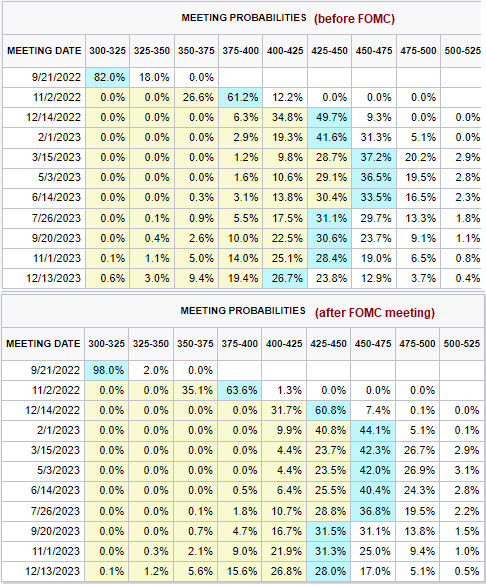

Mid-week market update: The Fed has spoken. As expected, it hike interest rates 75 bps. In its Summary of Economy Projections (SEP), it sharply lowered GDP growth for this year and it raised the Fed Funds projection to 4.4% for this year and 4.6% next year, which are both ahead of market expectations. In other words, higher for longer (though it did signal rate cuts in 2024).

Fed Funds futures reacted by extending the already elevated Funds Funds rates for next year, but it did show some skepticism of the Fed’s SEP by expecting rate cuts by September 2023.

The FOMC pattern broken?

The 2022 S&P 500 FOMC pattern of weakening into an FOMC meeting and rallying afterward appears to be broken. However, the market may be oversold enough to bounce. the 5-day RSI was already oversold coming into the meeting, indicating limited downside potential.

II sentiment shows more bears than bulls, which is conducive to market strength.

Two of the four components of my market bottoming model are already flashing a buy signal. The NYSE McClellan Oscillator was oversold coming into the meeting. Today’s estimated TRIN reading spike above 2 to 2.3, indicating panic selling and another buy signal.

The other two components are also very close to buy signals. The VIX Index briefly spiked above its upper Bollinger Band today and the term structure of the VIX also briefly inverted. In the past, two out of four components flashing buy signals have been indicators of positive risk/reward for long positions.

Subscribers received an alert yesterday that my trading account had tactically bought S&P 500 exposure. My inner trader is maintaining the long position in light of these buy signals in anticipation of a turnaround in the next two days.

Putin’s gambit

The other development to be aware of is the news of Russia’s partial mobilization. Putin appeared on Russian television and announced a partial mobilization of 300,000 reservists. While the measure was short of a full draft, it was also designed to keep soldiers with contracts that expire in the Russian Army. Moreover, he announced annexation referendums in the Russian occupied parts of Donetsk, Luhansk, Kherson, and Zaporizhzhia regions of Ukraine, which would make attacks in these regions an attack on Russia. It was a way of rattling the nuclear saber.

Take a deep breath. The risk of nuclear war remains low. The Ukrainians had already attacked parts of Crimea, which was considered Russian soil, and crossed Putin’s red line with no reaction. The market agrees. The relative performance of MSCI Poland edged down on the news and it remains in relative downtrends against the Euro STOXX 50 and ACWI. However, there is no sign of panic.

I interpret these developments as signs of Russian recognition that it needs to bolster the ranks of the Army for a fight over the winter. While the nuclear threat is always present, the risk of crossing that threshold is still low.

Disclosure: Long SPXL

We will be hearing from BoJ, SNB and BoE and then on Friday we will be getting Flash PMIs. That is some significant event risk ahead, even at very oversold levels betting on a bounce remains risky.

NQ Nasdaq 100 futures managing to eke out a foot hold above its developing VWAP at 22:45 ET. This inverted NQ chart showing how NQ price may be following the channel trend line after dropping ~1% after close of regular trading hours.

https://i.imgur.com/Ql5pZF0.png

FWIW, the intraday breadth model has issued at 11:36 ET buy at ES (SPX futures) 3774.25. This is a profitable (both long and short) intraday model that actually managed to short ahead of both the CPI and FOMC slide (see pic), but it is also susceptible to side way chop and that is where it loses the most equity in an otherwise profitable strategy. Resistance above at 3845.

https://i.imgur.com/corgnYg.png

A warning to investors has come as the weekly RCD / RHS discretionary to staples positioning is showing a sharp move down, a sign of defensive positioning. We saw this in Dec of 2021 and further back in 2011 for example, this sharp drop near 08/05/11 lead to a sharp sell off of -15% in about 2 weeks. If the bulls don’t stem the slide soon this week, that is certainly something that could happen next week.

https://i.imgur.com/9DgXOd3.png

‘Higher for longer.’ Sounds like a cannabis ad 😉

Speaking of which, the guy at work who funded his entire 403b with a collection of cannabis stocks recently retired at age 72. About a year ago he finally transitioned half of the portfolio to bond funds – just in time to experience the bear market in bonds. Much of life comes down to luck and timing.

Ouch!!!!

Following yesterday’s Fed announcement, no change in the 4% yield on 1-year CDs. However, the yield on 5-year CDs have increased to 4.5%.

TLT and VT poised to print new ytd lows today.

Wow! These investors have really become very bearish over the last week. They should be even more bearish this week.

AAII Sentiment Survey:

*One of the five highest bearish sentiment reading in the survey’s history (going back to 1987)

*Bullish sentiment ranks among the 20 lowest readings.

https://mobile.twitter.com/sentimentrader/status/1572914151915393026

I wonder how much appeal venture cap would have if we had not had this era of easy money…the unicorns made up for all the ventures that lost. If we are in a new monetary regime where P/Es will revert to those of the 70s, what will happen to the unicorns? The pension plans and endowment funds that have tilted more and more into venture cap, how will they do?

I also wonder about how all these zombie and soon to discover they are zombie companies will roll over their debt in the coming years.

The Fed may be willing to cause a recession, but what about Great Depression 2.0 and deflation? Debt does not go away, it sticks around until you pay it off or default. How can all this debt be managed with high rates? I hear how since the new year there has been 7 trillion in wealth vaporized so to speak, what about debt? It hasn’t decreased by 7 trillion is my guess, if at all. Massive defaults could do it, but then there is the Lehman kind of moment where the Fed had to bail out AIG and GS and others. When someone defaults a creditor eats the loss, what if that loss is too much for the creditor? To me this limits how much the Fed can do.

Had the USD been a fiat currency in the 30s would they have printed or gone to the 1933 turn in your gold so we can change the price?

Toss in politicians making promises and an electorate that does not want to deal with pain…

Japan tried boosting interest rates over the years but finally caved in and went for super low rates. Maybe this will repeat in the USA. Aging demographics and debt.

Remember the stimulus checks were used by many to pay down CC debt which has now reversed as people use the CCs to get by.

It’s gonna be a bumpy ride.

TLT and VT already printing new lows in the premarket session.

It’s been a slow-mo decline so far.

I think the market is finally hearing Jay Powell.

We’re back almost to the June lows. My gut says we go lower from here: seasonality, hawkish Fed and other central banks, inflation moderating but not yet easing, Putin going all in, corp warnings starting. What is there to be bullish about? Max pressure is coming and then we’ll see the pivot. I think.

I look forward to reading Cam’s posts this weekend.

FWIW, the bears may be taking profit for the weekend or a breather, but a bounce may be possible here at 13:25 ET. Both options and positional traders easing up on the shorts.

https://i.imgur.com/Qr5IHQH.png

Correction 15:25, 3:25 PM ET

I have always liked to go over trades for the week and see how a certain strategy could have traded the market price action and trends and what a week to 10 days that was. There was a trade in particular on Thursday Sep 22 11:36 ET, buy at ES (SPX futures) 3774.25 with the market breadth model that shouldn’t had been initiated as a buy in that situation even as the market did pop up to 3805 but then dumped into the close. Here is the corrected strategy that eliminated long trades in that situation and instead would have held the short trade all the way from Wed (FOMC) 10:07 AM to Friday 11:36 ET. This turned out could have improved the intraday %reversal breadth model to a 24% return in the last 3 months with a 20% max drawdown (trade to trade close) in 78 trades with both long and short trades near 1.43 profit factor.

https://i.imgur.com/YwQ3Xlz.png

US Flash PMI wasn’t exactly disastrous, Germany however, ouch – the market was expecting bad news as Thursday ended in a graveyard doji and today the DAX closed below the prior lows of the year. It is probably time to reread Cam’s “Will Europe drag us into a global recession?” post.

With regards to Europe – Italian elections on Sunday, German IFO survey data on Monday and a Lagarde speech coming up. What is going to stop the run of the US Dollar and will foreign central banks eventually be forced to do something that really hurts?

Stormy Monday on tap. For some reason, I just don’t see traders buying into this decline. IMO, it’s more likely they’ll be selling into it.

I would even place the odds of another Black Monday at up to 25%. Stocks down. In many cases bonds down even more. We’re looking at the other side of zero interest rates and record stimulus programs.