Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on research outlined in our post Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bullish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Neutral

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet any changes during the week at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

A gift from the market gods?

Now that Mr. Market has decided that Brexit has been “fixed”, it’s time for a sober second analytical look at the impact of this historic decision by the UK electorate on the US equity market.

The knee-jerk market sell-off appears to be a gift from the market gods to investors. The economic impact of the event on the American economy seems to be relatively minimal. Risk premiums have risen in response as the world is witnessing a repeat of the usual European theatre, whose last major production was staged during the Greek crisis of 2011.

The view from this side of the Atlantic

Pre-Brexit, here is the US macro picture looks good. The industrial side of the economy, which had been in the doldrums, is showing signs of recovery:

There has been a lot of recent hand wringing over weakness in capital expenditures. However, this report from Factset shows that capital expenditures ex-energy and finance (green line) has been steadily rising.

The American consumer, who has been a pillar of strength throughout this recovery, continues to be strong. The latest consumer confidence release beat expectations and it`s on the rise again.

The bottom-up picture of the stock market is constructive. John Butters of Factset also reported that the negative to positive earnings guidance ratio has improved from last quarter and it`s slightly better than its five-year average.

Equally encouraging is Factset‘s latest flash of post-Brexit earnings estimate revisions. Forward EPS is continuing to grind upward (annotations in red are mine).

Brexit impact: A slight positive

From my reading, the projected long-term impact of Brexit on the US economy is positive to neutral. Former IMF chief economist Simon Johnson thinks that America gains while Europe loses under Brexit (via Marketwatch):

In geopolitical and economic terms, the U.S. is potentially the biggest winner from the disintegration of the EU. The U.S. rose to global predominance as Europeans fought one another and their empires declined. The post-1945 U.S. role was challenged first by the Soviet Union, which, for a time, posed a real technological challenge. Today, Russia has a small — and shrinking — economy and a population in decline…

Prosperity is based on people and ideas. Who can attract the most talented people, educate them and their children, and give as many individuals as possible the opportunity to work productively? The U.S. has some serious problems, but absorbing immigrants and encouraging creativity have been among its main strengths for more than 200 years.

Ben Bernanke thinks that most of the negative global effects come from a rising risk premium. As long as the market doesn’t get too caught up in excess fear, “the [American] economic recovery is unlikely to be derailed by the market turmoil”.

Globally, the Brexit shock is being transmitted mostly through financial markets, as investors sell off risky assets like stocks and flock to supposed safe havens like the dollar and the sovereign debt of the U.S., Germany, and Japan. Investors are perhaps more risk-averse than they otherwise would be because they know that advanced-economy central bankers have less space than in the past to ease monetary policy. Among the hardest hit countries is Japan, whose battle against deflation could be set back by the strengthening of the yen and the decline in Japanese equity prices. In the United States, the economic recovery is unlikely to be derailed by the market turmoil, so long as conditions in financial markets don’t get significantly worse: The strengthening of the dollar and the declines in U.S. equities are relatively moderate so far. Moreover, the decline in longer-term U.S. interest rates (including mortgage rates) partially offsets the tightening effects of the dollar and stocks on financial conditions. However, clearly the Fed and other U.S. policymakers will remain cautious until the effects of the British vote are better sorted out.

In the meantime, the Fed is staying cautious as rate hikes are put on hold. In fact, the market implied probability of a rate cut is higher than a rate hike until the December meeting.

In short, we have healthy US economic and equity earnings growth. We have a dovish Fed driving down bond yields. What more could a patient investor ask for? Was this market panic a gift from the market gods?

Cue the European drama

Meanwhile in Europe, the drama begins. We’ve seen different versions of this play before and it always ends the same way. The European Union has been through one crisis after another. Just as it seems Europe is about to go over a cliff, the eurocrats cobble together a fudge and kick the can down the road. Just ask the Greeks.

Yet this drama is no Shakespearean tragedy in which the main characters all die at the end. Instead, it should be better characterized as a farce in the manner of Molière.

The play begins with a crisis. The British populace has voted to leave the European Union. After the vote, no one has a plan. The Prime Minister resigns. The leader of the Opposition is under pressure from his own parliamentary caucus as most of the shadow cabinet have resigned (Telegraph). The Leave side has no plan and some of its leaders backtrack on previous promises made during the campaign (CNN, Mirror). Then, Boris Johnson, who was a major Leave campaigner and frontrunner to become PM, got knifed in the back by an ally and took himself out of the race to become PM (Bloomberg).

In Brussels, the European Commission wants to make an example of the British, in case any Euroskeptic parties in Europe think about leaving (chart via Ian Bremmer).

European Commission President Juncker has banned EU officials from discussing Brexit terms with British officials until an official Article 50 declaration has been delivered (RT). Angela Merkel tells British PM David Cameron that there is no turning back from Brexit (Bloomberg).

As the first act ends, pandemonium and hilarity ensues. A Cambridge economist shows up at a faculty meeting naked to protest Brexit and no one says a word – for two hours (Telegraph). Then we have the Revenge of Odin, as the English loses a Euro 2016 match by a score of 2-1 to Iceland, a team that’s coached by a dentist. As the curtain comes down, a chorus of Brexiteers are heard to disparage so-called “experts” who “claim” that if the other team scores more goals than yours, you’ve lost the game.

Farce? Even Molière couldn’t make this stuff up.

The story behind the drama

Despite all the drama so far, we know how this story ends. While it is true that Brussels is doing its utmost to halt the political contagion of Brexit, a Eurobarometer survey done in April shows that British attitudes are an exception in that they tend to self-identify by nationality rather than as European. Beneath the sensationalist headlines, the risk of political contagion is relatively low.

In the UK, signs of regret are emerging. I am seeing much discussion, legal analysis and trial balloons of how to either reverse the Brexit referendum vote, or achieve some form of Brexit-lite, in which the British relationship with Europe remains relatively unchanged.

- The decision to leave (invoke Article 50) has to be passed by Parliament, which is no sure thing: Such an Act may not be possible given the disarray of both the Conservative and Labour party (and the pending leadership convention of the Conservatives and possibly Labour). We may see a general election before an act of Parliament is passed – which is likely to tilted towards parties favoring Remain.

- Perhaps Scotland can bail them out: Under the Scotland Act 1998, the Scottish Parliament has to consent to measures that eliminate EU law’s application in Scotland. As Scotland and Northern Ireland voted to remain, perhaps a Scottish veto could save Brexit.

- It’s a choice between Brexit-lite (Norway model) and full Brexit (Canadian model): The Norwegian model represents a form of Brexit-lite, a fig-leaf for Brexiteers while remaining in the EU. By contrast, the Canadian position within NAFTA involves far greater barriers to trade in both goods and services, as well as freedom of movement. Given the recent post-referendum trauma, expect greater support for the Brexit-lite Norwegian model, though that path may be blocked by Norway`s objections.

- The deadline for an Article 50 declaration under the Lisbon Treaty is March 31, 2017. After that, the UK may need a Qualified Majority Vote to leave. The Lisbon Treaty states that a member state can trigger the provisions of Article 50, after which they have up to two years to negotiate the terms of exit. Starting April 1, 2017, however, EU votes are weighted (Qualified Majority Vote), so Britain will have to persuade 14 member states to allow it to leave. So any declaration to leave on or after that date will get tied up under this arrangement and the UK may not be able to leave at all under any terms.

A settlement will be reached. Europe kicks the can down the road once again. Risk premiums fade and the markets stage a relief rally. (Just as Alexis Tsipras how well his referendum worked out.)

The week ahead

On Monday, I wrote that the US equity market was sufficiently oversold that a bounce was imminent (see Hitting the Brexit trifecta). The ensuring a reflex rally was so strong that, by Wednesday, I indicated that caution was warranted because both the bond and gold markets had not confirmed equity strength with retracement of their panic conditions (see How to trade the US election). I stand by those remarks.

Marc Chandler also sounded a tone of caution. Chandler is a currency strategist and therefore his comments related to Sterling, but his analysis is applicable to general risk appetite:

After plummeting 18.6 cents, mostly in a few hours after it became clear that the Brexit would carry the day, sterling has rallied four cents from the low set on Monday. We recognized that the magnitude of the drop left sterling technically over-extended, but we caution against suggests that the worst is behind us and that a durable low is in place. ..

t may take a few weeks before the shock feeds into economic reports. Expectations for a BOE rate cut as early as next month (July 14) have risen. From the high point last week to the low point at the start of this week, the implied yield of the September short-sterling (three-month deposit) fell 20 bp. They have recovered about five bp. Many economists are projecting a recession.

Sterling’s gains do not appear to reflect fundamental developments. Instead, we suggest the gains are driven by two considerations. First, is the money management of momentum traders. Once sterling stopped falling, short-term participants (fast-money) bought to take profits on short positions. Remember, in the futures market; speculators had were carrying one of the largest bearish bets on sterling on record (gross shorts = 93.7k contracts–each is for GBP65000). Second, institutional invests are adjusting portfolios and (currency) hedges ahead of the month- and quarter-end.

There are other short-term warnings that this market recovery is unlikely to be V-shaped, but W-shaped. Risk appetite in the junk bond and emerging market bond market are not confirming this advance, which is a sign that traders may want to fade equity market strength.

In the space of a week, the market has oscillated from an overbought reading to oversold and back to overbought again. This IndexIndicators chart of stocks above their 5 day moving average tells the story. At a minimum, expect a few days of consolidation before stocks can advance. A pullback would also be no surprise.

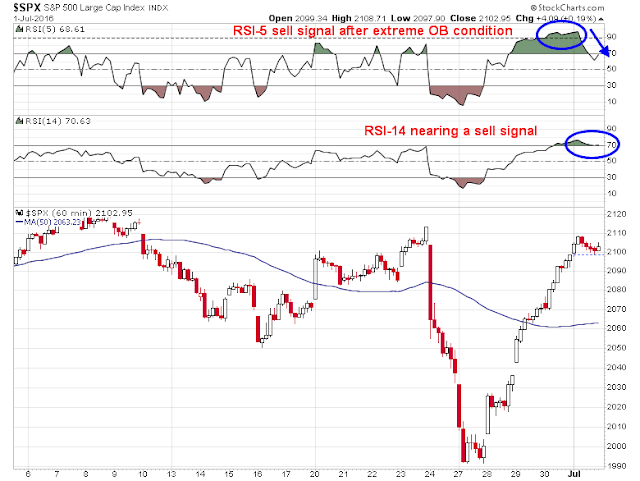

The hourly SPX shows RSI-5 at an extreme overbought level. Readings of over 90 are not sustainable and RSI-5 has flashed a sell signal after dropping below 70 from an overbought reading. In addition, RSI-14 is nearing a similar sell signal.

Nevertheless, the intermediate term outlook is constructive. The SPX Advance-Decline Line made another all-time high last week, which confirms the strength underlying this advance. I would caution, however, that breadth measures such as the A-D Line are intermediate term indicators and tell us little about short-term market action.

In addition, commodity prices, which is an important indicator of global cyclical strength, are rising despite the headwinds posed by the strong USD. I interpret this as a market signal of global reflation, which is positive for earnings growth.

My inner investor remains constructive on stocks and he is prepared to opportunistically increase his equity position on a pullback. The downdraft in stock prices was likely a gift from the market gods, but the problems haven`t totally disappeared and risk premiums have compressed too far too fast.

My inner trader is on holiday for the next two weeks. Even though regular blogging will continue, he believes that the prudent course of action is to stand aside during this volatile period.

Disclosure: No trading account positions

Cam looks like we have two gaps left open on this recent upward move (last week). One around 2035-2040 and another below that around 2005. Do you expect the “W” shaped retest that may come in next days/weeks to be filling those gaps and finding double bottom support around 1980-2000 (low of recent drop) or do you see a possible retest of 1900-1950 feb/mar ’16 breakout? I guess I’m asking what odds would you place to these 2 support levels being retested in the near future?

And thank you for valuable post pre-July 4th. Have a great 2 week holiday!

My guess, and this is only a guess, is we re-test the Brexit panic love low seen on Monday but in this environment anything is possible.

I continue to believe the overriding factor driving the stock market is the shocking fact that interest rates on bonds fell after the December Fed rate increase rather than going up. Everyone was poised for Fed rates to ramp up four times in 2016 with bond yields to follow suit once the lid was taken off the ‘artificially low’ rates the Fed was holding down. We all expected a return to ‘normal’ rates of 4% plus in a few years. Even the Fed governors projected the Dot Plots to show us the way.

U.S. rates going up would send the U.S. dollar up because they would be the only country raising rates. A rising dollar would crush the commodity prices. Finally rising rates would hurt the U.S. economy. That is why, commodities and currencies of commodity producing countries like Canada were plunging before the December Fed rate hike and for a month after. When rates started falling at the beginning of the year, it took a couple of weeks before the fact hit investors that this dim future for commodities and currencies wasn’t going to happen. Commodity markets and related stocks turned up and have been on a huge upswing. Commodity currencies have had a big recovery.

A key beneficiary close to home is strong dividend stocks and dividend ETFs. They have outperformed the index by 10% since the new message hit home in mid-January.

Anything happening that will reinforce that rates will stay “lower for longer” (you will see that phrase a lot) will send dividend stocks up, the U.S. dollar down, commodity prices up and commodity currencies and commodity country stock exchanges up.

Brexit is a case in point. It reinforces ‘lower for longer’. Here is a chart comparing the Select Dividend ETF to the S&P 500. Note how relative performance jumped during Brexit volatility.

https://product.datastream.com/dscharting/gateway.aspx?guid=0c2cc561-12b1-49b7-8903-df3bbd45f242&action=REFRESH

Strategists are confused as to why commodity sectors and defensives are both outperforming at the same time. It’s because defensives like utilities and staples are big dividend payers. People that focus only on PEs are doubters because their PEs are above historic norms. But a reversion to past norms may just be wishful thinking for investors waiting in zero interest rate cash waiting for Godot. One of the best quotes I have seen was ‘Successful investing is about having people agree with you later.” I believe in the next few years, the investment community will focus on dividends much, much more and earnings less. By the way, did you know that the dividends paid on the S&P 500 are projected to go up 7.5% over the next year? I think that will prove more meaningful than where one year forward earnings will be.

If rates had gone up as expected after the December rate hike, the dividend stocks would have been poor performers. At the expected ‘normal’ future rates, they were expected to go down along with the commodity group. So both sectors were VERY much ignored and the change in thinking to this new ‘lower for longer’ world is causing a buying stampede that is just starting. Research into momentum shows us that new trends starting after a major new information take several years to full play out. The outperformance of strong yield stocks in a yield-hungry boomer-retiring world is just starting.

The Select Dividend ETF yields an insanely rich 3.2% and growing in a world where the U.S. 10 year Treasury is less than 1.5% and fixed.

We experienced investors have a sense of ‘normal’ rates that makes it difficult to believe that 3.2% is a super deal. But the sooner we accept ‘lower for longer’ the better off we will be. We can then see the dynamics behind whats driving markets.

Lovely post, Cam; very amusing and to the point.

And Ken, thank you for pointing out the case for DVY.

+1 Martins comment.

Ken

In a nutshell, hard assets would be better place to hold capital after they have fallen 40-60% against the US$ (examples gold, WTI, metals and miners etc.). The second and parallel reason is loss of currency values, as we are seeing the pound decimated against a basket of currencies, some of that capital will flow back into depressed hard assets like US real estate, commodity plays etc. Yes, one could make a case for Manhattan real estate going higher as money flows into the US as Europe implodes.

Money flowing into scrips like utilities and staples is like buying money printing machines (other examples XOM, CVX, PG, CL, WMT, big pharma, KR, MSFT, AAPL, KO, T, VZ, TWC, etc.).

Fiat (=manipulated by politicians) currencies are being sold and more solid investments are being bought. Yes, the vanguards of the Brexit move have run away (Johnson, Faraj, Cameron and others). Britain now awaits a clean up crew, but none is forthcoming. Why would one trust fiat currencies when their vanguards themselves have run away? Cam’s article detailing the fragmentation of EC membership is comical. It is akin to saying I am a 70% EU/EC member, another country is only a 30% EU/EC member and so on. A flawed union is eventually going to implode. Why do people expect otherwise? Yes, DVY would be a good contrarian buy (and there are many other individual scrips throwing off larger dividends). Now waiting to see if Marine La Pen stirs the pot in France and the Scottish referendum. How about a Quebec referendum?

A barbell approach of high quality, high dividend stocks, some hard assets (US farmland, precious metals included), US real estate (still yielding at least 5-7% pre tax, cash on cash), and a dollop of cash would be a good portfolio mix. US municipals would be another place to look at (depending on the quality of municipals, one could crank out 3% tax free yield for investment grade).

Yes, British assets would be a good buy once the pound has collapsed another 50% against the $, British treasury has started to borrow and print, sell gold and other assets and so on. I hear estimates of 1.20 $ to the pound. Why not parity or below?