Both the Fed and FedEx had messages of recession for the markets. Fed Chair Jerome Powell said that the Fed would raise rates until there was clear and convincing signs that inflation was headed toward its 2% target, and its projections amounted to a recession that begins either late this year or early next year. FedEx warned about a slowdown in global shipping volumes and recessionary conditions.

As we approach Q3 earnings season, an interesting divergence is appearing in the derivative markets. While the SKEW, which measures the price of option tail-risk, is low for the S&P 500, the SKEW for individual stocks has been elevated. This reflects rising anxiety about possible blow-ups in individual stocks as earnings season approaches.

Still, a review of the risks shows that not all is at it seems below the surface.

The Fed’s hawkish message

The latest Summary of Economy Projections (SEP) was highly revealing of Fed policy. The Fed had sharply reduced its GDP growth projection for 2022 and raised its Fed Funds projections for 2022 and 2023. The median expected Fed Funds rate is now 4.4% for December 2022 and 4.6% for December 2023, which was ahead of market expectations. In other words, the message is “higher for longer”.

Even though the Fed can’t be seen to call for a recession, a recession is implicit in the Fed’s forecast. How can GDP growth slow to 0.2% by December 2022 and rise to 1.2% by December 2023 when the Fed is raising rates and keeping them elevated for all of next year? Moreover, former Obama CEA Chair

Jason Furman pointed out that the Fed’s unemployment forecast would trigger the Sahm Rule recession tripwire.

The market reflexively went risk-off in the wake of the FOMC meeting as it began to discount a recession.

New Deal democrat, who maintains a discipline of using coincident, short-leading, and long-leading indicators to forecast economic growth, isn’t now pondering whether there will be a recession, but how deep it will be.

Suddenly there are a lot of things for me to write about; including not just if there will be a recession, but also how deep and how long it might be. The longer the Fed goes on raising rates, the more I think it may turn into a bad, deep recession.

Alfonso Peccatiello, who writes as Macro Alf, went back 100 years and looked at all 16 U.S. recessions during that time. In all 11 episodes when we entered a recession with inflation above 3%, the resulting sharp economic slowdown did bring inflation down. On average it took 16.2 months to slow CPI from peak back to 2%. The peak-to-trough reduction in CPI was -6.8%. Based on his projections, this recession should end in late 2023.

The FedEx warning

In addition, FedEx CEO Raj Subramaniam recently issued a warning about a global slowdown:

Global volumes declined as macroeconomic trends significantly worsened later in the quarter, both internationally and in the U.S — We’re seeing that volume declined in every segment around the world, and so you know, we’ve just started our second quarter. The weekly numbers are not looking so good, so we just assume at this point that the economic conditions are not really good. We are a reflection of everybody else’s business, especially the high-value economy in the world.

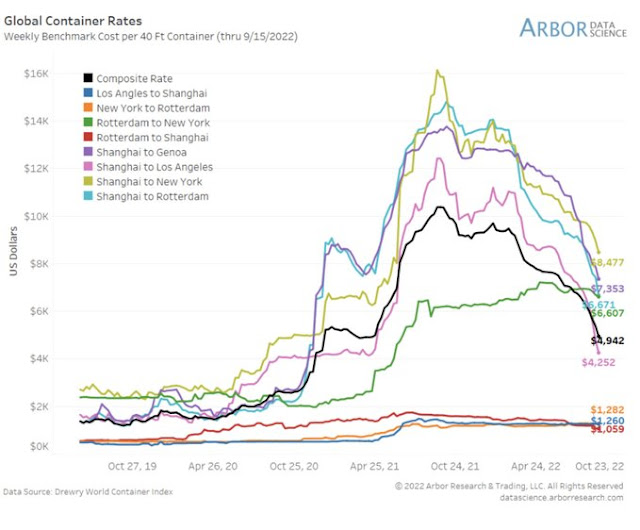

The slowdown is especially evident in China, but global container shipping rates have been falling since late 2021 and the collapse began to accelerate at the end of Q1 2022.

However, not all is gloom and doom. Demand has shifted from goods, which affects shipping companies like FedEx, to services. Bank of America CEO Brian Moynihan revealed in an earnings call that the American consumer is still spending.

In the month of August 2022, consumers spent 10% more than they spent in August 2021 — customers are spending more. They have – the amount of money and accounts is not going down. It’s been relatively flat — They’re spending it at a good clip. Their capacity to borrow. All credit cards are still enough to where they were in the pandemic. Our home equity loans are still down and you look across the industry capacity to borrow. So the consumer is in very good shape. And you sort of say, why is that true in the discussions with various people, it’s pretty simple. They’re getting employed.

VISA President Ryan McInerney agrees with that assessment:

So I think the best way to describe consumer spending right now is stable, and that’s what we see in our numbers. There’s been some shifts in the way consumers are spending, what they’re buying, and where they’re spending. But, overall spending has been remarkably stable, both in the United States here and for the most part around the world.

VISA CFO Vasant Prabhu explained that the weakness in FedEx results can be explained by a shift in demand from goods to services:

If you look across categories, as you might expect, people have switched from, as they say, buying things to doing things. And sort of buying goods, people are into experiences. Travel is booming as you might know from having flown yesterday. Hotels, airlines, and entertainment is doing well, restaurants are doing well. There’s no obvious difference between high-end consumers and lower-end consumers. They may be buying different things, but nominal levels of spending have stayed quite stable, and that’s largely true around the world.

We can see the shifts in demand in different categories of PCE. While Services PCE (blue line) has been remarkably stable, durables goods PCE (red line) has been extremely volatile during the pandemic and post-pandemic period, and nondurable goods PCE (green line) less volatile. The FedEx warning is reflective of the sudden downdraft observed in durable goods PCE, or the “transitory inflation” effect. The disaggregation of PCE components also shows the Fed’s dilemma. PCE inflation rates remain stubbornly elevated, which may prompt Fed officials to over-tighten and send the economy into a deep recession.

A dismal earnings outlook

This analysis indicates that investors will need to be prepared for volatility from different parts of the market. While services companies are more likely to meet or beat Street expectations, companies involved in goods production and their transportation are prone to disappointment.

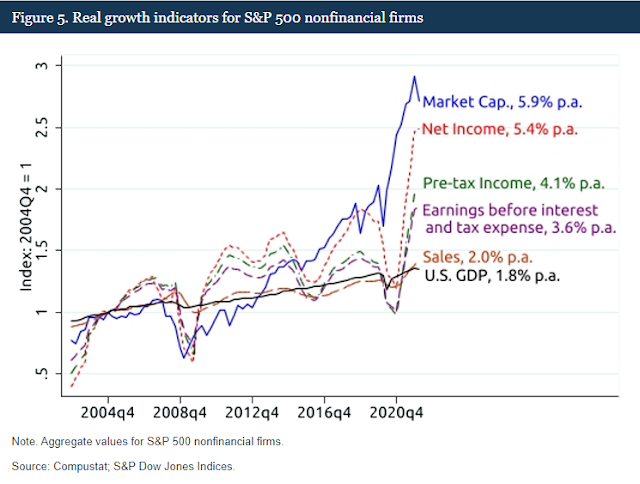

The outlook for long-term corporate profitability is even worse. Fed research Michael Smolyansky published a

note which concluded that much of the increase in net margins can be explained by falling interest expenses and lower tax rates, which are unlikely to continue.

Over the past two decades, the corporate profits of stock market listed firms have been substantially boosted by declining interest rate expenses and lower corporate tax rates. This note’s key finding is that the reduction in interest and tax expenses is responsible for a full one-third of all profit growth for S&P 500 nonfinancial firms over the prior two-decade period. I argue that the boost to corporate profits from lower interest and tax expenses is unlikely to continue, indicating notably lower profit growth, and thus stock returns, in the future.

In the short-term, the latest update from FactSet shows weekly EPS revisions falling across all time frames, which is bearish sign for equity fundamentals.

Investment implications

Putting this all together, these developments have ominous implications for equity market returns. The Fed is tightening policy, which is negative for equity valuation. A recession is on the horizon, which is bearish for the earnings outlook. Q3 earnings season could see some bifurcation as the goods-producing sector faces challenging conditions while services remain strong.

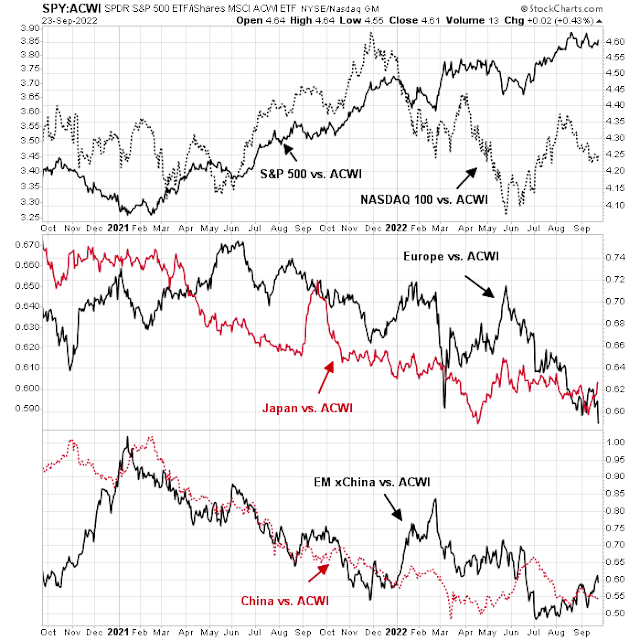

A non-linear thinker may conclude that while the equity market outlook may be bearish short-term, market history shows that the Fed always pivots in the face of a financial crisis. While US corporate and household balance sheets are strong, the same can’t be said overseas. Europe is already in recession, and China is probably in a recession. I am monitoring the stock market performance of regional markets for signs of a bottom and turnaround. In particular, Europe is extremely vulnerable to a financial crisis that would prompt global central bankers to ride to the rescue and ease policy.

GOOD BYE TINA. MY LOVE AFFAIR WITH YOU IS OVER !!!

Yes. There is there is an alternative to stocks now. Last week I did the most sacrilegious thing. I bought one year and three year Treasury bills and notes. With yields exceeding 4% it is easy to see money shifting to bonds when the yield on the S&P is 1.8%. I have an older friend who is in his late 70’s. He called me up and said I don’t need the volatility. I am going to buy 10 year notes. No money management fee and I now need to protect my capital. Multiply this thinking across an investment group which has the largest assets in the market and you get a seismic change.

I live in Miami in the winter months. A year and half ago a two bedroom apartment use to rent for $3500 a month. Today, the same place is north of $6000. Good luck Federal Reserve getting inflation down to 2%. It is not going to happen.

The world as we know it is changing. Here are some things to think about.

1. The idea that Bitcoin is an alternate to fiat currency has been rejected. It just is the Nasdaq on steroids. So what is an alternate to paper currency? Do we revert back to gold and silver?

2. Right wing parties in Sweden, Austria and Italy are getting a foot hold. In America Qanon and Proud Boys are going main stream.

3. Oil, grain and food is now being used as a weapon.

4. Long term the swift system of currency transactions is being weaponized.

5. We have a potential to start a war on Taiwan. At least economic sanctions against China.

6 The world is getting more polarized. China, India, Russia and Iran are now doing more trade in currency swaps. Is this the future?

I recently visited the US and was shocked about how expensive everything has become – this just compared to 2019, and not just because of the unfavorable EUR/USD exchange rate. At the same time I was surprised to see how packed and crowded many places still are, it seems the “consumer is still in violence mode” as Burry put it. The lower income people are already getting locked out of society. An IT executive from Seattle told me that software developers without any work experience are asking for $200k a year and are getting those kind of jobs at other companies, now Seattle may be special in that regard, but still the Fed has a long way to go.

Inflation comes in waves they say, and I would not expect the currently lower oil prices to stay low. The oil producing countries know well enough that the west is vulnerable right now.

I recently experienced inflation the other way over the Atlantic. While in Italy, our family of four had a 4 course meal and two bottles of wine. 130 euros. This week back in California we did take out Thai. $76.

They probably noticed you are American ;D – take this with some grain of humor. I remember getting a decent Margherita for 4.50 EUR in Italy, 2021. Domino’s Medium Margherita is 6.50 EUR (take out) in Germany right now, those prices include taxes. In Settle: Plain Bagel with Egg & Cheese $7.85 + 10.25% sales tax (and tip)

Seattle, not Settle

My wife and I briefly considered doing essentially the same thing your friend has done (10-year notes). We thought about 5-year CDs @ 4.5%. We no longer NEED the market in order to generate sufficient income/wealth over the remainder of our lives – what Bob Brinker used to refer to as critical mass.

However, we settled on one-year notes and CDs @ 4%. Why? We’re not ready to fully embrace the alternative(s) to TINA, and we’re still young enough (and maybe stupid enough) to think we can catch the next generational buying opp when it arrives.

Here’s a scenario to contemplate. What if ultimately all Boomers come to the same conclusion (walk away from the markets) and move instead to risk-free assets that generate a relatively modest yet decent income? Demand for stocks might plummet to multi-generational lows.

I continue trying to talk my friends out of the market, but many of them are still just mad at themselves for not taking advantage of the Covid bottoms and now they are determined to not let this opportunity go to waste. The Fed is tightening into a recession, the first of rule of investing is “don’t fight the Fed” (no matter how unhappy you are with them) – the second rule is that current conditions are among the worst you can get as an investor.

That being said, I marked yesterday in my calendar as a potential “quarterly funds rebalancing day” – that means we may have seen peak selling pressure, at least for a week or maybe a little longer. Jason Goepfert and others noticed that Retail Trader Buy-to-Open Put Premiums are very elevated – now retail does not have to be wrong all the time, but I think Wall Street will do what it can to take money away from retail traders. At least let those October puts expire worthless.

It’s very confusing, and scary.

If one looks at $UST2Y, it is zooming up.

What has happened in the past is that when the markets drop it goes down…I guess that means the Fed put.

In the early 80s when rates were high, this pattern was not observed, but starting in the 90s it has been with us.

So I take it that with it still going up, the pivot is not in play yet. But debt is worse than ever before, so does anyone believe this can continue without a serious crisis happening?

Is the Fed playing chicken with the bond market?

In 1998 when we had LTCM crisis the 2year dropped to something like 4.2 and then went back up into 2000 when of course it dropped during the bust.

But in 2008 when the 2year dropped, the market kept going down, so if things break and they pivot, will the market keep dropping because the damage is done?

Jeremy Siegel of the Wharton School ripping apart Powell and the Fed…

“They Know Nothing” 2.0

https://twitter.com/Stephen_Geiger/status/1573376154521817088

This is a case of Fed catering to political bosses. They should remain neutral and independent. Sadly like the Supreme Court, it is politicized. Average American workers are just collateral damages. The elite class does not give a damn, except to tell average joes to be patriotic and go die for the country. This is just not sustainable.

A gigantic bubble followed by a deep recession. Every cycle brings higher and higher level of distrust toward gov. It is just a matter of time before everyone simply just lies flat. What is in it for me?

Oh boy… Rick Santeli. I hope he doesn’t lose his lose his job over this.

https://twitter.com/WallStreetSilv/status/1573482293116674056

Seeing these rumors circulate over the last day or so…

Are they remotely credible? Of course, huge if true!

https://www.newsweek.com/li-qiaoming-general-center-china-coup-rumors-social-media-1746041

Fact check

https://twitter.com/schorselysees/status/1573949280234008576

market history shows that the Fed always pivots in the face of a financial crisis

FALSE

Never with high inflation

See Paul Volcker and the Mexican Peso Crisis, August 1982

It wasn’t a US only turnaround like the end 2018 when Powell made a 180 turn going from tightening call to easing within 30 days if i remember well.

And with near 8,5 trillion already on the balance sheet & 8 % + inflation it could be much harder to react to a new financial crisis.

Enough for my small brain