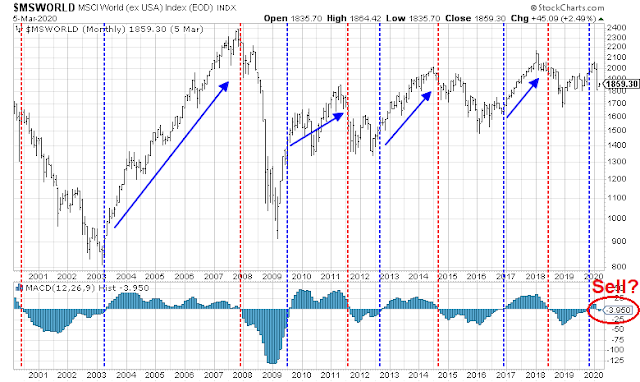

Is the bull on his last legs? It is starting to look that way. I alerted readers to an unconfirmed bullish monthly MACD buy signal in late July (see A (deceptive) long term buy signal). The buy signal was confirmed in late October by both the Wilshire 5000 and non-US markets (see Buy the breakout, recession risk limited). In the past, monthly MACD buy signals have usually been very effective and long lasting. The recent market downdraft has brought the indicator to the verge of a sell signal, indicating dying price momentum and the possible end of the bull phase. If the market were to end the month at these levels, the sell signal would be confirmed.

A similar bearish condition can be found in the MSCI World xUS Index.

Is the bull dying? Has it caught the coronavirus?

Possible recession ahead

It may be turning out that way. We are teetering on the edge of a possible recession. The COVID-19 epidemic has spread beyond China’s borders, and efforts to contain and mitigate the effects are creating both supply and demand shocks that are hampering economic growth.

Even worse, Chinese scientists announced that the virus has probably genetically mutated to two variants: S-cov and L-cov. The L-cov variant is more dangerous, featuring higher transmission rates and more harm on the respiratory system (see link to paper). This finding will make efforts to combat the virus more difficult.

Leading economist Ken Rogoff is already forecasting a recession.

It is too soon to predict the long-run arc of the coronavirus outbreak. But it is not too soon to recognise that the next global recession could be around the corner – and that it may look a lot different from those that began in 2001 and 2008.

For starters, the next recession is likely to emanate from China, and indeed may already be under way. China is a highly leveraged economy, it cannot afford a sustained pause today anymore than fast-growing 1980s Japan could. People, businesses and municipalities need funds to pay back their out-size debts. Sharply adverse demographics, narrowing scope for technological catch-up, and a huge glut of housing from recurrent stimulus programmes – not to mention an increasingly centralised decision-making process – already presage significantly slower growth for China in the next decade.

Austan Goolsbee explained the economic risks in a New York Times op-ed this way. The US has a much larger service economy compared to China, and social distancing could tank growth if fear levels spike.

But over all, the United States is substantially more reliant on services than China is. And, on the flip side, agriculture, a sector not noted for day-to-day social interaction and so potentially less harmed by social withdrawal, is a 10 times larger share of China’s economy than it is in the United States.

So for all the talk about the global “supply shock” set off by the coronavirus outbreak and its impact on supply chains, we may have more to fear from an old-fashioned “demand shock” that emerges when everyone simply stays home. A major coronavirus epidemic in the United States might be like a big snowstorm that shuts down most economic activity and social interaction only until the snow is cleared away. But the coronavirus could be a “Snowmaggedon-style storm” that hits the whole country and lasts for months.

Ray Dalio also fretted about a slowdown, which is exacerbated by inequality, the politics of populism, and ineffective policy.

Reactions to the virus (e.g., “social distancing”) will probably cause a big short-term economic decline followed by a rebound, which probably will not leave a big sustained economic impact. The fact of the matter is that history has shown that even big death tolls have been much bigger emotional affairs than sustained economic and market affairs. My look into the Spanish flu case, which I’m treating as our worst-case scenario, conveys this view; so do the other cases.

While I don’t think this will have a longer-term economic impact, I can’t say for sure that it won’t because, as you know, I believe that history has shown us that when a) there is a large wealth/political gap and there is a battle against populists of the left and populists of the right and b) there is an economic downturn, there are likely to be greater and more dysfunctional conflicts between the sides that undermine the effectiveness of decision making, and this is made worse when c) there are large debts and ineffective monetary policies and d) there are rising powers challenging the existing world powers. The last time that happened was during the 1930s leading up to World War II, and the time before that was in the period leading up to World War I. Certainly, the wealth gap and political conflict leading to possible policy changes will be top of mind along with the coronavirus on this Super Tuesday.

Ed Yardeni also issued a warning for the stock market:

The S&P 500 VIX has soared in recent days as it did during numerous previous panic attacks since the start of the current bull market. The risk is that the pandemic of fear unleashed by the global health crisis depresses economic demand and disrupts supply chains. That could squeeze business cash flow and trigger a credit crunch. The result could force companies to lay off workers and cause a recession. Unfortunately, this scenario is becoming increasingly possible. The Fed is likely to lower the federal funds rate to zero and restart QE bond purchases to avert this scenario.

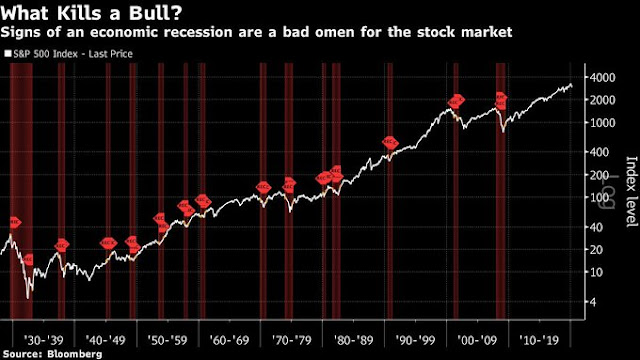

Recessions kill bulls

Recessions are bull market killers through two mechanisms. Corporate earnings fall in a recession, and stock prices fall further because of fears that lead to P/E compression.

Let us consider each of these factors, one at a time. A recent Bloomberg article reported that some top-down analysts are revising their earnings outlook downwards. Bespoke Investment Group outlined a scenario which shrank earnings by 20%. Citigroup Inc. cut their 2020 earnings forecast from $174.25 to $164.25 in 2020, or -5.8%. Carl Quintanilla at CNBC reported that Citigroup would cut its EPS forecast by $30, or -17%, if a recession were to materialize.

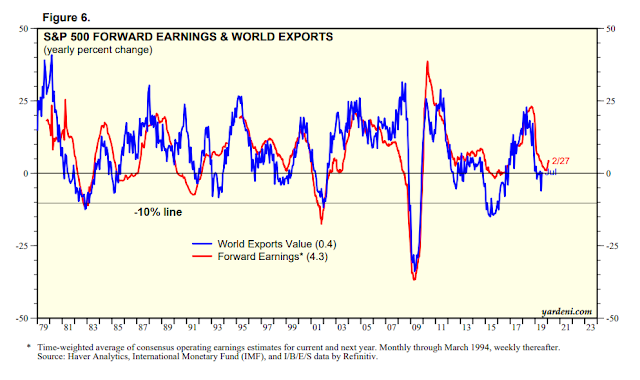

The chart of past earnings declines, recessions, and world exports puts the earnings declines into some context. This analytical framework is important because the coronavirus induced slowdown disrupts global supply chains, which puts downward pressure on exports. The last two recessions were historically atypical. The GFC of 2008 was a financial crash. The 2000 slowdown was caused by the bursting of the NASDAQ Bubble fueled by excessive speculation. You would have to go back to 1990-91 and 1981-82 to find more typical recessions. The 1990 experience was sparked by Saddam Hussein’s invasion of Kuwait, which caused an oil supply shock, and the 1982 period was the result of excessively tight monetary policy designed to squeeze inflationary expectations.

In both the 1982 and 1990 recessions, earnings declined by about -10%. A coronavirus induced recession should be relatively short. Therefore projections of -17% (Citigroup) and -20% (Bespoke) in earnings may be excessive.

The other way that recessions kill bull markets is through P/E compression. How far can multiples fall? Analysis from FactSet shows that the forward multiple fell to about 13.5 times earnings at the market bottom in late 2018, and to about 10 times at the 2011 bottom.

My estimate of forward 12-month EPS based on FactSet data stands at 178.17 today. If we assume a cut of -10% to earnings, and apply a 10 to 13.5 multiple to those earnings, it would yield S&P 500 downside targets of 1600 to 2165. This represents a peak-to-trough drawdown of -36% to -53%, or -25% to -45% downside potential from current levels.

Trump’s Waterloo?

There is another bearish factor that investors should consider. Informal polls at a Goldman Sachs events in late January revealed that almost all participants expect Trump to be re-elected in November.

Wall Street is going to have to readjust its expectations going forward. As the purpose of this publication is to deliver alpha, its purpose is to be apolitical and this is not intended to favor one candidate over another. Nevertheless, Trump is likely to face some headwinds over his re-election bid, which would a rude surprise for equity bulls.

At the start of Trump’s term, Newt Gingrich laid out Trump’s re-election chances in a New York Times interview:

“Ultimately this is about governing,” said former House Speaker Newt Gingrich, who has advised Mr. Trump. “There are two things he’s got to do between now and 2020: He has to keep America safe and create a lot of jobs. That’s what he promised in his speech. If he does those two things, everything else is noise.”

“The average American isn’t paying attention to this stuff,” he added. “They are going to look around in late 2019 and early 2020 and ask themselves if they are doing better. If the answer’s yes, they are going to say, ‘Cool, give me some more.’”

Up until recently, the economy had been performing well, but if a COVID-19 induced recession were to begin in Q1 or Q2, it would focus the electorate’s attention on Trump’s economic stewardship. Trump has like to style himself as “Dow Man” and measure his economic success by the stock market. While stock prices have risen during his term, an investor would have outperformed with the long Treasury bond (bottom panel).

Even though Joe Biden won a resounding victory on Super Tuesday, the COVID-19 outbreak is shining a bright spotlight on the GOP’s healthcare initiatives in a way that moves the Overton Window, or range of acceptable political discourse, towards the Sanders/Warren wing of the Democratic Party and greater acceptance of socialized medicine.

The US economic system is designed in a way that is ripe to enhance the spread of a viral outbreak compared to other major developed economies. It has roughly 30 million people without health insurance, and another 80 million who have coverage with high co-pays. (For non-Americans, a co-pay is a deductible that patients pay their doctors and healthcare providers on every visit). In addition, the workforce is composed of an army of hourly wage earners and gig workers with no sick days. These are the service industry workers who stock the grocery shelves, the baristas, the restaurant cooks and servers, and Uber drivers. Moreover, it is unclear who bears the cost if forced into mandatory isolation. An average day in an American hospital costs $4,293, according to the International Federation of Health Plans, and has the potential to bankrupt individuals forced into isolation. This structure creates enormous disincentives for someone who is too ill to work and infect others, and highlight the inequality problem raised by Sanders, AOC, and others.

For a stark reminder of how the healthcare system functions, consider this account from the New York Times about an American who was evacuated from Wuhan.

Frank Wucinski and his 3-year-old daughter, Annabel, are among the dozens of Americans the government has flown back to the country from Wuhan, China, and put under quarantine to check for signs of coronavirus.

Now they are among what could become a growing number of families hit with surprise medical bills related to government-mandated actions.

The American structure of health insurance raises the question of the financial cost of healthcare access. The quarantine was government mandated, but it was unclear who actually pays.

After their release from quarantine, Mr. Wucinski and his daughter went to stay with his mother in Harrisburg, Pa. That’s where they found a pile of medical bills waiting: $3,918 in charges from hospital doctors, radiologists and an ambulance company.

“I assumed it was all being paid for,” Mr. Wucinski said. “We didn’t have a choice. When the bills showed up, it was just a pit in my stomach, like, ‘How do I pay for this?’”

Mr. Wucinski’s employer, a standardized testing company, provided health benefits when he lived in China but does not offer coverage in the United States.

Patients in the United States regularly confront surprise medical bills that are hard to decode. Mr. Wucinski’s case suggests that those held in mandatory isolation for suspected coronavirus may be no exception.

Co-pays, out-of-network providers, and uninsured procedures are problems faced by Americans every day. Is it any wonder why socialized medicine would become a more attractive option should an epidemic hit the US?

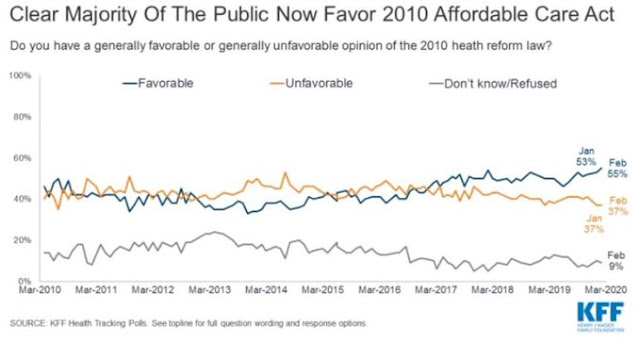

As well, the GOP’s efforts to dismantle the Affordable Care Act, or Obamacare, will not help its electoral chances in the current environment. ACA approval has been rising steadily, and the Supreme Court has accepted a case that challenges the ACA, with arguments to be heard in the fall, and a decision rendered in 2021. The timing of the challenge only serves to highlight the GOP’s vulnerability on the healthcare issue in the current environment.

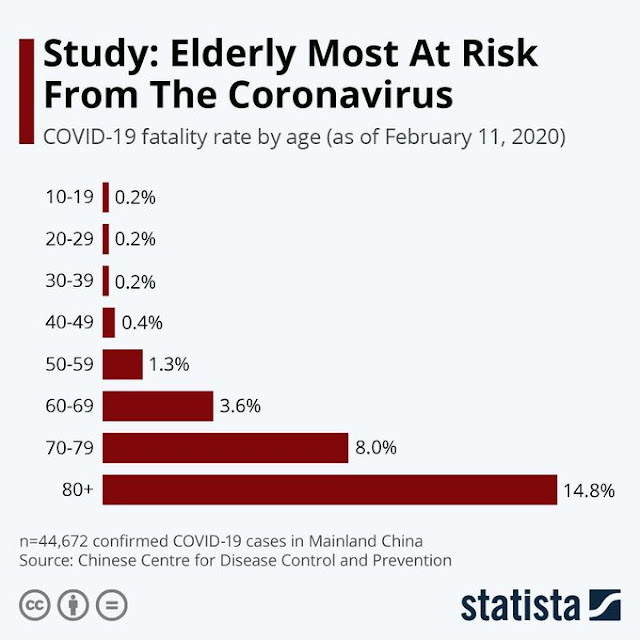

Trump’s “Dow Man” persona is putting him at elector risk. He will have to make a key political choice of trading off economic activity against the health of Americans. How he makes that choice, and how he is perceived to make that choice, could very well be a major campaign issue in the November election. As an example, one key electoral vulnerability for the GOP is Florida, which is a swing state with a high number of aged Americans who have tilted Republican. It is well known that the mortality rate rises with age, and Trump’s trade-off decision could easily tilt how this demographic votes in November.

To be sure, there are no warning signs of recession in the hard data. New Deal democrat‘s monitor of high frequency data shows that consumer spending is still strong. However, as the epidemic progresses, containment and mitigation policies will undoubtedly force more draconian steps, such as school closings, and the curtailment or cancellation of major events like Emerald City Comic Con (in Seattle next week), SXSW, and March Madness. Such steps have the potential to induce panic, or at least a higher level of concern, in the population. Steps to raise social distancing are also likely to cause a demand shock, as spending and travel plans are curtailed.

Watch consumer spending. It’s the key to whether the economy rolls over into recession.

Investment implications

What does all this mean for investors?

I generally try to be disciplined in my investment process, and I don’t like to frontrun my model readings. my inner investor is therefore not calling for an end to the bull market just yet, but risk levels are rising. Notwithstanding whether a recession is in the cards, my Trend Asset Allocation Model already moved to a risk-off reading recently, and my inner investor’s portfolio asset allocation is already becoming more defensively oriented.

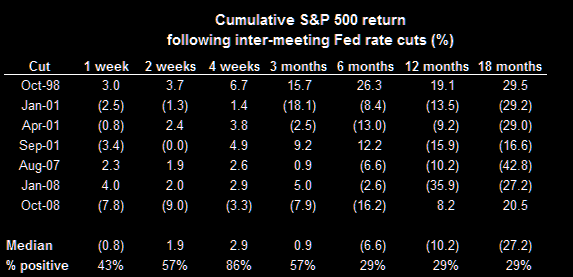

The Fed’s emergency rate cut is disconcerting. Inter-meeting rate cuts are emergencies, and emergencies have historically been unfriendly to equity returns. Even before the Fed’s rate cut, I suggested last week that something was seriously afoot in the economy (see A Lehman Crisis of a different sort). While the stock market may stage a short-term relief rally from these levels, historically it has not performed well over a 6-18 month time horizon.

However, my inner trader has a shorter time horizon, and he is operating on the assumption that a bear market may be starting. That means the market will be volatile, and position sizes should be adjusted accordingly. He is shifting to the mindset that the primary trend is down. In that case, any market rallies could be violent counter-trend moves.

While I am not prepared to call a recession just yet, I am going on recession watch. Events are unfolding in the US that could set off panic. Already, one school district in Washington State has closed schools (see notice here). A recent Harvard Business Review article suggests that we could see widespread operational business disruptions by mid-March.

As a result of events such as the 2002-2003 SARS epidemic, the March 2010 Iceland’s volcano eruption, Japan’s earthquake and tsunami in March 2011, and the flood in Thailand in August 2011, companies increased the amount of inventory they keep on hand. But they still usually carry only 15 to 30 days’ worth of inventory. It is possible that the Chinese New Year week-long vacation motivated some companies to increase their inventory coverage by another week. So, for most companies, the inventory coverage they have will allow them to match their supplies with demand, with no additional supply, for between two to five weeks, depending on the company’s supply chain strategy. If the supply of components is disrupted longer, manufacturing will have to stop.

Supply lead times will also have an impact. Shipping by sea to either the U.S. or Europe takes, on average, 30 days. This implies that if Chinese plants stopped manufacturing prior to the beginning of the Chinese holiday on January 25, the last of their shipments will be arriving the last week of February.

All this suggests that there will be a spike in the temporary closures of assembly and manufacturing facilities in mid-March.

Events like school closings and production disruptions will create widespread psychological impact and affect both business confidence and consumer behavior. I will be monitoring how events unfold, as well as the business environment and retail spending.

So far, high frequency data like retail sales and initial jobless claims remain upbeat. This chart from The Times shows the level of coronavirus fear by country.

So far, the rise in anxiety levels have been limited. Reuters reported that “Americans divided on party lines over risk from coronavirus”. Democrats report a higher level of concern of risk over the COVID-19, while Republicans have shown minimal concern, largely because Trump has downplayed the risks. As the incidence of infections spread, watch for fear levels to rise. that’s when the high frequency economic data will become critically important to how we make a recession call.

Stay tuned.

As well, don’t miss our tactical trading commentary schedule to be published tomorrow.

Cam, why is Chinese charts looking better than US ones, if Covid-19 is what causing the recession?

Also Cam, what of the reports of Chinese activity normalising?

The Chinese numbers on infections are indeed improving dramatically. But no one really trusts Chinese statistics so I am mainly focused on World xChina.

I rely on the PPO on weekly SPX that’s above the centre line to indicate if we’re going into or already in a bear or bull market. Right now the PPO is well above the center line.

.

It has been very reliable indicator for me. Check out the historical cases for confirmation.

.

Last year (2019) there was a lot of argument in the first few months of the year if the rally was a mere bear rally or a bully rally from the Dec 2018 bottom. After the weekly PPO crossed back above center line in Feb, I went 100% equity. It paid off for me.

There is a surge of retail buying as consumers stock up, clearing shelves. This may keep overall retail statistics up temporarily but just borrowing from future sales. I’d say watching Disney versus Costco will reveal the dynamic.

My study of momentum investing indicates that the first surprise surge either positive or negative after a significant new event is just the start towards some eventual end point. We humans as a group can’t foresee the end point and momentum is set up as the process of slowly getting to that endpoint (and even on overshoot when herding takes over at the final stage)

This tells me we are just starting our journey.

For those interested in the latest situation on Corona Virus, check this resource from Johns Hopkins:

https://www.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

Notice that 80% cases are limited to China, and the US has a handful minority.

It seems plausible that the next 1-2 weeks may bring a supply side shock in the US as inventories dwindle. That said, Chinese factories are humming back to activity at 70% of capacity (Cam, is this data from one of your articles??).

It appears that unless there is massive social distancing that gets underway in the US, we may not see the worst case scenario in the stock market. I can say what I like, but the MACD is painting a pretty bearish picture and is at the cusp of a breakdown.

Secondly, large inter meeting rate cut by the fed is generally a pretty bearish signal. It is hard to argue against these two conclusions of the above article.

This is one of the more bearish and alarming article from Cam. Thanks Cam for giving the unvarnished news the way you see it, and not being married to an ideology (perma bullish or bearish).

Lastly, it appears that Trump may not make a second term (see reasons above), and that would be the final straw that breaks the proverbial camels back.

The next rally back to 50% Fibonacci retracement (3125), or 66% retracement (3213), bears watching. We may get it next week, and if it fails at that level, it may be the last time to get off this bull train that started in 2009.

I do not want to steal Cam’s thunder nor pre empt nor

second guess Cam, but I am eagerly awaiting his conclusion in tomorrows update.

The statistics out of America are biased by the lack of test kits and testing capabilities as well as directives from authorities on whom to test.

This is even more true now that CDC has been told that all media reporting must be vetted by the Whitehouse. Expect their spin to be untrusted and untrustworthy. .

Politics aside, travel and entertainment may be getting restricted in the US and may affect the service sector, causing an earnings recession.