Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bullish (upgrade)

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

A growth revival

Sometime you don`t get the perfect signal. I had been watching for signs of an oversold extreme before covering my short positions and buying, but none of my tactical three bottom spotting models had flashed a buy signal yet (see Three bottom spotting techniques for traders).

Some got close. As this chart of the VIX Index shows, the VIX never managed a close above its upper Bollinger Band, but it traded above its upper BB several times.

Nevertheless, a combination of macro, fundamental, and sentiment models have turned sufficiently bullish for me to call an end to the current bout of minor stock market weakness. At a minimum, downside risk is likely to be low at current levels.

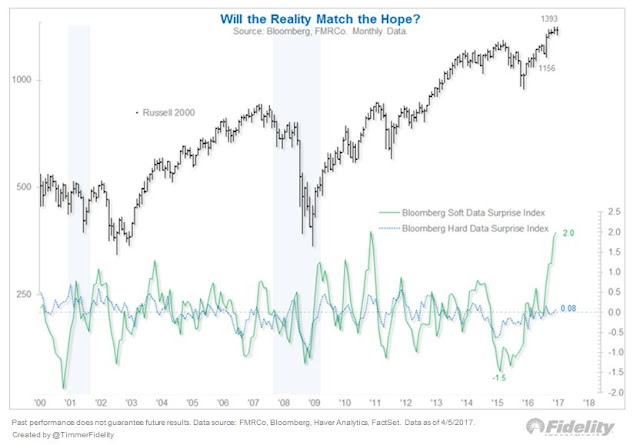

The triumph of “soft” data

For the past few weeks, analysts have observed a bifurcation between the soft (forecast) macro data and the hard (reported) data. The soft data had run far ahead of the hard numbers, and the gap was at or near historical highs. Many, myself included, believed that the forecasts were overly optimistic and were bound to turn down, which was bearish for the growth outlook.

Gavyn Davies recently featured an analysis of Fulcrum nowcasts of economic growth. The forecast called for extremely strong growth rates, especially in the developed economies. Much of the strength was derived from soft data.

An analysis of the effects of soft data in economic forecasting found many advantages of including soft data in nowcasts and economic forecasts:

- Including soft data makes the forecast more accurate

- Hard data forecasts are more volatile

- Soft data is more timely

- When soft data and hard data disagree, the soft data forecast tends to be better

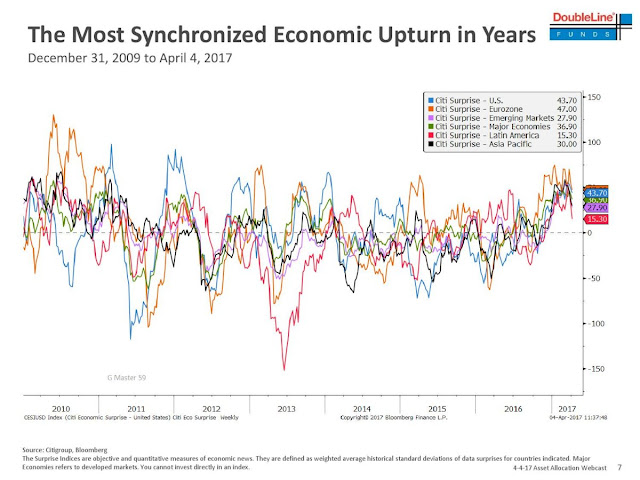

Davies concluded that the buoyancy of the US soft data forecasts isn’t just an effect of the enthusiasm of Trump supporters, “The synchronised nature of the upswing in so many economies increases our confidence that the buoyancy of US growth is not just a consequence of fake survey news in the American economy.”

Liz Ann Sonders at Charles Schwab came to a similar bullish conclusion, though she acknowledged that the two data series tend to converge with soft data weakness and hard data strength:

It’s been our contention that the inevitable narrowing of the spread between the soft and hard data would likely be in both directions; i.e., confidence measures would likely ease, while the hard data would play at least a little catch up. According to Bespoke Investment Group (BIG), when soft data outperforms, hard data usually plays catch up in the following three and six months; while soft data almost always declines. With regards to the stock market, average and median returns have been skewed to the positive over these time frames as well.

Indeed, Jeff Gundlach observed that the global economic is experiencing one of the most synchronized upturn in years (via Business Insider).

The global scope of the growth surge is good news for Europe. With eurozone business confidence rising…

The upturn is positive for eurozone companies because of their high operating leverage.

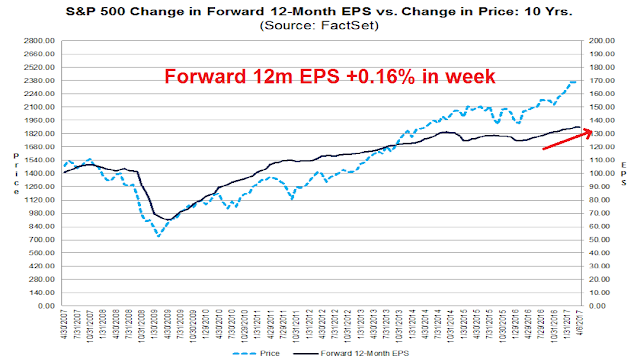

In the US, the latest update from Factset shows that forward 12-month EPS is rising, which reflects Wall Street’s continued optimism about earnings growth, a key driver of stock prices.

What about the NFP miss?

On the other hand, Friday’s March Employment Report was a shocker. The headline Non-Farm Payroll (NFP) came in at 89K, which was well short of market expectations of 175K. Looking through the internals, however, the March report presented a solid picture of growth.

First of all, much of the disappointment appeared to have been weather related. This chart of construction employment showed a dramatic slowdown in March, which was likely weather related and should reverse itself in the coming months.

More importantly, temporary jobs were strong. In the past, temporary employment (blue line) has peaked out before headline NFP (red line).

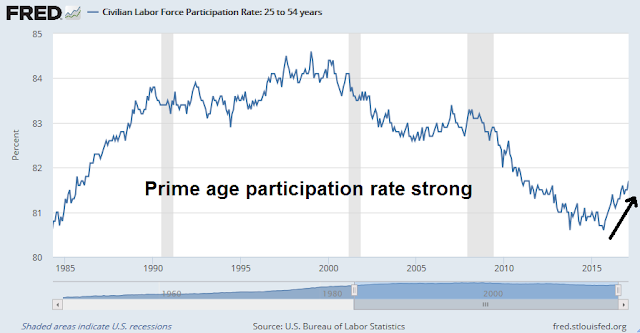

In addition, the labor force participation rate held steady, and the prime age participation rate rose.

Finally, the unemployment rate fell to a new cycle low at 4.5%.

Despite the headline NFP miss, I interpret this report as a solid report. These are all signs of robust economic growth.

Sentiment extremes = Buy signal

In addition to the strong macro and fundamental backdrop, I am also seeing signs of bearish sentiment extremes which led me to change the trading model from a “sell” to a “buy” last week.

This 10-year chart of Rydex cash flows show that Rydex investors had moved to a bearish extreme. In the past, the market had not necessarily rallied immediately when readings were this low, but saw limited downside during such episodes.

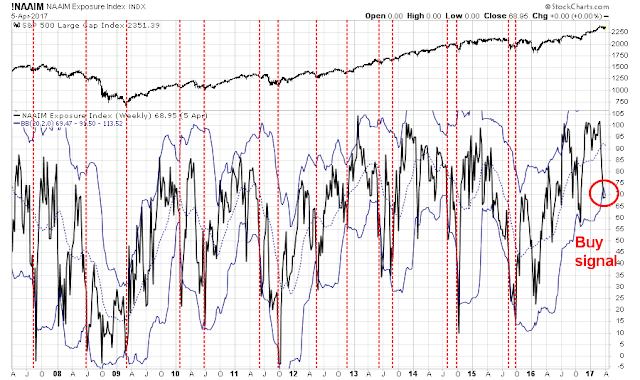

In addition, this chart of NAAIM exposure indicated that RIAs seemed to have panicked. In the past, NAAIM readings that fall to their lower Bollinger Bands have been good buy signals. Unlike the Rydex buy signals above that denote minimal downside risk, past NAAIM buy signals have seen the market rise.

Key risks

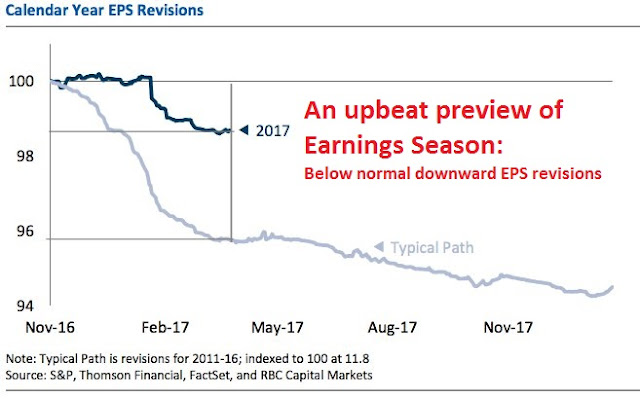

Despite the presence of all of these upbeat intermediate term factors, bulls should curb their enthusiasm as a number of key risks remain. First of all, the Atlanta Fed’s GDPNow nowcast of Q1 growth is coming in at a dismal 0.6%. The possibility of a negative surprise is still present. The big test for the stock market will be Q1 earnings season, which is just getting under way.

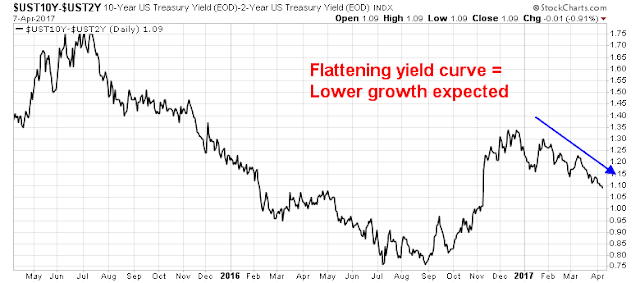

As well, the yield curve is flattening, which is the bond market’s way of telling us that it expects lower economic growth.

There may also be some unfinished business that the market needs to attend to from a sentiment viewpoint. The Fear and Greed Index did not reach oversold levels consistent with past bottoms. While every market is different, and we have already seen sentiment extremes from Rydex and NAAIM data, traders need to allow for a brief rally, followed by a sharp drop to a washout low before this shallow correction is over.

To be sure, the NYSE McClellan Summation Index (NYSI) is showing signs that it is undergoing a bottom process. Any pullback that produces a capitulation low is likely to be shallow.

Bullishly positioned

My inner investor remains bullishly positioned. The Wilshire 5000 remains on a long-term MACD buy signal.

He believes that the SPX point and figure price target of over 2500 is very achievable this year.

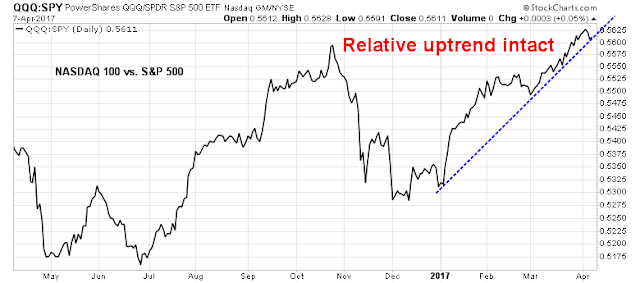

My inner trader flipped from short to long last week. He now has small initial long positions in SPX and NDX, which has been the recent leadership in the market.

Disclosure: Long SPXL, TQQQ

I am not convinced that this week will be bullish.In general the market is heading towards 2500 this year, but we are stuck in a trading range. The beginning of April usually is weak, people need cash to pay taxes.I think we will see SPY at 232-233.5 this week & a rally towards the end of the month.

Great trader’s acumen backed by depth of analysis – a brave position to take a tactical bullish trading position right now, given the sentiment. The insight that we could bounce before a washout is an excellent prognosis (max pain).

Whenever Good Friday (this week) is in April, market is likely to be up more than down. April also tends to be a bullish month because of IRA contributions, however, the effect is tilted to the latter half to third of the month. Earnings season is also starting for first quarter 2017 numbers, and hopefully would not be too dour. Geopolitical tensions have not dented this market except for a tiny correction. These soft data points most likely suggest a short term rally.

Cam, your note does not sound very high conviction. Bank earnings starting this week will be key, then we are running into French election, VIX is rising vs S&P.

re Gundlach he also thinks the reflation trade will unwind further and that stocks are v expensive.

The payroll report was strong – unemp down at 4.5%, headline number weather affected.

Biggest issue and I refer to Druckenmiller:

“In January 2015, Druckenmiller gave a speech where he revealed the secret to his success:

Earnings don’t move the overall market… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

Liquidity is going to be reduced still further with the reduction in the size of the FED’s balance sheet, we’ve all seen the S&P / balance sheet charts, highly correlated.

I am also a little worried that everyone expects the blow off rally to 2500 still, Hartnett, Garthwaite – all heavyweight analysts.

I suspect any blow off will come if Le Pen loses second round, especially if VIX positions have built up longs prior to then. Until then are we doomed to be trapped in this ever tighter range ????? See what JPM brings with its earnings release….

Hard mkt to monetise.

Thanks for your posts.

Phillip

I just finished reading an article “Bonds Flash Warning Signs” on the front page of Wall Street Journal from 4-10-17. Bonds are being purchased as though there is no tomorrow, with both hands. This is a contrarian buy for stocks and a Big Short for bonds. The article quotes an investment adviser that low rates are here to stay for years, which would perversely be positive for stocks (see Drunckenmillers comments). Cheap liquidity is mothers milk for stocks. High quality stocks with high yields and some growth could be the sweet spot. Another article last week in the journal points out how high quality larger companies are finding it easy to get credit at the expense of smaller companies. If low interest rates are here to stay, such mid and large cap companies are going to raise increasing debt and buy their own stock and raise dividends along the way. Again, a contrarian buy signal for stocks. A 20-25% correction would just be what the doctor ordered, for a new leash on this bull market. A rising VIX is also a contrarian buy signal (see Cam’s Trifecta bottom). What I read in the Journal reminds me of the housing market circa 2005. Just my 2c. Cheers. Cam, is there a way to have a generational short in the bond market (ala Michael Lewis’s Big Short)? Perhaps you will critique in one of the forthcoming articles on this. Thanks.

inflation kills bond returns but seemingly doesn’t kill bonds these days. ECB & BoJ buying pins bonds at unrealistic levels. The premium people will pay for bunds, 10 yr yielding 0.24% and CPI @ 1.5% so -ve 1.25% annual real returns. However Bunds may get re-denominated into German Marks should the Euro split, so a 40% FX uplift if the EZ breaks up…..makes the bund an option.

And BTPs clearly wouldn’t be yielding 2.5% or so if the ECB weren’t buying, a point not lost on Draghi – hence he stays uber dovish. Italy has 135% debt/GDP……….

So for Japanese and German savers US treasuries offer good returns when the USD X ccy basis swap isn’t expensive, and right now its not.

Bonds are v v distorted.

Phillip

All points well taken. Normalizing easy money policies are hard to unwind and will be gradual. This should be fuel for the stock market until Joe six pack starts buying stocks with both hands. Joe six pack is just starting to warm to the idea of stocks.

There is an old adage “buy at the first sound of the canons”. I suppose, the thunder of the cannons has started?