The June CPI and PPI reports both came in higher than expectations. The good news is core CPI is decelerating. The bad news is both core sticky price CPI and Owners’ Equivalent Rent, which is about one-third of core CPI, are rising rapidly.

These readings confirm the market’s expectations that the Fed will continue to tighten until something breaks. In effect, the Fed is behaving like the proverbial bull in a china shop.

Brave words

It is said that no battle plan survives contact with the enemy. The Fed’s current battle plan against inflation is to be “resolute”. A recent

WSJ article telegraphed the Fed’s concerns about a repeat of the 70’s era of “stop and go” inflation.

Fed officials are eager to see inflation pressures diminish soon so that they won’t have to raise interest rates above 4% or 5%. But they are also using terms such as “fortitude,” “resolute” and “bumpy road” to show they are alert to the risks of stubborn inflation.

“This kind of worry that there’s going to be a stop-and-go policy by the committee like what happened in the ’70s—that’s just not going to happen in my view,” Fed governor Christopher Waller said during a webinar with private-sector economists last week.

Officials are concerned that inflation psychology is shifting in a way that will lead businesses and consumers to continue to accept higher prices. To prevent those expectations from becoming self-fulfilling, the Fed is using words and actions now that it hopes will shock the public out of believing inflation will stay high.

Brave words indeed. The key question is whether the plan will survive contact with the enemy. That enemy’s name is financial stability. History shows that even Paul Volcker relented when faced with a Mexican Peso crisis that left the US banking system teetering on the brink of insolvency.

Will this time be different?

The conventional policy view is, that in the wake of the hot inflation reports, there is no off-ramp to aggressive rate hikes. By contrast, the market has shifted from a straight-line acceleration of rate hikes to pulling forward expected hikes in 2022, a plateau in early 2023, and rate cuts by the middle of next year. In other words, something is going to break – and soon.

Rising EM instability

Here is what`s breaking in the global financial markets. Riots engulfed Sri Lanka as it faced a foreign currency crisis. Protests over rising food and fuel prices caused the government to fall. Protests were also seen in the Albania capital of Tirana last week over inflationary pressures.

The USD is surging as investors piled into the greenback as a safe haven, which is pressuring fragile EM economies. A rising greenback imports disinflation because the cost of imports are lower while exporting inflation to America’s trading partners by raising their costs.

A

Bloomberg article identified El Salvador, Ghana, Egypt, Tunisia, and Pakistan as particularly vulnerable to defaults. The

WSJ echoed similar warnings and also identified Lebanon and Zambia as “already in the grip of crises”. In addition, Fitch downgraded Turkey’s rating another notch.to B, which is five levels below investment grade.

The FT reported that EM debt outflows is having its worst year on record. This is a classic recipe for an EM debt crisis.

Rising European instability

The outlook for Europe isn`t very much better. Inflation is rising everywhere.

The Nord Stream 1 gas pipeline is down for scheduled maintenance and fears are rising in European capitals that Russia will take the opportunity to shut flows in retaliation for the EU’s support of Ukraine in the war.

To be sure,

Robin Brooks of IIF pointed out that a gas cut-off is a two-edged sword. While there have been studies of the effects of a Russian gas embargo, what`s lost in the analysis are its asymmetric effects on Russia vs. Germany and Europe.

What’s missing from Germany’s debate on an energy embargo is just how asymmetric an embargo would be. Russia is a gas station. If you embargo energy, that shuts down the gas station and GDP will collapse. Germany will get hit, but much less.

The relative performance of BASF and Dow Chemical, which are both measured in USD, shows the growing disparity between energy costs. The relative performance of the two stocks (bottom panel) had been relatively steady until the war began. BASF tanked against DOW when the war began and it is lagging further. If Russia does fully embargo gas to Europe, drastic rationing measures will be taken and priority will be given to households over industrial users and the BASF to Dow performance spread will further deteriorate.

From a big picture perspective, the markets are signaling renewed concerns over the Russia-Ukraine war. The performance of MSCI Poland, which is a proxy for the geopolitical risk premium, has violated a relative support level against the Euro STOXX 50 and against the MSCI All-Country World Index (ACWI).

This combination of events has put the ECB in a difficult position of tightening into a possible downturn. EURUSD reached parity for the first time in two decades and the USD is at 40-year highs against the GBP. The ECB is expected to announce its interest rate decision next week. Christine Lagarde has given guidance for a 25 bps hike, though pressure for 50 bps is building.

China instability

China is also facing growing risks of instability. China’s Q2 GDP growth came in weaker than expected as quarterly GDP growth turned negative at -2.6%. Trade surplus figures were a bit of a mixed bag. The good news is China’s trade surplus soared to a record US$97.9 billion in June as exports grew by 17.9%, though export strength is likely to fade as the Fed tightens monetary policy in order to destroy demand. The bad news is imports only grew by 1% owing to weak consumer demand, signaling weakness in the household sector.

Meanwhile, the Chinese high yield bond market is continuing to collapse even amid a rebound in PMIs and fiscal front-loading signaling a warning to the property market. More and more home buyers have joined a mortgage boycott on stalled projects, which is unsettling investor sentiment. As another sign of growing financial stress, protesters seeking frozen funds in four rural banks in Zhengzhou clashed with police.

A recent

PBOC survey found that household income expectations and investment intention were at an all-time low while saving intentions were at an all-time high. Moreover, the latest Omicron-led wave of outbreaks and ensuing containment measures have delivered a huge blow to their incomes, casting a shadow over the health of the Chinese economy and potentially restraining authorities’ ability to inject stimulus via public spending.

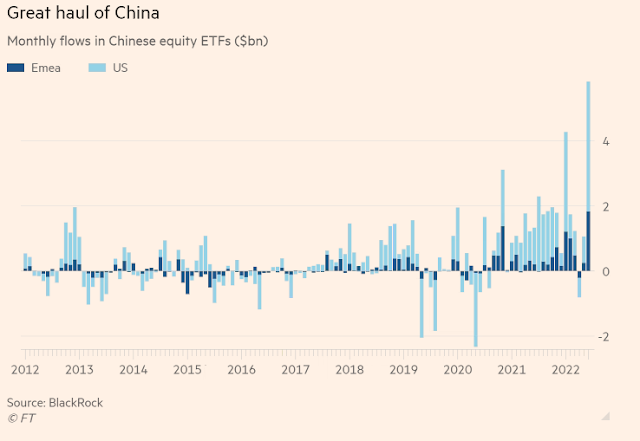

The

FT reported that “Western investors pumped a record amount into Chinese equity ETFs in June”. The foreign stampede into Chinese equities has the potential to be a disaster in the making.

A game of chicken?

In conclusion, the Fed is well aware that it is risking a recession with its tight monetary policy, but its main and only focus is fighting inflation. While the US economy remains resilient, as both corporate and household balance sheets are strong by historical standards, the same cannot be said of many other countries.

Even as Fed speakers assert their determination to bring down inflation, the market is signaling growing stress. The combination of a falling 10-year Treasury yield, which is an indication of falling growth expectations, and rising HY spreads, which is a sign of tightening credit conditions, is a possible lethal combination for financial stability.

It is therefore not surprising that in the wake of the hot CPI and PPI reports, Fed Funds futures is expecting the Fed to pull forward rate hikes but the terminal rate remains the same at 350-375 bps and rate cuts by mid-2023.

- July meeting expectations changes from a near certain 75 bps to about a one-third chance of a 100 bps move;

- A 75 bps hike at the September meeting;

- The target rate at the November meeting remains unchanged;

- A terminal rate of 350-375 bps is achieved at the December meeting; and

- Rate cuts by mid-2023.

They are stuck with the debt and entitlement problems.

The higher the interest rates, the greater the cost of carrying the national debt. If they default on entitlements we have big issues, so then they have to borrow more in order to avoid those issues. The more the government borrows to spend, the more inflation we ultimately get.

The 70s the boomers were entering the economy, getting credit cards and credit of course all of which increased demand, along with OPEC and an energy shock. More recently inflation has been tamed by outsourcing to cheaper labor and the aging boomer demographic.

We are faced with increasing energy costs, decreasing quality of resource sources, supply chains being onshored, competition from emerging economies for resources.

The inflation cat is not going back into the bag. Sure if we have a depression, as long as things stay depressed inflation will be under control. Some day robotics may replace cheap labor, but we have a stretch to go before we get there, ditto cheap fusion power.

What is the real agenda? You know how you have to watch the magician’s hands to catch the trick. We are given a narrative about inflation, something we fear and believe, so the Fed will go and break something. Since when does breaking things help, other than eggs and bad relationships. So they will push until something breaks, and then? Oh then they will lower rates and everything will be fine, inflation won’t come back, and there won’t be any consequences of whatever was broken? So what’s the real agenda?

I know I sound like a conspiracy nut, but it’s just that these types never tell the whole story.

The problem with the Fed is similar to the weakness inherent in most government institutions – the failure to think big and outside the box.

In the hands of private innovative leadership, I’m convinced the US would quickly solve the problems of underfunded entitlement programs (Social Security and Medicare), the national debt, the growing divide between the advantaged and disadvantaged, and of course inflation.

The guy who’s able to change the bureaucratic culture of government into the innovative culture of private enterprise is the guy who will deservedly win this century’s grand Nobel Prize.

There’s an idea floating around of a DAO based governance system. But unless something breaks, where people are at its most rebellious/revolutionary phase, I fear no real change will come.

Weakness in economies around the world should help the Fed in its inflation control strategy. To that extent, they will ‘watch closely’, whatever that means. I don’t believe Fed will stop raising rates. They might in fact stretch out the rate hiking cycle in order to see how all the forces play out and hopefully get a softish landing.

Would they stop before something breaks? Would the Fed bureaucracy be vigilant enough? They were off track last year.

As we all lived through the daily gyrations of the stock market in the months following the Covid-19 lockdown – often speculating on the time frame for the development of a vaccine – I would highly recommend reading Albert Bourla’s account of the period from his perspective as CEO of Pfizer. ‘Moonshot’ is an enlightening read and an excellent example of the otherwise ‘impossible’ things that motivated teams are capable of.

Nasdaq prints (barely perceptible) higher lows and a higher high.

Hi Cam,

The article does a good job of defining the “problem” but says little about what the “solution” should be. What is the alternative to the FED’s current actions?

Are you suggesting that the FED should be taking a more “steady as she goes approach” and maintain more steady (say 0.5%) rate increases ? Or should they be doing even less?

Maybe the question has a lot to do with the psychology of “fast” vs “slow” increases? (i.e. frighten people more with fast increases)

Should the FED be using another “pre-emptive” benchmark rather than the raw CPI which it says is it’s “bottom line” because this is “what the average person sees” ?

Cam, great overview of the present hidden risks. I fear the fog of war is too great and most of us can only somewhat rely on technicals and trends. It would be very helpful if you can offer tips in future posts on how to scale in and out nimbly in the current environment in terms of portfolio allocation. Thank you for your continued guidance.