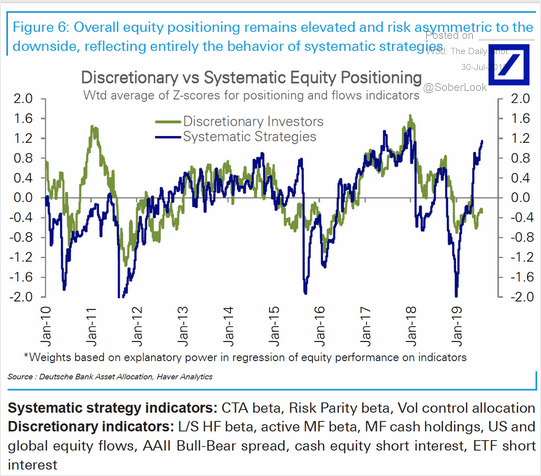

Should stock prices weaken, the risk of a deeper pullback is high. The equity position of trend following CTAs and risk parity funds are at a crowded long reading. Any sustained retreat could see a stampede for the exits as these systematic strategies unwind their long positions.

In addition, the months of August and September have been seasonally weak for equities.

My inner investor continues to be constructive on equities. He is neutrally positioned, and he is waiting for confirmation of the monthly MACD buy signal from broader indices like WLSH.

My inner trader is short. Any pullback is likely to be relatively shallow. Initial SPX support can be found at about 2950, with additional support at about 2910.

Disclosure: Long SPXU

Nice call, Cam!

Looks like they are buying the dip today. What strikes me the most is the difference between the eurozone and the US in terms of rates. When Japan had really low rates compared to the US there was the yen carry trade. One would think that there is a euro carry trade going on which would give support to the USD and quite possibly US equities and make headwinds for precious metals. Of course it all depends where the money goes, but I don’t think we will see negative rates here until we get some serious deterioration in data and markets, so it fits with the monthly long term buy signal, but I think things will get bumpy.

Got a little bumpy for sure!

Speaking of turbulence, interesting article in Barron’s re the havoc Trump’s tweets wreak on on an overnight trading strategy:

https://www.barrons.com/articles/a-successful-after-hours-trading-pattern-is-broken-by-trumps-tweets-51564789699

Looks like Cam expects a dead cat bounce next week…

Next week has got many confused (imo)

SPX may have dropped too far too quickly, so bounce more likely, however am wondering if another drop before that bounce comes in.

Ready to short a rise. But its wait and see for now before committing either way.

Waiting for China’s response to the latest threat of tariffs. I’m really not sure why the President considers it an effective strategy.

Trump likes to use ‘trade war’ as a catalyst to get what he wants i.e. get the Fed to cut rate, start QE again to boost asset prices. He know he has little control over Fed not without push back. He had much more control over the ‘trade war’ narrative. Only take a twit;

So that he can use equity market performance as a 2020 election selling point if fed cut rate and/or turn on the tap of liquidity