Mid-week market update: The stock market has mostly followed an FOMC cycle where prices decline into an FOMC meeting and rallied afterward. While the Jackson Hole symposium wasn’t an FOMC meeting, it nevertheless seems to have sparked market weakness.

After the S&P 500 stalled and pulled back at its 200 dma, I thought that it might experience a minor setback The market action is pointing to a deeper downside as every rally attempt this week has been met with selling. Both the VIX and S&P 500 appear to be undergoing Bollinger Band rides: An upper BB ride for the VIX and a lower BB ride for the S&P 500.

Cautionary signals everywhere

I am seeing cautionary signals everywhere. The market printed several high downside volume days of over 80%, which is consistent with past S&P 500 lower BB rides.

Rob Anderson of Ned Davis Research revealed that their short-term VIX indicator has flashed a sell signal.

I pointed out before that the VIX Index appears to exhibit a 50-day cycle, which bottomed out on August 17. If the cycle analysis is correct, the VIX is on its way to a target zone of over 34. This market drop is not anywhere near done.

The Relative Rotation Graph (RRG) a way of depicting the changes in leadership in different groups, such as sectors, countries or regions, or market factors. The charts are organized into four quadrants. The typical group rotation pattern occurs in a clockwise fashion. Leading groups (top right) deteriorate to weakening groups (bottom right), which then rotates to lagging groups (bottom left), which change to improving groups (top left), and finally completes the cycle by improving to leading groups (top right) again.

If we apply the RRG technique to the top-weighted stocks in the S&P 500, we can see that only two stocks, BRK.B and JPM, are in the top half of the chart, which indicate potential leadership. The rest, which are large-cap FANG+ names, are in the bottom half indicating relative deterioration. It’s difficult to see how the index could meaningfully advance under such conditions.

Bottoming tripwires

I am not going to estimate a numerical downside target for the S&P 500, but I can point to several bottoming tripwires.

One way is to watch for the VIX Index to rise up to its target zone which begins at 34 (see above chart).

Another way is to monitor the S&P 500 Intermediate Breadth Oscillator Momentum Indicator. Historically, corrective impulses haven’t ended until the 14-day RSI on ITBM has fallen to 20 or less.

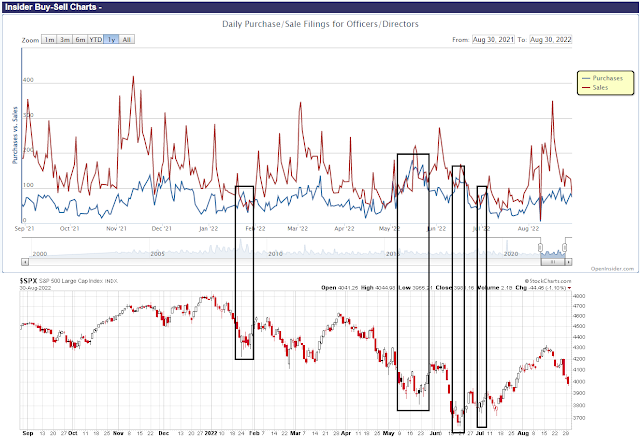

Another way is to watch insider activity. Should strong net insider buying appear (the blue line rising above the red line), that would be a signal that downside risk is becoming limited.

Tactically, the S&P 500 is extremely oversold and could stage a brief rally at any time, but the path of least resistance is still down. My inner trader remains short the market and he is enjoying the ride. He is watching for the tripwires to take profits and cover shorts.

Disclosure: Long SPXU

Sometimes the past leaders act as good “tells”. I am presently watching APPL. It is trading slightly below its 200 day moving average. Please pull up a chart of APPl you will see on 3/15/2002 it was in a similar position. If it were to stabilize and begin to rally it could start a short term rally in the qqq’s. However, for all practical purposes we are in bear market. Remember, bear market rallies are short and furious and tend to fizzle out.

Don’t fight the Fed, right?

Increasingly likely we get to 4% by Dec (at Dec meeting?) and maybe that’s when we see the pause. Ken might be proven right on that call.

I found the following regarding monetary policy:

In March 2020, when the Fed launched its pandemic-related quantitative easing (QE) program, it expanded its balance sheet by $3.0 trillion in three months before slowing its pace of purchases to $120 billion per month. In total, the Fed expanded its balance sheet by $4.8 trillion. As from September 1, they will accelerate the winding down to 90 billion per month, let’ s see how the market behaves then

A most rare and negative happening is that the CCC junk yield spread blew out 1.28% overnight. This has happened only seven other times since 1998 and stock markets were very weak going forward afterwards with all cases seeing at least a 10% or greater drawdown as much as 25%.

We could hear about a big credit default soon that is suddenly chilling the heart of corporate credit.

Longer term index traders may want to look at the Ned Davis research model that will go to cash/commercial paper if SPX closes below 3972 this week. This model is basically based on the Zweig 4% weekly rule but optimized to 8.4% buy, 7.2% sell. 78.7% accurate since 1947. We may get a small bounce here 9/1 14:30 PM and Friday 9/2 to make a close above 3972 happen. However, other daily and weekly models all consistently show on going short signals.

https://i.imgur.com/DhPUGQe.png

$SPX closed at 3966.85 on Thursday 9/1. Spearman correlation of SPX up volume with price is saying this could be a short term bottom coming. Spearman correlation of the CBOE Put Call equities ratio $CPCE with price is showing a flattening bottom as well suggesting less likelihood of a sharp drop in the next 1-3 days.

https://i.imgur.com/Aah61BH.png

If you have available market internals such as the ‘Percent of stocks above 50 day average’ (for example Stockcharts $SPXA50R) that is live intraday – unfortunately it may only be EOD data for some data providers, but its momentum is a good predictor of intraday markets as well as daily and weekly charts. Such a strategy gave a buy signal on 9/1 14:34 after shorting from 8/29 16:03. Chart of ES (SPX futures) shown.

https://i.imgur.com/USWgXuk.png

$SPX did an intraday reversal today when it rose to the 50 day MA and got slapped down hard and it looked ugly with heavy sell offs – but is it really bearish? May be not. The following chart shows that it is a frequent occurrence (up 1% then close red while losing 1% but closed nearly unchanged the previous day) – the large yellow crosses on chart. This intraday reversal is probably engineered by the bulls in order to set up for a better and lower entry to build a bull thrust and also to prevent bears from raiding the gains built up while the market is being heavily shorted. This doesn’t mean it is all clear for the bulls, just that the sell off is likely on pause or even a reversal to the upside is possible from here. Notice the last time this occurred was recently on 7/13/22 when the market gained 13.5% in 24 trading days.

https://i.imgur.com/siZ9t2k.png

Not sure whether or not I dodged a bullet today. I opened positions in SPY/ VT at yesterday’s close. Didn’t have the guts to add at today’s lows. Staying put for now. Awaiting the reaction to Friday’s jobs report.

Just noticed today’s price action in TLT as I had little time at work for more than a few glances at SPY/VT.

That’s enough to prompt me to clear the table – and very fortunate to be closing the one-day trade flat.

The 60/40 portfolio must be taking a record hit ytd.

As a rough proxy for target funds in my age group, Fidelity’s 2025 Freedom Fund is off over -15% ytd after adjusting for capital gains/dividends.

Which means a +18% gain will be needed to recoup the losses.

Cash or even a short-term CD with a small early withdrawal penalty looks good by comparison.

Sometimes nothing can be a real cool hand.

It’s too bad that Series I Bond purchases are capped. That + the 5% guaranteed annual return on my pension plan are serious outperformers this year.

It may be a coincidence, but the last two times TLT gapped down the way it did today – June 13 and August 19 – it seemed to presage weakness in stocks by 1-2 days.

So if I had to guess, the jobs report will catalyze a move to the downside.

So the downside materializes, but only after a convincing head fake to the upside.

https://www.marketwatch.com/story/bonds-enter-first-bear-market-in-at-least-30-years-11662111162?mod=mw_latestnews

High-Yield corporate bond spreads also continue to widen. While traders may be getting chopped up in the geopolitical newsflow, the bond market seems to be telling the story of the underlying downtrend.

Rug pull.