Mid-week market update: In my weekend post (see Buy the dip!), I wrote that despite my tactical bullishness, “traders need to allow for a brief rally, followed by a sharp drop to a washout low before this shallow correction is over”. We are finally seeing signs of an oversold market and a short-term capitulation.

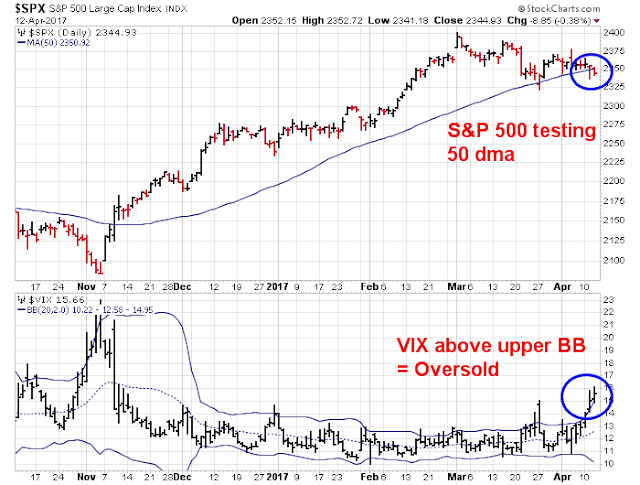

There were a number of signs of a short-term bottom. On Monday, the VIX Index closed above its upper Bollinger Band (BB), indicating an oversold condition for the market (see Three bottom spotting techniques for traders). As well, the SPX has been testing support located at its 50 day moving average (dma) in the last two days.

An oversold setup

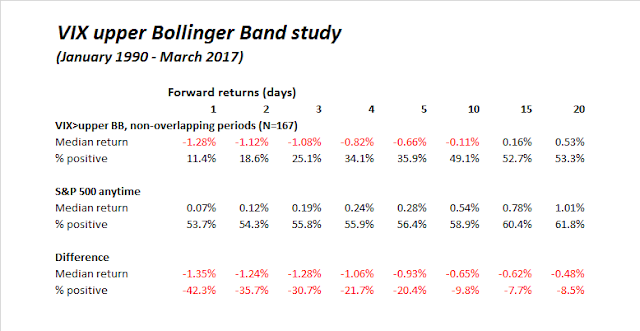

Just because a market is oversold doesn’t mean that it can’t go down further. Indeed, a study of past occasions where the VIX Index had risen above its upper BB indicated that it tended to continue to decline. As the results of the study below indicates, negative price momentum tends to start reversing itself after one day the VIX Index rises above its upper BB. Wednesday is day 1.

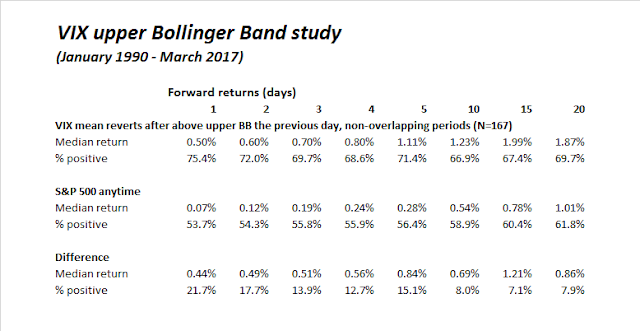

Once VIX mean reverts and falls below its upper BB, returns have historically seen an upward bias..

Watch the VIX Index for the mean reversion move.

A near exacta buy signal

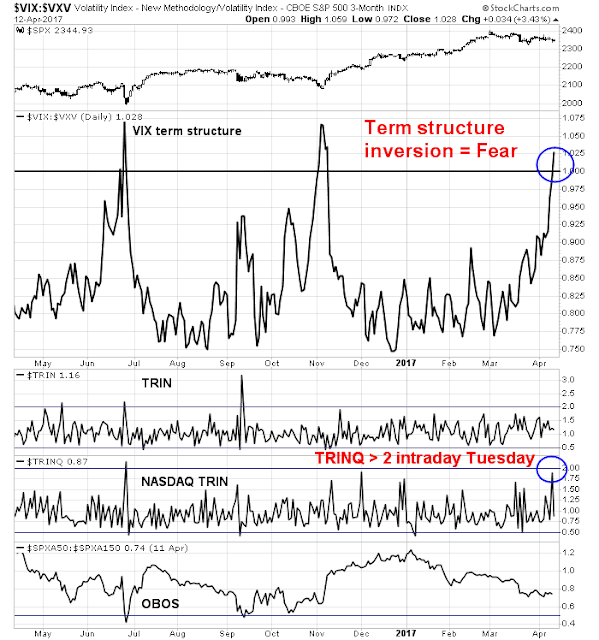

There are additional signs of market panic. My Trifecta Bottom Spotting Model (click link for a full explanation of the model) reached a near oversold reading on Tuesday. As a reminder, the Trifecta Bottom Spotting Model uses the following three components to determine an oversold market condition: inversion of the VIX forward curve; TRIN above 2; and a reading of below 0.50 on the intermediate term overbought/oversold model – all within three days of each other.

While the OBOS model is far from an oversold reading, the Trifecta Model hit a “qualified” exacta buy signal, which triggered two of the components. The VIX forward curve inverted today. While TRIN did not rise above 2, TRINQ, which is TRIN for NASDAQ stocks, went over 2 on Tuesday on an intraday basis. TRIN and TRINQ readings of over 2 are often reflective of price insensitive selling that are typical of forced “margin clerk” market sales.

Are those conditions enough to call this a capitulation bottom, or a market washout? I don’t know, but the combination of the technical test of the 50 dma, the oversold condition flashed by the VIX Index, and the near exacta buy signal make the answer a “qualified yes”.

Disclosure: Long SPXL, TQQQ

It’s been quite amazing this week that with the rise in the VIX, JPY, GOLD and Bonds that the S&P has been so resilient. It is trading like it is pinned between 35 & 63……..

So agreed if risk barometers like the VIX start to subside then stocks could rally again, however is that really possible prior to the French election. One reason the skew has changed is massive increased call selling, NOT put buying.

Slightly strange times.

It’s always strange. But now, especially given the White House Experiment/ Learning curve. Don’t like to mix politics and investments but we have real need for a heightened “black swan outlook”. The present combo of issues facing Trump will overwhelm his understaffed, inexperienced team: out comes multiply!

And the Fed Funds market is now showing just 32 basis points of hikes for the rest of the year vs the Fed’s 50 ! That’s quite a gap, economic slowdown ahead ? Rates think so

I suppose yesterday could have marked some sort of bottom, but, if so, it will have done so with an all-time low reading of my blood pressure in such instances. Perhaps that is some sort of bullish divergence.

on Sunday i predicted the market would be weak…i traded SPY options 4 times this week,all were profitable.I expect a sell off into the long weekend & a rally next week.If we are down tomorrow at the close i will be buying SPY calls that expire on 4/28.

Japanese market is now open. Watching e mini S&P opened down 5 points, now only 3.5 points down as I write this. May Vix (VIK 17) cracked higher and is slowly comping down to 15 (now 14.95). Let us see if it mean reverts. It is at the top end of today’s trading range. Hoping bank earnings will help turn this around. That said, the 10 year note must sell here and close above 2.25/2.26, and soon. Keeping fingers crossed. Things were volatile in the futures markets for the past several hours, but seem to be confirming the capitulation bottom.

Hi, Exacta reached today. I am all in. Hope it will goes well.