Mid-week market update: Is there any more “pop” after last week’s drop? The market certainly had a big rally yesterday, and it is not unusual to see a pause the day after a big move.

Here are the bull and bear cases.

Bull case

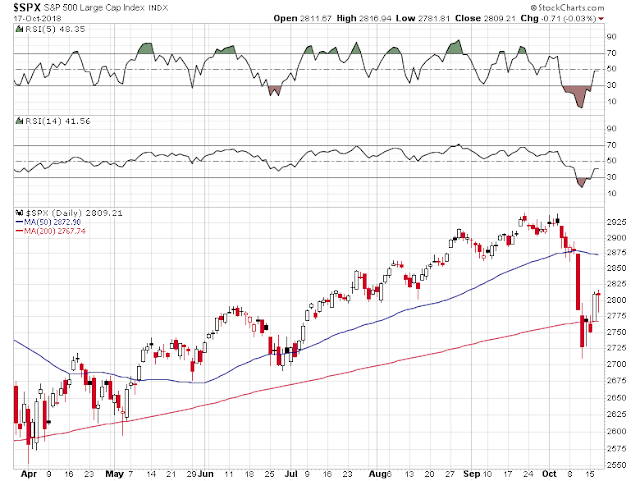

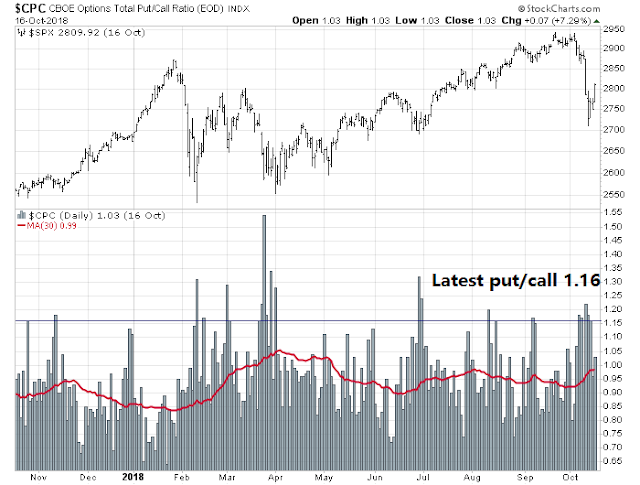

Option based sentiment is supportive of further advances. The history of the normalized equity-only put call ratio is high enough to see stock prices advance when sentiment has been this bearish in the past. That said, oversold markets can become more oversold and we haven’t seen this indicator reverse downwards, which would indicate a shift in momentum. Such an event would be a better trigger for a buy signal.

The put/call ratio remains elevated today and stands at 1.16, which is also short-term contrarian bullish.

Even Chinese stocks seem to be trying to bottom here. The Shanghai Composite hit a 4-year intra-day low Wednesday, but reversed to close higher on the day. This may be an indication of the start of a global relief rally.

I was recently asked about emerging markets. There is a nascent positive divergence occurring between EM equities and EM bonds. The chart below shows the relative performance of EM stocks against the MSCI All-Country World Index (ACWI, blue line), and EM bond price performance against their duration-equivalent Treasuries (green line). The bottom panel shows that the historical correlation of these two indicates has tended to be positive. EM bonds are turning up, but EM stocks continue to lag.

Is this a hopeful sign of a turnaround in risk appetite for the bulls?

The bear case

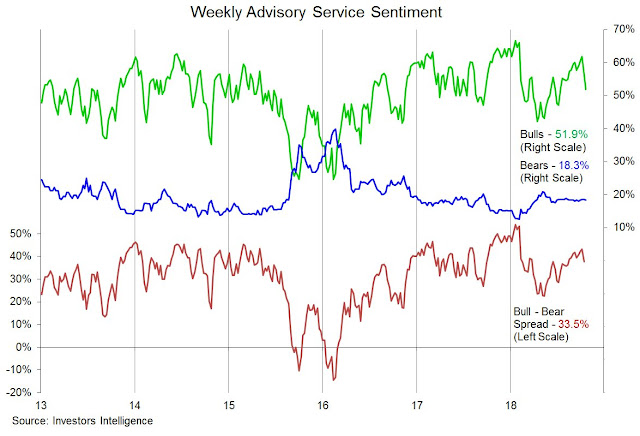

The bear case rests mostly on sentiment. The latest II survey shows that the number of bulls have plunged, but bearish sentiment has not risen. Where is the fear?

These results are consistent with Callum Thomas’ (unscientific) equity sentiment poll taken last weekend. Net sentiment turned more bullish after a -4.1% plunge in stock prices. There may be too much greed for the market to make a durable bottom here.

Speaking of too much greed, the WSJ reported that Wall Street banks told Uber it could price an IPO at a $120 billion valuation next year, which would represent a 66% increase from the valuation from its last financing, which was $72 billion. Too much greed, not enough fear.

Don’t overstay the bounce

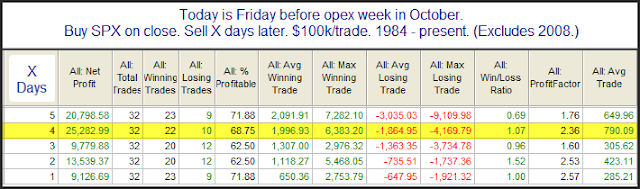

I resolve the bullish and bearish cases as the market is undergoing a short-term bounce, but it needs a second downdraft to flush out the stubborn bullishness among investors. So far, the market action this week is following the historical October OpEx pattern observed by Rob Hanna at Quantifiable Edges. Historically, Monday has been weak (yes), Tuesday strong (yes), and Wednesday has been weak (sort of), but expect a rebound tomorrow.

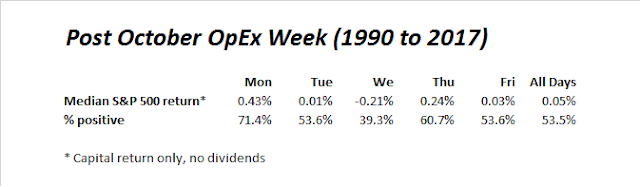

My own study of post-October OpEx week shows that Mondays has a bullish bias, but the rest of the week looks relatively normal.

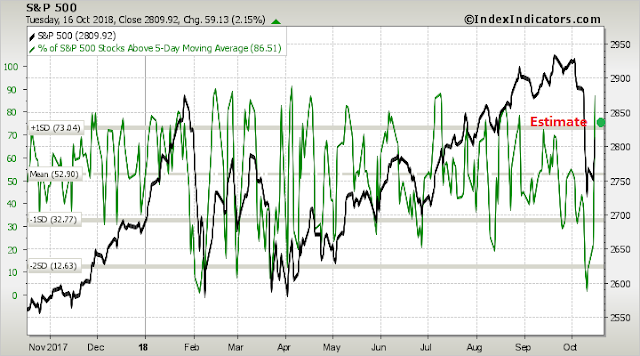

I am also watching the short-term breadth indicators from Index Indicators using different time frames. The % above 5 dma became wildly overbought Tuesday, and therefore is no surprise that the market pulled back today.

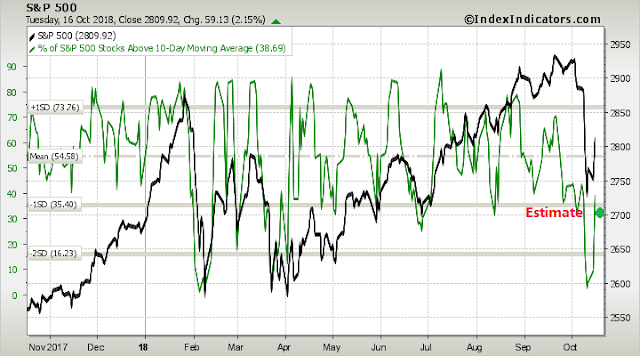

Using a slightly longer time frame, the % above 10 dma recovered Tuesday but it was still in negative territory. I would expect this indicator to recover to at least a mild overbought reading before this relief rally is over.

My inner investor is increasingly cautious. My inner trader got long the market last Friday and he is playing for a continuation of the short-term bounce before shorting against either late this week or early next week.

Disclosure: Long SPXL

Cam great call on the markets and appreciate all the insight. A questions on TARIFFS given everyone is talking how bad they are for the economy’s etc.. I look at at BA chart and it has held up very well. Also HYG has held up well any thoughts? Thanks AJD

If pundits are to be believed, Democrats would take the house in a few weeks.

What needs to be considered is what happens if Republicans keep the house. Here is what I am wondering; if the Republicans keep the house, president goes after China with a vengeance. Tariffs are already set to rise by 25% on 1 January. A real trade war will start then.

If pundits are to be believed, Democrats would take the house in a few weeks.

What needs to be considered is what happens if Republicans keep the house. Here is what I am wondering; if the Republicans keep the house, an emboldened president goes after China with a vengeance. Tariffs are already set to rise by 25% on 1 January. A real trade war will start then.

In daily chart of EEM:ACWI looks like there’s positive macd divergence and in its weekly chart there’s RSI positive divergence. Also heard that China have done more than 25 small tweaks here and there to support its economy is recent months.

Yep, got stopped out of my index futures long position as well at around 2780. Hindsight is 20/20, but for my S&P equities long position, I would keep a loose ATR LX stop of around (4,1.8), that is 4 period moving average on the daily true range and 1.8 average true range to trail the stop. That has worked better in the February correction earlier this year. See a chart here:

https://imgur.com/a/Y6cQKSR