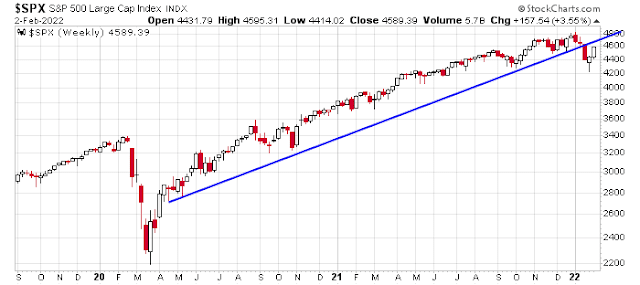

Mid-week market update: How far can the market rally run? The S&P 500 weakened in January and bottomed last week. It has mounted a strong relief rally, but it is testomg a key Fibonacci retracement level at about 4590 and a resistance zone at 4600-4630.

Is this the start of a V-shaped market recovery, or will the market weaken to retest the old lows?

Sentimental buy signals

The relief rally had to happen sooner or later. The market was deeply oversold on numerous technical indicators. Sentiment models finally showed signs of capitulation selling and the rebound was on.

NDR’s Daily Trading Sentiment Composite had become deeply pessimistic, indicating a washout low was near.

As well, equity fund flows had dried up, which is another contrarian buy signal.

The market appears to be climbing the proverbial Wall of Worry. Even as the S&P 500 roared up 1.9% on Monday, the put/call ratio remained elevated at over 1. It finally retreated to 0.95 Tuesday after a 0.7% advance.

The bear case

However, investors should sound the all-clear just yet. From a longer-term perspective on the weekly chart, much technical damage has been done when the index violated a long-term rising trend line. Strong resistance can be found at about the 4720-4730 level.

Tactically, I previously pointed out that the daily S&P 500 chart shows the index is facing overhead resistance at a key Fibonacci retracement level of 4590, with a further resistance zone at 4600-4620. In addition, the NYSE McClellan Oscillator is approaching an overbought reading, which would be a cautionary signal.

On the other hand, the RSI of the S&P 500 intermediate-term breadth oscillator is on the verge of recycling from oversold to neutral, which would be a buy signal. Buy signals in the last five years have resolved bullishly with a 72% success rate.

How will all this play out? I honestly don’t know.

My inner investor is neutrally positioned in accordance with the recent downgrade of the Trend Asset Allocation Model’s signal from bullish to neutral. He expects further volatility and choppiness in the coming weeks and months.

My inner trader is nervously long the market and enjoying the ride. He is carefully monitoring how the market behaves during this relief rally and whether it can overcome or fail at nearby resistance.

Disclosure: Long SPXL

Despite the outstanding performance of AAPL and GOOG, there are some spectacular misses this quarter as well: FB, PYPL. Maybe time to trim back the trading position? Fortunately I was long the former and not the latter stocks.

FB got slammed, beat on revs but missed on eps. I don’t really follow it, but haven’t they been investing on this meta verse which would dampen earnings. Maybe guidance is bad because it is down hugely in AH.

Gave the ESmini a hit…wow

What’s impressive is the ESmini took a 50 point hit from this. In the AH the volume was around 1 million shares (I think) and down 22%. But FB has 2.3 billion shares, of which approx 1.5 billion are held by institutions. So how does such a relatively tiny amount of selling move the needle so much? I don’t buy it.

NFLX had a similar earnings dumpster dive but recouped a good amount in the following week or so. I would not be surprised to see a repeat with FB. It makes sense to allow it to dump in order to get more cheaply…this is my cynic speaking.

Interestingly CCJ a major uranium producer was down today. Apparently the news came out that the EU has included nat gas and uranium into the sustainable green category, which opens up a way for many European institutions to invest in nuclear.We’ll see what happens over the next month. A curiously similar phenomenon occurred last year in the nuclear space, there was weakness among many stocks, it was really bad…..meanwhile Sprott was working on SPUT, then all of a sudden things took off….my cynical take is that buying was hushed to allow as much as possible to be picked up before things took off. The pros are not going to wave a flag for us, and beware of the bugs bunny gloved hand pointing at “Buy This!” So I am hoping CCJ sprints soon. Kazakhstan is certainly a less favorable location than Canada, but I am biased.

OK I checked, must have missed the flurry of selling at release…24 million if you believe nasdaq quotes…a lot of others in tech got hit too, so it wasn’t just FB.

Tomorrow we have AMZN, let’s see. I use AMZN a lot, minimally if compared to my wife lol. AMZN is not social FB is.

AAPL is making life very hard for the digital advertising world. FB’s brethren, like SNAP, TWTR, TTD, etc., are all down in sympathy. Mark looks seriously out of touch with his Meta gambit. If anyone is going to profit from AR/VR, it will be AAPL and GOOG with their massive hardware ecosystems. And MSFTs sneaky takeover of ATVI is a brilliant move into the metaverse, complementing their existing gaming ecosystem.

Well I haven’t given up on AMZN yet. It makes me think of what is useful as opposed to what is social or entertainment. AAPL, MSFT, GOOG provide things we use so their whole networks/products are harder to duplicate, while social media doesn’t have this kind of moat, so what happens when FB is no longer cool, or gets hassled over it’s use of data?

Honestly, if we didn’t have apple we would still have phones and computers, but I don’t even want to think of life without AMZN, even though I know many small businesses are getting crushed by it. What I don’t know is how much their AWS business is at risk.

AWS and other cloud providers have their place, they are way more expensive than on prem but provide elasticity and flexibility that is hard to duplicate. Essentially it comes down to age of the company and/or workload. This is a great article on that topic:

https://a16z.com/2021/05/27/cost-of-cloud-paradox-market-cap-cloud-lifecycle-scale-growth-repatriation-optimization/

I went long AMZN yeas ago when it was in the $600s and my wife had just signed up for Prime. Looks like the bump in Prime fees is sweet to investor ears!

It appears to me that we are in a trading range on the S&P500 between 4220 to 4800 as the lower bound seems to have quite strong support. Therefore it is difficult to know which way things will go in the short term as long as it is within this range.

Cam has called the turns with precise timing in recent months. I am sticking mostly to his commentary with the idea that his analysis will help along the way..

It will be rocky but if one can profit, it’s a more bearable ride.

No pun intended…

Nice catch…

Positive reactions to AAPL/ GOOG.

Negative reactions to NFLX/ FB/ PYPL.

No man’s land.

Will we retest last week’s lows, and will they hold. We’ll probably see a fake-out to the upside before that happens.

Facebook being pummeled is bittersweet – I am no fan but sympathetic of the employee and empathetic of the investor.

I think decent chance we see quite the yo-yo here, with Amazon doing well and jobs coming in below it could lead to a major bounce back tomorrow. We’ll see.

Opened positions in SPY/ QQQ heading into the close.

And closing in the after hours session.

I actually considered opening a small position in AMZN, but opted for the safety of index funds.

I had considered a position in SNAP today after FB dropped almost 10 SNAPs in value. Wish I had!

The market is quite good at psyching us out.

As is generally the case in these situations, I should have sized up further…

Many of you are missing the forest for the trees. This is the first bear market deriving in part from sticky inflation combined with Fed tightening. A bad combo for high growth stocks. The violent volatility in FB, Ebay, Amazon show where we are going in tech. In 2000-2002 it was mostly tech that collapsed. Whole areas of the market escaped the long bearish trend which unwound a 2 year bull run in tech. Look at the chart of any of 100 tech stocks. Most peaked in November and have gone down 35-65% in 10 weeks. One or 2 will escape. The rest will re rate after gut wrenching volatility and then settle down into useful but no longer exciting investments. FSLY started in the low 20s., went to 120 and is now completing a round trip. It is hardly alone

That’s an important perspective, Robert.

Some of the comments I’ve come across this week are paraphrased below.

(a) Re FB/ AMZN/ NFLX in comparison to CSCO in 2000. They’ve taken down the troops, now they’re coming for the generals. (I distinctly recall Jim Cramer writing for the The Street.com in 2000 at one point advocating for CSCO because it was holding around 60 while everything around it went down in flames.)

(b) We’re in a recession or at least headed for one, and don’t know it. Wages aren’t keeping up with prices of gas/groceries/utilities.

(c) EV/crypto stocks in 2021/22 are the dot.coN stocks of 1999/2000.

(d) This week’s rally is carving out the R shoulder of a top.

When was our last real bear market? The March 2020 decline lasted all of 1-2 weeks and then recovered in a four-month ‘V’ move. That’s not a bear market. More like the Netflix series version of a bear market.

Two day trades today. One in VT, another in FB.

Nothing big.

I would characterize my take at this point as between negative and neutral.

A few of the end-of-day price drops I’m seeing are pretty incredible for ETFs that normally move at a snail’s pace.

For instance-> VT declines from 103.03 to 102.51 in thirty minutes?

SPY/ QQQ now ~my after-hours exit levels yesterday. I could have made a second roundtrip had I bought back in this morning – but it was difficult to visualize that scenario this morning.

SPY/ QQQ now ~my after-hours exit levels yesterday. I could have made a second roundtrip had I bought back in this morning – but it was difficult to visualize that scenario this morning.

There’s a lot of market reaction around this morning’s jobs report, but keep in mind it contained years worth of revisions (a big reconciliation they do occasionally). Way more noise than signal.

The raw unadjusted numbers were down big, just like they are every January.

https://twitter.com/LynAldenContact/status/1489622700314222593