Mid-week market update: About two weeks ago, I wrote a post indicating that market had focused on the positives of a Trump presidency (see The Trump Presidency: A glass half-full?). Now it seems that market psychology is subtly shifting to a glass half-empty view.

It is very revealing when the new nominees for the key commerce and treasury cabinet posts make market soothing noises and stock prices barely move. Josh Brown’s reaction to Steven Mnuchin as the Secretary of the Treasury and Wilbur Ross as Secretary of Commerce is probably fairly typical of the market:

Good morning. Just wanted to check in briefly to voice my approval for the Treasury Secretary and Commerce Secretary picks announced by the Trump transition team this morning. They’re both highly accomplished and capable people who’ve held senior roles within businesses, even if they don’t have government experience.

To my knowledge, neither is looking to eject homosexuals, Jews or brown people from the country, so that’s a step in the right direction. I don’t believe that either has an agenda against women or takes money directly from Russian banks or posts frog memes on Twitter. Neither pick is a sitcom star from the 1980’s or one of the President-Elect’s children.

The hourly SPX chart below tells the story of a lack of positive reaction to good news. Such market reaction points to short-term bullish exhaustion.

A crowded long

There are a number of signs that the rally has gotten ahead of itself. Marketwatch reported that TrimTabs sounded a warning about the excess bullish enthusiasm that they were seeing in fund flows:

“Investors’ appetite for U.S. equity ETFs has been almost insatiable since the election, which is a negative contrary signal,” the firm wrote in a research report.

The category of funds saw positive flows every trading day between Nov. 8 and Nov. 22, amounting to “a stunning $52.2 billion” in overall inflows, TrimTabs wrote, adding that the level of inflows represented a record for an 11-trading-day period. November is on track to break the previous record for monthly inflows, December 2014, when $45.4 billion moved into the category…

“A wide range of sentiment measures suggests the bull camp has become quite crowded,” the firm wrote, citing its U.S. Equity ETF Index, which uses ETF flows to evaluate short-term market timing. On Nov. 18, the index hit a three-year low, which could presage a broader market pullback.

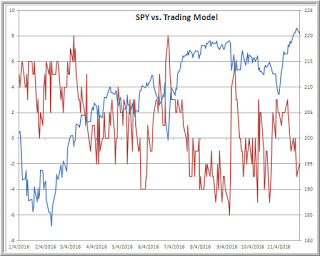

From a tactical perspective, Brett Steenbarger wrote that his composite trading model had sounded a cautionary note:

Readings of +3 or greater and -3 or less have had particularly good track records in and out of sample, anticipating price change 5-10 days out. Note that we hit a -3 reading on Friday; prior to that we saw +3 readings shortly before and after the election.

To be sure, these episodes can resolve themselves in sideways consolidation rather than downward corrections:

Thus far, we are not seeing significant breadth deterioration in stocks. For ten consecutive sessions, we have had fewer than 200 stocks across all exchanges register fresh monthly low prices. This breadth strength generally occurs in momentum markets; weakening of breadth–particularly an expansion in the number of issues making fresh lows–tends to precede market corrections. It is not at all unusual for momentum markets to correct more in time than price. We’ve seen selling pressure the past two sessions, but not significant price deterioration. This dynamic allows momentum markets to stay “overbought” for a prolonged period as price consolidates and often grinds higher.

While the predominant market psychology seems to be the “buy the dip” variety, there are a number of events that could change that in a hurry. First, there is the October Employment Report on Friday, which could be a big market moving event. In addition, both the Austrian presidential election and Italian referendum are scheduled to be held on Sunday, which are also potential market moving events with binary outcomes that are difficult to predict.

No signs of a major top

Despite these signs of short-term weakness from sentiment models, Ed Yardeni showed that sentiment is nowhere near levels that are consistent with major market tops (h/t Urban Carmel):

Still this equity rally still has a FOMO (Fear Of Missing Out) quality as underperforming managers scramble to buy risk as stock prices rise. Watch for the greed factor to dominate as we approach year-end, as exemplified this seasonal pattern analysis from Callum Thomas.

My inner trader remains in cash, but he is prepared to buy any dips in anticipation of a December market surge.

Always appreciated.

Waiting for Santa. ho ho ho

I stand by my statement that we might be seeing a false breakout. The market and the economy is facing serious headwinds. Here are a few:

1. The relentless strength of the dollar. S&P 500 companies earn a substantial portion of their earning from overseas. Also, cost of goods for consumer goes up.

2. Jump in crude. Another tax on the consumer.

3. Sharp rise in long term interest rates. Again, another blow to the housing market.

4. Lack of leadership from technology companies. FANG stocks are getting crushed. Face Book and Amazon have broken down. The Nasdaq 100 is acting very poorly and is under performing the market.

December is supposed to be seasonally a strong month for the stock market. If we don’t get a strong rally soon, the market will correct. The most contrary position now is nobody is looking for very sharp and prolonged downturn.

I stand by my statement that we might be seeing a false breakout. The market and the economy is facing serious headwinds. Here are a few:

1. The relentless strength of the dollar. S&P 500 companies earn a substantial portion of their earning from overseas. Also, cost of goods for consumer goes up.

2. Jump in crude. Another tax on the consumer.

3. Sharp rise in long term interest rates. Again, another blow to the housing market.

4. Lack of leadership from technology companies. FANG stocks are getting crushed. Face Book and Amazon have broken down. The Nasdaq 100 is acting very poorly and is under performing the market.

December is supposed to be seasonally a strong month for the stock market. If we don’t get a strong rally soon, the market will correct. The most contrary position now is nobody is looking for very sharp and a prolonged downturn.

Interesting! I liked it.

The title Glass Half Empty is so appropriate as to what I will be posting today. As Cam says the general market is showing exhaustion but that is only because it is amazingly divided by Trump extreme winning groups (banks,energy,industrials, domestic companies) and Trump big losing groups (interest sensitive,international companies,importers, IT). On a day by day basis the split market average of winners and loser goes up or down. But the movement of the whole is much more unpredictable than the sectors underneath.

The last couple of weeks since the election highlight why it is better to track indudtry sector ETFs rather than the general market.

Take today. The bank ETF lifted off after the new Treasury Secretary(former Goldman Sachs exec) was announced. Readers might remember I said don’t wait for the cabinet announcement to buy the banks because it would certainly be someone extremely friendly. The chart of the sector is very bullish and shows none of the rolling over that the S&P 500 shows. If you did an on balance volume on the sector, it would be soaring, the opposite if the general market. Goldman Sachs was up almost 4% and the bank ETF almost 2%.

Cam does a great analysis of forward earnings for the market. Doing the same thing for the bank industry would show fast rising forecasts that would more than justify higher stock prices. It’s easy to envision profitability being much stronger a year or two in the future in a Trump led, bank-friendly economy.

The advent of industry sector ETFs gives us the opportunity to target and profitably trade them when sectors have differing fundamental forces than the general economy.

I do.

While I do share Ken’s enthusiasm for the Banking sector I would also urge the readers to look at the High Yield Market (JNK). While the banking sector and the S&P 500 index have made new highs JNK is not confirming the strength. One of the two is telling the true story of the economy and the market. You can select which one is right.

With year end approaching money managers and hedge fund managers are chasing what is hot. In this business it as difficult or more difficult to know when to sell than what to buy.

Cam, do you think there is much chance that the near-certain rate hike in December might spook the markets and spoil the Santa rally? Remember last year?

P.S. Although I know there was more to it than that last year, with the China growth scare and the crude oil price plunge.

Not a chance John, the hike odds are at 100% (> 90% for better part of last month). Market has already made the decision for the Fed.

Right Tarun the rate hike is pretty much a given but will the market throw a tantrum over it or is it already priced in? Then again last Decmber it seemed it was already priced in.

Rajiv, the irony is that you are very right about so many industry groups that are most hurt by a strong dollar and higher rates. Those sectors are already falling while at the same time others like finance, energy and domestic Industrials are breaking out and I would argue that these are not false breakouts. This is what happens in a moonless world where industries have their own business and stock market cycles unlike the past where we had synchronized movements dictated by big swings in Fed policy ( the moon).

Investors that use the general market averages to invest are constantly frustrated by this internal dynamic. My suggestion is pick the sectors that fit your thesis and use them rather than THE MARKET. If your thesis is correct then you will make money. Simple.