Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A crowded short

In the wake of the post-FOMC meeting downdraft, three of the four components of my bottom spotting models flashed buy signals.

- The VIX Index has spiked above its upper Bollinger Band, which is an oversold condition for the market,

- Yhe NYSE McClellan Oscillator had become wildly oversold, and

- TRIN spiked above 2, indicating price insensitive panic selling.

In the past, buy signal counts above two have indicated bullish risk/reward conditions for stock prices.

Other sentiment models are also pointing to crowded short conditions. In many ways, traders had already thrown in the towel even before the FOMC meeting, which is likely to put a floor on stock prices. But there is a right way and a wrong way to throw in the towel.

Too many bears

Numerous signs have appeared of a sentiment washout. The BoA Global Fund Manager Survey, which was conducted September 2-8, 2022, showed equity positioning at a record low.

The AAII weekly sentiment survey showed that the bull-bear spread and bearish sentiment readings were only exceeded at the 1990 and 2008 market lows. Bearishness today is even worse when compared to the aftermath of the 1987 market crash.

I recognize that the AAII survey is flawed because of a small sample size and a varying composition of respondents, but

Ryan Detrick compiled the historical returns of the S&P 500 after AAII bears exceeded 60%. The instances were rare (n=4), but subsequent returns were strong across all time horizons.

In addition, S&P 500 futures net positioning is very bearish and has reached levels only seen during the downturns of 2008, 2011, 2015, and 2020.

In a report published on September 20, 2022, which was before the FOMC meeting,

Mark Hulbert observed that his Hulbert Nasdaq Newsletter Sentiment Index dipped in the bottom decile of sentiment readings.

The wrong way to throw in the towel

Despite the apparent signs of excessive bearishness, Hulbert had a warning for investors.

A new bear-market low is likely still in the cards for U.S. stocks, for two contrarian-related reasons:

First, at no point in the current bear market has there been the deep pessimism and despair that frequently accompanies major bottoms — what many refer to as capitulation, or throwing in the towel.

Second, whenever even moderate pessimism has emerged, it has been short-lived; investors instead have been eager to jump on the bullish bandwagon at the mere whiff of a possible rally.

Jurrien Timmer at Fidelity pointed out that for all the talk about excessive bearishness, fund flows aren’t showing signs of capitulation. That said, the latest fund flow reports indicate that investors pulled money from all asset classes and money market fund assets swelled, but that may be only a blip and not evidence of protracted panic.

Equally disturbing is the lack of insider buying. A monitor of insider activity shows that insider buying (blue line) hasn’t exceeded insider selling (red line) as it did during incidents of market weakness this year.

Option sentiment presents a mixed picture. On one hand, the VIX Index remains below the target zone of 33-36 where the market has bottomed in the past. On the other hand, put/call ratios have spiked to fresh highs and the 10 dma of both the CBOE put/call ratio and equity-only put/call ratio are consistent with levels reached at the June bottom.

Sell the rips

I interpret these readings in two ways. The signs of excessive bearishness are short-term in nature, which is likely to put a floor on stock prices as they weaken. In other words, the market is poised for a relief rally.

On the other hand, the bearish factors are more intermediate-term in nature. Barring a bullish macro or fundamental catalyst, the path of least resistance is still down after any counter-trend bounce (see yesterday’s publication

What the Fed and FedEx are telling the markets).

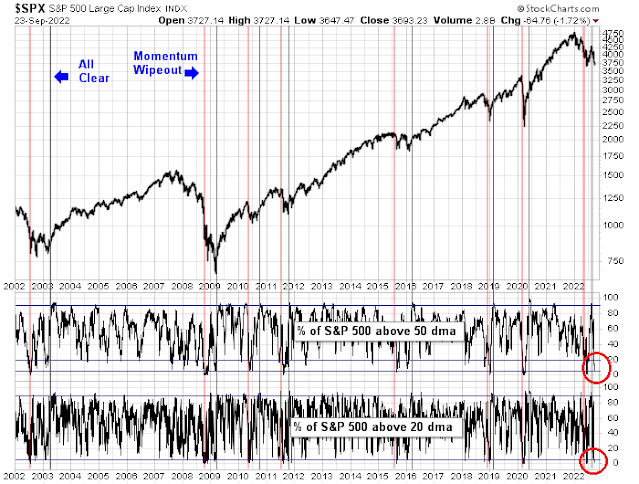

Technical analysts virtually all turned universally bullish after the strong momentum thrust off the June low when the percentage of S&P 500 stocks above their 50 dma surged from below 5% to over 90%. Since then, price momentum has fizzled and readings have returned to oversold again, indicating a failed breadth thrust.

Willie Delwiche also pointed out that global breadth, as measured by the percentage of individual markets above their 200 dma, is low at 17%. The moral of this story is not to over-rely on sentiment or any single model. Wait for confirmation from other uncorrelated models before making an investment decision.

In conclusion, sentiment readings and technical conditions are sufficiently washed out that a relief equity rally can happen at any time. However, the intermediate-term direction is still down. Prepare for the bounce, but don’t forget to sell the rips.

Disclosure: Long SPXL

I think this assessment is exactly right. Looking at the deep prolonged declines on the last chart of the bear markets of 2000-2002 and 2008-2009, it appears we may follow a similar course this time around.

VIX 36 has been a reliable buy signal in this bear to date but still think we need to hit 45 or higher at some point for real capitulation.

My Factor research has nailed it this year when it called a Beta Crash bear market of bubble-valued growth stocks. Over the last week, the market has shifted to a recessionary bear market.

What happened to mark the shift? The four key factors are Growth, Value, Small Company and Low Volatility. In a recessionary bear market, the two economically sensitive factors, Value and Small Cap underperform the most on a 90 day look-back basis. That is happening as of this week. Also, Growth finished its big rally from the June low and Low Vol is outperforming it. So we have a classic ranking of Low Vol-Growth-Small Cap-Value aligned to take us to our final low.

The other SUPER IMPORTANT occurrence was the December 2023 Fed Funds Future price shot solidly above the 2022 one. It is now approaching 50 BPs over! That means experts (the only people trading this contract) now believe the Fed will keep on tightening throughout 2023! The huge rally from the June low happened when the 2023 fell BELOW the 2022 signaling the opposite, a peak in rates early in 2023 and a soft landing to follow. Now, with the spike above, the forecast is for extreme Fed tightening and a HARD LANDING. That means a recessionary bear market is upon us pure and simple.

Early in August I alluded to the possibility that a December 170 put on the Russell 2000 Small Cap Index may have been bought by me when the index was at about 190. That was all about my Tactical Factor Rotation research. On Friday, the index closed at 167 and that put option is now in the money. That was the only time I’ve discussed options in this blog.

How will we know the bottom when Investment Winter ends and Spring comes? The bottom happens when a significant event occurs, usually a Fed pivot and the Value and Small Cap factors shoot up amazingly in one day. This is what I call a TWIST. This happened on Covid Vaccine Day Nov. 2020, Fed Pivot Days January 2019 and Feb 2016 and finally government bailout day March 2009. Unfortunately, this is not on the horizon now. We need profits to fall for the economically sensitive Value and Small Cap companies. Ford, GE and FedEx are a start. Third quarter earnings season is upon us soon. Pre-announcements will likely be negative even before official company results are announced.

There is a TWIST possibility in the world that can happen at any time. It is Europe, if peace breaks out suddenly. Their Value stocks have been crushed and will have a big TWIST when peace arrives. I will buy European ETFs at that turn when it comes even if the Fed on this side of the Atlantic is still in tightening mode. The positive change in their economic outlook will be so great. Waiting for a TWIST there is important, There could be rumors that start a rally that will be seductive to buy but without a TWIST, they will likely be premature. Insiders will know what’s happening especially the Russian oligarchs who will be buying European stocks in huge quantities when they KNOW the war is ending.

If you look at the comments of the last few posts, you can see the bearish sentiment.

One thing that the Fed cannot control is government spending, I would not rule out more fiscal stimulus of some kind, or talk about it anyways. I don’t think it’s right, but politicians will do whatever it takes to get elected or re-elected.

I remember once getting a mortgage and they do a calculation based on your debts and monthly recurring expenses and if you are above a certain level you don’t qualify. Long ago when the USA became a debtor it passed a point of not return because you simply cannot pay off debt by taking more on. So now with this interest burden rising as rates go up, what will happen.

The electorate will not accept default on social security or medicare. So ultimately there is only one outcome in my opinion.

Remember that in Weimar Germany the markets went up as long as the currency went down. Japan has been doing this since the 90s and the Nikkei has gone up and down in spurts but has yet to exceed the 1990 high.

You know zombie companies, the ones that have to borrow to finance their debt? What about a government that does the same?

Stay healthy, exercise, get sleep and consider dietary change if you are on SAD (standard American diet) because healthcare won’t get cheaper most likely.

Another thing I saw is that imports in 2021 were 44% higher than normal….now how much has that taken out of future imports. The whole WFH of 2021 and inventory build ups…this all should put pressure on prices and sales and of course earnings…so how fast will prices come down? Will Q3 GDP growth be negative? Since everyone is talking higher rates for longer, maybe that sentiment is wrong also.

I think the reality may be somewhere in the middle. Powell may pause / pivot but that is still away (earliest at the next FOMC meeting in Nov) and the higher rates may not last until the end of 2023.

That still leaves a lot of time for the market to continue drifting lower.

As Cam indicated earlier, a Few pivot may come soon if something severely breaks. It may happen in Europe (either war or Italy-related).

Couldn’t agree more with your bottom line.

A more quantitative study of the bear market of 2022 may be more useful because 2022 has proven in general to be very poor for dip buyers. In 2022 there has been 5 instances including Friday where SPX has dropped 4% or more in that week and 3 out of 4 of those cases had sizable losses in the next week. Only 6/17/22 proved to be a buyable bottom for one week (+6.89%) which lead to the rally in July and August. If you think this is June17, 2022 then buy otherwise wait. Pretty much all the SPX models on the daily and weekly time frames are all in cash, commercial paper or short positions.

If you bought on close on Friday, you would be long SPY at 367.95 which is pretty much the same level as buying SPY at 365.86 on 6/17/22.

Don’t really care what Powell does because the interpretation of his actions will show up in the markets even if it is the wrong interpretation before Powell even knows what he is going to do – as we have seen such an example from the ‘pivot rally’ from mid June to August.

https://i.imgur.com/mt3XgqB.png

Sweden, Italy, where next?

Thanks God, hopefully relief rally has just begun. How far can it go? 3800, 3900 or even 3950? Thank for any reaction.