Stock market pullbacks happen. The normal equity risk of pullbacks is the price investors pay for better long-term performance. But a recent analysis by Oxford Economics found that the average S&P 500 pullback during non-recessionary periods is -15.4% and -36% during recessions.

Here is why this matters for equity investors. The recent peak-to-trough drawdown for the S&P 500 was about -10%. If there is no recession, the downside risk is relatively limited. However, Fed Funds futures expect five quarter-point rate hikes in 2022, with some strategists calling for as many as seven. The current rate of expected tightening will push the 2s10s yield curve to invert in late 2022 or early 2023, which would be a recession signal. Markets look ahead 6-18 months. A 2023 recession translates into an equity bear market in 2022. Suddenly, the recent -10% S&P 500 decline could become a prelude to a vicious bear market.

Ominously, the path of the stock market is following the pattern of 1982. In 1982, the economy was in recession. CPI was 7% and the Fed had been hiking aggressively. It was a mid-term election year and the second year of the Presidential Cycle. The market experienced a down January and saw a bearish

turn-of-year barometer (TOY) signal.

The key difference between today and 1982 is the recession question. With all of the G7 central banks except for the BoJ turning hawkish, can the Fed rescue the stock market from the 1982 analogue by engineering a soft landing?

The Fed’s inflation challenge

It is an understatement that the Fed is extremely focused on inflation. In particular, Jerome Powell’s language in the wake of the January FOMC meeting was revealing. He declined every off-ramp offered from the Fed’s hawkish path. Instead, he said there was “quite a bit of room to increase rates without hurting the labor market.” Moreover, he pointed out that balance-sheet reduction could be quicker than in 2015 in light of the economy’s strength now, though no decision had been made

- Job market conditions “are consistent with maximum employment”, which leaves the Fed to focus on its price stability mandate. Moreover, the “labor market’s going to be strong for some time”.

- Powell was hawkish on the inflation outlook, “I’d be inclined to raise my own estimate of 2022 core PCE inflation” [since the publication of the December SEP estimates].

- The Fed would not commit to any particular path of rate increases. It could raise rates at every meeting. In addition, rate hikes could be as much as a half-point instead of the widely expected quarter-point.

- When questioned about the volatility in financial markets, Powell lowered the strike price on the Powell Put and later added that “asset prices are somewhat elevated”.

In reaction to Powell’s press conference remarks, financial markets took a sudden risk-off turn. In the following week, six of the 12 regional Fed Presidents spoke, all with the message that while the Fed is on a tightening cycle. However, they walked back some of Powell’s hawkishness by emphasizing a path of gradual tightening and the Fed’s data dependence.

In short, the Fed hates surprising the markets and officials may have decided that the market’s sudden risk-off tone was overdone. Had expectations ramped up to a half-point boost in the Fed Funds rate at the March meeting, the FOMC would have been put in the uncomfortable position of either surprising the market with a dovish quarter-point increase or following the market up with a half point. Subsequent Fedspeak may have been an effort to dampen overly hawkish expectations. The hawkish Kansas City Fed President Esther George said “unexpected adjustments” are not in anyone’s interest and the dovish San Francisco Fed President Mary Daly underscored the need not to be disruptive.

How the Powell Fed has evolved

While the Fed has taken a hawkish turn, its projections and policy direction has shown a remarkable amount of flexibility. This gives investors hope that the Fed could pivot back to a more dovish view in the future should conditions warrant it.

The

WSJ recently document the evolution of Powell’s thinking. Consider that, a year ago, Powell was dovish on the prospect of inflationary pressures.

He even said that higher price pressures, after years of weakness, could be a good thing. “We welcome slightly higher inflation, somewhat higher inflation” to compensate for the years when inflation had fallen short of the Fed’s 2% goal. He added, “The kind of troubling inflation that people like me grew up with seems far away and unlikely.”

Inflation concerns had started to creep in by the June FOMC meeting.

But by the June meeting, Mr. Powell sounded more concerned about inflation. He acknowledged that “inflation has increased notably in recent months,” and the supply problems driving it were proving bigger and more persistent than expected. He flagged uncertainty about what would happen as well.

Powell was still on Team Transitory in the fall.

By the fall, Mr. Powell still stuck to his view that inflation would moderate, but acknowledged the costs of what was happening.

“The level of inflation we have right now is not at all consistent with price stability,” Mr. Powell said after the Nov. 2-3 FOMC meeting. “We understand the difficulties that high inflation poses for individuals and families, particularly those with limited means to absorb higher prices for essentials such as food and transportation,” he added.

By the December FOMC meeting, inflation pressures broadened out from just a few categories. As a consequence, policy took a hawkish turn.

By the final FOMC meeting of 2021, the inflation outlook drove a notable change in the Fed policy outlook. Officials accelerated the drawdown of their bond-buying stimulus effort, in part to help open up space in 2022 for rate rises. The Dec. 14-15 FOMC press conference was dominated by questions on price pressures.

How quickly could the Fed pivot back?

Key risks

The key risk to the Fed’s hawkish policy is that it is tightening into an economic growth deceleration. The Economic Surprise Index, which measures whether economic indicators are beating or missing expectations, has rolled over.

It is unclear how much the significant beat in the January Employment Report moves the needle. The White House had issued a warning that it would likely be disappointing owing to the Omicron variant and a quirk of the survey techniques. John Authers of Bloomberg reported that “a number of Fed governors have already staked out a position that the January unemployment numbers will be bad, and that it doesn’t matter for the future of monetary policy”.

Notwithstanding the January Jobs Report beat, economic weakness isn’t just confined to the US. Global GDP growth estimates are being downgraded everywhere.

The Fed is now caught between the Scylla of inflationary pressures and the Charybdis of slowing growth. This spells policy error and possible recession if the Fed cannot react in time.

It is no surprise that the bond market has reacted with a flattening yield curve even as bond yields rose. As a reminder, an inverted yield curve is usually a recession signal.

When questioned about the flattening yield curve at the January press conference, Powell dodged the question.

JEAN YUNG. Thanks, Michelle. Chair Powell, some investors are expecting the yield curve could flatten or even invert after rate hikes begin. Would that worry you, and how important is that risk in the Fed’s consideration for adjusting policy?

CHAIR POWELL. So we do monitor the slope of the yield curve, but we don’t control the slope of the yield curve. Many flat — many factors influence longer-term interest rates. But it is something that we watch, and you will know that from — when we had this issue a few years ago. And we take it into account along with many other financial conditions as we try to assess the implications of all those conditions for the economic outlook. So that’s one thing I would say. Another is, currently, you’ve got a slope. If you think about 2s to 10s, 2-year Treasury to 10-year Treasury, I think that’s around 75 basis points. That’s well within the range of a normal yield curve slope. So it’s something we’re monitoring. We don’t think of it as — I don’t think of it as some kind of an iron law. But we do look at it and try to understand the implications and what it’s telling us. And it’s one of many things that we monitor.

Even as the yield curve flattens, which is a short-term forecast of slowing growth, the gap between the market’s and the Fed’s projected terminal rate is equally revealing. The market implied terminal rate of just under 2% is well under the SEP long-term median of 2.5%, indicating that the market believes the Fed will have to reverse course and lower rates as it realizes it had committed a policy error by over-tightening.

When questioned about the risk of over-tightening and the need for a course correction, Powell signaled that the Fed may be handcuffed by its Flexible Average Inflation Targeting framework and overly slow to react in the embrace of its backward-looking data dependency.

MICHAEL MCKEE. If I could — if I could follow up, does the danger of tightening too much as policy works its way into the economy with a lag mean that you should go back to being more forecast dependent in making decisions rather than the state dependency you’ve been using as a framework for the last year and a half or so?

CHAIR POWELL. State dependency was particularly around the thought that if we saw a very strong labor market, we would wait to see actual inflation, actual inflation before we tightened. And so that was a very state-dependent thought because, for a long time, we’ve been tightening on the expectation of high inflation, which never appeared. And that was the case for a number of years. So in this particular situation, we will be clearly monitoring incoming data as well as the evolving outlook.

Important indicators to watch

So where does that leave us? Consensus Fed Funds forecasts have been badly wrong in the past. The key question for investors is whether it is willing to push the economy into a recession to bring down inflation, or will it stop in time to achieve a soft landing?

While the consensus calls for five quarter-point rate hikes, bank projections of 2022 rate hikes are all over the place. The most dovish is Barclays with three, while the most hawkish is BoA with seven, followed by Nomura with five, but with a half-point hike in March.

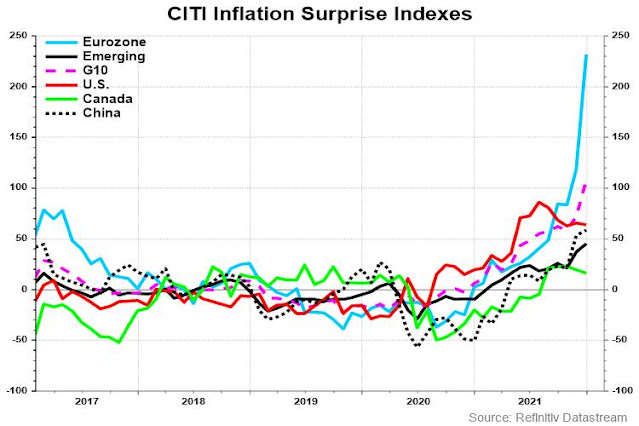

I am mostly watching how inflationary pressures develop in the coming months. Inflation pressures are rising globally, with the eurozone being the worst. The good news for the Fed is that inflation surprise is tame in the US.

The latest release of PMI data from IHS Markit shows a mixed picture. The good news is supply chain pressures are easing, which should alleviate some of the inflation pressures.

However, the inflation front presented some good news and bad news. Input price inflation is softening, but finished goods inflation has edged up.

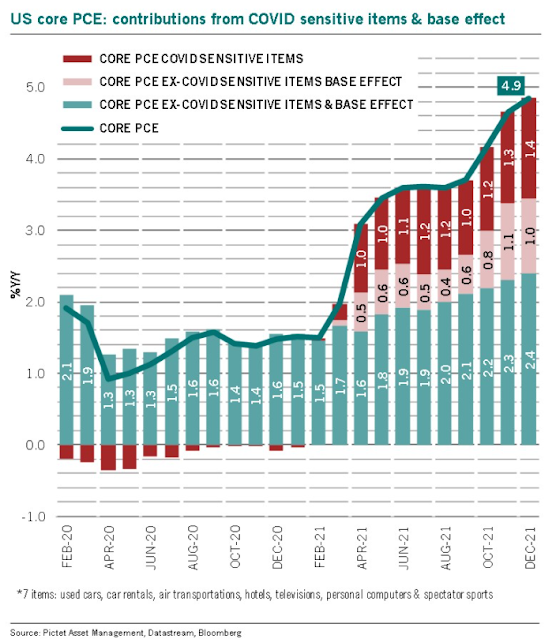

Analysis from Pictet indicates that inflation pressures may be overblown. While core PCE appears highly elevated at 4.9%, it falls to a far tamer 2.4% after adjusting for COVID sensitive items and base effects.

Keep an eye on the evolution of core PCE and CPI. Especially pay attention to owners’ equivalent rent, which accounts for one-quarter of CPI weight, has been relatively tame. If Team Transitory is correct, inflationary pressure should ease by summer. If core PCE can print 0.2% for a few consecutive months, the Fed may respond by taking its foot off the tightening brake.

Even though it will be difficult to time the inflection point, it may sneak up much quicker than anyone thinks based on this week’s cover of The Economist as a contrarian indicator.

Investment implications

For equity investors, the current environment is tricky to navigate. Analysis from Ned Davis Research shows that stock market returns vary depending on the speed of the tightening cycle. The current cycle is expected to be fast and investors should expect a choppy and volatile market.

My base case scenario calls for a soft landing, which I assign a 60% probability, though the risk of a policy error and over-tightening is high. Notwithstanding any geopolitical risk from Ukraine, Fed policy uncertainty will translate into choppy markets for the first half of 2022.

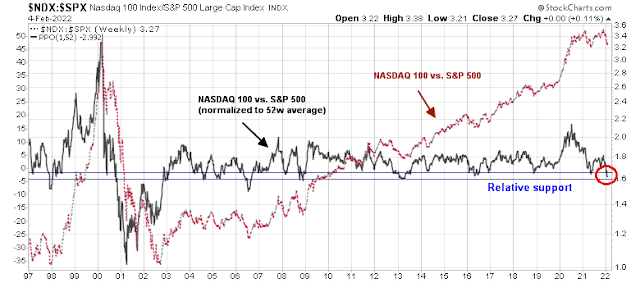

As long as the Fed adopts a hawkish tone, growth expectations will be under pressure and the yield curve will flatten. This environment should be favorable to large-cap high-quality growth as duration plays and unfavorable to value stocks for their cyclical exposure. However, recent surveys show that institutions are overly exposed to cyclicals (see

Rethinking the Hindenburg Omen). Combined with the oversold condition of the NASDAQ 100, which is a proxy for large-cap high-quality growth, FANG+ names should outperform under these conditions.

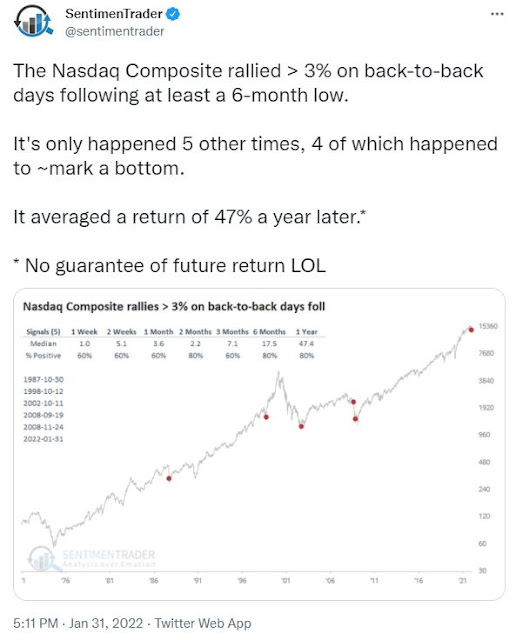

From a technical perspective, the outlook for the hard-hit NASDAQ stocks, which have begun to rebound, look promising. While the sample size is extremely low (n=5),

SentimenTrader observed that similar episodes had resolved bullishly.

For investors concerned about the recent downdraft exhibited by Meta (FB), don’t be fooled by recency bias. Of the large-cap growth stocks that reported during Q4 earnings season, four (Apple, Microsoft, Alphabet, and Amazon) saw positive market reactions while two (Netflix and Meta) saw negative ones. While the sample size is small, the results were better than just a coin toss, though the daily volatility has been hair-raising.

As the economy slows, watch for the turn in inflationary pressures. If core PCE can fall to 0.2% on a monthly basis for two or more months, it should allow the Fed to gradually ease policy. This would be the signal to take great risk in portfolios and to rotate from growth into value stocks for their cyclical exposure.

“This would be the signal to take great risk in portfolios and to rotate from growth into value stocks for their cyclical exposure”.

Cam, if PCE drops to 0.2%, shouldn’t value/cyclicals be replaced with growth (opposite of the above statement)?

I am currently underweight tech, overweight cyclicals/value and waiting to fade cyclicals/value. Sure, large cap growth (FANG+) falls into tech value, I get that part.

When the Fed is tightening, the last place you want to be in are cyclicals. People bid up growth stocks when growth is scarce.

When the Fed loosens, the cyclicals should rip.

I don’t think the growth is scarce yet. Most growth stocks peaked last year, and have been slowly bleeding since. Still GOOGL and AAPL are near ATHs, MSFT is only 10% off from its ATH. FB is a unique case because of competition from Tik Tok and other factors. These stocks may be oversold but I doubt if they have reached their lows yet. Many other growth stocks may be 50-70% off their highs but they are still trading at 10-20-30 times their revenue.

Also, even if the yield curve is flattened, the interest rates will go higher and remain stuck at higher levels for a few more quarters which should further bruise high growth duration stocks.

Growth doesn’t look scare yet. Economy is growth and so are many of these growth stocks. I think it is premature to take a position in growth stocks yet, interim oversold rallies notwithstanding. The cycle is playing out.

Maybe if the Fed raises the Fed Funds rate a few times, the economy slows down to a screeching halt and/or enters into recession, the market craters more, then the growth will be scarce. We are not there yet. Just IMHO.

Totally agree

Excellent big picture forward looking article. Agree with base case scenario. Also a little confused with last sentence.

Cam, excellent analysis of the conundrum facing the Fed – how fast and how much to raise the rates to control the inflation but not triggering a recession that would be very damaging to the labor markets and the economy. Market expectations for interest rate are for five hikes this year. What are market expectations for economic growth under that scenario? Ken has already hunkered down for the investment winter. Trend Model is neutral. How long after 2s10s curve inverts does the economy go into a recession?

Like others, I do not understand the rationale of being in large cap quality growth versus value. Ken, if I understood his thoughts correctly, is suggesting value to do better.

Regardless, thanks for all that you do.

See my previous comment. Investors pile into growth stocks in a growth-starved environment. But focus on quality growth, not speculative growth.

Whatever the Fed officials are saying, professional investors are pushing up the December 2022 Fed Funds Futures contract dramatically. Take a look at the chart.

https://refini.tv/3urIevr

As Cam was organizing his information for this great newsletter, on Thursday and Friday, the futures tacked on almost and additional rate hike to 6 from 5. Since September when inflation went from ‘transitory’ to longer term, future projections of interest rates have soared, especially this year. Growth stocks went into a bear market.

This is a killer for growth stocks. Seeing the rally in growth over the last week with this surge in Fed Funds Futures in the background, I would bet on the rate rise will win and growth stocks fall to continue their bear market. When the first jobs numbers on Tuesday were weak, there was a hope that rates would cool to help growth stocks but the Friday jobs number was as hot as it could have been given Omicron. Nasty.

The relative performance of bank stocks have been correlated with the shape of the 2s10s yield curve. A steepening yield curve, which indicates better economic growth expectations, is better for banks because they borrow short and lend long. Conversely, a flattening yield curve is a headwind for bank relative performance.

The yield curve is flattening right now.

Maybe the bank stocks won’t do well because of what you stated. But look at Energy (Oil) and Basic Materials stocks. Or, DBA (Invesco DB Agriculture Fund). They are all trading near 52-week high.

Growth stocks come in many flavors. ARK flavor where there are no current earnings but high growth that may lead to sustainable earnings, cash flows, and disrupt current business models; quality growth companies that have growing businesses, earnings and incredible cash flows for years to come. So, to lump them all together as growth may be technically correct but not differentiated between the two ends.

When you refer to growth, what exactly are you referring to? Similarly for value?

Markets may reflect all known information (Fama) but may be inefficient too(Schiller). Too much noise. So, what gives you the certainty in your outlook? I am more confused by the twists in your factors. Has your outlook changed from being in investment winter chill?

I believe Fed will try to thread the needle. No Fed Chair wants both inflation and recession as their legacy. Cam for now is 60% confident. As data changes, so will Fed and Cam.

BTW, Fidelity’s Timmer thinks inflation will moderate but not to the prepandemic level. High inflation is an antidote to inflation.

Still in Winter.

My momentum work highlighted a key development on Friday.

It was a big week for Growth as it rallied from the January sentiment, intermediate low. (BTW I have rebased my short term momentum ETF sectors to the Jan. 27 low).

But on Friday, the Bank ETF KBWB, a Value sector surged to outperform the market index (bottom chart). This happened as interest rates lifted off. Higher rates are a key benefit to banks. Here is the chart;

https://refini.tv/3Jg0wVq

My momentum strategy is to combine momentum stats with an understandable (to me) favorable fundamentals. I’ll let you guess if this is my biggest holding by far.

From the new rebased low January 27, other Value sectors are underperforming. Financials, especially banks are the first to lead again. If I am right about higher interest rates undercutting growth, the Value sectors will reassert their leadership, led by banks. I will say the other Value industries are economically sensitive and need a decent economic environment as rates climb.

From a common-sense perspective, the big picture is starting to come into view.

(a) Most assets have been inflated to unsustainable levels. Not just stocks. Real estate stands out. We bought our current home nineteen years ago. Its value almost doubled during the housing bubble, then deflated back to purchase price post-GFC. Now it’s 3x our purchase price. The +20% gain last spring was both a shock and a wake-up call – the kind of appreciation one expects over several years, not a few months. Would I buy my home at today’s prices? No.

(b) The closest analogy might be the late Eighties, when I spent two years in B school where it seemed as if every other lecture seemed to laud the brilliance of Japanese business practices. That unsustainable situation ended around the time a Japanese developer paid $850 million for the Pebble Beach golf course. The Nikkei has yet to recover.

(c) Is the total US stock market worth the price at which it changes hands today? Probably not, and certainly not should interest rates continue to rise.

(d) With the exception of Series I Bonds, I can’t think of a single asset worth investing in right now. Maybe a college education – in many cases, tuition prices are coming down. A few medical schools are even moving towards tuition-free programs in the wake of physician shortages. That’s the direction I’m pointing my youngest.

It’s hard to sit in cash for extended periods of time. But any Japanese investor with the foresight to have done just that in 1989 would have come out way ahead ten years later.

Cam’s advice re quality growth companies makes good sense. Assuming that ‘quality’ translates into ‘solid earnings growth,’ then x% earnings growth per year translates into x% valuation improvement per year. Whereas a growth company with no earnings is just a bet on spectacular growth at some point in the future.

In a relatively ‘overvalued’ market, assets that have weaker foundations will suffer the most. Yet, there are major trends that are inescapable such as EVs, Batteries etc To profit over a period of time, a position in the strong players is justified imo.

We are contemplating selling some real estate before the higher rates become a hurdle. Raising cash for opportunities that may arise in 2023 seems wise.

After an email exchange with another reader, I understand the confusion. Here is a clarification of my views:

As the economy slows (and the Fed tightens), you want to be in quality growth.

The last paragraph refers to when you should rotate from growth to value/cyclicals:

As the economy slows, watch for the turn in inflationary pressures. If core PCE can fall to 0.2% on a monthly basis for two or more months, it should allow the Fed to gradually ease policy. This would be the signal to take great risk in portfolios and to rotate from growth into value stocks for their cyclical exposure.

If inflationary pressures slow, that lessens the pressure on the Fed to tighten and maybe even turn to easing. In that environment, rotate from growth to value/cyclical exposure.

Why the belief that the decline in inflation will not be related to the economic slowdown? Even FED turn to easing under these circumstances Value will be underperforming and this will be the time when Growth should outperforming, not now, when rates still go up, and not immediately when rates turn down. Like you wrote “Powell lowered the strike price on the Powell Put” so some time will pass before FED change mind. The best example can be end Q4 2018.