Well, my Bremain call didn’t go so well (see Positioning for a Bremain result). As I write this, the BBC has called the referendum in favor of Leave by a margin of 52-48. GBPUSD is down about 10% and Asian stock markets are down 2-4%.

If you were correctly positioned for this outcome, congratulations, but don`t get overly excited about doing a victory lap as there is going to be market volatility ahead. During these episodes of unexpected market shocks, here is what I am watching for:

- Technical: Watch for logical areas of technical support

- Sentiment: Signs of panic and oversold reading that signal a bottom

- Macro: Either official intervention or policy responses that could rip a short`s face off

Where`s support?

I will also watching my Trifecta Bottom Spotting Model for signs of panic and capitulation (see link for full model description and use this link if you would like real-time updates to follow along at home).

Watching for oversold readings

Another way to watch for a bottom is to watch for oversold readings on various technical indicators. The market ended Thursdays at or near overbought levels, so it remains to be seen how much these indicators retreat on Friday. The Fear and Greed Index, for example, will be a useful intermediate term indicator to watch.

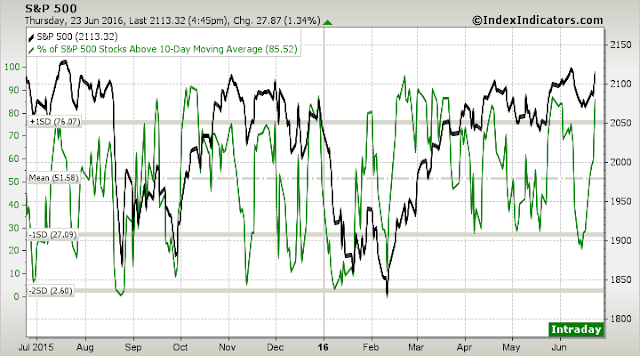

Breadth readings such as % of stocks above the 10 dma, which is available from IndexIndicators, will also be a useful gauge of how much panic there is in the market.

Beware of intervention

As well, such periods of market turmoil are ripe for official intervention. Janet Yellen indicated in her Congressional testimony that the Brexit vote was one of many risks that the FOMC considered in making its interest rate decision. As I write these words, the GBP is in freefall and both USD and JPY are rallying. These are the kinds of classic conditions that calls for coordinated central bank intervention.

An alert reader also sent me a note by George Friedman of Stratfor, who indicated that the UK government has lots of wiggle room even after the Brexit vote:

A vote to exit does not mean that the U.K. has left the EU by any means. Under the Treaty on European Union (TEU), the vote would put in motion a process that takes two years. However, the decision on whether Britain exits sooner is up to Britain. Potentially, Britain can remain in the EU even longer, if the members of the EU vote unanimously to allow it to remain longer.

The government of Prime Minister David Cameron is bound by the referendum, but is opposed to leaving the European Union. So long as he remains prime minister and maintains a majority in Parliament, it is up to him to decide what time frame he will pursue. He can leave the EU tomorrow or ask the EU to extend the time limit – in effect, the exit could be tabled indefinitely. The referendum ballot does not provide a timeline, leaving it to Parliament.

If panic sets in, the markets could easily turn around on any hint of official action. As there is a weekend coming up, the EU could conceivably hold an emergency meeting to try and work out a compromise in order to stabilize the situation.

If you are short, I would be cautious about maintaining such a position over the weekend because we have no idea what might happen.

The Friday futures market is down big and today looked like a bull trap. But future over sold markets may become a launching pad for a rally into year end +/-, Nov/Dec 2016. If this scenario does come about, then a blow off rally may lead to major market problems after Nov/Dec 2016.

Biggest egg on the face belongs to those forecasters who trusted the betting markets that seemed to go heavily for remain. Their record in the past has been superior to polls, but as that has become known, the return on gaming them has gotten bigger. It now looks clear that those markets were manipulated.

One could have gone big long GBP, and then taken a tiny fraction of that money and dump it into a remain bet on the relatively minuscule betting markets, making remain seem inevitable and discouraging the leave camp. I know you hate Zero Hedge, but an interest tell was their article two days ago (http://www.zerohedge.com/news/2016-06-22/something-strange-emerges-when-looking-behind-brexit-bookie-odds) pointing out that most bets were for leave, but the money amount of the remain bets were on average five times bigger, and all that money had a big impact on the odds.

The ploy worked, the pro-leave people were demoralized, but won anyway. As soon as polls closed, before any votes were counted, Nigel Farage was quoted as saying his side probably lost. I wouldn’t be surprised if, without that manipulation, the margin for leave would have been even higher. I think the lists of winners and losers from Brexit will have to put betting markets firmly in the loser category.

Sometime these events have long term implications and signify major trend changes. I don’t remember the year maybe Cam does there was a United Airlines strike which was the top of the market on an intermediate term basis. I think the best thing to do would be to step back and let the dust settle. The market will be around there should be no rush to call the bottom. Even if one does accurately call the bottom it could be tested again after a knee jerk rally.

This event is a boost for ‘lower for longer’. Expect the futures markets to reduce the probability of a Fed rate increase any time soon. I see the long U.S. Treasury bond will open up trading about three points today. This should make U.S. dividend ETFs and stocks continue to perform better than the S&P 500. This is THE new market phenomenon since mid January when bond interest rates surprised by falling after the Fed rate increase in December. Lower for longer. Repeat Lower for longer.

Ken: Lower interest rates in the short run, definitely, but depending upon how central banks and governments respond, this could easily be the end of the ~35 year bond bull market. Keep in mind that the ideology of central banks these days is, no matter what the problem, the answer is to print more money and push interest rates lower. At the same time, there is rising populism throughout the world.

Both come from belief in completely wrong economic theories – Keynesianism, monetarism, socialism, crony capitalism, and anything else that posits that a few government bureaucrats can manage the economy better than what the free market would do on its own.

So central banks including the Fed will print more money. The populists will demand, don’t give it to the banks, give it to everyone directly. They would be right that giving it to the banks hasn’t worked, and only financed asset speculation (bull markets in bonds, stocks, real estate, art, etc.). But giving it directly to the public increases demand and does nothing for supply of goods and services measured in the CPI and other price statistics, which will lead to big jumps in inflation, and the start of rising interest rates and a bond bear market.

Rick, I agree with you entirely. But until all that happens, inflation and interest rates will stay low and the extremely generous relative dividend yield of stocks over bonds will have dividend ETFs performing much better than the general market.

Cheap money might, no likely, will lead to speculative borrowing and hence a pickup in the velocity in money. One would have thought that would have happened by now. When that finally happens, I will pivot and become the biggest inflation bug on this blog. But amazingly, people are not borrowing even as Central Bankers are trying to push banks to lend. This money printing is sitting on the banks balance sheets. Go figure???

So until then, it’s ‘lower for longer’ and back up the truck for quality dividend stocks.

At one time gold was considered a “barbaric metal” with no intrinsic value. With zero and negative interest rates in the major industrialized countries you already seeing a flight from the bond market. Gold is now competing against bonds which is basically paper backed by the full faith of the Governments whose policies are now being considered a failure (Japan). Therefore, as the flight to gold and other assets take hold the Bond market will have to raise rates in order to attract funds. That will be the start of the bear market in bonds. It is not a matter of if but when it will happen.

I noticed the Nikkei index was testing its february lows. It already went down more than 7 percent. If it goes down more, I guess there’d be a lot of panic in Japan too.

It’s quite a frightening sight actually. The Nikkei index is down more than 25% from its top in 2015. I’m having this feeling that Japan is not only the front runner in having an aging population. But also the front runner in what happens when massive stimulation no longer works. I mean, it just seems that it has to come down. Who would want to trust a debt burdened country with falling exports? That’s hard for me to do.