Welcome to the coming global recession. We can debate all day about the global growth outlook, but consider this: Global Manufacturing PMI has fallen to 48.5, indicating contraction. It’s the first negative reading since the COVID Crash of 2020.

The signs of deceleration have been confirmed by the G10 Economic Surprise Index, which measures whether economic reports are beating or missing expectations.

Even in a recession, there is opportunity for equity investors. This week, I analyze the economic and equity outlooks for the three major trading blocs, the US, Europe, and Asia.

To make a long story short, I conclude that a survey of the world economic outlook shows the increased risk of a global recession. An analysis of the global regions indicates the US is no longer a safe haven in downturns. Relative valuations of non-US markets have converged and the best opportunity is appearing in non-German eurozone. Asia may be constructive but it is subject to China lockdown risk and possible fallout from India’s heatwave.

Price performance and valuation

Let’s begin with global equity performance. The relative performance of the major regions relative to the MSCI All-Country World Index (ACWI) shows that US outperformance has stalled and all of the other regions are beginning to catch some bids. Europe is recovering after the Russian invasion of Ukraine. Japan is trying to bottom. The emerging markets are all trying to bottom.

From a valuation perspective, the US stands out in exhibiting a premium forward P/E ratio. The forward P/Es of all of the other major regions are all converging to a narrow range.

Commodity prices also offer a cautionary message. While most headline commodity indices are strong, their strength can be attributable to the heavy weighting in energy, which has risen because of the Russia-Ukraine war. Equal-weighted commodity indices have been trading sideways and they are testing their 50 dma. Just as disturbing is the behavior of the cyclically sensitive copper/gold and more broadly based base metals/gold ratios, which have been falling.

Here’s what this all means.

America: Safe haven no more?

The major reason US equities were trading at a premium P/E valuation is their growth characteristics. The FANG+ stocks are large-cap dominant companies with strong competitive positions and cash flows. When the global growth outlook faltered as the COVID pandemic ripped through the world, investors piled into US equities as a safe haven. According to the BoA Global Fund Manager Survey, the US is the region with the greatest overweight position.

Fast forward to Q2 2022. The US economy looks far more wobbly today. The April ISM print shows that economic growth is decelerating. ISM Manufacturing fell to 55.4. New orders fell and employment dropped sharply.

New Deal democrat, who maintains a series of coincident, short-leading, and long-leading indicators, is beginning to ponder the prospect of a recession in Q2 2023 in his

last update. He now has more negative components in his long-leading indicators, which look ahead a year, than positives.

There was deterioration across all three timeframes this week. The coincident nowcast is only weakly positive, the short term forecast is neutral, and the long leading forecast, for this first time since before the pandemic, has turned negative.

It is important to emphasize that while the high frequency indicators give early warning of changes, they are also somewhat noisy. Some of the negative trends might reverse (e.g., financial conditions, which showed tightening for the first time), and some positive trends (like corporate earnings beats) may amplify…

To sum up: the outlook for the rest of 2022 remains a weak positive economy, while for the first time, the outlook for 2023 beginning in Q2 may include a recession. From here on, we look to see if the negativity persists in the long leading indicators, and begins to spread into the short leading indicators.

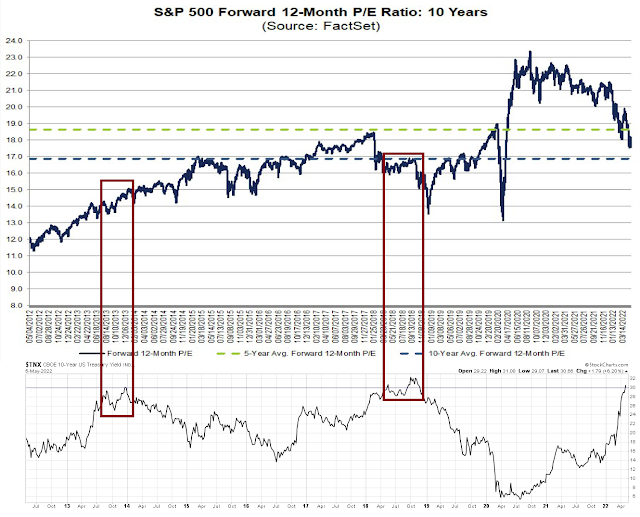

The S&P 500 is trading at a forward P/E ratio of 17.6. The 10-year experience of the 10-year Treasury yield at above 3% indicates that forward P/E should be about 14-15, indicating a downside potential of about -20%.

The S&P 500 has even more downside risk than -20%. The market is in the part of the cycle in which estimate revisions are has begun to decelerate and P/E ratios are undergoing compression. In the past, the S&P 500 has struggled when EPS revisions were flat to down.

This is the first week of decline in forward 12-month EPS estimates. While it could be just a data blip, a detailed analysis of the weekly quarterly EPS revisions shows a disturbing trend. Q1 2022 EPS estimates were revised upwards, mostly because 79% of reporting S&P 500 companies have beat estimates. However, the Street substantially cut estimates for the next three quarters and Q2 2023. The only exception was a minor upward revision for Q1 2023.

Not such a safe haven anymore.

Asia: A recovery mirage?

Looking across the Pacific to Asia, the relative performance of Asian markets can be characterized as constructive. All of the major Asian regional markets are in the process of making relative bottoms. India is in a minor relative uptrend.

The apparent strength could be a mirage. That’s because of the unknown effects of China’s spreading lockdowns because of its zero-COVID policy. April’s manufacturing PMI has nosedived.

As China is a major global manufacturing hub, a Chinese slowdown will cause a renewal of supply chain bottlenecks around the world. The

WSJ reported that the average time to receive production materials rose to 100 days in April because of the lockdowns.

The Institute for Supply Management said its index of U.S. manufacturing activity in April hit its lowest level since July 2020, and the average time to receive production materials increased to 100 days in April, its longest span ever. In the survey, 15% of panelists expressed concern about the ability of partners in Asia to reliably make deliveries in the summer months, up from 5% in March.

If you thought manufacturing PMI was weak, the weakness in China’s services PMI illustrates the damage of the lockdowns are doing to the economy.

Barron’s reported that China Beige Book, which compiles bottom-up statistics for China, revealed “severe pressures” for the Chinese economy not reflected by official statistics.

There is no sugarcoating the economic situation in China. Lockdowns to fight Covid-19 whose effects aren’t yet reflected in official data are already causing “severe pressure,” according to a survey of more than 1,000 firms conducted in the last week of April by China Beige Book and released on Monday. Almost a quarter of the companies reported virus outbreaks among employees, up from 20% in March.

Growth in revenue and profits in manufacturing, retail, and services already is slowing. Even more troubling: Hiring took its first big hit since the initial Covid outbreak in 2020 as companies took on fewer staff and wages dropped. Companies also demonstrated little appetite for credit. Both borrowing and bond sales dropped, according to the China Beige Book, a troubling sign for investors waiting for easier access to credit to help stem the slowdown.

As well, OPEC indicated that China is facing the biggest demand shock since early 2020 because of its lockdowns.

Over in India, Bloomberg reported that the country is experiencing the worst heatwave in 122 years. This has resulted in power cuts owing to a coal shortage and high coal and oil prices have pressured inflation. The heatwave has also damaged crops and added to the global food shortage as India is considering restricting wheat exports.

Europe: First in, first out?

Turning to Europe, the economic outlook looks like a mess, but European equities present opportunities because the region may be the first to undergo a recession, and it could the first one out of one.

The BOE raise rates by a quarter-point last week and presented a dire forecast for the UK economy. It sees the second largest drop in living standards since 1964, with inflation peaking at 10.2% in Q4. Unemployment will rise and GDP growth will fall -1% by Q4. While large cap UK stocks are showing some relative strength because of their large energy and mining exposure, small caps, which are more reflective of the British economy, is lagging.

Across the English Channel, the April Eurozone manufacturing PMI is falling, which is not a surprise because of weakened Chinese demand.

The bright spot was services PMI, which rose “amid falling COVID-19 case numbers and an associated relaxation of health restrictions”.

The relative performance of eurozone countries was a surprise. Relative performance was better in all countries other than Germany, which is struggling with the severe political pressure over a possible ban on Russian energy imports.

Non-German eurozone equities represent an opportunity for investors, especially when the BoA Global Fund Manager Survey indicates it’s a very hated regions.

What about the Russia-Ukraine war? I use the Polish equity market as a proxy for geopolitical risk. The relative performance of Poland is still weak, indicating an elevated level of geopolitical risk premium. Poland has violated relative support against the Euro STOXX 50 and it is testing a key relative support level against ACWI. Avoid it for now.

In conclusion, a survey of the world economic outlook shows the increased risk of a global recession. An analysis of the global regions indicates the US is no longer a safe haven in downturns. Relative valuations of non-US markets have converged and the best opportunity is appearing in non-German eurozone. Asia may be constructive but it is subject to China lockdown risk and possible fallout from India’s heatwave.

Cam

“The S&P 500 is trading at a forward P/E ratio of 17.6. The 10-year experience of the 10-year Treasury yield at above 3% indicates that forward P/E should be about 14-15, indicating a downside potential of about -20%”.

If I interpret this correctly, we are looking at a further 20% downside, from Friday close (4150 on the S&P 500), all the way down to 3250 or so? Thanks.

Yes, if history is any guide.

When will the Fed pivot, if it does? What will it take? Some horrible jobs data? Housing falling into a hole? The year 2 elections?

Shortening supply chains will take years for many things. Will energy become cheaper? If gas is more expensive, people will drive less but they will likely spend less, so how far into recession will the Fed want us to go. How long before the federal gov’t gets annoyed about debt servicing?

As we get past the base effects, inflation numbers will get better….as an example a year ago oil was at 65 bucks, now it is 110 so about 55%, and oil is a big factor. Will it be 170 in a year and 300 in 2 years? Maybe but not likely.

So at some point inflation will become disinflation and they can blame a lot of it on factors outside the USA. At some point they will return to money printing, only when.

Is china trying to nationalize it’s economy? Making it impossible for businesses to survive so that they can be absorbed into SOEs? First the crackdown on Evergrande, and now this lockdowns….

The Fed will pivot when something breaks. Keep an eye on financial conditions and bond spreads in particular.

Could the bond and stock markets pivot before the Fed does as the market participants predict the direction of interest rates watching the inflation and economic data.

Yields today are much higher than the current Fed Fund Rate would imply.

Normally I wouldn’t be too concerned about an additional -20% decline with a position size of 25% in equities.

However, with the recent high correlations between bonds and stocks, I am beginning to worry how bond funds will perform under those conditions.

Anyone with thoughts as to whether bonds will continue to decline along with stocks?

My thoughts this weekend:

(a) I plan to give my current asset allocation (bonds/stocks/cash 40%/25%/35%) a relatively limited period of time to prove itself. Depending on market action, a limited period of time may be up to 1-2 weeks, or as short as 1-2 trading days.

(b) The maximum loss I’m willing to accept for the portfolio is generally 5-7%. Should bond yields and/or stock prices exceed ytd highs/lows next week, they will no doubt trigger my sell signals.

3.25% is resistance on TNX.

TNX is usually 1.5-2% higher than German ten year bond rates (currently 1.13%). If German ten year goes to 3% if ECB unwinds their QE, run the numbers on TNX.

If you look at TLT:SPY, it almost always goes up with market declines. I posted about that a few days ago. Even TLT:JNK is going down, so what’s going on?

Which is why I wondered if china or Russia were dumping treasuries….or maybe they are letting the sentiment run TLT down to the lowest prices possible before buying.

I get it that TLT goes down with rates going up, but why is JNK outperforming TLT…we gonna call JNK a safe haven lol? Maybe it is a way to send a message….if everyone dumps treasuries, who will buy them? What will the Fed do? What will happen to housing if the yield on long treasuries goes to 7%, mortgages at 9%?

This is the problem with debt….when they decided years ago to push rates down to deal with debt, they got deeper and deeper into the hole. Raising rates won’t help imo paying off the debt would, but can you imagine fiscal responsibility from Washington for decades?

But my guess is that at some point the Fed cries uncle, and we get more printing, so bonds would appreciate then

Support on TLT going back to 2017 is at 105, if it breaks that hard, who knows ?

Mortgage rates have been helped by the Fed buying MBS, and I think the reason why rates have jumped so much is because lenders can’t let the Fed hold the potato much longer…

It’s gonna be a bumpy ride

I respect you Humble Students so much that I will share some deep secrets of the investment industry (half tongue in cheek). I’m anonymous here so my colleagues won’t blackball me for doing this.

When markets are heading into a recession, the industry will NEVER say cash in their products. In forty years, no mutual fund or ETF provider has called me up to cash their fund because it will go down. They talk about ‘volatility’ coming which in the investment industry jargon means you will lose your ass but everything will be wonderful after the hurricane passes.

The next thing to realize is that stock analysts work for those product suppliers or for brokers that want everyone to keep on trading. That means the future profit summary of all these in industry biased folks in the form of Future Earnings Estimate is very suspect in normal times and a complete misleading number when we are heading into a recessionary tsunami with war, hyperinflation (had to dig that word out from a 1976 dictionary) and a Chinese Covid crisis. My guess is the actual profit per SPX share will be closer to zero than the current estimates. I’ll bet anyone $100 on that with loser to donate to the winners favorite charity.

The current running PE is just under 20X. That is no bargain especially with the high risk of uncertainties over the foreseeable future. Here is a chart of running and future PE back to 2007.

https://refini.tv/3vR48bF

You can see that these indexes rose consistently from 2012 to 2018 before Powell was appointed Fed Chief. I would guess that so many commentaries I see nowadays refer to future earnings estimates are due to confidence in their veracity that was built at that time. I no longer use them only to picture why gullible investors think markets are good value.

As Cam mentioned, this is the first week the future earnings number fell. Look up at the PMI chart above falling off a cliff and Consumer Discretionary Indexes plunging. That is happening at the start of Fed tightening. Please bet me. I have a very worthy cause that would be grateful for your donation.

A true and a sobering thought indeed. It’s a tough business.

Thanks Ken. Your opinion is valuable. I like more cash right now, even though that’s tough with inflation. If I’m wrong I will miss out on upside and be just fine. If I’m right I’ll have to figure out the best way and time to deploy the dry powder. Feels like the best one can do right now.

Thanks for sharing as always. I’m not sure why PE kept rising from 2012-2018 but maybe because the Overton Window of market sentiment shifted to price in a new Fed regime (i.e. the “Fed Put” and a reactive market friendly Fed)? And unfortunately that Fed regime are shifting due to inflation fears. From above chart forward P/E now is very close to the 10 year average. 10% down to 16x Fwd PE doesn’t sound too farfetched if one is an optimist.

Oh if earnings drop then then the PE will shoot up again. Color me a pessimist now.

The whole thing is worrisome., I’ll add zombie companies, balance of trade deficits, an economy supported by service consumption….it makes me think of the old saying ” If you owe the bank 100 thousand you have a problem, if you owe 100 million the bank has a problem”

With the trillions of public and private debt, the Fed has a problem, so just like in the old saying, what will the bank do? Call the loan and swallow the loss?

Still holding my Cameco but thinking that even if uranium keeps going up and CCJ makes decent earnings, if we are in a secular bear the PEs will be no where what they have been…sigh

Epic popping of the everything bubble?…but it reminds me of how horrible things felt in the GFC

https://static.rusi.org/special-report-202204-operation-z-web.pdf

Sending my friends some good night time reading, a detailed analysis of recent events in Russia, Ukraine, the ideology behind it, implications for Moldova, Transnistria and other vassal states, written by two brilliant British analysts. There are historic references in this scholarly document to Nazi forces, The great patriotic war, and such, and their relevance to current history. Makes for a chilling read. Any insights are appreciated. The document is relevant to energy prices, inflation and the commodity complex IMHO. What happens if for whatever reasons the war goes down, quickly?

9th May, Monday is climax day for Russia, but may be not.

Great read. Thanks

Reading the first sentence “…Moscow was anticipating capturing Kiev in three days…” already tells me that this report is BS. A city of 3 million defended by a well equipped, NATO trained army to fall in 3 days to an invading force of only 40,000 (towards Kiev)?

If you want insights, try to read analysis and reports from independent journalists, as well as what the other side has to say. They are hard to find due to the information suppression that we in the west are subject to, but not impossible. A document with misleading analysis of the political and military situation does not provide reliable guidance for the economic consequences.

This doc sheds no new insights. It is just long and winding. We have known pretty much anything mentioned in it pre-invasion. Ever since 2014 Russian’s Crimea annexation UK and US have been working with Ukraine to transform its military (training and equipment). Politically Ukraine is gradually shedding its Russian-style corruption. This is the major point for Putin’s invasion: Ukraine is moving away from Russia and into the West. You can say the same thing about Belarus. NATO’s inaction about Crimea gives Putin confidence and with his 20-year long machination with European politicians (two stand out: Gerhard Shroeder and Angela Merkel) also boosted his delusion.

There has been a movement to merge Moldova and Romania since they are the same country before Soviets broke it apart. Some Romanians don’t like the idea because Soviets has installed in Moldovan gov ethnic Russians. Their children and later generations are continuing to occupy the gov. Nevertheless the movement is gaining traction. This made Putin furious.

The last several years I have read reports (not open to the public) detailing how to deal with Putin in Ukraine. There are systematic implementations inside Ukraine. It keeps being adjusted based on experience fighting Russians in Donbas region. You can say a trap was being set to lure Putin into an invasion. But you can’t force it. Patience finally pays off and Putin bites. It helps that you have a very good actor Zelensky as a president. It makes a good show although the human toll is a little too high.

All the electronics shown in the doc are not something special. Any RF engineer can design them. In this war you can see how much better NATO is in electronic warfare and satcom and system integration. More importantly the new approach in conducting a war.

You see the pics about US loading supply to ship to Ukraine. The reality is a lot of them are already in Ukraine before the invasion. Now you know this partially is a staged show. Putin is looking for a way out but US and UK would not let it happen. Never let a crisis go to waste (Churchill), especially when there has been such a long wait. Stay tuned for something exciting regarding Putin. Does he still have some curveballs?

Interesting point of view. Thanks for sharing.

Yes, indeed. Thank you for sharing.

I agree with some and disagree with other of your points, but will refrain from commenting much, for various reasons.

But I’ll just note that Ukraine was and is one of the most corrupt countries in Europe and this has little to do with Russia (at present). They had systematic violations of human rights and the government has conducted crimes against their civil population. The nazi presence in the Ukrainian army is well documented in the western press over the last several years before the invasion. Ukraine has been controlled by the west (the US) since 2014.

Yup! The human toll is very high. More than 5M people became refugees and many more displaced in the country. The destruction of the cities and infrastructure is real.

For me, the question is why did Zelensky choose to fight? Even if Ukraine wins, it has already lost too much. The ultimate end will probably look close to what he would have negotiated before the invasion. Anyone?

He doesn’t choose anything. He does what he’s told to do from abroad.

Sentiment is quite bearish. Seeing lots of posts about another 20%+ selloff into June.

Charts don’t look that great, all in all, nervously long into the weekend.

Apart from the 1987 Black Monday Crash, I have never experienced a -20% decline unfold in a single day. My strategy right now is to begin de-risking as stock/bond prices start setting new ytd lows. There’s plenty of time to scale out of positions, and no need to do it all at once. You may even see one or more countertrend rallies which then allows you to scale out at higher prices (in your case, for gains).

If markets do in fact crash next week, then I have a different plan. I’ll be buying.

Here is something that makes me worry about the future of the global economy being led by the U.S. Federal Reserve Board and its Chief Jerome Powell.

Mr. Powell is the first Fed Chair to not have an economics degree. He graduated from Princeton with a degree on politics (!!) followed up with a law degree (!!). He went out and worked on Wall Street street ending with his own private investment firm.

The next few years of unwinding the great Central Banker monetary experiment successfully is going to be tricky (or impossible) for the most qualified economist but a lawyer? It would be like your insurance agent doing the open heart surgery on your spouse.

Also remember he was appointed by President Trump. The extreme easing going into the 2020 Presidential election year, before Covid, were very politically suspect with unemployment at 35 year lows. Also, his continuing extreme unnecessary easing into the last half of 2021 before his possible nomination was to be decided has led to this extreme inflation we see now. I remember him at that time talking in media sessions about the homeless people he saw driving (likely driven) to work. A political ploy to get the job that all worked because Biden wanted a strong economy and didn’t know that the inflation unleashed (as Larry Summers warned) would be very nasty politically after. He hasn’t mentioned the homeless folks lately.

He is the wrong guy and very dangerous for the global economy at this time. I should qualify that. He is dangerous for the normal folks. It’s okay, or good, for his friends in the investment community (and us), that know how to protect their wealth and grow it while inflation rips into the life savings and lifestyles of the general populace.

Interesting take. The Fed Reserve has a lot of very capable economists, I assume, among other qualified professionals. Powell knows he doesn’t have Ph.D. in economics. I think it will probably make him lean more on his colleagues.

He comes across as very pragmatic. He began QT but stopped when the market sank in late 2018. I don’t think he will run roughshod over the markets if the markets and the economy do not behave in a gentlemanly fashion.

There were very few people who were forecasting massive inflation (except Larry Summers) last year.

Personally, I don’t think the Fed can go very far with its campaign to restrain the inflation that is primarily driven by the supply-chain and supply issues with the Russia-Ukraine war being partly responsible. The highly levered US economy will crumble much before that. It won’t take years. Some people are already forecasting a recession in 2023. It’s early but even 2Q 2022 may print a negative GDP following a negative print in 1Q GDP.

BTW, how close are we to Operation Ukrainian freedom? In the past two decades, there have been several such operations?

A sobering post and equally sobering thoughts on the post. Some were entirely expected but I sense a shift in the sentiments of some others.

Cam has done a good job of outlining what has happened and extrapolating to the future if everything else remains the same! Are changes brewing under the surface that may impact the trend? The second derivative change as the industry calls it.

Global recession is coming. More color such as where does it start(China is by some measures is already in recession and may be coming out), how hard does it hit, when? What are the triggers? One month of global PMI may be unduly affected by China lockdowns. How did it unfold last time around?

Markets have definitely priced in a growth slowdown(earnings revisions are one indicator). Is the jury out on a recession? I think so.

A post from JPMorgan alludes to the difficulty ahead (The integrity of such advisors has been impugned already, so read it with an open mind).

https://www.chase.com/personal/investments/learning-and-insights/article/tmt-may-six-twenty-two

I saw the last bar graph in this article that shows if one were to miss the 30 best days, in 20 years, returns are only 0.09%. Does this seem correct?

If that is how rare the gains are, most of the days would be in a loss?

I have seen similar analysis from Fidelity. No one talks about missing the 10 worst days however. Market timing has not worked for me. But, I am seriously considering it this time.

Many analysts said that Covid Zero isn’t going away at least until our esteemed comrade, Chairman Xi, is destined to be gloriously re-elected again late this year. Also, China currently have 3 mRNA vaccine candidates. One at phase iii trial and two others at phase i & ii. But I’d personally wait for the phase i&ii candidates if I were Chinese since the phase iii one sounds military-linked. One does not simply sue the military in the case of a problematic vaccine. And no idea if anything will be approved in time to save the economy.

During omicron’s early days it was funny how one day my newsfeed showed two adjacent articles, one being about omicron’s transmissibility and the other about Covid Zero policy. Didn’t know whether to cry or laugh so I did both to some small degree. Almost felt like witnessing the slow motion of a flying turd hitting the fan.

Interesting take. China has no mRNA vaccines and is holding the rest of the world hostage. This is time China accepts available Western mRNA vaccines and get its population vaccinated.