Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Something for everyone

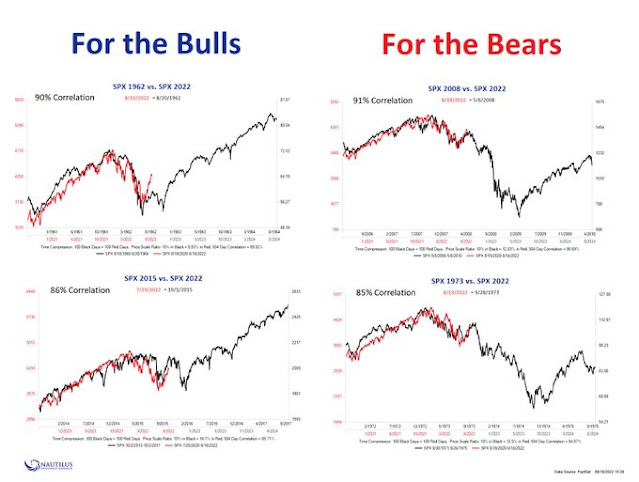

During the recent bull and bear debate, Nautilus Research provided some historical analogs for both bulls and bears. Depending on what camp you are in, Nautilus had a market template for you.

I have been in the bear camp ever since this rally began (see

Lessons from a study of past major bottoms). As the S&P 500 rally stalled and pulled back at the 200 dma, here are six reasons why the advance was likely a bear market rally and not the signal that a new bull had begun.

A short covering rally

The rally off the June low was mainly a short covering rally as sentiment and positioning were stretched at historic extremes. While the S&P 500 has risen 15% from its June low, the Goldman Sachs Basket of most shorted stock basket was up over 45% at its peak and the performance of the basket has dramatically pulled back. While short covering rallies can be bullish indicators of positive price momentum, the market needs additional catalysts to push prices higher once the fast money has covered its short positions.

Flagging momentum

When the S&P 500 was rejected at its 200 dma resistance, momentum began to turn down. The 14-day RSI recycled from an overbought condition, which is a tactical sell signal. The index has reached its first Fibonacci retracement level and may see some near term strength early next week.

A similar pattern can be seen in the weekly chart as the 5-week RSI recycled from an overbought reading.

Unchanged leadership

New bull markets are generally characterized by a change in leadership. Investors have seen no signs of the emergence of any new leadership. In fact, the same old large-cap growth leadership is still leading the way as the relative performance of the NASDAQ 100 remains sensitive to the 10-year Treasury yield.

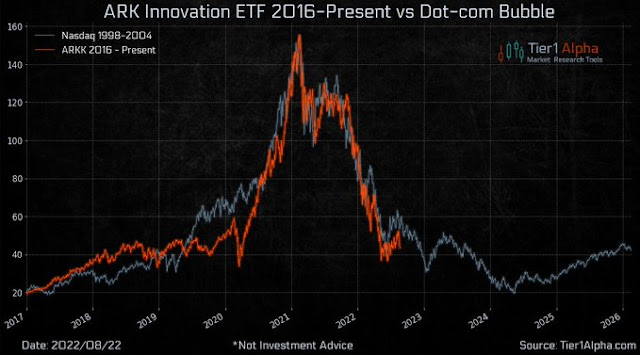

On the other hand, speculative growth stocks have cratered and its price pattern is following the script of growth stocks in the aftermath of the dot-com bust.

The script hasn’t fully played out yet. A new bull won’t emerge until new leadership appears.

Deteriorating fundamentals

In all likelihood, the US economy is headed into a recession by Q1 2023. Earnings estimates are falling. Jeff Weginer at WisdomTree observed that S&P 500 EPS growth is inversely correlated to credit conditions, as measured by the loan officer survey. Once earnings estimates decline, valuation support for stock prices will weaken.

A hawkish Fed

The Federal Reserve has made it clear that its north star is fighting inflation. In his

Jackson Hole speech, Powell affirmed the Fed’s “responsibility to deliver price stability is unconditional”. He admitted that monetary is a crude tool because it can only affect demand and not supply, but he implicitly accept that the economy could fall into recession as the Fed tightens monetary policy.

It is also true, in my view, that the current high inflation in the United States is the product of strong demand and constrained supply, and that the Fed’s tools work principally on aggregate demand. None of this diminishes the Federal Reserve’s responsibility to carry out our assigned task of achieving price stability. There is clearly a job to do in moderating demand to better align with supply. We are committed to doing that job.

He acknowledged that higher rates will cause some pain, but invoked the short-term pain for long-term gain mantra. In other words, the Fed will tolerate a recession in order to control inflation.

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Powell warned, “We must keep at it until the job is done”.

History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

With the inflation rate running close to a 40-year high and the unemployment rate at half-century lows, the Fed will stay hawkish for a considerable period.

Ryan Detrick highlighted analysis from Strategas that in the past eight cycles, the Fed kept raising rates until the Fed Funds rate exceeded CPI.

Even if we use the most optimistic assumptions by substituting core CPI for headline CPI and assumethat the transitory nature of goods inflation subsides, core CPI is likely to decelerate to only about 4% by early 2023. But sticky price CPI is stubbornly high and accelerating. This indicates that the Fed Funds rate will continue to rise to 4% or more before the Fed is done, which is well above current market expectations.

Negative seasonality

Tactically, a number of seasonality studies indicate that September is a poor month for stock returns. September is especially negative during midterm election years.

Mark Hulbert also found that history shows September to be a particularly negative month. He could find no explanation and chalked it up to a market mystery.

As well, the Fed is scheduled to double the pace of its quantitative tightening to $95 billion per month starting in September. Investors should be prepared for the possible negative effects of a withdrawal of liquidity from the financial system.

In conclusion, while there appear to be some superficial reasons to support the case for the start of a bull market, an analysis of market internals, valuation, and monetary policy backdrop indicates that the bear market isn’t over. Investors should watch for a re-test of the June lows and make a decision then about downside risk based on sentiment, technical conditions, and insider behavior.

Disclosure: Long SPXU

Chairman Greenspan was renowned for speaking in a mumbled language. However, Powell has left no ambiguity. In old days the saying was don’t fight the Fed. Now we should substitute that by the new saying – Don’t fight the pain!!!

You’re right. Powell’s comments on Friday has changed the tape.

I’ll need to acknowledge the change and begin scaling out of positions on Monday.

https://www.youtube.com/watch?v=76yctdQST5E

Off topic.

I came of age in the late Sixties on the Peninsula. Two junior high classmates and I caught The Youngbloods at one of their first public performances at the Santa Clara Fairgrounds, where they reprised ‘Get Together’ as an encore because they hadn’t rehearsed for any encore requests. By the time ‘Ridgetop’ came out in 1976 our family had relocated to Ann Arbor – but I would play the song frequently on my car’s tape deck when driving around SE Michigan. In the back of my mind I always knew that someday I would (i) return to the Bay Area, and (ii) live in a house with a panoramic view. My first home was in fact located on a ridgetop with views of 280 and surrounding neighborhoods. My current home isn’t exactly on a ridgetop – more of a terraced section of a steep hill – but close enough. Three ‘hundred-foot pine trees’ line the area behind the back fence, ‘dance in the wind’ with the afternoon breezes from the coast, and ‘serve as a squirrel sanctuary.’ My wife grows berries in a garden that she ‘bakes into pies in July.’ And our cul-de-sac lies off a road that ‘winds like a snake’ up from the flatlands.

The things we visualize in our younger years have a way of turning into reality in middle age. That’s because we consciously or subconsciously make countless small decisions each day that ultimately lead us to the life we envision.

Cam, I would be interested on your views of LT bonds based on recent events. I believe you have been fairly positive of late. Would a more aggressive Fed reinforce this view? Thanks.

I continue to be constructive on the long Treasury bond. You may have noticed that as yields rose in response to the hawkish message from Jackson Hole, the long bond yield actually fell Friday and the yield curve has inverted further. This is the bond market’s signal that it expeccts a weaker economy, which should be bullish for bond prices.

Thanks..

Finance for dummies….that’s my model.

A dummy way to look at things is just debt….so once upon a time long ago we had debt and high interest rates….then interest rates started coming down, and as they came down it was easier to pay the debt and so there was more money to spend on other things.

Not only that, but as rates came down people were enabled to borrow more and they did which created more debt and money. So now we have a terrific amount of debt and rates are going up, so my inner dummy says that people will have a harder time with their debt, a harder time borrowing because the cost of debt to income won’t fit, and people will default on debt destroying money. This does not mean the market can’t go higher, remember the Cisco quote about” what were you thinking?”

Dummy has a question for Cam….has a bull market ever happened in the face of massive debt deleveraging? Has one ever ended that way?

The summer rally still appears to me like an orchestrated effort by people who have the power to do that to ramp markets higher because there was money to be made by letting last weeks puts expire worthless and suck in some retail money. PMIs and interest rate uncertainty do not justify SPX above 4000, and while it is possible that inflation moderates from here that is still a very optimistic case. There is no catalyst for the energy crisis to get better and new conflicts in Libya are flaring up.

To address an issue that Jan has raised indirectly and some of us are missing is the lack of leadership. The statement of lack leadership is not true. Energy and Materials are up for the year. On a fundamental basis they might be the new leaders. At their low they constituted a small percentage of the S&P. What the conflict in Ukraine has shown us that Russia and the Mid East are unreliable sources of energy. Therefore, energy as an issue is not going to go away for the foreseeable future.

Gallows humor would suggest that Europeans should invest in down. If not down then down jackets. It is going to be a long and cold winter in Europe.

The summer weakness in XLE may have also been one of these opportunites, but with regards to European companies I would certainly bet on political backlash against them making outsized profits. This can go either way as some European companies with already huge profits will be benefitting from the german “Gasumlage” (a kind of extra tax to distribute the cost for bailing out Uniper and others) – look at Spain and Italy however and its a completely different case. Wouldn’t want to comment on what politics has in store for the XLE companies but I guess its a risk factor. China trying to spend their way out of the current situation may be beneficial for Energy and Materials ex-Europe. Too few people however seem to be talking about the power situation in China, all I see is additional inflationary pressures coming out of China. Current situation in Europe right now is less dire than sentiment suggests, I have business partners in Texas, we are growing, they are not, but we keep making jokes about the energy situation in both of our locations (always keep your notebook plugged in and your battery at 100%, just in case)

As Powell told the whole world there is “pain” to come, will businesses and people listening go and invest in their businesses or buy new stuff? Will they defer and wait-and-see? Could this statement alone cause a recession than Powell seems to so much desire?

What could be the new leadership in a new bull?

Out of all positions in the premarket session for an additional loss of ~-0.5%.

NDX is backtesting its rising 50-day moving average on deeply oversold RSI. If one would not know about Powell and all that’s been said on Friday, one would probably try a long here.

Monday was too oversold to crash, but today…let’s see….

This seems to be largely US based selling as European indices close only slightly down with some positive suprises. US indices have been largely outperforming so far and need to give back their gains (it seems) but this is not global risk-off so far.

Good call.

The above comment was intended to fall under Jan’s last post.

My wife and I were chatting last night about the markets and almost simultaneously asked ‘Why do we even need to be in the market?’ The answer, of course, is that no one is forced to participate.

Long VT/SPY at the close.