Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

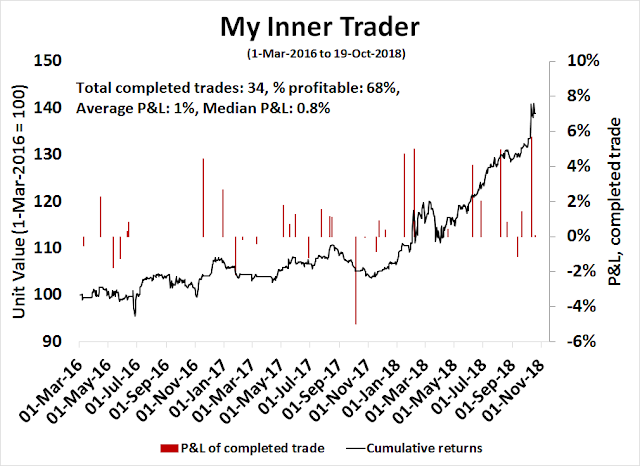

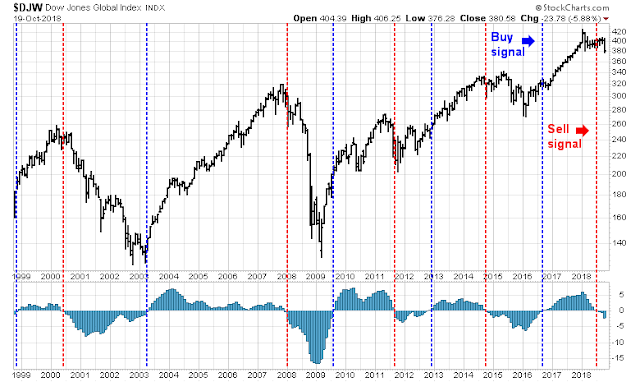

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. The turnover rate of the trading model is high, and it has varied between 150% to 200% per month.

Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Looking for the risk in the wrong places?

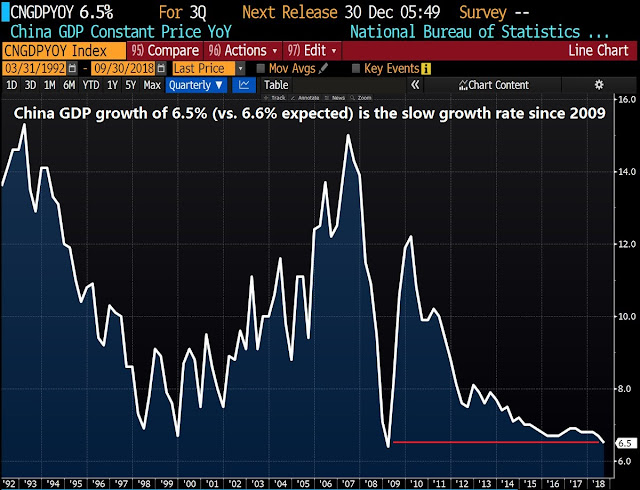

Waiting for China to report its Q3 GDP growth used to be not very suspenseful. Is it going to be 6.7%, which was the last report, or will they allow it to fall to 6.6%, which is the market expectation? As it turned out, Q3 GDP came in at 6.5%, which was below market expectations, and a possible signal of acute weakness in the Chinese economy.

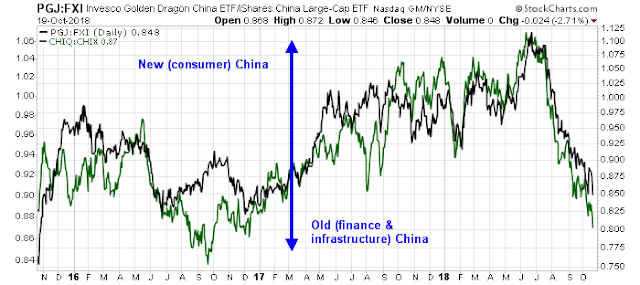

Notwithstanding the highly manipulated economic statistics coming from China, I have been monitoring the real-time signal of the China rebalancing theme using my long New (consumer) China ETF and short Old (finance and infrastructure) China ETF pairs for quite some time. The two pairs consist of long Invesco Golden Dragon China (PBJ) and short iShares China (FXI), and long Global X China Consumer ETF (CHIQ) and short Global X China Financial ETF (CHIQ). As the chart below shows, New (consumer) China has been dramatically underperforming Old (finance and infrastructure) China.

To add insult to injury, Old China is also performing badly on an absolute basis. Last week, I outlined a number of disparate real-time bearish tripwires (see A correction, or the start of a bear market?). Most of the indicators focused on either US or global macro factors. One was the share of major Chinese property developers because property prices are sensitive barometers of financial stress, and rising financial stress would be especially important in light of the high degree of leverage in the Chinese financial system.

The share prices of Chinese property developers are weakening, and in some cases breaking down technically. When I focused on US indicators, I may have been looking for risk in all the wrong places.

Cracks appear in the China real estate

A recent FT article illustrates the high level of dependency that the Chinese economy has to real estate:

The property sector is estimated to account for 15 per cent of China’s gross domestic product, with the total rising closer to 30 percent if related industries are included. A downturn would add to financial strains on China’s heavily indebted property developers which paid record sums for land during auctions last year but are now struggling to recoup their investment.

Other evidence of a downturn is starting to emerge. Sales by floor area dropped 27 per cent year on year during the “golden week” national holiday earlier this month a peak period for house buying in China, according to research house CRIC, which tracks 31 cities.

Although average new home prices in China’s top 70 cities grew 1.4 per cent in August, the last month for which official figures are available, analysts say falling sales mean a period of price cuts has begun.

Since financial statement quality can be *ahem* dubious in China, lending is mainly based on asset value, and land constitute roughly 40% of collateral in total lending. If property developers were to cut prices, it would have an immediate effect on the health of the financial system. It was therefore no surprise that protests against price cuts have arisen across China:

A wave of protest by Chinese homeowners against falling property prices in several cities has raised fears of a downturns in the country’s real estate market, adding to pressure on Beijing to stimulate the economy.

Homeowners in Shanghai and other large cities took to the streets this month to demand refunds on their homes after property developers cut prices on new properties to stimulate sales.

In Shanghai, dozens of angry homeowners descended on the sales office of a complex that offered 25 per cent discounts to demand refunds, causing clashes that damaged the sales office, according to online reports that were quickly removed by censors. Similar protests have been reported in the large cities of Xiamen and Guiyang as well as several smaller cities.

As official statistics from China tend to be unreliable, I rely on indirect real-time market-based indicators for clues to the healthy of the economy. Here are the shares of China Evergrande Group (3333.HK), which is one of the largest property developers in China. The stock is resting at a key support level.

Here is China Vanke (2202.HK), which is in a downtrend and broke a support level.

The chart of Greentown China (3900.HK) looks downright ugly.

Country Garden (2007.HK) also broke support and it is in freefall.

You get the idea. The share prices of Chinese property developers have all broken support, with the exception of Evergrande, which is testing a key support level. All are in major or minor downtrends. They only recovered on Friday after the authorities verbally intervened, as reported by the Asian Nikkei Review:

Chinese financial regulators on Friday provided verbal support to ease unrest in the markets. People’s Bank of China Yi Gang said the central bank is studying some targeted measures to ease financing difficulties of companies. Guo Shuqing, chairman of the China Banking & Insurance Regulatory Commission, said separately that systemic financial risks were “totally controllable” and that the recent market turmoil is “seriously out of line” with economic fundamentals.

I am watching if the strong stocks like Evergrande (3333.HK) break support, or the weak stocks like Greentown (3900.HK) breaks its long-term support and test its 2011 or GFC lows. That will be a sign that the authorities have lost control and China’s economy is undergoing a disorderly unwind.

A weakening economy

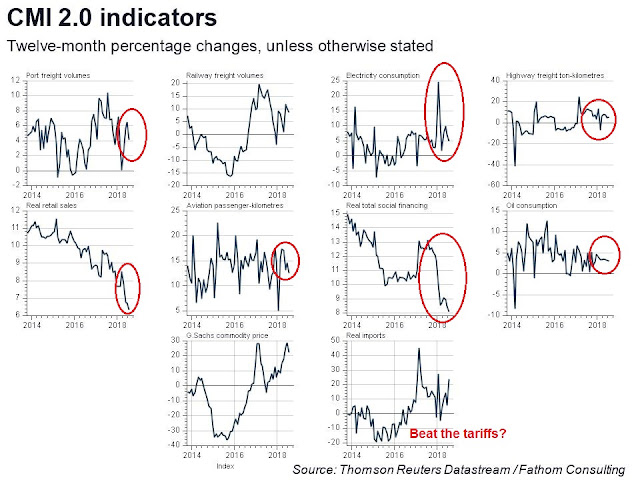

The softness in property prices is occurring against the backdrop of a weakening economy. Seven out of 10 of Fathom Consulting’s CMI 2.0 Indicators, which is an array of indicators that monitor the economy, are falling. Only one out of the 10 is rising, real exports, but the increase could be attributable to a surge from a “beat the tariffs” effect that is likely to be given back in the next few months.

The Epoch Times reported that China Beige Book, which monitors the Chinese economy through a myriad of bottom-up sources, had some good news and bad news about China. The good news is Q3 was not as bad as it looks:

China Beige Book’s broader gauges of capital expenditure show that in the third quarter investment spending expanded faster in most sectors, not surprisingly led by key industries in the new economy.

Consumption trends are another area of misconception. Market watchers have been behind the curve on the state of Chinese retailing since at least May this year, when official retail sales growth fell to a 15-year low. More timely China Beige Book data show this weakness in official retail sales was primarily a lagged reflection of past softness, which we had reported during late 2017 and early 2018.

China Beige Book’s latest results show retail outperforming yet again, with sales, profits and hiring all improving. Recent official data have only very recently been playing catch up.

Lastly, the credit environment is also far more active than Beijing would have you believe. In spite of the government having yet to officially reverse its deleveraging policy, our data show corporate borrowing spiked in Q3, rocketing to the highest level since 2013.

The bad news is the systemic nature of the slump. Manufacturing is weak, and it is likely to become weaker. Moreover, the economy is not responding to the traditional stimulus tools:

What is most worrisome, then, is not the conventional story of Q3 weakness, but rather the opposite: that the economy is already seeing boosted levels of borrowing and investment and yet growth is weakening, nevertheless.

Like 2015, manufacturing is under fire, with earnings and profits weakening and orders getting crushed, especially on the export side. Notably this is occurring even before the more recent, larger round of Trump tariffs were imposed.

Moreover, cost pressures are increasing. Inventories are ramping up. And cash flow is suffering across the board, with the Q3 spike in late payments the worst we’ve picked up since late 2015.

In all of this we see alarming parallels with mid-2015, a period of heightened activity which presaged the China crisis of early 2016.

No PBOC rescue

Reuters reported that Beijing’s efforts to stimulate the private business sector with easier credit is not working. In central banker parlance, the transmission mechanism is broken:

Beijing is keen to show results after four rounds of policy easing, so China’s big banks are playing along, highlighting their efforts to boost lending to cash-starved small firms, offering collateral waivers and setting loan targets.

But in reality, banks’ loan eligibility requirements for small and medium-sized enterprises (SMEs) remain stringent, making it too difficult or too expensive for them to borrow, according to bankers and company executives.

That has forced some small firms, including exporters, to simply give up on borrowing and put investment plans on hold.

The health of millions of small firms, most privately owned, is crucial to China’s efforts to ward off a sharp slowdown and mass job losses while fighting a bitter trade war with the United States.

In the meantime, S&P recently warned that local government (LGFV) hidden debt could be “as high as Chinese renminbi (RMB) 30 trillion-RMB40 trillion (US$4.5 trillion-US$6.0 trillion)”. The ratings agency expects that the central government will weaken support for LGFV debt over time, and more defaults are likely.

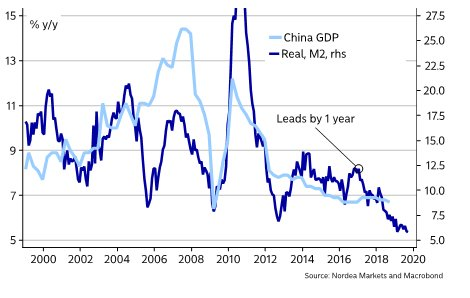

This time, the PBOC may be out of bullets. It is difficult to see how the central bank could ride to the rescue one more time by turning on the credit spigots when the economy is already over-leveraged, LGFV debt is out of control, and the SME transmission mechanism is broken. The PBOC has embarked on a program to slow the economy, and M2 money supply growth has been slowing. As the chart shows, M2 growth leads GDP growth by about a year, and the market has to be prepared for further growth deceleration.

A China hard landing?

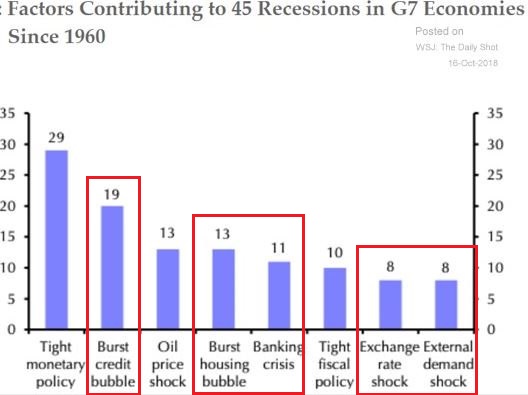

The WSJ recently posted the factors leading to the past recessions in G7 economies since 1960. Of the 111 factor occurrences, China is at high risk in 59, or 53%, of those instances, if you add in the potential of a currency war, as well as a trade war.

We have heard these kinds of China scare stories before, but this amounts to a “this will not end well” story if there is no bearish trigger. The poor performance of over-leveraged Chinese property developers, which represent the canaries in the coalmine of an over-leveraged sector, could very well that trigger. Such a development has grave implications for China, and possibly for the prospects of the global economic and financial systems.

From a technical perspective, the monthly MACD sell signal flashed by global stocks is another bearish warning for investors.

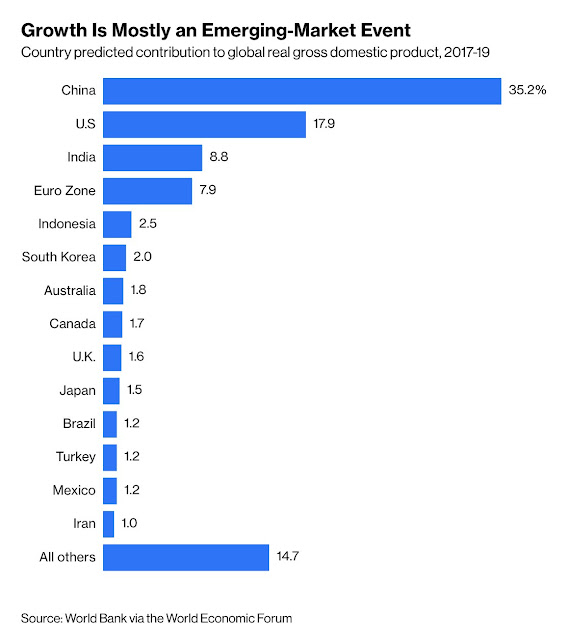

A storm is brewing in Asia, and investors should be de-risking their portfolios. If the share prices of the property developers were to break down to multi-year lows, it would be a signal to really batten down the hatches. These stocks represent real-time canaries in the coalmine of an over-leveraged sector. The global economy relies on major EM countries like China and India as sources of growth. A hard landing in China would have grave implications for the prospects of the global economic and financial systems.

The week ahead

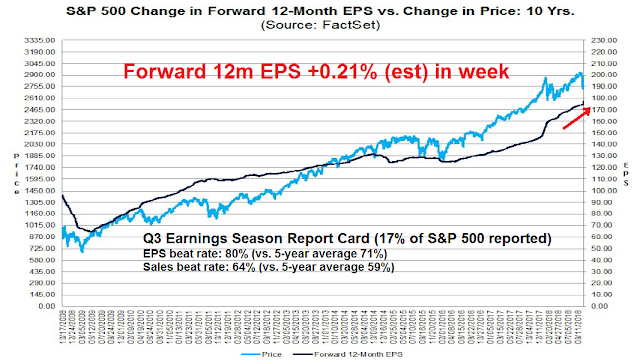

In the past week, the bottom-up fundamentals were strong, but the market did not respond to the good news. Q3 earnings season is under way, and the latest update from FactSet shows that both the EPS and sales beat rates were well above the historical averages. Moreover, Street analysts continued to revise earnings upwards, indicating positive fundamental momentum.

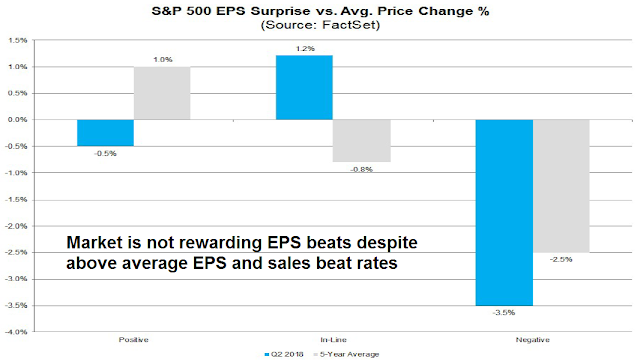

Here is the bad news. While the market punished earnings misses, it did not reward beats. The market’s failure to respond to positive news is a bearish sign that investor psychology may become excessively bullish, and some adjustments to expectations need to be made.

Bespoke also observed that the market was “selling the news”, as stocks that reported, regardless if the results were positive or negative, opened higher but closed lower on the day.

The hourly chart shows that the S&P 500 broke down out of a rising trend line (dotted line) Thursday, and rallied up to test the falling trend line Friday. These are the hallmarks of a relief rally failure indicating that a likely test of the old lows is likely underway. Subscribers received email alerts when my inner trader was stopped out of his long positions Thursday, and his entry into an initial short position Friday when the market strengthened to test the falling trend line.

The Fear and Greed Index stands at 14, which is in the sub-20 level where past bottoms have been made. However, low readings represent a bottoming condition and they are not immediate actionable buy signals.

That said, the market is likely too far off. The normalized equity-only put/call ratio flashed a buy signal by reaching a panic extreme level and began to mean revert.

As I pointed out in my last mid-week post (see Is there any more pop after the drop?) sentiment has not panicked yet, as evidenced by the lack of a spike in bearish sentiment in the II survey, and the backdrop of greed that allows Wall Street banks to price an Uber IPO at $120 billion valuation, which is a 66% boost from its last financing. These conditions suggest that we need another flush before a durable bottom can be made.

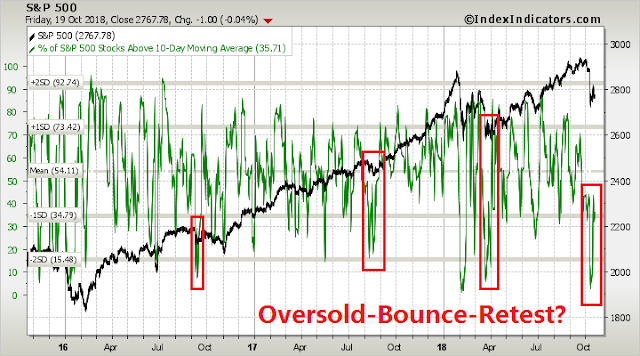

Short-term breadth indicator readings from Index Indicators are consistent with past oversold-bounce-retest patterns seen in past bottoms.

My inner investor has been increasingly cautious on equities since August. My inner trader tactically shorted the market in anticipation of a final panic selloff that marks the bottom of this pullback. He entered into a small initial short position Friday, but he is prepared to add to his shorts should the market strengthen early next week.

Disclosure: Long SPXU

When you say “durable” bottom, do you believe this bottom would endure for days, weeks, or months?

Durable bottom from a trading perspective. The longer term outlook is more uncertain and I have been cautious since August.

Thanks for the great analysis Cam. If the upcoming bear market is not a shallow and short one (>30% in SPX), there should be serious damage on the economic fundamentals and I guess China could be one of those triggers.

This post is long. Don’t even start into it unless you believe in behavioral economics to the extent that you have come to the realization that you yourself are just as prone to the biases that effect the rest of humanity.

I came to a turning point this week in my approach to the investment world that will guide me for the next few years. I believe this new strategy will make me the best performing portfolio manager in the world. A tall order, but if I miss my goal somewhat, my clients will still do great.

The secret to my future success will behavioral economics and how I approach the new economic forces at work in the world.

On the first, I reread for the thousandth time, a quote taped to my computer monitor from the great Bob Farrell. “Change of a long term or secular nature is usually gradual enough that it is obscured by the noise caused by short-term volatility. By the time secular trends are even acknowledged by the majority, they are generally obvious and mature. In the early stages of a new secular paradigm, therefore, most are conditioned to hear only the short-term noise they have been conditioned to respond to by the prior existing secular condition. Moreover, in a shift of secular or long-term significance, the markets will be adapting to a new set of rules while most market participants will be still playing by the old rules.”

Reading this always gets me thinking but another thing happened that basically blew my mind. I read that Trump is pulling the U.S. out of the 192 nation Universal Postal Union as a way of hurting imports of small Chinese packaged good into the U.S. This tells me that this trade war will not end soon. We are seeing intelligent anti-Chinese trade people thinking of every trick in the book uncovered and used.

How do these two things add up to my new strategy. I had been thinking we were in a changing world with new big forces at play but the Bob Farrell comment made me really think about how profound and new these new ones are. They are propelling us into an unknowable economic environment with a whole host of unintended consequences that make our previous experience and opinions, not just useless but down right dangerous.

First and foremost, we are ending a grand monetary experiment that was never tried in the past, Quantitative Easing. The Fed has purchased over three trillion dollars in bonds and mortgages. When this policy was started all economists thought it would work to stimulate the economy but ALL worried about what would happen when it would be unwound, in other words when the Fed would sell those bonds back into the financial system. That includes Ben Bernanke, who designed the program. Well we are there now at QT, Quantitative Tightening. The Fed is selling or not rolling over more than half a trillion in QE bonds a year for the next many years. That would have been a tricky thing but Trump and the normally deficit GOP party have decided to cut taxes that leads to trillion dollar deficits that need to be financed by sell bonds too. That turns a tricky exercise into an unknowably dangerous exercise. So we are here at the point that previously all economists said was risky with the U.S. government upping the uncertainty many-fold. I haven’t seen any economist talking about this recently. I think the whole bunch of them are holding their breath.

This huge government (Fed and Treasury) bond-selling supply factor coming into the bond market at a time when wage and price inflation is starting to roll and the Fed’s Dot Plot is heading up all make the next few years interest rate outlook totally unknowable. Any previous experience is useless because the world has never been at a point like this, EVER. Those commentators who have been very successful are most dangerous to listen to because they will be confident due to their previous success.

On the trade-war, anti-globalization front, the pulling out of the Postal Union made me finally, and I must be really slow, embrace how much the Trump Presidency is embracing Nationalism and turning its back on Globalization. His speech at the U.N. and attack of the WTO combined with all the other stuff and now the global postal system. Okay, I get it. You are VERY serious. No surprise realization from some expert whispering into the ear of the President will see a return to the right policies will happen.

Globalization has promoted capitalism generated prosperity incredibly around the world. The anti-globalization movement will do unknowably great harm. There is no way to guess what will happen. The unintended or even intended harms are possibly huge. No expert forecast can be trusted, especially those experts that have been right in the past. Once again, success in the past will lead to overconfidence that will be dangerous to listen to.

I read a lot of macro economic research and follow a number of great economists and investment strategists. It’s my thing. I’ve avoided every bear market since the early 1980’s by following macroeconomic clues along with market valuation and investor sentiment. I’ve come to the conclusion that we are entering the Twilight Zone of economics for the next five to ten years. I will try my damnest to not be one of Farrell’s ‘market participants playing by the old rules when markets are adapting to new rules.’

So I will try to stop having macroeconomic opinions. I will follow technical, objective indicators of investor sentiment for short term and intermediate swings. I will stay with outperforming sectors and countries and avoid underperformers wherever that leads me. I will follow my new original research on analyzing stressed industries and countries to detect when the economic stress is both rising or relieved. I will follow my new, original persistency sector research to detect extremes of one-way investor thinking as see turning points. I will follow my new research on tactical factor turning points to be on the right side of factor rotation in the markets.

I will do this as much as my own biases will allow without an opinion on where the global economy is or where its heading. I believe my opinion or the opinion of others will be wrong and misleading because we are entering the economic Twilight Zone of QT and anti-globalization. I would have listened to Rod Sterling but unfortunately he passed away.

Ken, Awesome post and what a great quote by Bob Farrell. I think Trump is serious about pulling the US supply-chain out of China. Your observation about Trump pulling out of UN Postal Scheme is spot on. However, given the NAFTA 2.0 agreement (ok, UMC) and the on-going trade talks with Europe and Japan, he may only be anti-China, not anti-globalization. Will keep your observations in mind. Thanks for the post.

Ken, I like your post. The other significant change that is happening is that China is turning into a more market-friendly environment while the US is turning more protectionist. The US big tech companies are facing increasing politically motivated headwinds from left- and right-wing poiticians in the US as well as the EU – at the same time China has recognized that it needs to cut dependence on US technology.

Kem:

You’re next to the last paragraph is now taped to my monitor.

Hi

I found the following article on US China relationship quite interesting.

https://www.wsj.com/articles/the-crisis-in-u-s-china-relations-1539963174

The link may not work.

The crux of the matter is how US foreign policy towards China has been self centered, over the past few decades, using China as a pawn in the US-Soviet cold war. That was in the 1960s. As a result, US supported China to a full status of recognized sovereignty, at the expense of Taiwan. That was then. With a subsequent ascendant China flexing its muscle, US policy towards China has reversed with Mr. Mike Spence’s speech accusing China of not being a responsible actor on the world stage. Of course, from a Chinese perspective, Mike Spence’s speech makes no sense to them. China, after all, remains, for, of and by the Chinese (not for America). This Chinese perspective is not likely to change. A China, that is backed into a corner, will become more defensive. Larry Kudlow has made a statement saying that the have had “no response from the Chinese” to American demands. These factors play out over years, and one needs to watch this space carefully, as much of South East Asia including Japan, Europe, and Energy centers of the world, in the middle East remain subservient to Chinese buying.

Thanks for the link, there are other interesting developments happening right here and right now in front of our very eyes:

Axios today – “He wants them to suffer more” – Inside Trump’s China bet:

https://www.axios.com/donald-trump-trade-war-china-tariffs-38e67c6b-8285-4019-a743-a426eda919a6.html

They (Axios) have reported on Sep 24 about the Trump administration’s “secret anti-China plan” – that was before the Pence speech, the Bloomberg article about Supermicro (which Apple CEO Tim Cook again denied vehemently) and Mnuchin’s currency remarks (which may not be a good example as they were somewhat muted, buy anyway)

The Axios report about the “non-trade negotation nature” of the Trump-Xi meeting in November alone could be a shock for the market already, but in addition we are now seeing Taiwan separatists protesting on the streets there. What is happening in Taiwan is an unknown and possibly uncontrollable variable that could spark fears of the “trade war” escalating into something more scary.

All to say, we are in the Twilight Zone where old rules are not a guide.

Make America Great Again is looking like Make the Developing World Poor Again.

That’s an easier task than getting the U.S. to burn more coal or jobs to shift back from Mexico to the Rust Belt.

There have been pretty significant losses in overseas bourses overnight that are pulling US indices down. From the 2950 peak of S&P 500, let us pencil in a 10% decline, that takes one into the 2650 range, give or take. Let us see, if this is a classic retest of the February bottom. Usually, markets should hold the 2530-2650 range (2530 was the intraday bottom early February, when the Dow lost 1500 point within minutes). At the 2530-2650 range, markets would be relatively better value, for longer term portfolios, to put fresh money to work. Multiple risks that Cam has chronicled are coming to roost here. Watching spot VIX, if it rises to the 40-80 range, money needs to be put to work.

Ken, very interesting perspective! Now, more than ever, technical analysis is a must tool. The short term tactical approach, (sector analysis) can be challenging. Money rotates very quickly in this market. I would love to give and get more input from Cam and members of this site on approaches to focus on this.

Thanks again for great input.

Mike