Mid-week market update: Even though the sample size is small (n=4), the stock market seems to be repeating the FOMC meeting pattern of 2022. The pattern consists of weakness into an FOMC meeting and a rally afterward. The post-meeting rally in May fizzled out quickly but the others were more sustainable.

The S&P 500 is now testing support after breaking out. If the market were to rally, gap resistance can be found at 3980-4020. Is there any more life left in the current rally? Will the market decline into the next FOMC meeting scheduled for July 26-27?

Sentiment support

While it is true that the market retreated from a short-term overbought condition and prices would weaken further from current levels, excessively bearish sentiment will act to put a floor on prices. II sentiment improved this week but remains at a bearish extreme.

A recent survey of JPM Macro Quantitative conference attendees revealed a bearish bias.

Macro Charts pointed out that aggregate futures positioning is at a record low.

Outside of a cataclysmic event such as California getting hit with the BIG ONE and sliding into the sea, markets simply don’t crash with sentiment at such extremes.

Timing the peak

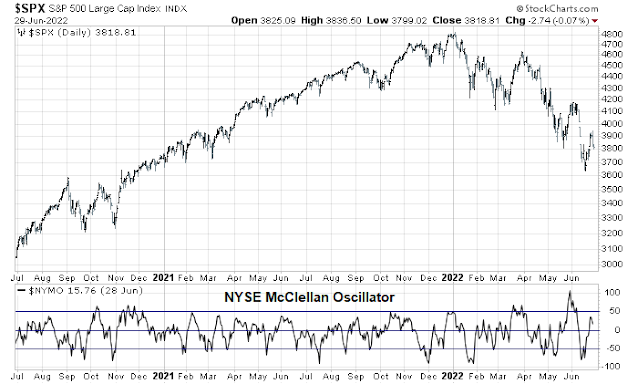

While there are no guarantees, if the market were to follow the FOMC pattern, watch for a peak about 10 days before the next FOMC meeting, which takes us to mid-July. Tactically, I would stay bullish and watch for an overbought condition in the NYSE McClellan Oscillator.

My inner investor is still cautiously positioned but he will nibble away at positions should the market weaken. My inner trader is on the sidelines. It’s too late to buy but too early to short.

The SPX chart clearly explains my trading strategy. When in a bull market by dips below $NYMO going below and THEN crossing above – 50. In a bear market which we are in now sell above 50 after it goes below 50. Notice you would have caught most of the declines close to the top of the bear market rallies,

It looks like the move continues, ok, I get it thanks. Only one never knows when the market changes. Right now we have clear lower highs and lower lows since new year’s so it looks bearish.

‘Just another pop’ according to Tom McClellan.

https://twitter.com/McClellanOsc/status/1541859160739811328

Although it is not clear how he comes to determine ‘Strong initiation’ vs ‘termination’ in the chart other than duration and perhaps the trend of the channels. Duration at the recent highs and how the market lost $SPX 3900 so quickly in less than 2 trading days may be the answer.

My research indicates a bottom on December 14, in the SPX 2500-3200 range (lower most likely) with the U.S. market a world leader.

That is very fast so rallies might be short lived.

Wow! Thank you for sharing.

Very precise date and level. Could you pls share more details on how you came up with them?

He doesn’t say December 14 of what year 🙂

December 14 is Fed meeting day this year when they will pivot from tightening.

Thank you, Ken. If the Fed waits that long to pivot, 2500 is not entirely unreasonable. I guess you’re assuming inflation will remain stubborn and the Fed will remain committed to curbing it out at the expense of economic deterioration.

It will be very painful for the ordinary citizens. Many businesses will fail in the mean time. Asset prices, including those of homes, will fall apart.

Powell isn’t bluffing.

2500?!

Wow,amazing, thank you for sharing

The probability that Europe will be running out of gas during the winter has risen. There will be a maintenance window from July 11-21 on Nordstream 1 where no gas will be flowing to Germany, if Gazprom extends that maintenance window it is very likely that some industrial consumers will have to be shut off very soon. In addition German utility company Uniper issued a press release saying they need help from the government with liquidity.

I wonder if they will extend their reactors..they can burn coal of course. Perhaps people will truly learn the value of more than one supply chain. Be very careful when u put all your eggs in the most cost efficient source.

Why Germany is so afraid of nuclear power? France has no problem. In a way US is very similar to Germany. Both have a very large group of zealots spread misinformation for decades and yet have no plan at all for transition to renewables. Germany is much worse off. E Germany Stasi and Soviet KGB ties still have not died off.

I think the leaders in Germany and the US will eventually come to their senses, and embrace nuclear (maybe SMRs). That’s the only solution if you want energy independence and security, and mitigate climate change in a cost-effective way.

I agree Germany is much worse off. How could they tie the fortune of the country at the mercy of wind, sun and Putin? Must be the ties between E Germany Stasi and Soviet KGB ties during Merkel era.

Is there a blow back in Germany against these policies YET?

I am not here to engage in political discussion, but I am not sure if the posts above lead to the correct investment decisions based on the assumption that there is some kind of political pivot that needs to be made in order to solve the current problems at hand. I want to point out here that since Macron, Scholz and Draghi visitied Kiev the geopolitical situation has deteriorated, add Sweden and Finland entering NATO now. Europe emerging as a new customer for coal and LNG has widespread implications for energy prices in southeast Asia and other parts of the world. In addition parts of the European economy have been trying to leverage the benefits of cheap Russian gas and are now faced with wildly different circumstances, electricity is probably the least of Germany’s worries. I encourage US investors however not to underestimate the potential effects on the global economy and US based multinational corporations. The weakness of the Euro and the Yen are adding up to inflationary pressures in the relevant economies and up until now it does not seem like central banks are acting in a globally coordinated way, which opens up all kinds of potential tail risks. That the ECB is still running NIRP is just downright crazy.

Sanjay’s comments about Germany are depressingly accurate. Had Germany maintained and improved their nuclear power plants, its dependency on Putin would be much less than it is now. Putin’s action are really intended to harm Germany and Nato economically as much as it is an effort to conquer Ukraine. The world situation is hardly bullish.

I have no idea whether we sell off further to retest last week’s lows, but I felt comfortable enough with this week’s retest to increase exposure from 70% to 75%.

Green close?

https://www.bloomberg.com/news/articles/2022-07-01/el-erian-says-receding-liquidity-is-biggest-risk-to-markets?srnd=premium

“We would have expected major rebalancing flows by now to help equities” after a bad second quarter, El Erian said, and wondered whether markets “are being upset by outflows? Or is it that investors are less willing to rebalance in favor of risk assets?”

So, the rebalance at the quarter-end didn’t help equities. Can anyone here comment on that?