One of the key risks to the stock market is earnings expectations. As recession risk rises, it has been unusual to see forward 12-month EPS estimates continue to rise. The latest update finally shows that earnings expectations are beginning to stall. S&P 500 estimates are flat for the week, up a miniscule 0.01, while small-cap S&P 600 estimates are down over -1% in the week.

Why haven’t stock prices skidded further? Here are some reasons why this cycle is different from others.

Recession fears overdone

Here is the bull case. Recession fears are overdone and a slowdown may already be discounted by the markets. Global web searches for the term “recession” has spiked to levels consistent with the COVID Crash and the GFC.

Economic deterioration is attributable to three factors.

- Household consumption has shifted from goods to services. While the shift is not recessionary, it does resulted in a dramatic change in indicators like manufacturing PMI.

- Inflationary pressures from higher prices have resolved in volume destruction, but no demand destruction, which would be recessionary.

- Monetary policy is working to dampen growth expectations.

LinkedIn chief economist

Gary Berger pointed out that the economy may not be as bad as many people feared. While most investors and economists focus on GDP, which is derived from spending data, GDI, which is calculated from income data, is not that bad. Q1 GDI expanded at the trend growth rate of 2%.

Berger’s observation that income-derived data points to continued expansion is consistent with

Ben Carlson‘s conclusion that consumers are prepared for a recession. Household balance sheets are strong and any recession should be mild as leverage is low in the system.

Inflation pressures are easing

Remember the transitory inflation narrative? It’s actually happening. Container freight rates have peaked, which is a signal that supply chain bottlenecks are easing.

The latest release of PCE shows monthly core PCE at 0.3% for May and annual core PCE at 4.7%, both of which were below market expectations. The good news is PCE and core PCE are decelerating on an annual basis. The bad news is the progress in monthly core PCE has been stalled at 0.3% and the base effects of high inflation will dissipate by July. These readings will be encouraging for Fed officials, but they aren’t likely to be convincing enough for a pivot to an easier monetary policy.

Effective monetary policy

The positive effects of tighter monetary policy are appearing. Inflationary expectations are well-anchored and falling. Central bankers will think twice when they consider tighter policy to overshoot their neutral rate targets.

The current cycle looks like a rapid rate hike cycle. The market focus has shifted to whether the Fed will hike 0.50% or 0.75% at the next FOMC meeting to the terminal rate and the timetable for easing policy. Fed funds futures are now expecting a terminal rate of 3.25% to 3.50%, which is down 0.50% from 3.75% to 4.00% after the hot May CPI print. The market expects the Fed to reverse course and ease in mid-2023. In other words, it’s expecting a recession. While this is consistent with the Fed’s SEP projection of a Fed Funds rate of 3.4% at the end of 2022, the Fed expects further tightening in 2023.

Financial markets are inherently forward-looking. If they discount events 6-12 months ahead of time, any recession is already priced in and the stock market’s strength is anticipating a Fed pivot towards easing.

Value signals

Finally, value signals are appearing in the stock market. Insiders have been buying the dips whenever the market has weakened, which could put a floor on stock prices.

As well, value investor Howard Marks, whose newsletter is admired by Warren Buffett, was profiled in the

Financial Times and said, “Time is ripe to snap up bargains”. He revealed that he is “starting to behave aggressively”.

You ain’t seen nothing yet

Here is the bear case. A global recession is looming. NDR’s Global Recession Probability Model is now at 89.3%. It has never moved above 90% without a global slowdown either being in place or happening soon.

Central bankers are engineering a recession. Even as they focus on fighting inflation, PMI data indicates that they are tightening into a slowdown.

Commodity prices are also signaling a slowdown. Both the liquidity-weighted headline commodity indices, which are heavily weighted in energy, and the equal-weighted indices are breaking down. The all-important copper/gold and base metal/gold ratios are falling, indicating cyclical weakness.

In particular, the copper/gold and base metal/gold ratios have shown a strong history of being a good risk appetite indicator.

More downside risk

If you thought that the market has already fully discounted a slowdown, think again. S&P 500 forward 12-month estimates are just starting to wobble. Historically, EPS falls -17% during recessions. The coming days could see both P/E compression and a falling E.

As an example, Micron’s earnings and Q4 guidance was astonishingly bad. That said, the market reacted positively on Friday to GM’s negative guidance.

The

WSJ also reported that stocks normally don’t bottom until the Fed eases:

If history is any guide, the selloff might still be in its early stages.

Investors have often blamed the Federal Reserve for market routs. It turns out the Fed has often had a hand in market turnarounds, too. Going back to 1950, the S&P 500 has sold off at least 15% on 17 occasions, according to research from Vickie Chang, a global markets strategist at Goldman Sachs Group Inc. On 11 of those 17 occasions, the stock market managed to bottom out only around the time the Fed shifted toward loosening monetary policy again.

In other words, brace for more downside risk.

China weakness

Furthermore, don’t bother waiting for Chinese stimulus to pull the global economy out of its slump. The Chinese economy is exhibiting signs of weakness with few signs of recovery.

CNBC reported that China Beige Book found widespread weakness in the wake of the zero-COVID lockdowns.

Chinese businesses ranging from services to manufacturing reported a slowdown in the second quarter from the first, reflecting the prolonged impact of Covid controls.

That’s according to the U.S.-based China Beige Book, which claims to have conducted more than 4,300 interviews in China in late April and the month ended June 15.

“While most high-profile lockdowns were relaxed in May, June data do not show the powerhouse bounce-back most expected,” according to a report released Tuesday. The analysis found few signs that government stimulus was having much of an effect yet.

Sales and profit margins are slumping.

Credit growth is still weak, indicating a lack of stimulus.

The

SCMP reported that Q1 migrant worker wages were flat year on year in real terms, which is a signal of anemic household demand. Other anecdotal evidence points to weakness in both the property market and household sector. If you were waiting for another round of stimulus to boost infrastructure spending, forget it!

A rapid tightening cycle

Here is how I resolve the bull and bear cases. This has been an extraordinarily rapid rate hike cycle.

Mary Daly of the San Francisco Fed pointed out that financial conditions have tightened very quickly compared to past cycles. It is therefore no surprise that the market is discounting Fed easing in 2023.

The economy is in uncharted waters in light of the speed and intensity of the current tightening cycle. Conventional cycle analysis argues for more equity downside in light of the earnings adjustments should a recession materialize.

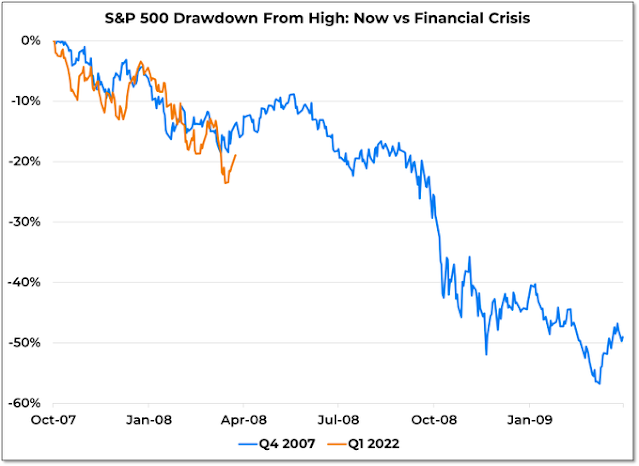

Willie Delwiche at All Star Charts has proposed a 2008 style template for the stock market.

I think his conclusions are overly alarmist. Even if a recession were to occur, its effects on employment and spending should be relatively mild, like in 1990, when the S&P 500 peak-to-trough drawdown was -20%. The bulls will argue the market has already discounted the downturn and it’s now looking ahead to the easing cycle.

The acid test for market psychology will be Q2 earnings season. How will earnings and guidance come in? More importantly, how will the market react to the news? More immediately, the June Employment Report will serve as another guidepost for the trajectory of monetary policy.

Stay tuned.

I haven’t seen this analogy mentioned before, but FWIW I see a similarity to WW2.

We have inflation, and it will persist/linger and should not go ballistic unless Washington decides to send trillions more of free money into the general circulation.

Back to the analogy…europe is really impacted by energy and Ukraine…they will likely have energy problems for years barring an about face by Putin.

China has it’s zero covid policy, and it’s housing bust, and the supply chain issues.

This leaves the USA with fabulously cheap natural gas in comparison, we are done with lockdowns, the inflation of supply chain disruptions is a stimulus to local businesses. I would think that US based fertilizer can outcompete European since the feedstock is so much cheaper, ditto for US steelmaking. Unless these were already at 100% capacity before this all began they should be getting a boost. I just used these as examples to point out that with things being so bad on the energy front in Europe, Japan and China’s troubles could give a boost to the USA .

Of course the market could tank big time, but I think we are better off than Europe or Japan, and as far as China and zero covid…..until they have decent herd immunity they will be at risk of covid, it’s not going away although it seems to be getting milder. So it could be less severe here.

Through the eyes of an investor, however, US based multinationals will be impacted by a strong Dollar and international weakness. I see pressure on JCB and ECB to turn hawkish as well and this may make things break in some way.

Responding to the bull case – the 90s had relatively low energy prices and strong technological advances, semiconductors for instance have made significant and rapid advances in the last 30 years, this is also not going to happen again.

I have been less active in posting lately and let me explain why. I spend over half my day consuming macro information, especially Central Bank related. This included long videos the bankers G7 roundtable, a Bullard speech and went in person to hear Mark Carney talk. I read two new policy papers by Fed districts. I have Google Alerts by thought leaders and read them or watch their videos. I also have 45 years of experience doing this in paranoid fashion after going through a crash early in my career. All this to say, I am aware of what’s happening and how it compares to the past.

What is happening is UNPRECEDENTED. That is not just me. Brilliant thought leaders are saying that too.

That means when I read a recommendation based on precedent, I try to block it out. Because relying on precedent in an unprecedented world is a destructive trap. That is especially true if the previous track record of the analysis is great and one has confidence in it. For example, sentiment indicators that I and others have used to great success are screaming BUY. They are at bear market turning point lows. But this is an unprecedented world.

This unpresented world backdrop is huge, no humungous Central Bank past easing with a massive destructive inflation that is being reversed extremely quickly. This led to an unprecedented epic fall in stocks and bonds TOGETHER. At the same time sentiment indicators scream BUY, sensitive economic data is showing the world economy literally imploding. Commodities are crashing, junk bond spreads blowing out, a sudden stop in home buying with house inventories surging, consumer confidence hitting 50 year lows, leading indicators of almost every country falling etc. The precedent of these economic indicators is a nasty recession. If the world is unprecedented for its economic trajectory over the next few years, either a soft landing or a depression-like hit, I would bet that a soft landing is not in the cards.

Let me share a secret about the investment industry. They may revoke my membership card for revealing this. The industry sell products to investors and will NEVER say get out of those products. When a bear market is coming or here, they will tell investors to ‘look across the valley’ or ‘things will turn up soon’ and ‘the bear market is already in the stock prices.’ A big decline ahead is referred to a ‘patch of volatility’ or ‘We may have a bumpy ride.’ During a bear market I do not listen to product providers and that includes the security analysts in those firms that do the profit forecasts. They are too biased. I have blocked their email addresses. (When the new bull market starts, I will hang on every biased word, belive them and buy, buy, buy) I now only listen to non-product speakers and they are all calling for a shit show until at least yearend. I will watch the sensitive economic stats for a true turn.

BTW one unprecedented thing happening now is how investors have become very intense Central Bank followers. This used to be the purview of only nerds in caves like Cam and I. That will mean when the Fed pivots from tightening to easing (or maybe just to neutral) the markets will surge like the Covid Vaccine Day (up 10-15% for Value and then kept going.) That will be the type of THRUST that I will leap at not the past reliable sentiment-based thrusts that are failing in an unprecedented manner in 2022.

To sum up, I don’t comment on Cam’s analysis of previously reliable indicators because we are in an unprecedented world and they may or may not work now and I can’t tell you why. A great quote is, “If you aren’t confused, you simply don’t know what’s going on.”

Good luck folks. We are in this together.

You realize that you are saying “this time is different”.

Well, not exactly, but how often does a global hegemon have a sovereign debt crisis?

But for sure things are happening faster because of the internet.

Myself, I will try and keep a focus on useful things, because no matter what happens, useful things stay useful.

Thanks for sharing. I do agree at the unprecedentedness of it all and how it could possibly warp the indicators to some degree. Just wondering if you are bearish mostly due to global synchronized slowdown and if you are just as bearish when looking at the US economy in a vacuum?

Cam recently said the market might make a double or triple bottom and with Ken going all out on his bearish call I see little reason not to reduce some more position esp during a rally.

Ken,

A great post. I need to paraphrase the message, make a yellow sticky out of it, and paste it on my monitor so I don’t forget it.

The sentiment indicators have been screaming Buy for a while now as Cam’s posts attest. But they don’t seem to be working this time.

Great suggestions on how to follow Central Bankers. Would love if you would share any specific links that are particularly valuable.

Thank you very much!

Cash, once again and even with inflation, seems to be king again. I’m not all cash, but cash is my largest position. I have been a buy and hold investor since 2009, occasionally taking short term positions but mainly just adding to my longs. However more and more I think the only way to succeed in this market is to ride whatever waves come our way, even if that wave runs counter to what I’ve done for so long.

Ken is right. It is unprecedented in that it reflects the tectonic shift in several important parameters usually associated with evaluating economy. And how the correlations have shifted and how interpretations need to adjust accordingly. New and more useful parameters may need to be invented to more closely emulate economy.

One of my hobbies is something I personally coined as computational economics. It is an offshoot of my regular activities involving large data modeling and analysis, some more deterministic as in engineering applications and others more statistical/probabilistic in nature. So just a hobby. I found that BOJ’s Kuroda has very high chances of being right. He is dealing with a unique Japanese-style problem that will in short order become obvious Western countries will need to address.

The simultaneous drops in stocks and bonds reflect an underlying fact that cash is being raised to accommodate the needs for retirement. The trend will accelerate going forward. Our newest cohorts, Zoomers, is the smallest population group. So chances are high that investment returns will be very mediocre in the future. Better get used to it. Additionally people’s confidence in Gov will only go lower which will exacerbate the situation.

In other words the World has seen better days. You will be shocked to see how China declines the next 10 years, ditto Russia.

Well there is demographics, but the demographics of Japan have been bad for ages and the solution for demographics is immigration.

But in Japan with the boom that busted 1990, there was a tremendous amount of credit destruction. The value of real estate , the zombie banks, this has dragged on. If inflation is a monetary phenomenon due to increased money, then deflation is due to decreased money. In the 1930s a lot of credit was destroyed by the 29 crash, so decreased money but the currency was tied to gold so you couldn’t just print. The yen is fiat so the BOJ has been printing away but the credit destruction has been enormous and the python has slow digestion. Remember how one prefecture was worth more than California? Stimi checks cause inflation. We are also on fiat. We will get more printing, but those zombie companies and their bonds…lotta credit destruction coming, or zombie credit