Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

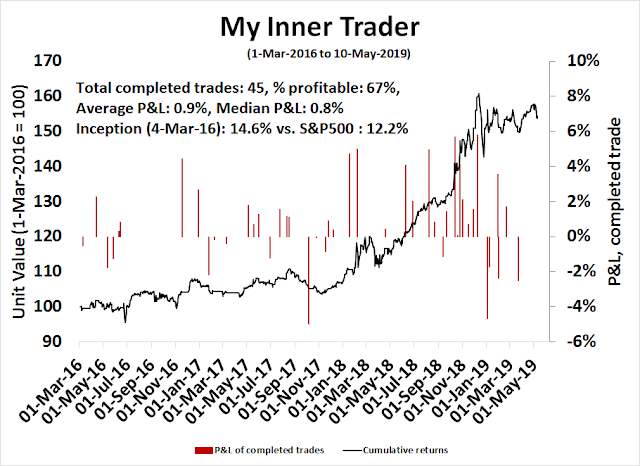

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Looking through a trade war

Josh Brown made an astute comment last week that all investors should keep in mind.

Here is why I think investors should look through the effects of any trade tensions.

Imagine a trade war

Imagine a US-China trade war, what is the worst that could happen? Bloomberg reported that Citi estimates an initial 0.5% hit to GDP growth:

An increase of tariffs on $200 billion of Chinese goods would cut 0.5 percentage points off China’s growth over one to two years, and the impact could more than double if duties are slapped on all its shipments to the U.S.

That’s according to Citigroup Global Markets Inc economist Cesar Rojas, who also wrote in a May 8 note that raising tariffs on $200 billion of China’s goods to 25 percent from 10 percent on Friday would slice 0.2 percentage points off global growth over the same period. The impact on global expansion also would also double if duties of 25 percent are slapped on the remaining Chinese imports, he said.

In a full-blown and protracted trade war, the IMF projected that China would lose 1.6% of GDP growth, the US would slow by 1.0%, and the rest of Asia would get sideswiped.

Who think that it would actually last as much as a year? Calculated in economic terms, China would “lose” a trade war, but when calculated in political cost, America would lose as Trump does not have the same pain threshold as Xi.

In isolation, an addition 15% in tariffs on $200 billion of exports will not totally derail the Chinese economy. China has a number of policy levers to mitigate the effects of a trade war. First, it could resort to stimulating its economy with more targeted debt financing. I pointed out that China threw caution to the wind and raised total social financing (TSF) by roughly 9% of GDP in Q1 (see Sell in May? The bull and bear debate). The latest April update shows that TSF slowed to (only) 1.4 trillion yuan, or about 2% of GDP. To be sure, such a course of action increases its financial fragility, and China is already seeing rising defaults. But in a war, normal rules go out the window.

Keep an eye on the relative performance of China’s property developers. This group is highly sensitive to PBoC policy, and the effects of monetary stimulus or tightening will be immediately visible.

Another policy lever open to Beijing is a currency devaluation. While it would undoubtedly annoy Washington and create capital flight problems, a long stalemate will break the soft RMB peg.

Taken all together, these initiatives are likely to defer a hard landing, but they would not serve as the engine of global growth.

Now imagine the consequences of a trade war from Trump’s viewpoint. You are facing an election next year. Economic growth will decelerate because of the trade war, and you can’t order the Fed to cut interest rates. There is a little wiggle room in the timeline for further negotiations, as the tariffs are only payable for goods exported from China on or after May 10, 2019, and any exports in transit escape the higher rate. And despite Trump`s misguided perception, the tariffs are only paid by China in the same way Mexico was paying for the Wall. They are paid by American importers, and they are going to hurt. The damage will be felt in a number of Republican states such as TN, GA, KY, AR, and ID, and battleground states like MN, PA, and IN, and he will face pressure from his own party in those states.

Just remember the Newt Gingrich criteria that he outlined in the New York Times at the start of Trump’s presidency:

“Ultimately this is about governing,” said former House Speaker Newt Gingrich, who has advised Mr. Trump. “There are two things he’s got to do between now and 2020: He has to keep America safe and create a lot of jobs. That’s what he promised in his speech. If he does those two things, everything else is noise.”

“The average American isn’t paying attention to this stuff,” he added. “They are going to look around in late 2019 and early 2020 and ask themselves if they are doing better. If the answer’s yes, they are going to say, ‘Cool, give me some more.’”

I am also old enough to remember Ronald Reagan’s 1980 campaign slogan, “Are you better off than you were 4 years ago?”

The Hill reported that Trump’s “Art of the Deal” trade tactics have alienated Republican legislators:

Senate Republicans feel that President Trump has once again pulled the rug out from under them on trade, leaving GOP lawmakers frustrated over their inability to influence the White House’s policy on an issue that could have major economic and electoral ramifications.

Days after a group of Republican senators relayed to Trump at a White House meeting their concerns about trade tensions with Canada, Mexico, Europe and China, Trump over the weekend threatened new tariffs on China, escalating a fight with Beijing and rattling markets.

The President will not be able to chart as independent course as he did in the last election cycle. He needs the support of his party, as he is reverting to a traditional style of fundraising. Tanking the economy and the stock market will not endear him to big money donors (via The New York Times):

About 200 bundlers from across the country are expected to gather Tuesday at the Trump International Hotel for a series of meetings and workshops about the campaign’s new fund-raising program. Vice President Mike Pence will address the group. Brad Parscale, President Trump’s campaign manager, will play host. Stephen A. Schwarzman, the Wall Street billionaire, has R.S.V.P.’d yes.

The group will be divided into tiers, based on success in raising money. The “Trump Train” donors, or those who raise $25,000, will be given a lapel pin and access to a national retreat and leadership dinners. “Club 45” members, or those who raise $45,000, will get all of that, as well as monthly conference calls with Republican Party leaders. And the “Builders Club,” or those bundlers who raise $100,000 or more, will be given access to national campaign events.

It is the kind of traditional campaign fund-raising apparatus that Mr. Trump thumbed his nose at during his 2016 run. And it involves some donors who only grudgingly accepted him once he was the Republican presidential nominee.

Playing the investing odds

To summarize, the suite of possible Chinese policy response is nothing more than band-aid solutions, but in a war, no one questions band-aids. On the other hand, it doesn’t seem that Trump has a Plan B, and he is going to face increasing political pressure from traditional Republican supporters as the trade war goes on.

Both sides need a deal, or at a minimum, a truce. It is only a question of how long it takes to arrive to an agreement. Sino-American trade frictions will continue to be a feature of the next decade, and the details of any deal in 2019 is unimportant as I fully expect that its provisions will be broken within a year. The Economist made the case that the fundamental problem is a clash of two different economic systems:

Any deal will also include promises to limit the [Chinese] government’s role in the economy.

The trouble is that it is unlikely—whatever the Oval Office claims—that a signed piece of paper will do much to shift China’s model away from state capitalism. Its vast subsidies for producers will survive. Promises that state-owned companies will be curbed should be taken with a pinch of salt. In any case the government will continue to allocate capital through a state-run banking system with $38trn of assets. Attempts to bind China by requiring it to enact market-friendly legislation are unlikely to work given that the Communist Party is above the law. Almost all companies, including the privately owned tech stars, will continue to have party cells that wield back-room influence. And as China Inc becomes even more technologically sophisticated and expands abroad, tensions over its motives will intensify.

Bottom line, be skeptical about the longevity of any agreement:

At some point this year Mr Trump and Xi Jinping, his Chinese counterpart, could well proclaim a new era in superpower relations from the White House lawn. If so, don’t believe what you hear. The lesson of the past decade is that stable trade relations between countries require them to have much in common—including a shared sense of how commerce should work and a commitment to enforcing rules. The world now features two superpowers with opposing economic visions, growing geopolitical rivalry and deep mutual suspicion. Regardless of whether today’s trade war is settled, that is not about to change.

This view of a clash of economic systems is becoming mainstream, and it was advocated by China hawk and now trade negotiator Robert Lightizer in his 2010 testimony to the US China Economic and Security Review Commission:

There are several reasons by China’s political system is fundamentally at odds with the American conception of the “rule of law.” At the national level, the Communist Party is willing to ignore international commitments to maintain power. Moreover, the Communist Party owns and operates, or is tied to, private enterprises in key sectors such as transportation, energy, and banking. China also suffers inadequate governance at the provincial level – a result of many factors including corruption, a lack of uniformity among rules, and arbitrary abuse of power. Finally, China suffers from a culture of noncompliance “where bad actors set the norm, where laws and regulations are often ignored or unevenly enforced, and where many citizens and market actors don’t know or can’t obtain their rights under the law.”

However, from a tactical perspective, it is evident from the market action that even a ceasefire that eliminates near-term tail-risk will spark a risk-on rally. The market is on the verge of a significant and extremely effective buy signal on the long-term monthly chart, even with the recent pullback.

How far can stock prices rise?

Now imagine that in the absence of trade tensions, how far can stock prices rise? While this is not a forecast, it is a projection of upside potential if everything goes right.

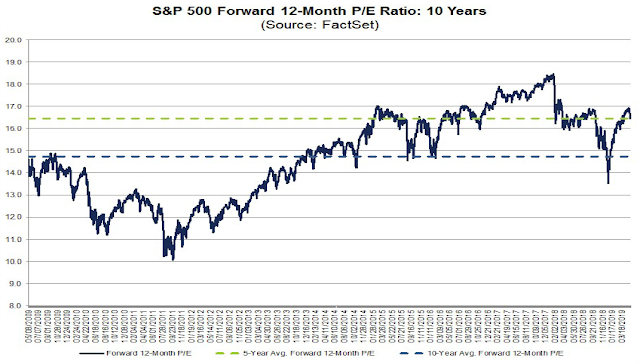

The US economy was on track for steady non-inflationary growth of 2-3%, with the Fed on hold. Such an environment represents a sweet spot for equities. According to FactSet, the forward P/E of the market is 16.5, which is equal to its 5-year average but above its 10-year average. Imagine it is now December 2019, and the forward P/E ratio has risen to its recent high of 18.5. Pure P/E expansion would add 12% in capital appreciation. On top of that, forward earnings grows at 3-5%, and the market could be 15-17% higher by year-end.

In conclusion, while the trade negotiation headlines are dire, there are many incentives for both sides to conclude a deal. Trading is a marathon, not a sprint. I therefore believe these trade tensions are temporary. Should the threat of a trade war recede, the market is poised for a significant rally with upside potential of 15-17% to year-end.

The week ahead

The market action last week was one of the most unusual weeks of my investing career. The market had been rising steadily, and the downdraft came out of nowhere. While the news flow had extremely bearish implications, the market wasn’t responding to bad news. The S&P 500 only fell -2.2% in the week, and the intra-day peak-to-trough drawdown came to only -4.5%.

The bear case is easy to make. The surprise imposition of the new round of tariffs had severe negative implications. Bloomberg reported that some trade groups were projecting job losses of as much as 400,000.

President Donald Trump’s higher tariffs on Chinese imports will have “dire consequences” for U.S. equipment manufacturers and worsen prospects for American farmers and others already reeling from lower commodity prices, an industry trade group warned on Friday.

The tariffs will “drive down exports, and suppress job gains for the industry by as much as 400,000 over 10 years. It will also invite China to hit back at American businesses, farmers, communities, and families,” said Kip Eideberg, vice president of government affairs for the Association of Equipment Manufacturers, which represents more than 1,000 U.S. makers of farm, construction and mining machinery.

“With producers already struggling with falling commodity prices, additional retaliatory tariffs on U.S. agricultural exports will have a chilling effect on equipment manufacturers,” Eideberg said in a statement after the penalties went into effect.

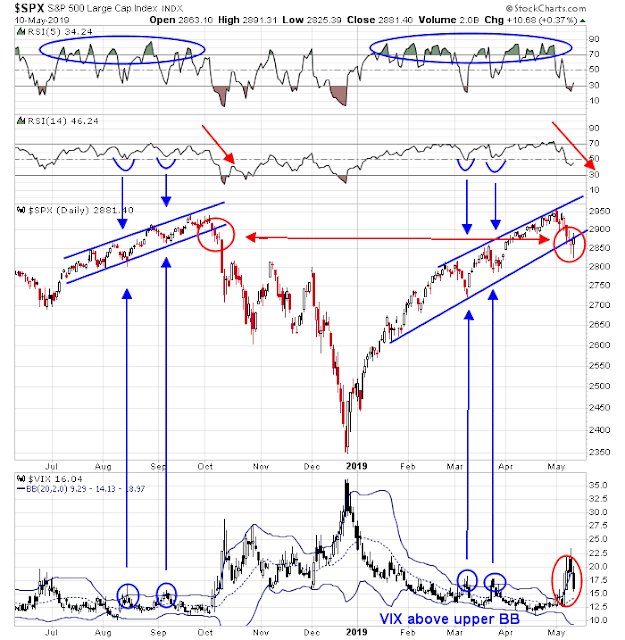

When the news of Trump’s about face on trade negotiations broke, I suggested waiting for the market reaction first before reacting, as the news flow was rapid, and headline risk was high. By Thursday, the technical condition of the market had dramatically deteriorated. The S&P 500 had broken down out of a rising uptrend, indicating the steady advance is over. The last episode of a broken uptrend saw the start of the mini-bear that culminated in the panic bottom on Christmas Eve. Could it happen again?

NASDAQ leadership has also broken down, which is another confirmation that the bulls were losing control of the tape.

Is it time to turn bearish?

Not just yet. As I pointed out, the magnitude of the downdraft on the trade news was remarkably mild. Monday’s market action was especially puzzling. The market gapped down -1.2% at the open, but rose the rest of the day to end with only a loss of -0.5%. The market was simply not responding to bad news. Friday’s market action was equally puzzling. After the news that the US had imposed another round of tariffs at one minute after midnight, the Shanghai Composite rose 3.1%. To be sure, Bloomberg reported that state owned firms were in the market buying stocks to support prices, but Hong Kong was up 0.8% and Korea was up 0.3%. All of the European markets were also green on the day. Was Beijing intervening in all those markets too?

When the US market opened, it gapped down, but rallied and ended the day in positive territory. The hourly chart shows that the S&P 500 rallied through a downtrend line, with possible gap fills as upside objectives. Is this how the market reacts to ugly news?

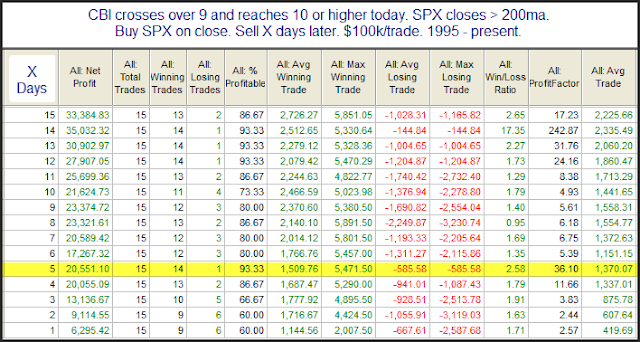

One explanation is the market had become washed out, which is an unusual condition in light of the shallow nature of the pullback. Rob Hanna of Quantifiable Edges reported that his Capitulative Breadth Indicator (CBI), which is a bottom-up count of stocks in the S&P 100 experiencing capitulative selling. Hanna found that CBI readings of 10 or more were indicative of market washouts. Even though these buy signals did not necessarily mark the exact bottom, stock prices have exhibited a strong upward bias upwards after such events.

A similar, but less rigorous, historical study by Urban Carmel based on Thursday’s closing price came to a similar conclusion. The market is oversold, and due for a bounce.

Signs of fear have broken out in the option market. The CBOE equity put/call ratio spike to levels seen in the market downdraft late last year, and the term structure of the VIX curve had inverted.

Similar signs of panic selling in the TRIN index are also appearing. The 10 day moving average of TRIN has spike to levels consistent with past market bottoms. With the exception of the capitulative selling episode last December, downside risk has been limited at these levels.

In view of the potentially Apocalyptic nature of these trade developments, how can we reconcile a market capitulation event with a shallow decline? A protracted and full-blown trade war has the potential to push the world economy into a synchronized global recession.

I can offer two explanations. One is the market is not taking Trump’s threats seriously. In that case, potential downside risk is high as further negative developments could crater prices.

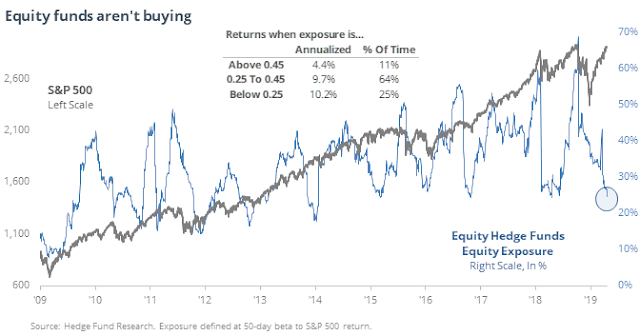

The other explanation is most market players are already short beta, and there is little selling left to do (see A stampede you could front run). Both institutional investors and hedge funds are underweight equities. Retail investment accounts are at best neutrally positioned. In effect, cautious positioning is putting a floor on the market.

I had already pointed out that the BAML global fund manager survey shows institutions are underweight equities, and they have been slowing buying.

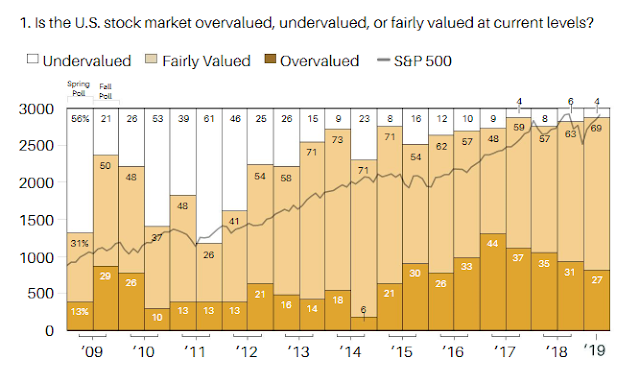

The semi-annual Barron’s Big Money poll shows domestic manager bullishness has been in retreat.

Jason Goepfert at SentimenTrader found that hedge funds have a low equity exposure.

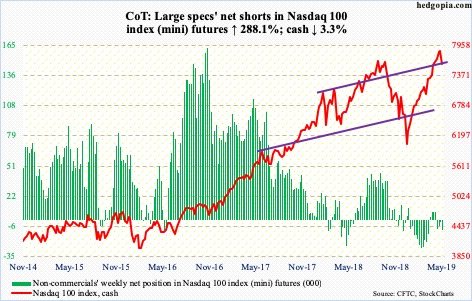

The latest Commitment of Traders report shows that large speculators, which are mostly hedge funds, are short the high beta NASDAQ 100.

The combination of these readings, and the market’s inability to respond to bad news, are supportive of the thesis of exhausted sellers. Nevertheless, this raises a dilemma for both investors and traders. While the market may be poised for a reflex rally, what will happen afterwards?

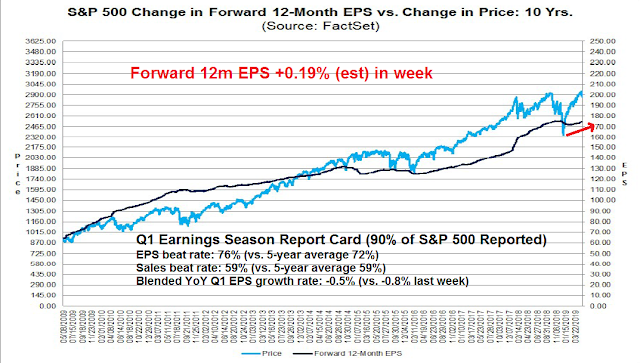

Here is what I am watching, other than the news on trade negotiations. One of the most important questions is, what will happen to earnings expectations? Earnings estimates have been steadily rising, will we see wholesale estimate cuts because of tariffs? Q1 earnings results have been solid. The EPS beat rate is above average, and the sales beat rate is in line with historical experience.

Q2 guidance has so far been solid. Will it reverse course?

If the Street revises estimates downwards, we should see the effects in the next 2-4 weeks. That time frame also coincides with the window for a market bounce. If the stock market is rallying as estimates are being cut, then that is a signal to turn cautious. The 2-4 week window is also a negotiation window. The latest round of tariffs are applied to goods exported from China starting on May 10, not landing on US soil on that date. Within that period, all imports from China will be subject to the new tariffs as it takes that long for shiploads of goods to arrive. The US has made it clear that if there is no deal by late June, the new tariffs of 25% will be imposed on the remainder of goods coming from China.

Another item to watch is the message from the credit market. Despite last week’s near inversion of the 10-year to 3-month rate, the 2s10s yield curve has steepened during this episode, indicating better growth expectations. The 10s30s remain elevated, and it is not signaling a slowdown.

As well, I am watching New Deal democrat‘s monitor of coincident, short leading, and long leading economic indicators. Is there any sign of a slowdown? The current outlook is relatively upbeat.

Driven by the “flight to quality” in bonds, the long-term forecast improved to positive this week. The short-term forecast also remains slightly above neutral. The nowcast also is positive. The picture for 2020 looks increasingly positive. I’m watching initial claims, and will watch the regional Fed reports, particularly closely to see whether the recent improvement has been temporary or not.

My inner investor is giving the bull case the benefit of the doubt, and he is overweight equities. My inner trader is waiting for the inevitable bounce, but he is watching developments for what he will do next.

Disclosure: Long SPXL, TQQQ

Here we have a market that just went up the longest in history from its December low without a 3.5% correction. We have two Sumo wrestlers in the global trade ring going flesh on flesh at a crashing speed as of midnight Friday, past. This is potentially a death blow to the trend of globalization that has created so much prosperity and profits. We have a U.S. carrier fleet steaming to the Red Sea with the supreme commander, Donald Trump, less predictable on the international stage than any leader in modern history. Last week saw junk bond spreads widen by 30 basis points.

This is going to be very exciting. This reminds me of Las Vegas crap tables that get hot. More and more players are drawn to the action. Just as in dice, the outcomes in financial markets from all of these huge forces is totally random with big impacts on one’s portfolio results. The biggest day to day swings in markets are in downswings. Passions are hot. Fear and greed swing.

The question most people ask themselves is “Do I feel lucky?” Behavioral economics says we are wired to be overconfident. That means we jump into the action.

The question I ask myself is “Do I need to be lucky to make a decent return on my money?” I answer no and keep a good deal of powder dry for more predictable times.

Seems to me the market went up 25% and has pulled back a puny 2.5% in the face of tectonic, unpredictable forces being unleashed. I can envision a great, low risk, more predictable buying opportunity in the future.

Color me still very very bullish over the next year just like I was when markets turned up at year end. Las Vegas is a better place to gamble. You can take your spouse to great shows and fine dining.

Cam, my understanding is that very little of the new tariffs are being borne by the US consumers. Consumers will find other sources or substitutes for the imported products if the US importers forced to pass that entire tariff to consumers. The tariffs costs are being defrayed with lower Renminbi, Chinese government incentives, and the partial absorption of the tariffs both by the exporters and the importers to minimize passing the additional cost to the US consumers. Also, the tariffs collected go into the US treasury so may be the US consumers are a net beneficiary after all.

Having said that, I think the damage is already done. The US companies will get a lot of scrutiny from the shareholders and the US government if they decide to invest more in building manufacturing facilities or extending supply-chain in China. Many if not most are already looking at alternate sources outside of China.

I agree President Xi and the Communist Party would never agree to enshrining the agreement on IP protection, government subsidies and forced technology transfer into country’s laws. The question is why did they agree to that in the first place and are now backtracking on that, as reported in the media?

There are two issues here:

1) The May 10 tariffs just raises the rate from 10% to 25%on an existing list

2) Trump has threatened to slap tariffs on more or less everything else imported from China, but that step has not been implemented yet

As for (1), there has been little or no warning for importers, so that’s going to hurt. Anecdotal evidence from Fed surveys indicate that some importers have absorbed some of the 10% initial increase and have not passed it on. They will not be able to cope with additional 15%, especially with no warning.

The existing tariffs is on a mix of consumer and intermediate goods. While consumer goods have not seen much price pressure (see above comment about importers eating some of the cost), intermediate goods are more problematical. Imagine if you are an American manufacturer sourcing an electric motor that goes into your product, a 15% increase in the cost of that motor is going to be a hit to your margin. Similar, Apple will have to make a choice between raising prices because the cost of their screen glass just rose, or eating the cost.

In addition, the lack of warning also means that American businesses have no time to consider substitutes. Finding a new supplier for an iPhone screen or electric motor will take time. You need to give potential supplier the specifications, conduct due diligence that they have the capability to produce what you want at the quality and quantity that you need.

Over time, all this does is move production from China to other low wage countries like Vietnam, the Philippines, Thailand, Bangladesh, etc. With only a few minor exceptions, manufacturing will not return to the US. Forget about the textile mills in New England, they are gone forever.

Sanjay

What we are talking here is taking complete supply chains out of China and relocating them to the US or other countries. This is going to take much longer time, as China has provided a “one stop shop” for all manufacturing supply chains. To replace such “one stop shop” will take a long time. There may be increased prices for US consumers, and at worst supply chain disruptions, as China is pushed out of the manufacturing picture, unless there is a quick resolution of this trade impasse.

https://www.axios.com/trump-china-trade-war-tariffs-negotiations-public-8ea9cc5a-a6ec-4e77-9caf-f3e2251edccd.html

I agree with the points In this Axios piece. The manner in which this administration negotiates is self defeating and hardens positions on both sides. Agree with Ken that it’s a crapshoot right now. Might get resolved tomorrow; might not. Who knows? There will probably be more attractive re- entry opportunities in the future.

I read somewhere last week that the Chinese Government is absorbing the tariff costs and allowing them not to be reflected in prices. This has the effect of maintaining their market share in tariffed products by not increasing costs to the end user.

Larry Kudlow

http://time.com/5587848/kudlow-trump-china-tariffs-fox-news-sunday-interview/

Full interview and transcript here

https://www.realclearpolitics.com/video/2019/05/12/larry_kudlow_on_china_tariffs_a_risk_we_should_take_to_correct_20_years_of_unfair_trade.html