Mid-week market update: Happy Price Stability Day to you!

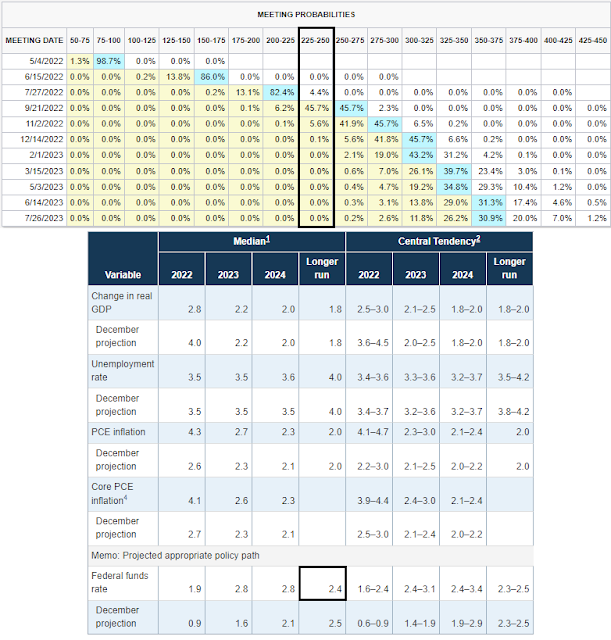

Ahead of the FOMC meeting, I had been pounding the table that market expectations were unrealistically hawkish. The market was discounting strong rate hikes well beyond the Fed’s stated median neutral rate of 2.4%, according to the March Summary of Economic Projections.

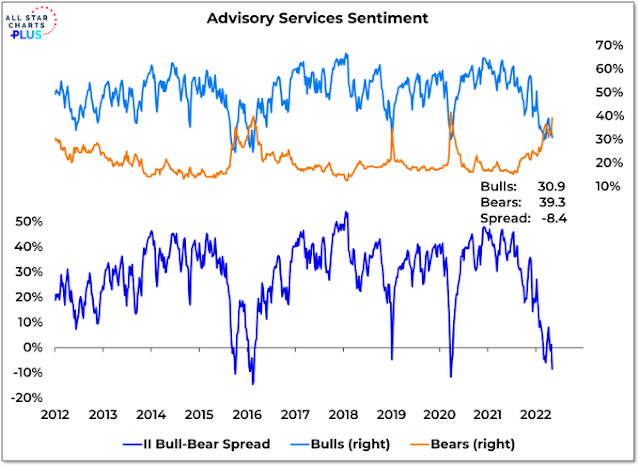

Combine the market’s hawkish expectations with a continued sense of panic in Investors Intelligence sentiment where bearishness jumped to a two-year high. What did you expect would happen?

The Fed came through with an expected half-point rate increase, quantitative tightening to begin on June 1 at $47.5 billion per month and rising to $95 billion after three months. These actions were entirely in line with expectations. More importantly, Powell pushed back on a 75 bps hike and it is not something the Committee is considering.

Inflation may have peaked

Here is what the picture is on inflation. Core PCE, which is the Fed’s favorite inflation metric, has been falling in the past two months. So has the Dallas Fed’s Trimmed Mean PCE. The high PCE prints will begin to drop off over the next few months, which makes the YoY comparisons tamer. At the current monthly rate, core PCE is running at 3.0-3.5% on an annualized basis, which is below the SEP projection of 4.1%. This makes the Fed’s job of pivoting to a less hawkish policy easier, though the Employment Cost Index remains stubbornly high. Investors should keep an eye on Average Hourly Earnings in Friday’s Jobs Report.

In addition, 5×5 inflation expectations is in retreat. While they are still elevated, readings are below the highs of the last cycle. While the Fed will undoubtedly remain vigilant, this will also allow Fed officials more room to make a dovish pivot.

Powell acknowledged in the press conference that inflation has decelerated, but a one-month data point is not enough to change policy. The FOMC is watching for trends in inflation, though Powell allowed that there is no evidence of a wage-price spiral.

Upside potential

In light of the excessively bearish sentiment, it was no surprise that the market took on a risk-on tone when Powell took a three-quarter point rate hike off the table. The question is how far the market can rally from here.

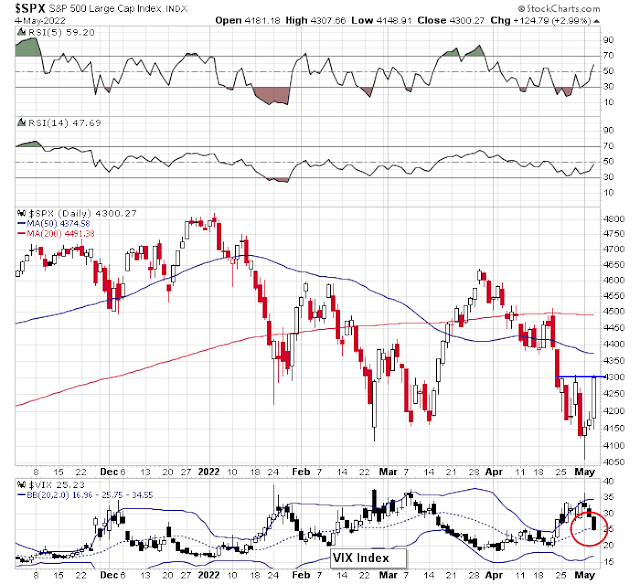

The S&P 500 surged today to test resistance at the 4300 level and the next logical resistance level is the 50 dma at about 4375. Moreover, the VIX Index retreated from above the upper Bollinger Band to its 20 dma. The market gas often paused its advance under such conditions. The key test is whether the market can exhibit bullish follow-through tomorrow, or whether it will consolidate sideways.

My inner trader is highly conflicted. Generally, he is inclined to exit long positions when the VIX recycles back to its 20 dma, but it’s difficult to see how such record levels of bearishness can unwind itself in a single day. Stay tuned for tomorrow’s market action and Friday’s Jobs Report.

Disclosure: Long SPXL

>

Well done, Cam!

Home run. Congrats!

Congratulation to Cam on a cogent analysis. It was quite a tug and pull for a while until the last 80 minutes of the regular session, but any impartial observer will have to say a gain of 3% in that time was abnormal. Many of you would have read the tweet by Jason Goepfert

@jasongoepfert

· 48m

The S&P 500 is on track for more than a 2.25% gain on a day the Fed hiked interest rates.

That’s happened only one other time in 40 years.

It was March 21, 2000.

Price action on what followed from Mar to Apr 2000 (ralley continued for 3 days but most of the gains were lost within 2 weeks).

https://ibi.sandisk.com/action/share/e125393b-0f86-406b-8171-9a6f1fdedde1

Typo in the previous link corrected:

https://ibi.sandisk.com/action/share/a51b0a89-70fe-4b38-9f63-a07979950022

Is the context the same as in 2000? I think SPX was trading at a much higher multiples then.

This is a stock picker’s market. Indices won’t give you the edge. Just go straight to the relevant sectors for alpha. Not until these kinds of whipsaw die down can we feel more confident that bottom is in.

Simple SPX swing trade short strategy +34.4% gain YTD with 0.10% drawdown (close to close) if you maintain a proven back tested model. Not a day trade strategy. Not an offer to sell anything.

Great call, take a victory lap Cam!

Cam’s track record for trades has been incredible recently. I start locking in profits so I don’t benefit as much but that is my trading style.

Take a bow!

Is it not also possible that we have seen the lows in both stocks and bonds for the year?

Of course, with the preponderance of bearish sentiment right now that’s an opinion that would engender the same kind of reaction that a Trump bumper sticker might give rise to in downtown San Francisco.

I’ll say it anyway.

I have been of the view that we are in a trading range. It undercut the previous lows but there was no follow through. I still maintain that view but the range may be narrower.

Cam has provided excellent analysis to take positions with confidence.

As to that Trump sticker, better in SF than in Chicago. Just saying..

Give you more fuel. rx mentioned City of SF DA Chesa Boudin not doing his job a while ago. This guy is now facing a recall. His mother Kathy Boudin died three days ago. Both of his parents are leftist terrorists in the 60s. Both of them are in jail for a long time, but his mom later released thru the influence of her father’s connection. And Columbia gave her a teaching job and praised her at her death. A convicted terrorist is a professor in a college.

Chesa then was adopted by Bill Ayers and his wife. Bill is another leftist terrorist in the 60s, and is mentor of Barrack Obama. Chesa surely feels right at home in a place like SF.

So if you want to find leftist terrorists/ communists, it will not go wrong to just go straight to UC berkeley, U of Chicago, and Columbia U. Nicely and evenly spread over continental US, from sea to great lakes to shining sea.

Bill Ayers and the Weather Underground were on the scene when I moved to Chicago just after the famous DNC Convention. Surprisingly he stayed in the area all these years.

Ravindra- Right. You’ve been consistent in your view re a trading range. At some point, the market will break out of the range – whether to the upside or the downside remains to be seen.

It’s natural for traders to extrapolate the continuation of trends – which is why they tend to expect new highs at tops and crashes at lows. I don’t expect a crash. In some ways, the bear market that many are looking for – and headlines have been rife with calls for even greater declines – has already happened. Maybe it’s time to take the other side of their trades – assuming, of course, that they themselves haven’t already privately positioned themselves on the other side of their public views!

Eventually the range will give way to a directional move. I just feel that too much emphasis is being placed on comparisons to 1970’s experience. There were no supply chain issues then. If my memory is correct, it was primarily wage inflation. Currently we have tremendous technology to improve productivity. Oil supply should increase, supply chain issues get resolved, China should come out of lockdown, and Russia is running is losing steam.

A few more weeks of time is needed to heal what ails the market.

Re Chesa Boudin- I wouldn’t want to live in SF. Left-leaning politics has destroyed the city. It’s as if the students I went to school with never moved on to real life.

I was part of a few activist Asian-American groups at Michigan in the Seventies. We traveled to Madison/ Oberlin/ Chicago and met some wild guys/gals with wild ideas. We would book a room at the Michigan Union in the Fall to recruit members. I played jazz piano back then and opened a few meetings. Looking back, it was the equivalent of sowing wild political oats. My opinion today is that I was an idiot – but aren’t we all at that age? SF City Hall is filled with people that haven’t moved on from the Sixties.

Great call, Cam! Thank you.

You are right all the time Cam. However I am pretty sure Jerome said he expects that inflation has not peaked yet, although market expectations probably have temporarily as you forecast.

Great trading call, Cam. Thanks.

TLT/ IEF at new lows this morning – so that part of my thesis has already bitten the dust.

Brutal retest. One reason I haven’t been day trading is that it’s almost impossible to game the moves right now. Set an asset allocation that you’re comfortable with, and stay the course.

It is just a market going to (at least) pre-Covid levels, the only unknown seems to be how long it is going to take.

Bulls should recapture 4210 else we are going to have another down week.

They killed the shorts yesterday, and are now taking out anyone who went long either Wednesday or at the open today.

That’s what the market does.

Any retest (especially in light of today’s somewhat more sophisticated traders) has to be convincing. Otherwise – it’s not a retest.

Very difficult market to game. Even Cam was conflicted yesterday, and rightfully so.

Do we close green? I wouldn’t rule it out. Anything is possible in this market.

Undercutting May 3 lows.

Any longs opened yesterday absolutely stopped out today.

Where is the money going to? Cash? TLT is way down, Gold is not up much, not much change in the 2 year treasury. There is no discernible rush to safety of treasuries unless Russia and china are dumping them. Very odd

Cash is not necessarily a safe haven with inflation at 8%. And honestly, I’ve never understood why paper entitlements to gold in storage are ‘safe.’ If you want to own gold, own the physical and keep it in a safe place.

The only truly safe havens I can think of:

(a) Owning a home. There are hazards here too but for all practical purposes a roof over our head is the safest asset any of us can own.

(b) A relatively secure job. The last thing we need during a market crash is to raise cash for living expenses by selling stocks or bonds.

(b)

Totally agree on a roof and a job! My view on cash is at this point in the cycle it’s a decent option to hold more of because everything dollar denominated is adjusting to inflation. So a “good bad” option. Stocks will become much better, in spring as Ken would say, and bonds I think will become very attractive at some point too. For now, holding more cash than usual, focusing on family and job and vacations, and just bring ok with things.

Well, what cash has is optionality. You can put it into whatever you want. If 8% inflation continues for a year, 8% of the $SPX at 4200 is around 340 …in a year! So like the $SPX down 1.5 in a day, so being in cash when one day things are up 100x as much, then the next day 100x as much down has appeal. Yes at 8% in 9 years using the rule of 72 it will have lost 50%. One of my daughters works for NFLX so from December to now the stock is down 18 years worth for cash at 8% inflation. If there is no safe haven, then at least optionality is a haven. How low can NFLX go? You could write may 27 140 Puts for almost a buck, earnings is behind us…at some point the Flix has got to bottom…my point being that in 3 weeks you can get a better return than 8 % by using puts wisely. Yeah if the $spx goes to 500 all bets are off, but in that case cash looks good.

Cash for a week or a month is where I am at. May go long at the close for a scalp risking only a toe.

Lots of reasonable trading plans outlined above, and I don’t disagree with any of them. We have different goals, different risk tolerances, and different trading styles.

I’m still positioned at 40% bonds/ 25% VT/ 35% cash. I never expected this large a drawdown on the bond portion, but markets are full of unexpected surprises (up or down).

SPX down 3.82% less than 24 hours after the +3% price spike after Fed statement. Clearly the bulls lose control of price very quickly in this downtrend. If you are a dip buyer, there is no reason to buy until price reached extreme negative ATR (average true range), in this case the cyan dots where price closed near the -3 ATR (red) band. If you are are short seller, any time you have a price/up volume thrust or when price moved above +2 ATR could be a shorting opportunity. E-mini S&P futures Kase Bar 40 shown, the ATR range on your chart selection will vary – pick one that suits you.

https://ibi.sandisk.com/action/share/120e2f6c-5c01-4315-a101-bd7d71202a24

The above description really only applies if VIX stays high, which it never does and will eventually fall, it always has.

After studying the intraday developing VWAP, one can actually put forth a bullish case for those who are buying here – so if you got stopped out, that may be the time more buyers are coming in. The reason intraday VWAP can tell you how either side is doing is by the way the previous VWAP gaps are handled. We see that Thursday close, with S&P500 down 3.5% is actually on net 0.5% down from Tuesday close and higher than Monday’s close. In addition, notice how buyers were always able to close the VWAP from Monday and always able to buy into price weakness to push price towards the intraday VWAP (mangenta line). This suggests even as the print is showing price down 3% or 4%, the bulls are still in control and willing to buy. Finally, where do you think the day’s VWAP ended up? It is higher than Monday and same as Tuesday. No harm done if you are bullish and still buying.

Good luck to you. The market is hard to read.

https://ibi.sandisk.com/action/share/39b98aa6-a385-4feb-8114-d0f98ea5c278

We have seen this movie before. 4100 may be a good place for a swing trade long if we can see a VIX retrace lower. Kase chart of ES and VIX.

https://ibi.sandisk.com/action/share/0cf95cd9-e6a9-4197-8f9e-7c4b2467f2be

I stopped out of my positions. All my longs were liquidated this afternoon

Just a slightly positive day tomorrow would be sufficient to brighten the outlook for the next few weeks (but I’m not going to make a decision before tomorrow’s close) – investors seem to be convinced that bonds will continue to sell off, but lets wait and see. 6 Fed speakers on the line tomorrow, they are going to sound a little less hawkish now that they finally started to take (a little) action and now everyone is concerned about a not so soft landing. Eventually I do not believe that “going to neutral” will be enough to tame inflation sufficiently, but expectations right now are still very hawkish and Fed needs to walk back some of the hawkishness in order to keep the markets from tightening financial conditions too much.

Despite the brutal action, if I compare today’s closing balance to Monday’s closing balance, the difference is a relatively tame -0.65%.

When making these calculations, I take into account bond funds and VT only – ie, absent the percentage allocated to cash, which I consider a static portion of the portfolio and not really meaningful when calculating daily performance.

I don’t know Cam’s take on today’s action, but based on his recent performance I think his decision to give his latest trade more time to play out will be proven correct.

A question for all. How do you capture ideas/thoughts yours/others that you learn over time in a format that’s easily accessible?

I find capturing/cataloging and retrieving the relevant information in a timely fashion about the market is rather hard.

Would love to hear from y’all. Thanks.

Sanjay,

I have a document where I save Ken’s links with situations for action depending upon a pre-requisite in one line description.

Similarly, I write down things that are Pertinent for action based upon Cam’s recommendations.

Also, I write down the different ETFs mentioned by other contributors on this page along with a line of description. Now the only issue left is that there is no Trigger which pops out the situation meeting something I wrote in the document, So I just quickly scan the document and see if a particular situation has met, or close to meeting and then decide if I want it to be an actionable item for a particular Buying or Selling opportunity.

That is one way that works for me. Of course the document gets longer over time, however not all types of situations need to stay in that document, if somethings have fundamentally changed, I remove it, or put a strike through it, while still retaining the information. Hope this helps.

I log decisions I make around asset allocation over time. Why did I do what I did? I try to capture my state of mind as well, as I find this and the “what happened next” most informative for my future decisions.

Thank you. Yes, an entry in a journal is most helpful. I have one but need to be more disciplined in updating it.

Thanks, Mohit.

The key is to keep the document short. Strike out the information that’s no longer relevant.

I guess I need to make it a habit to review it frequently.

It still feels like a bottoming process is underway. Need to see more weak opens->strong closes rather than the reverse.

If you’re looking for silver linings in a bad tape, dividends from all classes of iShares bond funds were paid out today. Many retirees are likely invested in TIP, and they’ll at least receive a decent monthly deposit.

I still think Cam will be proven right. We are still poised to rally hard. A one-day (more like a one-hour rally, really) that fades into an even stronger selloff just makes the subsequent rally more durable. JMO.

Predicting a green close is getting old – what really matters is a green close that isn’t taken back the following day or two. A series of green closes that turns bearish sentiment into bullish.

SMH turns green.

5/6/2022 3:33:08 PM

The last time VIX and SPX both down while VIX > 30 was 3/10/22 and at that time, SPX was 2 daily bars from bottom. So this may mean something as today, both SPX and VIX may close down a bit.

The bulls should really try not to jinx this by running SPX up too high too fast. That will only attract the shorts.

Friday close, both VIX and SPX both slightly in the red but more importantly, VIX is at 30.19 and falling. Traditionally a close below 30 after it stayed above 30 for more than 5 daily bars has been bullish. As you can see the chart of SPX and VIX Kase bars. The bulls are hopefull but VIX has to trend down in the next week.

https://ibi.sandisk.com/action/share/77c6981a-e3fd-47a0-a579-c0b913ba2b63

Feeling uneasy here, but maybe that’s from all the doom I’m seeing on twitter.

Jumped back into longs at the open and still holding.

fwiw – the time to be concerned is generally not when you’re uneasy, but when you’re not uneasy.

Looks like the answer to last week’s question (‘Will the Fed rally or tank the markets’) is neither, as the SPX closes just eight points lower.