It’s finally happened, the euro fell below par against the US Dollar. The weakness can be attributable to a combination of Fed hawkishness and European economic weakness.

Europe is almost certainly in a recession. Consumer confidence has skidded to levels last seen during the Eurozone Crisis of 2011-2012. The questions are whether the region will drag the rest of the global economy down and the implications for asset returns.

Bears in Europe

European equity market performance looks grim. The relative performance of the MSCI Eurozone is testing a key relative support level. The region’s laggards are Germany, which has become the sick man of Europe, and Italy, which is burdened by concerns over yield spreads and the political uncertainty of the upcoming election on September 25, 2022. Polling indicates that a right-wing coalition consisting of Fratelli d’Italia, which has its roots in the fascism of Benito Mussolini, Lega, and Forza Italia are poised to seize control of power. Not only would the new government be anti-Europe, and anti-immigrant, but it is also expected to be more Moscow friendly, which would weaken the EU consensus in support of Ukraine in the war against Russia. The outperforming country is Greece (yes, that Greece) as it appears to be trying to carve out a relative bottom against the MSCI All-Country World Index (ACWI).

Across the English Channel, large-cap UK stocks have held up well, but that’s because of its heavy energy weight. The relative performance of large-cap UK stocks has been highly correlated to the relative performance of energy stocks. By contrast, small-cap UK stocks, which are more reflective of the performance of the British economy, are exhibiting relative lows against ACWI.

Energy crisis

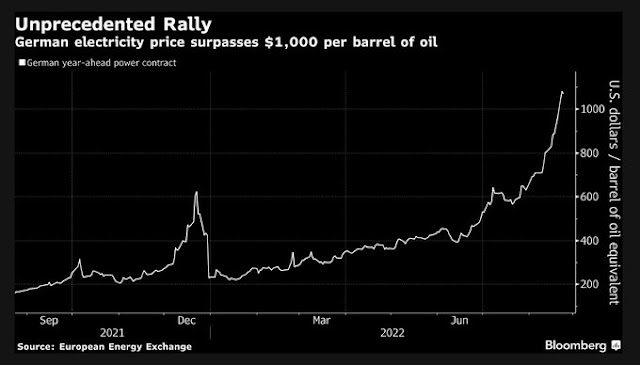

Russia has weaponized its natural gas exports in the wake of the Russo-Ukraine war. Investors are seeing almost daily headlines about how gas prices have surged to another high. For some context, on a per barrel of oil equivalent basis, wholesale electricity prices in most European countries are over $1,000 oil. The 1974 Arab Oil Embargo cratered the American economy. Will the Russian gas curtailment be any different for Europe?

This chart of the showing the difference in USD performance of BASF and Dow Chemical tells the story of the burden being carried by European heavy industry.

It was no surprise that Eurozone flash PMI fell into contraction territory.

While core HICP came in at 5.1%, which was slightly ahead of an expected 5.0%, German PPI rose an astounding 37.2%. These inflation readings will handcuff the ECB and force it to tighten into a slowdown.

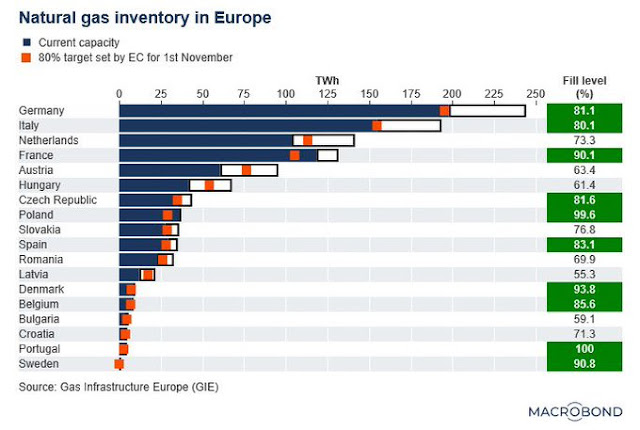

The good news is that most European countries are on track to reach their targeted 80% gas storage capacity by October 1, and a considerable number already have. Europe won’t freeze this winter, though it may have to shut down some industrial activities. The feat was accomplished through a combination of Russia’s slowness to curtail gas exports and a pivot towards gas from other sources.

Here’s the bad news. A Bloomberg Odd Lots podcast with Bloomberg Opinion Columnist Javier Blas and Singapore-based hedge fund manager Alex Turnbull reveals that Europe achieved its natural gas position by outbidding others for LNG cargo. While Europe won’t freeze this winter, Europe’s gas shortages were exported to EM economies like Pakistan, Bangladesh, and India, which would affect industrial output in those countries. As well, while Europe may emerge from the coming winter relatively unscathed, gas storage will be depleted in the spring and it will face supply problems next summer and winter.

The geopolitical wildcard

Much of Europe’s economic outlook depends on how the Russo-Ukraine war evolves in the coming months. Putin issued a decree last week ordering that the Russian defense ministry raise its budget and plan for an increase of 137,000 troops. This is a signal that he is planning for a long war.

EU support for Ukraine has been strong but a little uneven. Ukraine has received strong support from the US, UK, former Warsaw Pact states, and Baltic countries like Sweden and Finland, the principal axis of the EU, France and Germany, have lagged in military support. Surprisingly, a recent poll shows a vast majority of Germans want to continue to support Ukraine in the war, even if this entails income losses due to high energy prices. In fact, three politicians, from SPD, FDP, and Greens have written a Der Spiegel op-ed calling for more weapons for Ukraine. As long as the conflict persists, this will undoubtedly affect the security of Europe’s Russian energy supply.

Currently, the market’s perception of geopolitical risk is still rising, and the relative performance of MSCI Poland continues to weaken.

Looking longer term, continued Western support is likely to translate into a Ukrainian victory. However, investors have to be prepared for any possible geopolitical consequences of a Russian defeat. Just as Russia experienced political upheaval soon after the defeat of the Russian fleet at the Battle of Tsushima Strait in 1905, Russia is likely not to be the same within five years. The West will need to better manage Moscow’s decline in a better way than the collapse of the Soviet Union. Russian culture has few institutions in place to support democracy, property rights, and the rule of law and any collapse could be disorderly. European businesses and investors will also have to be prepared for any blowback from such an event.

Limited contagion effects

In conclusion, developed market flash PMIs are exhibiting a synchronized decline, led by Europe. The contagion effects of a European slowdown appear to be limited to selected EM economies through the globalization of natural gas prices.

European equities are lagging badly on a relative basis, but the relative performance of the other regions are largely unaffected by European weakness. Investors are advised to avoid Europe, but monitor the region based on the first-in-first-out principle. If European stocks begin to recover and outperform, it could be the bullish signal of global recovery.

So, for long term investors, is it time to buy Europe?

Europe is cheap, but it could get cheaper. It depends on your pain threshold and time horizon.

Thanks.

Thank you Cam for this analysis. I am from Czechia therefore I think that we are able to cope with the war with Russia. Now we have taken care of 300 thousands of refugees. For 10 mio nation it is 3% of inhabitants ! Refugees have public health care, education incl. university one for free. Stand with Ukraine and help Poland and Czechia to take care of refugees and help to Ukraine to win the war. Thx

If one is unhappy with the politics in the US it is a good time to consider immigrating to Spain and Portugal. Euro parity makes real estate in these countries attractive!!

I have dual Canadian-EU citizenship. My wife wants to buy a place in Villefranche and spend the winters there. 18-20C daytime highs in December.

Property still a bit pricey there. Waiting for the recession to beat prices down.

As of now I spend my winters in Miami and summers in Denver. Ideal weather in both places.

Florida too hot and humid for me.

I remember the hot and sticky summers in Boston and NY/CT when I lived there. It was unbearable.

Cam: WINTERS IN MIAMI!!!!

I have a very rich friend who does not own any house. He told me the reason is very simple. When you own a property you need to take care of it, which he does not like to do. And process involving selling/buying property is tiring. He owns a fancy hotel and the penthouse on top is his place when he is not traveling. He does not own that penthouse. One of his orgs renting this penthouse for him to live in there and incurring biz expense as write-off. Any place he rented while traveling around is all handled the same way. So he got to live in all kinds of houses in various locations around the world on write-offs. A very good idea.

I copied his practice when traveling. But I need to be careful. Biden just hired 80K new IRS agents.

Be grateful for what you have.If you are able to do that you can weather the storm more peacefully.

Yup,

Things will go up and down, roll with it. Expecting continual Growth for the sake of Growth is the definition of Cancer.

Agree – one of those ‘real deal’ comments. If you’re a subscriber to Cam’s site, then you are better off than 99% of the world’s population. Any complaints about losses or missed opportunities rank among the smallest of ‘small stuff’ to the rest of the world.

Cam, do you have some data / resources to support your conclusion that Ukraine is likely to win in this war?

The coverage of the war is really spotty in the US media. Even Colbert hasn’t mentioned the Z word for several months.

Also, won’t Putin or some renegade general detonate a few nuclear bombs rather than accept the defeat?

Russia is becoming exhausted. The fact that Putin is trying to mobilize 127K men without declaring a war and announcing a draft if politically revealing. It means that he doesn’t want to upset the Moscow and St. Petersburg elites and ask their sons to go to war.

This doesn’t mean, of course, that Ukraine will win. It may resolve in a frozen conflict. Nevertheless, I think that we need to be prepared for what might happen in the event of a catastrophic Russian collapse.

I have a small summary out of recent reports I reviewed. Some are facts and others are scenario analyses of higher probability.

1. Chasm is growing between Putin and RUS military leaders.

2. These military men and certain politicians are covertly working with US/UK for plans to resolve the situation with minimal damages.

3. The coming new order need to avoid USSR collapse situations where many bureaucrats and profiteers together pillaged Russian assets.

4. The new order is set up to be not friendly to China. Essentially to isolate China totally.

5. Caucasus region is potentially a brewing trouble spot.

6. Italy Party Fdl leader Giorgia Meloni is to be next PM. She has adopted a stance to oppose RUS/CHN expansion. But we will have to monitor that.

In light of Powell’s tough talk Friday, USD and bond markets did not react much. So we need to monitor this anomaly. One hypothesis is that rate hikes are to be limited because of EM. At this point all short-term traders and algos are programmed to watch 200dma (4300, and slope down)) and 50dma (4000, and slope up), together with UST10Y. It doesn’t get any simpler than this. But overall most firms think June low is the cycle low.

There’s no chance for Ukraine winning and there’s no stalemate either. Ukrainian forces are suffering heavy attrition. They keep throwing fresh, untrained men agains the russian artillery. These soldiers spend 90% of their time hiding in the trenches, 10 to 1 (at least) outgunned by the Russian artillery and with no air support. It’s a one-sided meat grinder, not a stalemate.

It seems that the Russians have brought new troops recently, which they are using to start offensive operations on the whole front – from Kharkov down to Nikolayev. From what I have read, these troops are reservists, who have had regular military training before. Additionally, because the Russian casualty rates at the moment are not high, they have time to get training “on the job” before getting killed.

Bloomberg had an article the other day saying Russian corporate profits jumped 25% despite sanctions, economic contraction and inflation.

For a hypothetical US/Cdn investor who invested on Jan 1 2022 $10,000 each in STOXX of Germany (in euro) and MOEX of Russia (in ruble). His Russian investment would be handily outperforming his European investment today. All this is to say even on the econ front, Russia is likely to outlast the West.

Italy is a good example of what could happen when the voters have had enough.

On the battlefield Russia is also making slow but steady advances towards the river….

Hello Cam.

Wouldn’t you ain’t hear in your update on GDX as a hedge to global politics and asset volatility. Seems less attractive as interest rates move higher.

Thanks

So much for speech to text. But, you likely get my question.

A hawkish Fed is bearish for gold and GDX