Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bullish (upgrade)

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Remember the Audacity of Hope?

Does anyone remember Obama’s “Audacity of Hope” campaign that won him the White House? As a reminder, here is a video clip from eight years ago which depicted an Obama supporter who believed that the new administration would pay for her gas and mortgage. Fast forward to today, Obama’s legislative legacy is far less impressive than what his enthusiastic supporters expected from St. Barack of Chicago.

While the jury is still out on what the political expectations are for Donald Trump’s win, market expectations are getting positively giddy, which may be setting itself up for disappointment. Here is what Ed Hyman of ISI Evercore observed from his survey of institutional clients:

Will the legacy of Trump’s “Make America Great Again” be similar to Obama’s “Audacity of Hope”? While it’s far too early to make any kind of judgment, I made the point last week that the fundamentals for the current market rally have been in place before the election (see The start of a new Trump bull?), the electoral results seemed to have awakened the market`s animal spirits.

There is much to get enthusiastic about. Evidence of a reflationary turnaround had been brewing since the summer. Many of the stated business friendly policies of the Trump administration are also reasons to get bullish on stocks. However, excess bullishness can carry the risk of the bulls’ demise. Jeffrey Gundlach recently warned that the rally was losing steam:

The strong U.S. stock market rally, surge in Treasury yields and strength in the U.S. dollar since Trump’s surprising Nov. 8 presidential victory look to be “losing steam,” Gundlach, who oversees more than $106 billion at the Los Angeles-based investment management firm, said in a telephone interview.

“The bar was so low on Trump to the point people were expecting markets will go down 80 percent and global depression – and now this guy is the Wizard of Oz and so expectations are high,” Gundlach said. “There’s no magic here.”

Gundlach had warned last month that federal programs take time to implement, rising mortgage rates and monthly payments are not positive for the “psyche of the middle class and broadly,” and supporters of defeated White House candidate Hillary Clinton are not in a mood to spend money.

“There is going to be a buyer’s remorse period,” said Gundlach, who voted for Trump and accurately predicted in January the winner of the presidential election.

Has Trump made stocks great again? Should you get cautious? Here is how I would play the market as I peer into 2017.

No shortage of good news

Notwithstanding the Trump Effect, there is plenty of good news to get excited about. The reflationary trend is not just isolated to the US, but it is global in scope. Bloomberg recently featured an article about 10 good pieces of economic data from around the world:

- China’s manufacturing purchasing managers index rose to 51.7 in November, above market expectations.

- Manufacturing in the U.S. expanded in November at the fastest pace in five months, underscoring the healthy outlook for domestic consumer demand.

- Sentiment among U.S. consumers has held close to the highest level of the year, a boon for spending prospects.

- In the euro-area, joblessness fell to 9.8 percent in October from a revised 9.9 percent the month prior, the lowest level since July 2009.

- Industrial output in the euro-zone accelerated at its strongest pace in almost three years last month.

- In Canada, third-quarter growth surprised to the upside at 3.5 percent.

- In South Korea, exports rose 2.7 percent year-on-year in November, after a 3.2 percent decline in October.

- In Japan, corporate profits have rebounded by over 11 percent year-on-year, underscoring “a broad pattern around the world (U.S., China, other countries as well) that has seen the ‘earnings recession’ driven by higher dollar and lower oil/commodities start to roll off without an economic recession,” according to a note by Bespoke Investment Group.

- PMI readings by IHS Markit for Austria, the Netherlands, and Russia are both at the highest levels since the financial crisis. Meanwhile, purchasing managers indexes for Spain, Italy, France, and Germany are slowly, though, unevenly improving.

- Even in Russia, a rebound may be nigh: In the third quarter, the manufacturing PMI rose above the 50 threshold for the first time since 2014.

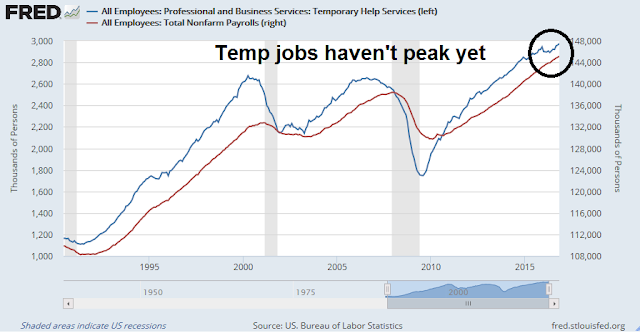

Last but not least, the November Non-Farm Payroll report came in slightly ahead of expectations. Unemployment fell to a cycle low of 4.6%. The best news of all came from temporary employment (blue line), whose growth has led Non-Farm Payroll (red line). Temporary employment continues to rise and made a new cycle high, indicating that employment has not yet peaked this cycle.

Wall Street analysts are getting on board the Trumpflation train. The latest update from John Butters of Factset shows that forward 12-month EPS rose 0.30% in the week.

What’s more, the latest Trump nominees for Treasury and Commerce went on CNBC and told the market what wanted to hear. Tax cuts is the #1 priority and Yellen is “doing a good job at the Fed”. More importantly, they walked back the much of the tough protectionist rhetoric of Candidate Trump (see Avondale CNBC interview notes). Tariffs are said to be a “last resort” and Mexico/NAFTA is about a “better trade deal”.

What is there for the stock market not to like?

Market psychology turns bullish

As a result, Bloomberg reported that Wall Street strategists have been falling all over themselves to raise their stock market targets for 2017 (also see Ed Hyman’s institutional survey results above). The enthusiasm isn’t just restricted to strategists and institutional investors, but it has spread to individual and corporate investors as well:

It’s not just Wall Street that has changed its mind. Charles Schwab Corp. surveyed clients in October, and found 34 percent reporting that Trump would have a “major negative impact” on the U.S. economy in the short term, while only 14 percent felt that way about Hillary Clinton. Last week, however, consumer confidence surged and individuals said that they were more optimistic about their financial future.

Corporate executives have also changed their tune and are now salivating at the prospect of lower taxes and a potential tax holiday to repatriate cash held overseas.

What’s the risk?

It’s hard to stand in front of a bullish stampede. The combination of a positive turn in fundamentals, and better investor psychology have created a tailwind for stocks. In addition, underperforming hedge fund and other managers are scrambling to buy risky assets as year-end approaches (aka the career risk trade) makes Callum Thomas’ SPX 2400 year-end projection a realistic possibility.

What could go wrong? Not much in 2016. But Inauguration Day is when the hope meets reality. Starting January 20, the market will start come face to face with the operational risks of a Trump administration.

As an example, Trump’s recent telephone call with President Tsai Ing-wen of Taiwan could create a major diplomatic rift with China (see Ian Bremmer’s alarmist reaction). While I may not necessarily agree with Bremmer’s negative view of this incident, another risk is Taiwan interprets these events in a way that assumes a level of American support that may not be there. For now, the Obama State Department (!) is in place to soothe ruffled feathers and clarify matters. But rookie mistakes like this one just highlights the risk of major fumbles on many fronts, not just foreign policy, as the new team takes over the White House.

As well, Reuters reported that Donald Trump is a micro-manager, which is a bad quality in a President:

It has proven one of Donald Trump’s greatest strengths in building a worldwide luxury brand: An obsessive attention to detail, down to the curtains hanging in hotel rooms and the marble lining the lobby floor.

As president, it may prove one of his major liabilities, presidential historians warn.

Remember Jimmy Carter? He was another notorious micro-manager:

Even if he does make a clean break, Trump will have to guard against getting bogged down in the bureaucratic minutiae inherent in the office. He should avoid the example of President Jimmy Carter, another famous micromanager, who spent his first months in office poring over the White House tennis court schedule, said Ross Baker, a professor of political science at Rutgers University.

Micromanagers rarely make successful presidents, said Rick Ghere, an associate professor of political science at the University of Dayton in Ohio. To be effective, presidents must delegate authority to members of their cabinet and rely on a range of expertise, he said.

“Being a decisionmaker in a high-level public position is a lot different than being a CEO,” Ghere said.

Increasingly, the market action during post-Inauguration period is likely to see a hangover effect from a post-electoral rally. The combination of a strong USD, probable December rate hike, and rising bond yields are going to put downward pressure on stock prices. Expect a softer and corrective period for stock prices in Q1.

President Trump will undoubtedly get tested in the days and weeks ahead, in the realm of domestic policy, economic policy, trade policy, foreign policy, and so on. The first test will come in December, when the FOMC is very likely to raise rates by a quarter point. How will Trump respond? Most of his supporters come from the hard-money and audit-the-Fed school who hated the Fed’s QE programs. Will Trump view the rate hike as a welcome move and consistent with the withdrawal of monetary stimulus (and QE)? Or will he view it as a challenge to his stimulus program?

Already, a number of economists and analysts are questioning the wisdom of fiscal stimulus when the economy is nearing full capacity, as evidenced by an unemployment rate of 4.6% and GDP growth rate of 3.2%. Fiscal stimulus at this stage of the cycle would only raise inflationary pressures. Moreover, cost-push inflation that buoys wages would put downward pressure on operating margins, which would negative for stock prices.

My game plan for 2017

From a technical perspective, it’s hard to argue with the bull trend. The chart below depicts the weekly NYSE McClellan Summation Index, which is in the early part of a rising cycle and nowhere near overbought territory. These readings suggest that the market advance has much more room to run.

The chart below shows a 20 year history of the Wilshire 5000 and MACD bullish crossovers. In the past, such buy signals (blue vertical lines) have tended to lead to further gains that can last for many months, and sometimes years.

The MACD crossover is a trend following indicator. Back in August, I also featured another trend following buy signal from Chris Ciovacco’s three moving averages (click link to see his video, also see my post The roadmap to a 2017 market top).

In my past post, I analyzed previous Ciovacco buy signals and found that about half lasted about 1.5 years, and the remainder went on for much longer. My assessment of the current macro and fundamental backdrop suggests that this latest buy signal will be of the shorter variety. Note, however, that trend following models tend to be slow and they will not catch the exact top of a market. Bottom line: these readings are pointing to a cyclical market top in the second half of 2017.

I wrote that I am going on recession watch because some of the long leading indicators are starting to wobble (see Going on recession watch, but don’t panic!). Most notably, rising bond yields are pressuring mortgage rates, which will eventually act to depress the cyclically sensitive housing sector. For now, risks are elevated but not at panic levels. Therefore the recession watch is only cautionary.

I expect that stocks will continue their advance after a brief Q1 correction of no more than 5-10%. After that, I will be monitoring earnings expectations, interest rates, Fedspeak, and the new administrations interaction with the Fed and the markets.

The week ahead: ¯\_(ツ)_/¯

My inner investor continues to be bullish on equities. He is enjoying this party, but he is keeping a close eye on the long leading indicators I outlined above.

At a tactical level, traders should be aware that tax-loss selling season is upon us. Jeff Hirsch has identified a calendar effect in December, where early strength is followed by mid-month tax-loss selling weakness, which ends in a year-end rally. If 2016 were to follow that pattern, then expect a corrective period to begin early in the next week.

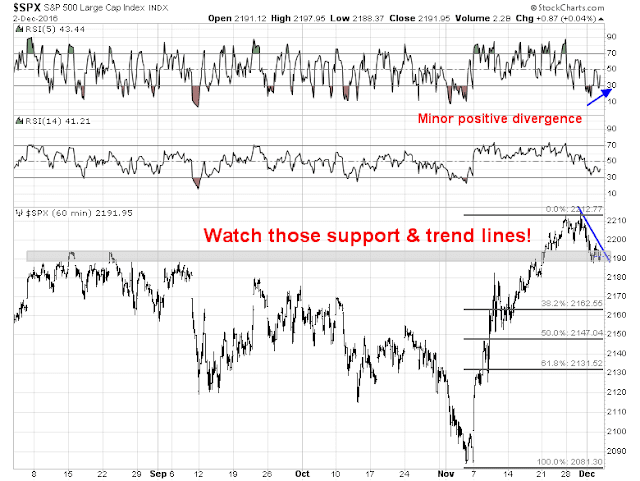

On the other hand, the hourly SPX chart below shows that the index pulled back and it is testing a key support zone, while exhibiting a minor positive RSI-5 divergence. At the same time, it is testing a downtrend line (blue). The market is unlikely to weaken significantly from these levels given the strong FOMO tendencies this time of year, with likely secondary support at about 2163 should the current levels be broken. My inner trader took an initial long SPX position on Thursday with a view that he would add to his long positions on weakness.

Which effect will be the strong one, tax-loss selling, or FOMO buying? I have no idea. trading is about knowing the possibilities, understanding the odds, and properly estimating the risk-reward ratio. That’s why my inner trader only took a partial long position.

¯\_(ツ)_/¯

Disclosure: Long SPXL

Wouldn’t tax loss selling be focused in the issues with poor performance and the FOMO buying be focused in the winners?